First, US President Donald Trump and his administration are likely in damage control mode, spooked that the equity sell-off did not lead investors to seek safety in US Treasuries, sending the USD diverging with rising bond yields. Following the significant market turmoil, Trump paused on April 9 reciprocal tariffs for 90 days for countries that did not retaliate. On April 11, he also temporarily exempted electronics from tariffs, including those from China. US Commerce Secretary Howard Lutnick said tariffs on semiconductors would be delayed to May-June. It would also be good if Trump resisted his warning to impose tariffs on pharmaceuticals.

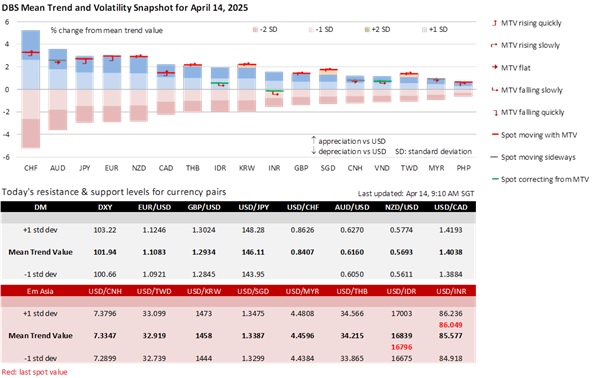

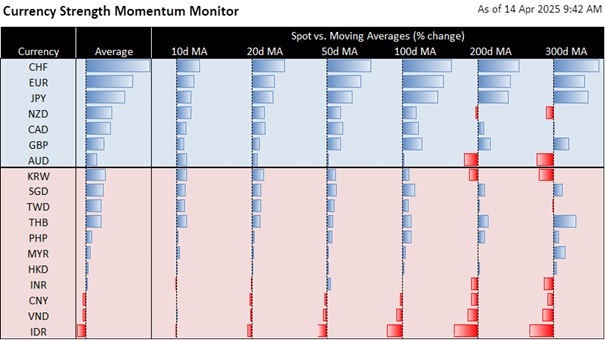

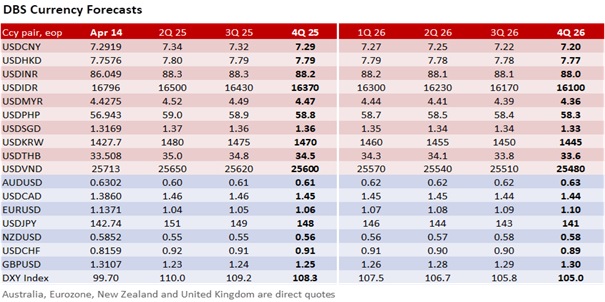

Second, Fed officials do not see the tariffs leading to a US recession; they are alert to inflation risks and disagree with the market’s pricing for four rate cuts this year. New York Fed President John Williams sees tariffs slowing US GDP to below 1%, lifting inflation to 3.5-4% in 2025, and the unemployment rate rising to 4.5-5% over the next year. Chicago Fed President Austan Goolsbee reckoned rates would be lower 12-18 months from today. Today’s New York Fed inflation expectations will be important, especially if the longer-term readings start rising. If the DXY recovers from its pivotal 100 level amid lower US bond yields, the haven appeal of the CHF and JPY should subside.

Third, China said it has become meaningless to keep retaliating against Trump’s tariffs; its tariff on US imports from 84% to 125% on April 11 will likely be its last (for now). Fears that China would respond to the high US tariffs with CNY devaluation subsided. Offshore USD/CNH ended last week at 7.2875, below onshore USD/CNY’s 7.2919. In turn, this brought relief to other Asian currencies, especially the VND and IDR. USD/VND retreated from its lifetime high of 26125 to 25737, while USD/IDR peaked at 17224 and fell to 16580. Chinese President Xi Jinping will tour Southeast Asia this week to strengthen regional alliances and economic partnerships amid the challenging global trade landscape.

Fourth, EUR/USD likely capitulated after its explosive surge from below 1.10 to almost 1.15 last Thursday-Friday. Languishing around 1.13 this morning, EUR/USD faces downside risks if the focus shifts from the US towards the Eurozone economy. At its meeting on April 17, the European Central Bank will lower its deposit facility rate by 25 bps to 2.25%, the top of its 1.75-2.25% neutral range. Contrary to the Fed, ECB officials believed Trump’s tariffs would lead to a significant negative demand shock that creates deflationary pressures. Trump’s tariffs will likely weigh on Germany’s hopes to embark on defence and infrastructure spending to pull its economy out of its doldrums. To deflect the heat from tariffs, Trump should focus on engaging Russia to end the war with Ukraine.

The Monetary Authority of Singapore reduced slightly the SGD NEER policy band’s slope this morning, in line with recent guidance by the government to lower this year’s growth forecast to 0-2% from 1-3% previously. The new slope will likely be flattish; the statement said the NEER has, over the last 3 months, been broadly unchanged vs. the preceding 3 months. On a positive note, fears of global recession are not imminent yet because the NEER has fluctuated in the upper half of the band. USD/SGD will likely bottom if the Trump administration enters damage control mode after the recent significant market turmoil.

Quote of the Day

“You can’t do damage control dead.”

Karen Marie Moning

April 14 in history

The Titanic hit an iceberg in the North Atlantic and sank in 1912.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.