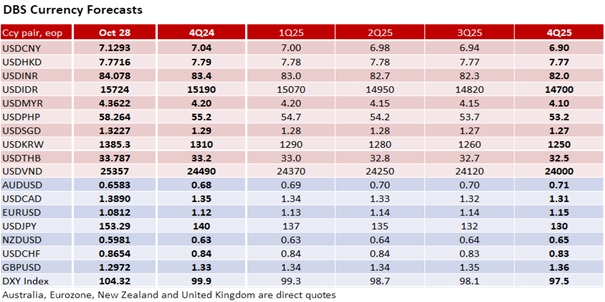

The DXY Index was barely changed at 104.32 overnight, consolidating in a 104-104.6 range for the fourth session. Since October 23, the greenback’s gains against the JPY and CAD have been offset by losses against the GBP, EUR, and CHF. Technically, the DXY is overbought. The 14-day RSI has cooled to slightly below 70 (overbought level) after peaking at 74.7 on October 23. A decline in this Friday’s US nonfarm payrolls to 110k (consensus) in October could reverse this month’s USD recovery driven by the surprise jump to 254k in September. The Fed’s Beige Book noted that employment growth was modest, primarily driven by replacement hiring rather than expansion.

The greenback has not been responding to rising US bond yields. First, the futures market has priced in two Fed cuts in November and December, which would lower the Fed Funds Rate to 4.25-4.50%. if so, this should cap the rise in the 2Y and 10Y yields, which closed overnight at 4.14% and 4.28%, respectively. Additionally, WTI crude oil prices plunged 4.4% on Monday to USD68 per barrel, reversing the spike to USD77 in early October driven by fears of a broader Israel-Iran conflict.

Markets should look past tomorrow’s US advance GDP growth for 3Q24, which is expected to stay at the same pace as 3Q24 at an annualized 3% QoQ saar. The Fed’s Beige Book noted that US economic activity has changed little across most districts since early September, contrasting with recent positive economic data. The report also cited cautious consumer spending because of the uncertainties surrounding the US Presidential elections on November 5. With bond yields some 50 bps higher this month, consensus may be too optimistic in expecting today’s Conference Board’s consumer confidence index to improve to 99.5 in October from 98.7 in September.

Second, US fiscal sustainability worries have increased. According to a study from the nonpartisan Committee for a Responsible Federal Budget (CRFB), former President Donald Trump’s election pledges would add twice as much to the federal debt as Vice President Kamala Harris’ proposals, tainting the attractiveness of the Trump Trade. During Trump’s first term (2017-2020), the US federal debt increased from 76% to 98.7% of GDP before rising to a projected 99.6% during President Joe Biden’s term (2021-2024). In August 2023, Fitch Ratings cited the expected fiscal deterioration over the next three years for removing America’s second “AAA” debt rating. If neither the Democrats nor Republicans sweep the US elections, expect another political standoff to raise the federal debt ceiling, which was last suspended to January 2025.

Quote of the Day

“Tyranny naturally arises out of democracy.”

Plato

October 29 in history

IN 1929, the stock market crashed on Wall Street and triggered the Great Depression.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.