The factors that drove the USD’s recovery in October are reversing.

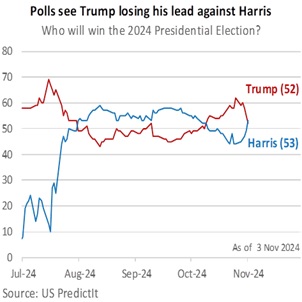

First, the confidence in a Trump victory in the US Presidential elections on November 5 has waned. The outcome of the closely contested race remains uncertain, raising the potential for significant market volatility. News reports suggested that the Republicans could help former president Donald Trump overturn the election results if vice president Kamala Harris wins. Trump’s scheduled sentencing on November 26 for his 34 felony convictions could also sow confusion if he wins.

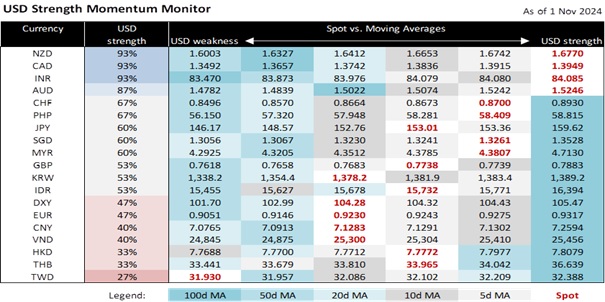

Hence, markets are hedging their “Trump Trade” bets. For example, the VIX Volatility Index is close to this month’s high above 20 again, and Bitcoin retreated to 69,114 yesterday after nearing its lifetime high of 73,798. The DXY Index has struggled to keep pace with rising US bond yields amid worries about US fiscal sustainability. USD/JPY was capped at 154 after Japan’s snap election on October 27 stripped the ruling LDP-Komeito coalition of its majority. However, the political resistance to the Bank of Japan’s rate hikes supported USD/JPY around 152.

Second, we see the Fed Funds Rate (FFR) declining by 25 bps to 4.50-4.75% at the FOMC meeting on November 7. US nonfarm payrolls were significantly weaker at 12k in October vs. the 100k consensus; September was revised to 223k from 254k. Fed Chair Jerome Powell will reiterate that further labour market weakness is unnecessary to lower inflation. With the economy and labour market in better balance vs. two years ago, amid low global energy prices, Powell will likely be confident about inflation returning to the 2% target next year. Hence, the Fed will keep the door open to lower interest rates towards neutral. Our view remains that the FFR will decline to 3% by 3Q25.

We also anticipate the Bank of England lowering its bank rate by 25 bps to 4.75% on November 7. CPI inflation fell to 1.7% YoY in September, below the 2% target for the first time since Covid. However, core inflation remained high at 3.2% in September. BOE Governor Andrew Bailey should address monetary policy in light of the controversial Budget announced on October 31. While the IMF backed Chancellor Rachel Reeve’s economic plan to boost public investment to drive growth, Moody’s warned that frequent changes to the fiscal rules could erode credibility. The Office for Budget Responsibility (OBR) reckoned the additional spending could provide a short-term lift to growth before crowding out business activity and investment and lifting inflation. Following its knee-jerk sell-off to 1.2844 on the announcement, GBP/USD has stabilized above 1.29 on expectations of cautious BOE rate adjustments.

Quote of the Day

“I am the president of the United States. I’m not the emperor of the United States.”

Barack Obama

November 4 in history

In 2008, Barack Obama became the first person of biracial or African-American descent to be elected as President of the United States.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.