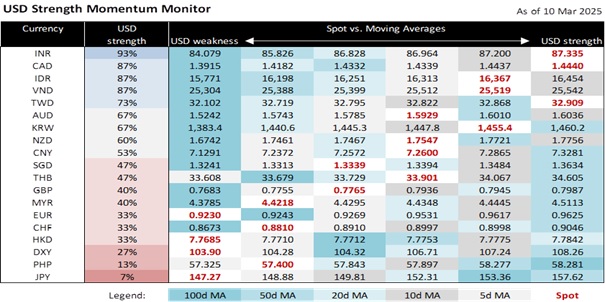

The DXY Index rose by 0.1% at 103.9 overnight, slightly above Friday’s close of 103.84. As markets move from downgrading US exceptionalism towards US recession fears, the greenback could transition from being sold off to being sought after as a haven currency. For now, JPY and CHF are still preferred havens. Emerging Asian and commodity-led currencies remain vulnerable to global slowdown worries.

US recession fears hammered the S&P 500 (-2.7%) and the Nasdaq Composite (-4%) indices to six-month lows. The VIX volatility index rose 19.2% to 27.9, slightly above the previous high of 27.62 on December 18. US President Donald Trump spooked investors with his weekend comment that the US economy would enter “a period of transition” from tariffs.

Investors sought safety in bonds, sending the US Treasury 10Y yield lower 8.8 bps to 4.213%, below last Monday’s 4.155%. Although the Fed flagged that it would keep rates unchanged at 4.25-4.50% at the FOMC meeting on March 18, the futures markets increased bets for a rate cut at the next May 7 meeting, followed by two more cuts in 3Q25. With the markets bringing forward rate cuts, the yield curve (10Y-2Y differential) steepened by 2.7 bps to a one-month high of 30.1 bps.

The New York Fed reported that tariff fears drove 1Y inflation expectations higher to 3.1% in February from 3% in January. At the same time, the 3Y and 5Y expectations were unchanged at 3%; recent retaliatory tariffs risk transforming the assumption of one-off inflation into more persistent inflation.

EUR/USD consolidated within a tight 1.08-1.09 range overnight. European stocks were not spared by the growth fears that hammered US equities. The pan-European Stoxx 600 Index fell a third session by 1.3% to a month’s low of 546.2. EU bond yields are also susceptible to declining with their US counterparts. The “ReArm Europe” plan that bolstered the EUR by 4.4% last week has hit a hurdle. In Germany, the Green Party has rejected the plan to relax the debt brake and support the EUR500bn infrastructure fund. The CDU/CSU and Social Democrats are working towards forming a “grand coalition” government and need the Greens to provide the two-thirds super majority in the Bundestag to pass the plan. Even if a compromise could be found with the Greens, the coalition still needs to win over the Free Democratic Party to get the two-thirds majority in the Bundesrat. The CDU/CSU and SPD want to get the support of the Green and FPD parties before the new Bundestag session starts on March 25th because the far-right opposition AfD party has lodged a motion with the constitutional court to block the outgoing parliament from debating the plan.

Quote of the Day

“If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is, your life is a disaster.”

Warren Buffett

March 11 in history

In 2011, Japan was hit by a massive earthquake that severely damaged the Fukushima Daiichi nuclear power station.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.