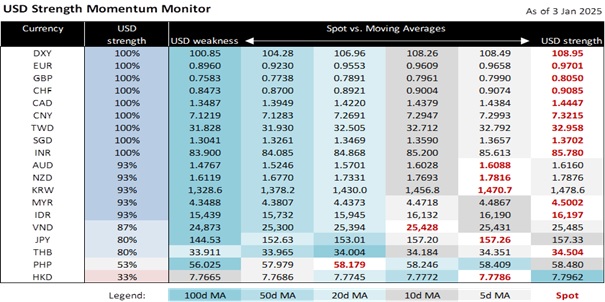

The USD’s momentum is strong against most currencies a fortnight away from Donald Trump’s inauguration as the 47th President of the United States on January 20.

Trump has proposed several tariffs at the start of his second term, such as a 25% tariff on Canada and Mexico to address drug trafficking and illegal immigration, tariffs on the EU unless it imports more US oil and natural gas, an additional 10% tariff on Chinese goods, and a 100% tariff on BRICS countries if they pursue policies that undermine the USD’s status as the global reserve currency. Apart from Mexico and Canada, most of America’s trade deficits were with Asian and European currencies. While Trump’s policies are considered transactional in design, his tactics also appear predatory due to their coercive, unilateral, and zero-sum nature to push his America First doctrine globally.

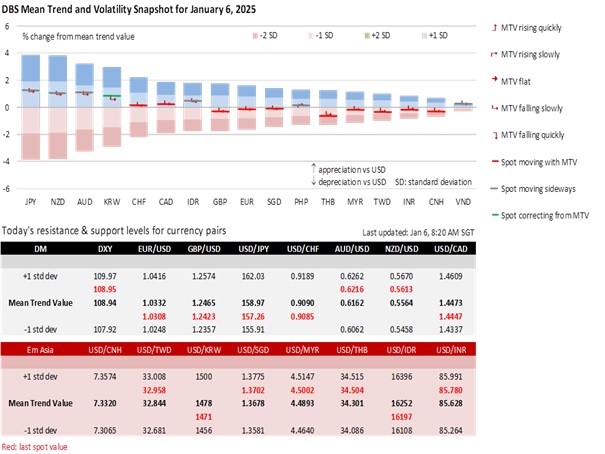

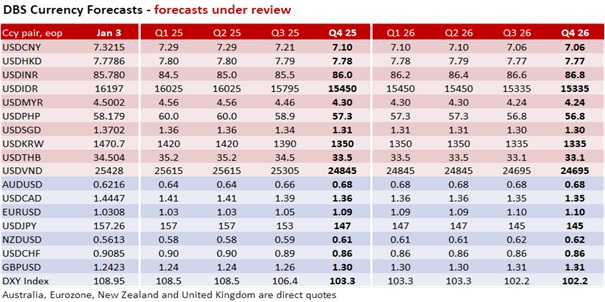

USD/CNY finally broke above its multi-week cap at 7.30 last Friday, indicating that China would partially allow depreciation to offset the potential tariffs. Although USD/JPY has stabilized around 156-158 since December 20, the JPY will not find support at the Bank of Japan meeting on January 24, where inadequate guidance has reduced the odds for a hike to below 50%.

The futures market’s odds are significantly low at 11% for the Fed to reduce interest rates at its January 29 meeting. At last month’s FOMC meeting, the Fed projected only two rate cuts in 2025, fewer than the four cuts forecasted three months earlier. Fed Governor Adriana Kugler reckoned monetary policy had moved to a more moderate level of restrictiveness after 100 bps of Fed cuts in September-December. This week, Fed speakers will likely stay optimistic about the US economy outperforming its Developed Market peers. Upside surprises in US ISM services and jobs data will lift the USD. Fed officials should be vigilant of inflation risks from an escalating trade war with reciprocal tariffs.

Conversely, the bets for a 25 bps cut are larger at other central bank meetings, i.e., the European Central Bank (107%) on January 30, the Bank of Canada (80%) on January 29, and the Bank of England (71%) on February 6. ECB President Christine Lagarde was hopeful about the inflation target hitting the 2% target in 2025, with some ECB members optimistic about lowering rates to 2% by autumn. Unlike the Fed, the ECB sees disinflation risks from Trump’s tariffs, leading China to divert more competitive exports to the bloc.

Political crises took their toll on some currencies. No single party is expected to win Germany’s elections on February 23 amid doubts that the next coalition government would be stable enough to last a full four-year term. France faces challenges in forming and maintaining a stable government after the 2024 snap elections led to a fragmented parliament. Canada could hold snap elections ahead of schedule (October 25) if Prime Minister Justin Trudeau steps down from internal party pressure to resign or a no-confidence motion led by the opposition. South Korea is facing a leadership vacuum after suspended President Yoon Suk Yeol’s failed martial law declaration last month led to an impeachment that has yet to be finalized by the Constitutional Court. EUR/USD is eyeing parity again. USD/KRW is at its highest level since 2009. USD/CAD may hit its loftiest levels since 2003.

Quote of the Day

“Life is 10% what happens to you and 90% how you react to it.”

Charles R. Swindoll

January 6 in history

Village People's "Y.M.C.A." became their only UK #1 single in 1979. The song is widely recognised as a hallmark of Trump’s political rallies.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.