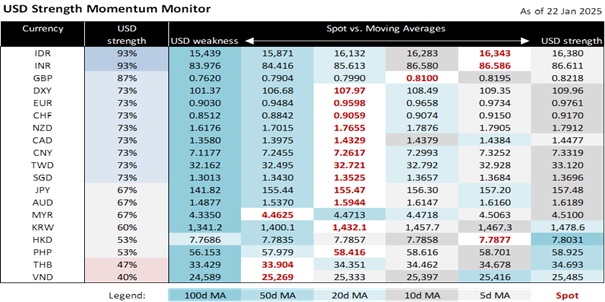

Two factors support the DXY Index around the 108 level. First, US President Donald Trump has set February 1 as the day to impose tariffs on Canada, Mexico, and China. Trump also instructed the commerce secretary to examine the US trade deficit and evaluate the feasibility of a universal tariff. The Senate is expected to confirm Howard Lutnick, Trump’s nominee for Commerce Secretary. Second, the futures and OIS markets see the Fed delaying its next rate cut to June and many central banks delivering multiple cuts before that. At next week’s FOMC meeting, the Fed could affirm a longer journey towards achieving the 2% inflation target due to Trump’s incoming policies on tariffs and immigration. Conversely, the European Central Bank will likely view tariffs as a greater risk to growth than inflation when it lowers rates next week. This divergence in how the Fed and the ECB interpret Trump’s tariffs reflects the contrasting dynamics between the resilient US economy and the stagnant Eurozone economy.

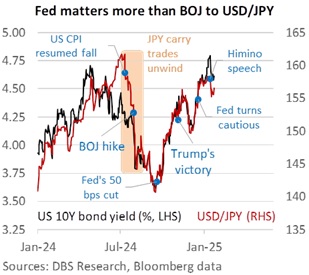

USD/JPY is trading near the top of the 155-156.5 range established since mid-January. The OIS market has priced in a 96% chance of a 25 bps hike to 0.50% at tomorrow’s Bank of Japan meeting. BOJ is also likely to raise its inflation forecast. Base wages grew by 2.7% YoY in November, nearing the 3% threshold necessary to sustain 2% inflation. Tomorrow’s national ex-fresh food inflation is expected to increase to 3% YoY in December from 2.7% the previous month. In the end, the US’s inflation and interest rate outlook will probably matter to USD/JPY than Japan’s. On a positive note, the BOJ’s hike expectation did prevent USD/JPY from revisiting last year’s highs above 160 despite the US 10Y bond yield briefly pushing above April 2024’s peak.

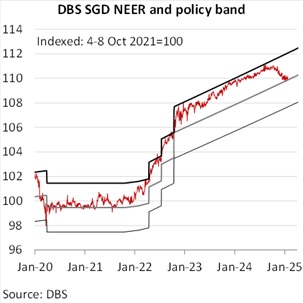

We expect the Monetary Authority of Singapore to maintain the status quo at tomorrow’s policy review. We do not interpret the NEER’s decline from the top to the mid-point of the policy band as an imminent signal to tweak any of the band’s three parameters – the slope, mid-point, and width. Instead, we consider this repositioning consistent with the recent decline in the MAS core inflation into this year’s 1.5-2.5% forecast range and a lower official growth outlook of 1-3% in 2025. There is no urgency to act now. The IMF’s latest outlook is calling for stable global growth this year amid a warning about inflation risks from Trump’s policies. The upcoming Budget announcement on February 18 will address the cost of living issue, which has become a primary concern for Singaporeans ahead of this year’s general elections. Barring any surprise rise in the USD, with the NEER near the band’s centre, USD/SGD’s upside will likely be limited to 1.3570, according to our model.

Quote of the Day

“What you do today can improve all your tomorrows.”

Ralph Marston

January 23 in history

The Wham-O toy company rolled out the first Frisbees in 1957.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.