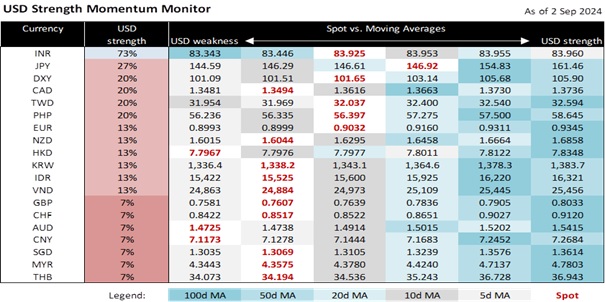

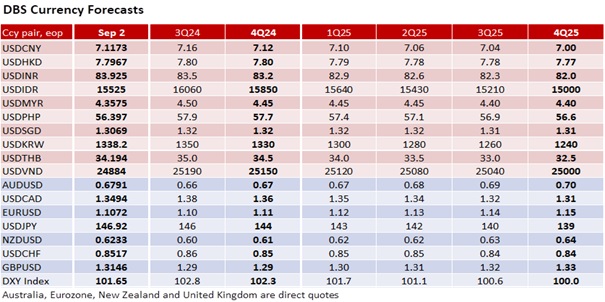

The DXY Index consolidated in a 101.55-101.80 range after a three-day rally from 100.55 to 101.80. US stock and bond markets were closed on Monday for the Labor Day holiday. Still, the S&P and Nasdaq Composite futures are pointing to a positive open today after being in negative territory for most of Monday. Today, consensus sees the US ISM Manufacturing PMI improving to 47.5 in August from 46.8 in July. However, markets see Friday’s jobs report as the primary support for the anticipated 25 bps rate cut at the FOMC meeting on September 18. With markets also weighing this potential against the other rate cuts expected from other central banks, markets will likely fluctuate more after the past two months of USD selling.

EUR/USD appreciated by 0.2% to 1.1072, brushing aside the victory of Germany’s far-right Alternative for Germany (AfD) in the eastern state of Thuringia. The euro had depreciated in the last three days of the previous week, dropping to 1.1048 from 1.1184, amid expectations of a second interest rate cut at the European Central Bank meeting on September 12. Following the Eurozone CPI inflation decline to 2.2% YoY in August, down from 2.6% in July, the OIS market has priced in a 94% chance of a 25 bps cut in the deposit facility rate to 3.50%. Last week, ECB Chief Economist Philip Lane cautioned that the mission to return to the 2% target was “not yet secure,” signalling concerns with the market pricing in a neutral rate of 2.00-2.50% by mid-2025.

USD/CHF recovered to 0.8520 after touching the 0.84 low on August 29, a level last seen at the start of the year. On August 30, Swiss National Bank President Thomas Jordan said Switzerland’s moderate growth outlook, along with gains in the CHF, would influence the central bank’s inflation assessment. Jordan also highlighted that the strength of the CHF poses a challenge to the Swiss industry, particularly given the weak demand from Europe. In June, SNB forecasted inflation at 1% or the mid-point of its 1-3% target range through 1Q27. As a result, the market will be closely watching today’s CPI and GDP data for any downside surprises. The consensus is that CPI inflation declined to 1.2% YoY in August from 1.3% in July and that GDP growth improved to 1.5% YoY in 2Q24 from 0.6% in 1Q24. The OIS market has priced in a 126% probability of a third 25 bps rate cut to 1.00% at the SNB meeting on September 26.

Quote of the day

”A genuine leader is not a searcher for consensus but a molder of consensus.”

Martin Luther King Jr.

3 September in history

Dow Jones Industrial Average reached an all-time high of 381.17, to be shortly followed by the Crash of 1929.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.