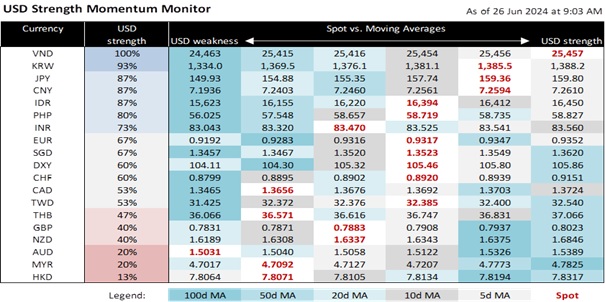

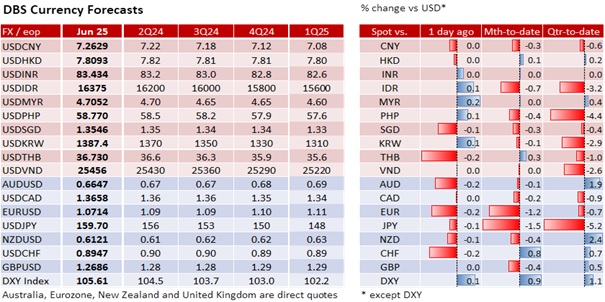

The DXY Index rose 0.2% to 105.63 overnight but stayed in the 105.10-105.90 range set after the FOMC meeting on June 12. The same trading behaviour was also evident in the US Treasury 10Y yield, which firmed 1.6 bps to 4.25%, inside a 4.20-4.30% range for the comparable period. Per the futures market, the probability for a Fed cut in September flatlined into a very tight 60-65% range in the past week due to mixed signals from Fed officials and US data. For example, Fed Governor Michelle Bowman favoured keeping interest rates unchanged in 2024, ready to raise them if the progress on inflation stalls. Conversely, Fed Governor Lisa Cook believed it was fitting to lower rates but saw a bumpy fall in monthly inflation over the rest of 2024. Hence, all eyes will be on Friday’s US PCE deflator, which is expected to mirror the fall in CPI inflation a fortnight ago. Additionally, the Fed’s recent concern over the US unemployment rate rising to 4% in May has not gone unnoticed, placing tomorrow’s initial jobless rate and next Friday’s monthly jobs report high on the agenda.

The components in the DXY basket are also range-bound amid uncertainties over monetary policy and the elections in France and the UK.

EUR/USD is in a 1.0660-1.0760 range, awaiting the first round of France’s snap election on June 30. Assuming none of the parties win an outright majority, a second round will be held on July 7. The polls suggest President Emmanuel Macron’s party will not secure an outright or relative majority. The far-right National Rally leader, Jordan Bardella, said he would not become Prime Minister without an outright majority. Hence, France is looking at a “cohabitation” with Bardella as Prime Minister and Macron as President or political paralysis because new elections cannot be called for another year. The European Central Bank will probably play down EU break-up risks at its Forum on Central Banking in Sintra next week. The ECB and the other global central banks will probably be closely aligned in their plans to navigate a data-dependent path toward removing top-level restrictions on rates for the rest of this year.

GBP/USD has been holding a lower 1.2620-1.2700 range over the past week. Although the UK’s CPI inflation hit the 2% target in May, it was not enough for the Bank of England to lower rates on June 20 or for Prime Minister Rishi Sunak’s Conservative Party to avert the worst outcome at the elections on July 4. However, the OIS market has assigned a 60% probability for a rate cut in September, around the same odds that the futures market has for a Fed cut in the same month.

USD/JPY rose from 155 to 160 In June but settled in a 159-160 range this week. Although the Bank of Japan signalled plans to raise rates and reduce JGB purchases, it delayed the details to the July meeting. The US Treasury Department (USTD) placed Japan on the monitoring list for currency manipulation, a decision it said was not attributed to Japan’s interventions in April-May to prop up the JPY but for meeting two of the three mechanical criteria. Japan’s policymakers said the USTD’s decision had “absolutely no impact” on its resolve to address the excessive currency speculation. Japan’s officials clarified that the interventions were aimed at protecting households and corporates from further yen depreciation, and not aimed at weakening the exchange rate to gain an unfair advantage in international trade.

Quote of the day

“If you put the federal government in charge of the Sahara Desert, in five years there’d be a shortage of sand.”

Milton Friedman

26 June in history

The United Nations Charter was signed by 50 nations in 1945.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Asset)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.