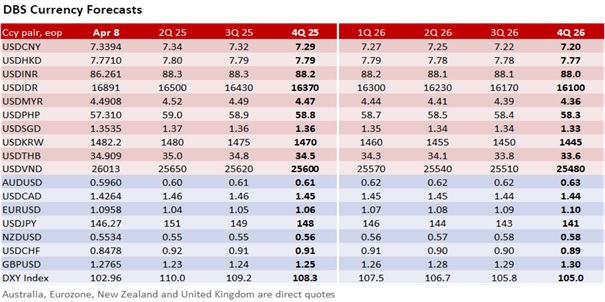

Offshore USD/CNH rose 1.1% to 7.4257, a new lifetime high. The People’s Bank of China set the onshore USD/CNY daily reference rate to 7.2038 yesterday, its highest level since September 2023. China stood by its decision to retaliate with an equivalent 34% tariff, mirroring the rate the US imposed on China on Liberation Day. The Commerce Ministry said China would “fight to the end” against US “blackmail.” With China not backing down, US President Donald Trump scrapped meetings with China and will likely lift tariffs on Chinese imports by another 50% to 104% today, which will likely prompt another response from China.

While this morning’s fixing was higher at 7.2066, it was lower than the 7.3348 estimated by markets, sending USD/CNH down to 7.38. It remains to be seen if the PBOC will abandon its calibrated approach to keep USD/CNY basically stable and discourage one-way depreciation bets. After Governor Pan Gongsheng assumed office in July 2023, the spot rate has weaned off the fixing, fluctuating more within the upper half of its trading band around its fixing, which has been stable between 7.0074 and 7.2150.

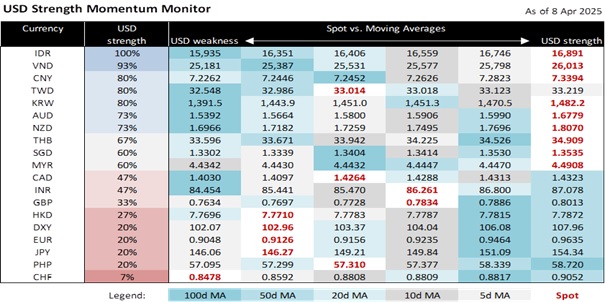

Investors sentiment deteriorated again due to the intensifying trade conflict between the world’s two largest economies, which together account for more than a third of the world economy. US stagflation fears lifted the US Treasury 10Y yield by 10.9 bps to 4.29% and sent the S&P 500 Index below 5000 for the first time since April 2024. Despite the futures market pricing a more than 100% chance for a Fed cut in June, Fed officials viewed tariffs as posing a higher risk to inflation than growth for now. That did not prevent demand worries from extending the decline in WTI crude oil prices below USD60/barrel, four days after they took out 65, a three-year support level. In the currency market, global risk aversion leads investors to reduce exposure to the AUD and NZD, opting instead for traditional havens such as the JPY and CHF. The OIS market priced in more than 60% probability for the Swiss National Bank to lower rates to 0% at its June meeting.

Investors are also monitoring the backlash against Trump’s trade policies. US lawmakers on the Senate Finance Committee grilled US Trade Representative Jamieson Greer over the escalating trade dispute with China. Senator Ron Wyden (Democrat-Oregon) said there was no strategy at all regarding China. Senator Thom Tillis (Republican-North Carolina) asked whose throat should be choked if the gamble proved wrong. For example, President Trump and his administration were dissatisfied with the offers from the European Union and Vietnam to eliminate tariffs on US imports. The “Hands Off” protests across America, which reflected public dissent against the Trump administration’s policies, have garnered international attention. Similar protests also started in European cities – Berlin, Frankfurt, Paris, London, and Lisbon. On April 3, Senators Chuck Grassley (R-Iowa) and Maria Cantwell (D-Washington) introduced a bipartisan Trade Review Act 2025 that sought to reassert Congress’s constitutional authority over trade policy by requiring the president to notify Congress within 48 hours of imposing new tariffs and providing 60-days for congressional review and approval.

Overall, the escalating trade tensions between the US and China, coupled with the emerging backlash to the Trump administration’s policies, have increased “on again, off again” two-way risks and divergences in the currency markets.

Quote of the Day

“Although the world is full of suffering, it is also full of the overcoming of it.”

Hellen Keller

April 9 in history

"The Lion King" became the highest grossing Broadway show in 2012, overtaking "The Phantom of the Opera".

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.