Trump’s nomination of Bessent to be the next US Treasury Secretary had reined in concerns over US fiscal deficits and tariffs, and tempered USD strength. Bessent’s background as a macro hedge fund manager means that he can speak about the US fiscal position credibly, even with Congress holding the authority in setting budgets. Furthermore, Bessent had publicly said that Trump’s tariff threats are a negotiation tool to push trading partners to lower tariffs on US goods. He believes that tariffs should not be imposed on goods that the US does not make, and that they should be layered in to avoid excessive inflationary impact. These are positions that should avert the worst outcomes for global trade.

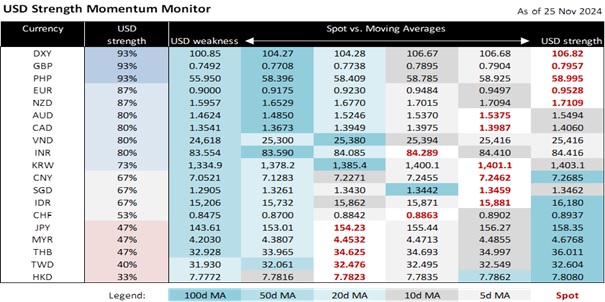

Still, Trump’s protectionist tendency and volatile temperament imply that uncertainty for markets will remain, no matter who is Treasury Secretary. Perhaps as a reminder to his base of his protectionist credentials, Trump posted on social media today that he will charge China with an additional 10% tariff over drug inflows, and that he will impose 25% tariffs on all Mexico and Canada goods, purportedly for the influx of people and illegal drugs. Despite Mexico and Canada being signatories to the USMCA trade agreement, markets have still taken fright at Trump’s threat, with MXN and CAD falling by 1.4% and 0.8% respectively. For the RMB, even if tariff threats on Chinese goods are already partially expected and priced, USD/CNH still rose by 0.3% towards 7.27 in the wake of Trump’s fresh posting.

Given Trump’s unpredictability, China could more actively support broad-based stability in the RMB to temper undue volatility. On a trade-weighted basis, the RMB has seen little change since Trump’s election victory. The PBOC is leaning against RMB depreciation expectations by setting a series of strong CNY fixings around 7.19, which are now more than 500 pips away from spot market levels. Given our economists’ assessment that proposed US tariffs to China pose no more than a 1% drag on growth, we believe that any RMB adjustment in response should also be quite small.

Quote of the Day

“I am a tariff man standing on a tariff platform.”

William McKinley

November 26 in history

The Concorde made its final flight in 2003.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.