- Tax-sensitive sectors to benefit from Republican sweep; healthcare, clean energy for Democrats

- Credit: Corporate credited boosted by Republican sweep; Democrat win neutral for credit

- Rates: Yield curve to steepen either way, with Democratic sweep relatively steeper

- FX: USD recovery expected to date out after elections, regardless of results

- Gold: Optimistic either way, with Trump's stance on geopolitics; Harris' expansionary policies

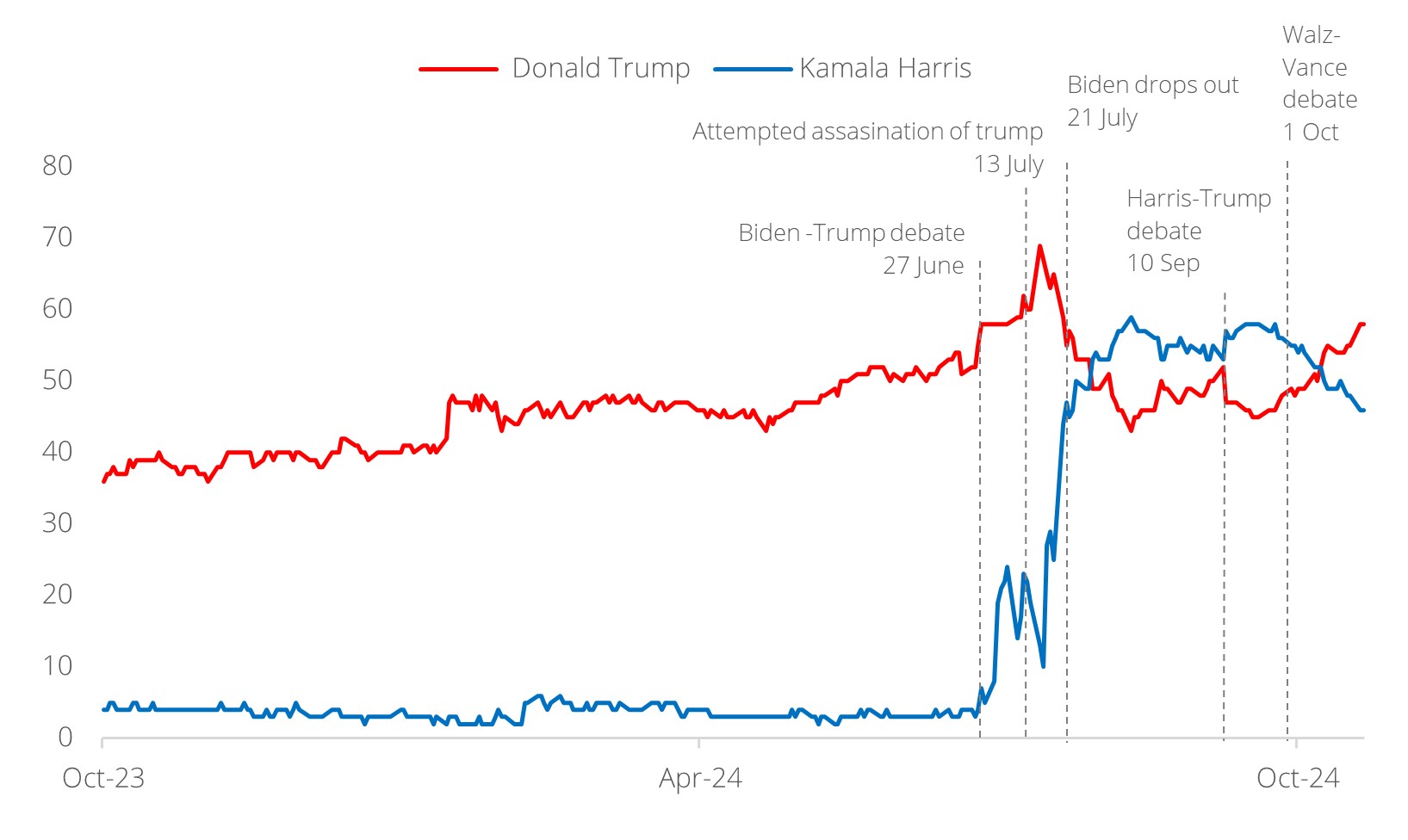

2024 US Presidential Election – Down to the wire. The 2024 US Presidential race begun with Trump leading the polls, fuelled by strong support and a campaign centered on economic nationalism. However, the race took a significant turn when President Joe Biden stepped down from seeking re-election, allowing Vice President Kamala Harris to secure the Democratic nomination. Since then, Harris had gained significant momentum, with early polls showing her taking the lead over Trump.

However, in recent weeks, the political landscape took a dramatic shift as Trump regained momentum and now finds himself in the lead once again. With less than two weeks until the election, much can still change, adding to market volatility as investors weigh the implications of different outcomes. In this CIO Perspective, we highlight the macro and cross assets implications in the event of either a Democratic or Republican sweep.

Macro Implications

Taxes

Republican Sweep

In the attempt to revitalise domestic manufacturing and job creation, Republicans to lower corporate tax rates from 21% to 15% for US-based companies.

Extension of the Tax Cuts and Jobs Act (TCJA) across all income levels, further reducing the overall tax burden. While these policies are designed to promote economic growth, they come with the risk of increasing the national debt, especially if the resulting economic growth does not generate enough additional revenue to balance the fiscal impact.

Democratic Sweep

Extension of the TCJA tax cuts for individuals earning less than USD400k while expanding the Child Tax Credit and Earned Income Tax Credit to provide further relief for low- and middle-income families.

Democrats to raise taxes on corporations and high-income earners to fund social programs. Key proposals include increasing the corporate tax rate from 21% to 28%, alongside raising the top individual income tax rate from 37% to 39.6%.

Republican Sweep

Trump’s protectionist stance to be revived, focusing on tariffs to reduce trade deficits and protect domestic industries. This may encompass the imposition of a blanket 10% tariff on most imports, along with significantly higher tariffs of up to 60% on Chinese goods.

The imposition of tariffs, along with renegotiations of trade deals like the USMCA, would aim to revitalise US manufacturing, but also carry the risk of escalating trade tensions.

Democratic Sweep

Harris's policies would likely align with Biden's approach, which has retained many of Trump's tariffs, especially on Chinese imports.

While there is relatively more openness to international trade, the administration is expected to maintain a cautious stance, preserving existing tariffs to protect domestic industries and workers.

Republican Sweep

Republicans to focus on fiscal policies aimed at extending the Tax Cuts and Jobs Act (TCJA) beyond its 2025 expiration, which could add approximately USD 7.5tn to the national debt.

Republicans to propose significant cuts to entitlement programs like Medicare and Medicaid to help offset revenue losses from tax reductions.

Proposed spending cuts may not be enough to fully cover the costs, and this can potentially exacerbate the budget deficit and raise concerns about long-term fiscal sustainability.

Democratic Sweep

Democrats to focus on increased social benefits, potentially adding USD 3.5tn to the national debt.

Significant investments in childcare, education, and healthcare would be at the centre of their fiscal policy, aiming to boost labour force participation, particularly among parents.

These policies are designed to drive long-term economic growth, although they may contribute to moderate inflation in the short term.

The tax increases that will be introduced may not fully cover the costs of expanded social programs, leading to growing deficits over time.

Cross Asset Implications

Equities

Republican Sweep

A Republican sweep would create short-term opportunities for tax-sensitive sectors, with expected corporate tax rate cuts of 15%, deregulation across various industries, and increased tariffs on imports, particularly from China. Sectors like energy, transportation, and financial services stand to benefit from lower taxes and reduced regulatory burdens.

Additional tariffs could boost US manufacturing especially in pharmaceuticals, semiconductors, and renewable energy through competitive advantages and tax cuts. However, these gains may be short-lived due to the retaliatory nature of global trade, which can increase costs and disrupt production for companies reliant on global supply chains.

Democratic Sweep

Harris has positioned herself as a leader who aims to blend continuity with Biden’s policies while also injecting her own distinct vision for the future.

Significant deviations from current policies are unlikely, expect enhancements for existing initiatives. Key policies such as the Affordable Care Act, the Inflation Reduction Act, the CHIPS Act, and the Infrastructure Investment and Jobs Act will continue to benefit crucial industries like healthcare, semiconductors, and clean energy.

Republican Sweep

The predominant assumptions of a prospective Trump presidency revolve around runaway federal debt (stemming from unfunded corporate tax cuts), and hence higher 10Y UST yields.

Our quantitative examination of past Republican presidencies, however, reveals that the prevailing narrative warrants investigation. Empirically, UST yield curves tend to flatten under past Republican presidencies, with 10Y UST yields inhabiting lower ranges under Republican presidencies vis-a-vis Democratic presidencies, an observation which also echoed near the end of Trump's first presidential term.

Drastic unfunded tax cuts under a second Trump term could amplify deficits and introduce further risk premiums to US Treasuries, which suggests that investors should continue to avoid ultra-long duration trades like 30Y bonds. We also see a likelihood for Trump to revive tariffs which, in 2018, had in fact sent 10Y UST yields tumbling following aggravated trade tensions. Note also that Trump’s business-friendly inclinations had been supportive of risk assets like corporate credit in his previous term.

Higher credit yields in anticipation of a 2024 Trump victory is a buy-the-dip opportunity for investors, especially in the 7-10 year duration segment.

Democratic Sweep

A Democratic victory would be the voters’ bid for stability. As markets are already well-acquainted with the incumbent’s policies and views, we believe the market impact of a Democratic victory would be credit neutral.

Although Kamala Harris’ proposals to raise corporate taxes could hit the bottom line of US companies, we note that interest expenses are ultimately paid from pre-tax earnings which would impact credit more moderately due to its seniority in the capital structure.

The Fed will likely stay on an undisturbed course towards its 2% inflation target and move ahead with the rate-cut cycle. Our empirical assessment shows gradual steepening of the UST yield curves 1 year after election under past Democratic presidencies. Taken together, a post-election bull steepening may gradually manifest, which favours the front end at the margin.

Republican Sweep

Trump’s victory is currently reasonably anticipated by the betting markets, which have assigned odds higher than 60% of him retaking the Presidency in November.

Trump is widely considered to be looser on the fiscal side. Issuances worries would likely prompt the curve to be somewhat steep as investors demand a premium. Moreover, there is the added complexity that Trump would likely add more pressure on the Fed to cut rates.

If rates get driven lower than they otherwise should be, inflationary pressures could re-emerge, compounding tariff inflation worries, leading to upward pressure on the back of the curve.

Democratic Sweep

A Democrat victory would likely be more of the status quo. Harris is the frontrunner now that Biden has dropped out, but her odds of victory is still hovering around 40%.

A Democrat victory will temper deficit worries somewhat and fiscal deficit expectations should not differ too much from the CBO’s projection of 5-6% over the coming decade.

However, there should be less tariff worries, less worries on Fed intervention and accordingly, less worries on inflation. Curves would be relatively flatter and yields relatively lower under a Democrat victory compared to a Trump victory.

Republican Sweep

In the short term, USD bulls want to re-enact the greenback’s year-end rally on a Trump-led Red Wave at the 2016 election. They believe higher fiscal spending and tariffs could reignite inflation and keep US interest rates relatively high.

However, the UK mini-budget crisis illustrated how rising government bond yields could expose currency vulnerabilities, mainly if they reflect an unsustainable fiscal situation.

A second Trump presidential term could hurt the USD’s coveted reserve status if he undermines the Fed’s independence and pushes for lower rates. Trump will also weaponise tariffs and step up efforts to reshore manufacturing activities and jobs to America while complaining that Japan and China seek unfair competitive advantages through their weak currencies.

Democratic Sweep

Speculators noted that a Democratic sweep in the 2020 elections led the USD for the rest of the year.

However, the circumstances that led to the USD’s rise in the first two years of Biden’s term are missing. Biden’s back-to-back fiscal boost to tackle the COVID-19 pandemic led to exceptional US growth that required aggressive Fed hike rates to rein in decades-high inflation.

In contrast to the last two presidential terms, Harris’ term will start with falling, not rising, interest rates. With Harris respecting the Fed’s independence, the Fed should keep reducing interest rates towards neutral in 2025 based on its projection for a soft landing in the US economy, allowing inflation to decline towards the 2% target. In such scenario, the USD’s recovery is likely to lose momentum.

Republican Sweep

The immediate impact of a Republican victory on gold should be a positive one as Trump’s adversarial stance on geopolitics will likely boost gold’s safe haven appeal.

Trump’s looser fiscal stance, which is set to increase federal debt by USD7.5tn through 2035, should also be a tailwind for gold as the latter is positively correlated with US indebtedness.

Overall, gold should be structurally well-supported under a Trump administration. The key downside risk to this scenario is that tariffs and government spending could see a resurgence in inflation and prompt the Fed to raise rates, which will in turn put downward pressure on gold prices.

Democratic Sweep

While the Democrats may practise more restraint on the fiscal front, Harris’s fiscal expansionary policy proposals are still expected to grow federal debt by USD3.5tn through 2035.

Notwithstanding that this figure is smaller than the projections under a Trump presidency, there is still a substantial increase and should contribute positively to gold demand. To the extent that the (relative) fiscal discipline by the Democrats manages to keep inflation at bay, the Fed should be able to maintain its gradual rate cutting cycle, which would be positive for gold.

Republican Sweep

The economics of a Trump presidency will likely be inflationary; loose fiscal policy in the form of tax cuts and government spending will raise aggregate demand while protectionist policies tighten and disrupt supply.

This suggests the impact on commodity prices will likely be to the upside, though different sub-asset classes will experience different nuances. The main exception to this is energy as Trump’s pro-fossil fuel position will likely see the easing of environmental regulations and make

Conversely, his combative stance towards the energy transition may see parts of the Inflation Reduction Act (IRA) repealed, which will have a negative impact on the demand and prices of green metals.

Democratic Sweep

A Democrat victory should see a relatively tighter fiscal stance, fewer protectionist policies, and consequently a smaller impact to budget deficits and supply chains.

In such a scenario, inflationary pressures will be lower, and commodity prices should maintain more of a status quo trajectory. Demand for green metals will likely stay supported from clean energy investments and associated tax credits under the IRA.

Energy prices should also remain more stable under the Democrats as Harris is unlikely to dole out the same regulatory concessions that Trump would to energy producers; this should keep supply more constrained and prices on the higher side.

Look beyond short-term volatility and focus on long-term secular trends.In conclusion, predicting election outcomes and their market impact is inherently complex, as campaign promises often face challenges in execution due to shifting political, economic, and global circumstances. Therefore, it is crucial to look beyond short-term volatility and focus on long-term secular trends like the rise of AI, which can provide sustainable growth regardless of political outcomes.

Over the past several years, technology has consistently been one of the best-performing sectors under both Presidents Trump and Biden. The resilience and rapid advancements in areas like artificial intelligence, cloud computing, and cybersecurity have proven that the technology sector remains a key driver of economic growth, regardless of which party holds power

Figure 1: Market poll on who will win the 2024 US Presidential Elections

Source: PredictIt, Bloomberg, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")