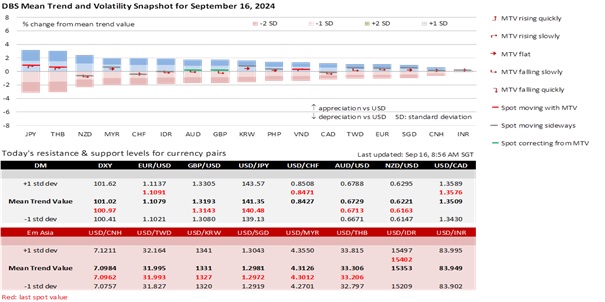

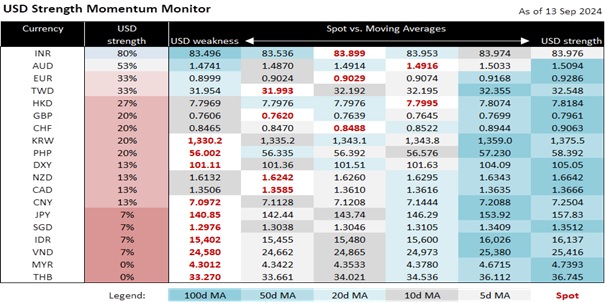

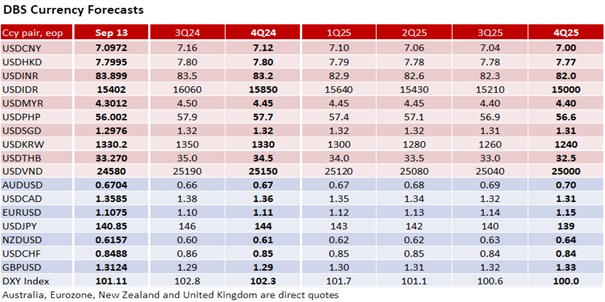

The DXY Index depreciated by 4.5% this quarter, closing last Friday at 101.11, below the 101.33 mark at the end of 2023. A knee-jerk rebound is possible if the Fed delivers a 25 bps cut (our call) at the FOMC meeting on September 18 instead of the 50 bps reduction priced in by the futures market. However, looking ahead into late 2024 and 2025, we anticipate a further decline in the DXY, potentially falling below its 101-107 range since December 2022.

Unlike the earlier part of 2024, the Fed is not pushing back the market’s aggressive rate cut bets with a “higher for longer” rate stance on sticky US inflation. In the third quarter, the Fed has grown more confident that inflation will continue its downward trend. As a result, the Fed has been paving the ground to start a rate-cutting cycle at this Wednesday’s FOMC meeting to avert a further cooling in the US labour market, an intention likely reflected in the Summary of Economic Projections.

Beyond the Fed’s rate outlook, the greenback also lost momentum with the “Trump Trade”. Vice President Kamala Harris’ performance in last week’s presidential debate cast doubt on a guaranteed victory for former President Donald Trump at the US Presidential elections on November 5, which remains too close to call. Regardless of the election outcome, the next presidential term will face two distinct challenges. First, the next term will begin during a Fed rate-cutting cycle, not a hiking cycle. Second, the massive federal debt accumulated during the last two presidential terms will limit the ability to stimulate the US economy. We forecast US GDP growth slowing to 1.7% in 2025 from 2.3% in 2024.

Other central banks have taken notice of potential USD weakness stemming from the Fed’s rate cut guidance. For example, over the weekend, Bank of Canada Governor Tiff Macklem opened the door to lower rates by 50 bps, citing a weaker labour market and lower oil prices. Despite the recovery in USD/CAD from 1.3440 over the past fortnight, a depreciation bias remains below 1.36.

Meanwhile, appreciation biases in EUR/USD and GBP/USD are intact above their respective support levels of 1.10 and 1.30. The European Central Bank, having lowered its deposit facility rate by 25 bps to 3.50% last Thursday, is unlikely to signal another cut at its next meeting on October 17. Similarly, the Bank of England is expected to hold the bank rate steady at its September 19 meeting after its 25 bps cut to 5% on August 1.

With USD/CHF and EUR/CHF returning this year’s gains, the Swiss National Bank has been reinforcing its dovish stance, with a rate cut expected at its September 26 meeting. The SNB has expressed concerns about the CHF’s strength influencing its inflation assessment and the challenges it poses to the Swiss industry facing weak demand from Europe.

USD/JPY is looking to test its crucial support level at 140 after ending last week at 140.85, its lowest closing level since July 2023. Barring any hawkish surprises from the Fed, the Bank of Japan will likely maintain its commitment to hike rates again at its meeting on September 20. With US data supporting a soft-landing outlook, a repeat of August’s acute market volatility due to an unwinding of yen carry trades is unlikely.

Quote of the day

”If you lose money for the firm, I’ll be understanding. If you lose reputation, I’ll be ruthless.”

Warren Buffett

September 16 in history

Black Wednesday in 1992. The UK government was forced to withdraw GBP from the first European Exchange Rate Mechanism after failing to keep it above the lower limit for ERM participation.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.