- Global software market is projected to grow 12% and reach a market value of USD1,789bn by 2032

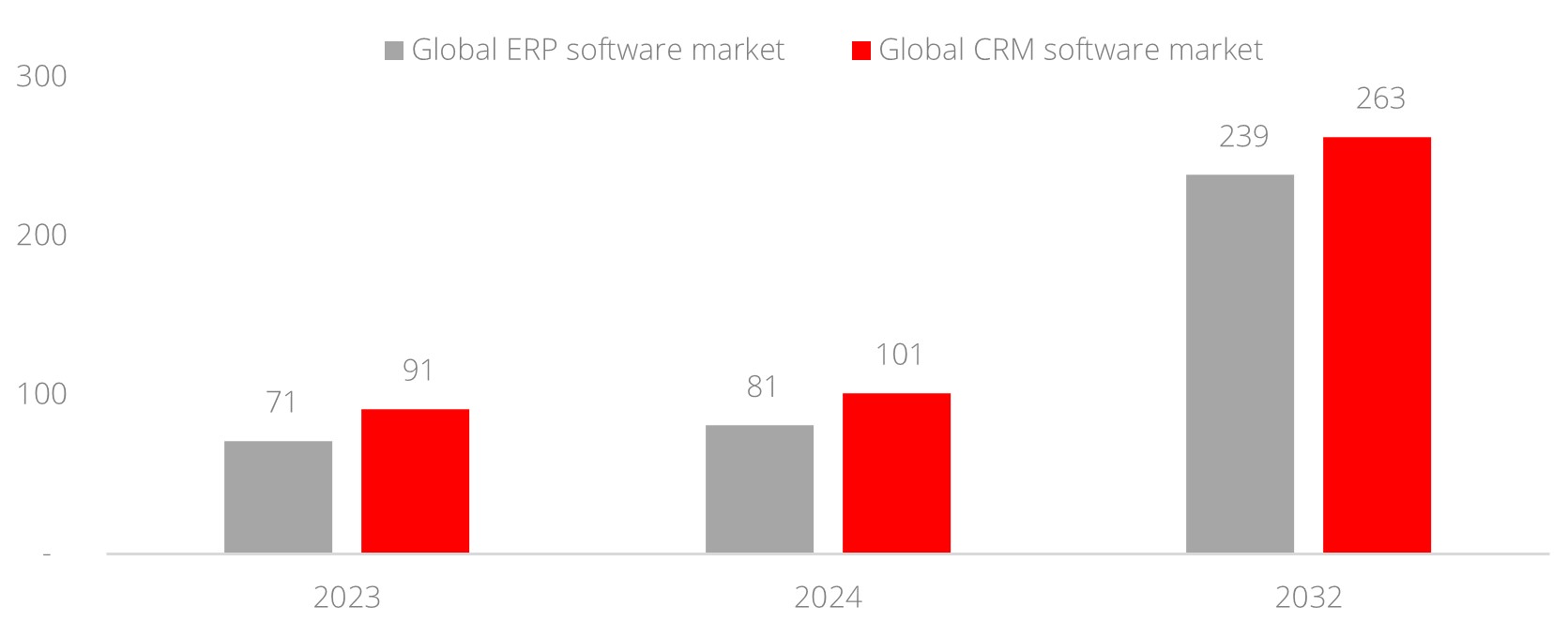

- ERP and CRM markets expected to grow 14% and 13% CAGR over 2024-2032 respectively

- Alibaba, Amazon, and Microsoft among key hyperscalers in providing compute power and AI platforms

- Prefer SaaS providers as they accelerate monetisation by directly integrating AI into products

- Hyperscalers to maintain long-term dominance as they are key providers of AI infrastructure

AI agents are benefitting businesses, while GenAI benefits consumers. Both Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems will benefit differently from Agentic AI. For example, the ERP system providers benefit from cost reductions and efficiency gains, making AI an essential element for complex workflows. On the other hand, AI adoption among CRM system providers is driven by more efficient customer interaction and a better user experience which enhances brand differentiation. Businesses focused on automation will adopt ERP Agentic AI, while those prioritising customer experience will choose CRM Agentic AI solutions.

AI agents drive cost efficiency. In the US, a physical human agent would cost USD15–25 per hour and handle 4-6 interactions, translating to a cost of USD4-6 per interaction. In comparison, adopting Salesforces’ Agentforce will halve the cost with each interaction at only USD2. Internally, the all-in per interaction cost (compute power, AI model licensing, API overhead) for using Agentforce is even lower at USD0.65-0.75. This effectively enhances the gross margin to a range of 60-70%. Furthermore, advancements in AI technology like DeepSeek are driving down operational costs (AI Model Licensing), further driving cost efficiency. In Mar 2025, Salesforce launched AgentExchange, a marketplace designed for partners, developers, and the Agentblazer community to build and monetise Agentforce solutions. This platform enables corporate users to adopt plug-and-play AI agents without heavy in-house development.

Favour hyperscalers in addition to ERP and CRM. Besides the aforementioned application providers, hyperscalers like Alibaba, Amazon, and Microsoft are equally important by providing compute power, storage platforms, and the vast SaaS ecosystem. Expect high revenue growth and profitability ahead. Major players such as Salesforce, SAP, and Alibaba reported above-consensus adjusted earnings in 4Q24 (calendar year), driven by cloud growth and AI deployment. In terms of forecast, Salesforce has guided revenue growth of 7-8% y/y for FY1/26F with their Agentforce and Data Cloud contributing USD900mn in annual recurring revenue in 4Q25, reflecting a 120% y/y growth. SAP forecasts cloud revenue growth of 26-28% in FY12/25, while the street expects Alibaba cloud revenue to achieve a CAGR of 18% over FY25F-FY27F. In addition to cloud revenue, Alibaba could potentially monetise its AI solutions such as: i) AI-To-Consumers Qwen Chat, ii) AI-To-Business Dingtalk, iii) AI search assistant, and iv) AI-related projects in Tmall within the next two to three years.

Prefer SaaS providers and Chinese hyperscalers. SaaS providers are well-positioned to accelerate AI service monetisation by integrating directly into their existing products, utilising the AI infrastructure, compute power, and storage of hyperscalers. In China, the hyperscalers are in the early stage of cloud revenue growth, while SaaS infrastructure providers have yet to catch up. ERP and CRM providers will gain significant advantages from AI agents globally. These applications will not only proactively generate insights for autonomous decision-making, but also automate system configurations, ultimately lowering costs and making advanced solutions accessible to businesses of all sizes. In this backdrop, Salesforce and SAP have higher exposure to the CRM and ERP segment, while Alibaba is the largest hyperscaler in China.

Figure 1: Global ERP and CRM software market size (USDbn)

Source: Fortune Business Insights, DBS

Download the PDF to read the full report.

Topic

DISCLAIMERS AND IMPORTANT NOTES

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. The information herein does not have regard to the investment objectives, financial situation and particular needs of any specific person. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Companies within the DBS Group or the directors or employees of the DBS Group or persons/entities connected to them may have positions in and may affect transactions in the underlying product(s) mentioned. Companies within the DBS Group may have alliances or other contractual agreements with the provider(s) of the underlying product(s) to market or sell its product(s). Where companies within the DBS Group are the product provider, such company may be receiving fees from the investors. In addition, companies within the DBS Group may also perform or seek to perform broking, investment banking and other banking or financial services to the companies or affiliates mentioned herein.

This publication may include quotation, comments or analysis. Any such quotation, comments or analysis have been prepared on assumptions and parameters that reflect our good faith, judgement or selection and therefore no warranty is given as to its accuracy, completeness or reasonableness. All information, estimates, forecasts and opinions included in this document or orally to you in the discussion constitute our judgement as of the date indicated and may be subject to change without notice. Changes in market conditions or in any assumptions may have material impact on any estimates or opinion stated.

Prices and availability of financial instruments are subject to change without notice. Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results. Future results may not meet our/ your expectations due to a variety of economic, market and other factors.

This publication has not been reviewed or authorised by any regulatory authority in Singapore, Hong Kong, Dubai International Financial Centre, United Kingdom or elsewhere. There is no planned schedule or frequency for updating research publication relating to any issuer.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

The investment product(s) mentioned herein is/are not the only product(s) that is/are aligned with the views stated in the research report(s) and may not be the most preferred or suitable product for you. There are other investment product(s) available in the market which may better suit your investment profile, objectives and financial situation.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

Country Specific Disclaimer

This publication is distributed by DBS Bank Ltd (Company Regn. No. 196800306E) ("DBS") which is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS").

This publication is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) or an “Institutional Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only and may not be passed on or disclosed to any person nor copied or reproduced in any manner.