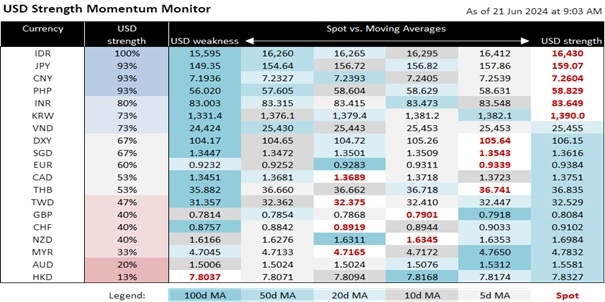

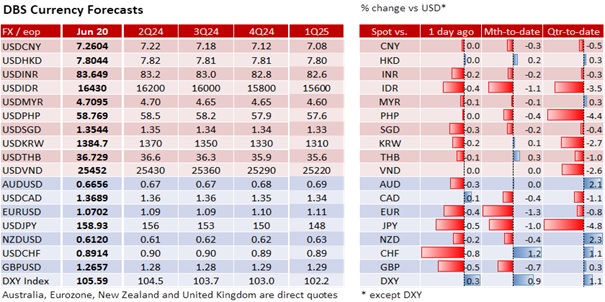

The US Treasury had added Japan to its monitoring list for its semi-annual report on currency practices, but this should not pose any hurdle for Japan to intervene in support of the JPY. Japan was added to the list simply because its current account surplus has risen to over 3% of GDP, thus meeting 2 out of 3 criteria set by the US Treasury. Furthermore, the US Treasury is only concerned if there are also large FX purchases to weaken the currency, but Japan is doing the opposite by supporting the JPY. We still see a high chance for intervention if the JPY depreciates sharply again, especially if USD/JPY rebounds above 159, which had triggered interventions back in April-May. The US Treasury’s monitoring list also contains many other Asian economies besides Japan, including China, Taiwan, Malaysia, Singapore, and Vietnam.

The offshore RMB has softened to its weakest level since Nov 2023, as markets anticipate a relaxation in the onshore fixing. The USD/CNY fixing has inched closer towards 7.12, and could break above its 7.09-7.12 range that has held since January. Onshore USD/CNY is now trading close to the 2% upper limit from the fixing at around 7.26, while USD/CNH has traded above 7.29. We had previously cautioned that trade tensions could be a risk for RMB policy, and the risk does seem to have risen after the EU announced extra duties of up to 38.1% on Chinese electric cars, starting July. Chinese state media now reports that Chinese auto companies are calling on Beijing to increase tariffs on large-displacement cars from Europe. An escalation in trade disputes could pose downside risks to growth, and the RMB.

USD/KRW has rebounded towards 1390, with the KRW seeing spillovers from RMB and JPY weakness, on top of a broadly stronger USD overnight. But Korean trade remains a bright spot, with the country’s first 20-day exports in June growing steadily by 8.5% y/y, undoubtedly helped by a semiconductor boom.

USD/CHF rallied above 0.89 after the SNB cut its policy rate by 25bps to 1.25%, marking a second consecutive rate cut. SNB sees a further decrease in underlying inflationary pressure compared to the previous quarter, and that lower rates will maintain appropriate monetary conditions. It expects growth to remain moderate at around 1% this year, with unemployment likely to continue rising slightly.

Quote of the day

“I paint self-portraits because I am so often alone, because I am the person I know best.”

Frida Kahlo

21 June in history

Mexican artist Frida Kahlo became the first Hispanic woman to be honoured on a US postage stamp in 2001.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.