- Will liquidity in the banking system stay tight?

- Will the growth of new loans and credit continue to be slow?

- Will exports continue contracting after two years of declines?

- What sectors present opportunity for export growth?

- What are the major downside risks to the growth outlook?

Soft landing, soft rebounding, soft risks

Hong Kong's economy is poised for a soft landing in 2024 as annual real GDP growth moderates to around 2% from 2023’s 3.5%. Ironing out base effect, estimated growth between 2023-2024 is 2.75%, nearing the average growth rate achieved in the decade prior to the pandemic's onset. Central to this recovery is mainland tourism revival, fortifying retail and catering sectors. This bodes well for tourism-reliant industries representing one-third of retail sales and 4.5% of GDP. Further tourism recovery will aid employment, especially the 15% workforce in retailers, hotels, and restaurants. Together, this should augment incomes and support domestic spending.

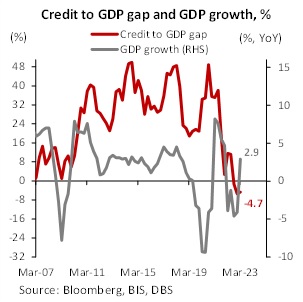

Lending growth remained subdued in 2023, with credit-to-GDP dipping to -4.7% in 1Q23 from a peak of 48.9% in 3Q20. Credit risk materialized from economic slowdown, lofty interest rates, and persistent stress in the mainland’s property sector. However, the worst may be over. Incremental stimulus should gradually lift Chinese consumer and business spending. Meanwhile, likely US tightening conclusion could alleviate Hong Kong dollar pressure, reducing HKMA intervention needs and bolstering liquidity.

Should the Fed commence monetary loosening in 2H24, Hong Kong rates will follow, easing strains in key sectors. We believe 3M HIBOR peaked at 5.7% and will retreat once seasonal effects dissipate, reaching 4.33%-4.7% in 2H24. After contracting ~20% in 2023, M1 may resume modest growth as households redirect funds to demand deposits amid lower cash holding costs.

Although domestic recovery is underway, slack persists with real GDP around 2% below 2018 levels. Output gaps and easing external price pressures are expected to offset inflationary forces from an improving labour market, keeping headline CPI steady at 2.0%. Prospects for private investment remain tepid amid restrained global economic expansion. Supportive policies are therefore imperative to maximize recovery potential. Initiatives stimulating investment and job growth remain crucial.

Downside risks include a pronounced global slowdown and regional conflicts capable of derailing recovery momentum. But such risks are soft, in our view, as indicated by the cautious optimism offered at the recent APEC summit. Enhanced cooperation promises from China and indications of eased bilateral tensions from the US signal a reduction in geopolitical risks, redirecting focus to bolster economic growth and reassure foreign investors navigating uncertainties in China and Hong Kong. Such developments may inject fresh momentum into the capital markets.

While overall external demand is expected to remain modest, prospects for Asian markets appear more promising. Evidence indicates the regional goods cycle downturn may have troughed. Given Hong Kong's electronics industry represents a whopping 70% of total exports, recoveries among key trading partners could strengthen the city’s role in regional supply chains through increased intra-regional trade. We expect headline export value growth to rebound by 7% in 2024 after two years of contraction.

HKD rate: Strain set to ease

Persistent interest rate hikes by the Fed over the past year widened the rate differential between the HKD and USD, fuelling speculative carry trades and putting downward pressure on the HKD. To defend the currency peg, the Hong Kong Monetary Authority has repeatedly intervened, draining interbank liquidity. The aggregate balance for Hong Kong banks consequently fell from over HK$400 billion in 2021 to around HK$48 billion currently—the lowest since 2008.

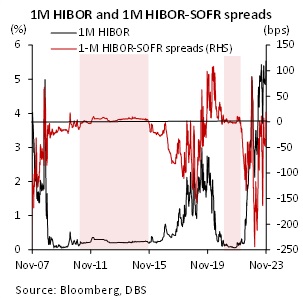

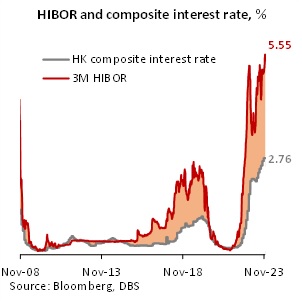

With a smaller liquidity pool, HIBOR has become more sensitive to fluctuations in HKD demand. 1M HIBOR spiked to 5.53% in early December from 0.18% in May 2022. Seasonal factors were also at play. Regulatory requirements and shifting liquidity profiles amongst banks systematically induced higher intermittent volatility in HIBORs approaching year-end.

Heading into 2024, further headroom appears limited. In the past five years, the degree of HIBOR increases leading up to December varied from 9bps-114bps. But rates consistently retreat once demand wanes in January. More importantly, the HIBOR-SOFR gap has essentially vanished after HIBOR caught up over the past year. As chart above shows, HIBOR tends to remain stable once differentials disappear, hinging future moves on the dynamics of the US counterparts.

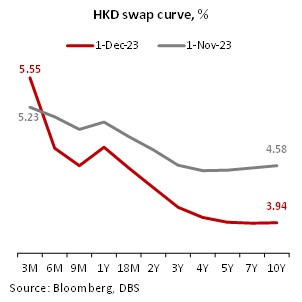

Markets currently price in no additional Fed hikes in 1H2024 and around 100bps of cuts in 2H2024, reflecting expectations of economic softening due to strain on leveraged businesses after US rates climbed 525bps in the past year. Such expectations were reinforced by recent easing in CPI and jobs data. Under the currency peg, Hong Kong rates should follow suit, albeit with short-term volatility from transient forces. Our view aligns with IRS pricing lower funding costs across tenors versus one month ago.

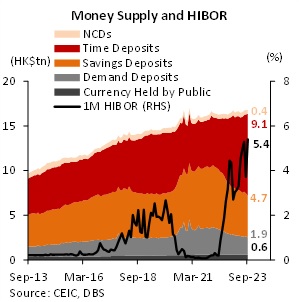

Abundant domestic bank deposits are also expected to keep a lid on overall funding costs. Total deposit volumes have grown steadily this year at 3.3% as of October. Higher time deposit rates prompted fund rotation out of demand deposits and into higher-yielding time deposits. This led to a decline in the narrow money supply M1 while the broader M2 maintained expansion.

Robust deposit balances have thus far enabled banks to gradually absorb upward pressure on funding costs. This is reflected in the modest rise of local banks’ HKD composite interest rate - from 0.22% in March 2021 to 2.76% by November 2023 - notwithstanding sharp upticks in HIBOR. Absent acute liquidity stress, we anticipate the spread between HIBOR and the composite interest rate to narrow as their historical correlation suggests.

All told, the 3M HIBOR rate is believed to have peaked at 5.7% in December and expected to retreat as seasonal factors dissipate, settling at 4.33%-4.7% in 2H24. Receding domestic interest rates synergized with Fed moves should anchor local money market stability, buttressing both the value and supply of Hong Kong dollars in the period ahead. This will lead to impacts on both the price and quantity of Hong Kong dollars. In terms of price effects, the HKD versus the USD will tend to appreciate, with our model pointing to the USD/HKD rate reaching 7.78 by 4Q24. In quantitative terms, net Hong Kong dollar liabilities of Hong Kong banks (or net spot foreign currency positions) is expected to rebound after contracting 45% from the February 2021 high.

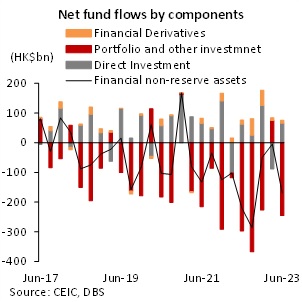

M1 may resume modest growth as households redirect more funds into demand deposits, driven by the reduced opportunity cost of holding onto cash. This trend could become more pronounced on the back of buoyant asset market performances. Our equity strategist anticipates the Hang Seng Index lifting approximately 15% to around 19,500 by end-2024. A turning equity market may attract capital inflows. Over the past year, Hong Kong's non-reserve financial account recorded unprecedented private fund outflows of HKD510 billion, mostly from portfolio and other investments. Stabilizing economic conditions and moderating funding costs could reverse this trend.

Credit growth: potential lift from rate cut

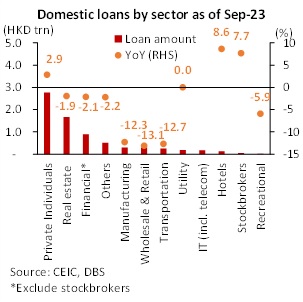

Economic activity remained lacklustre in 2023, contributing to subdued credit growth. Bank lending for use inside Hong Kong SAR flattened during Jan-Sep. The credit-to-GDP gap dipped to -4.7% as of 1Q23, down from the peak of 48.9% in 3Q20. Most economic segments registered credit contraction. Adversely affected by sluggish external trade, trade finance declined 19.2% while loans to manufacturing, wholesale and retail trade shrank by 12-13%. Loans to building, construction, property development and investment contracted by 1.9% as Hong Kong developers grappled with 16-year high inventories, elevated interest rates and China slowdown.

Businesses’ cautious outlook is likely to restrain credit demand in 1H24. The S&P Hong Kong SAR PMI declined to 48.9 in October 2023 from 49.6 the prior month, marking the fourth consecutive monthly decline and steepest drop since November 2022. According to the HKMA survey, the proportion of SMEs reporting "tighter" bank credit lines surged to 34% in 3Q from 18% previously. Potential monetary easing by the Fed in 2H24 might prompt a downward shift in Hong Kong's rates, strengthening borrowing and lending. Incremental stimulus from the Chinese authorities could further support Hong Kong banks, given their exposures to mainland nonbanks are sizeable at about 24% of banking sector assets (or 225% of GDP).

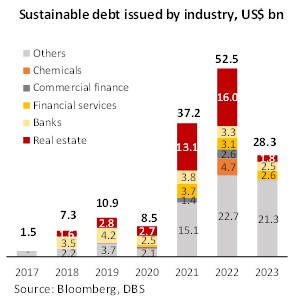

Meanwhile, Hong Kong's commitment to sustainability and robust green finance framework will propel its advancement. China's 14th Five-Year Plan endorses Hong Kong's role in green finance for the Greater Bay Area. Policy measures like the Green and Sustainable Finance Grant Scheme will help to reinvigorate progress after a slowdown in 2023. Use of green loan proceeds is expected to diversify beyond real estate given property softness. By instrument, a more meaningful resurgence is anticipated for “sustainability-linked loans” as their viability depends less on specific investments and instead incentivizes broader performance targets.

Trade: Asia the beacon

Total exports witnessed a sizable drop of 11% y/y during January-October owing to weak global demand. The recovery in cross-border land transport capacity also lagged expectations early this year, contributing further to declining exports. Dwindling domestic demand in China weighed particularly hard given 60% of Hong Kong’s exports go to the mainland led by electronics (-13.5%), clothing (-7.6%), textile yarn and fabrics (-25.9%) and toys (-23.6%).

The current account surplus narrowed to 9.32% of GDP in 2Q23 from 12.6% in 1Q22. Weaker merchandise exports alongside stabilizing domestic demand caused the trade deficit to widen noticeably. This overshadowed the services surplus, which received a lift from reopening borders and the tourism recovery.

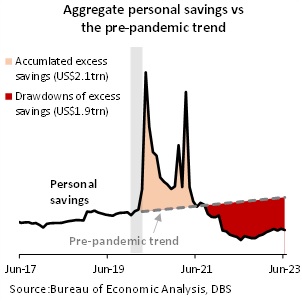

After two years of contraction, we forecast exports to stage a 7% year-over-year rebound in 2024, underpinned partly by base effects. Shipments beyond Asia are expected to see tempered expansion as demand cools in advanced and other emerging markets. Specifically, shipments to the US - which proved more resilient than anticipated in 2022 - are projected to lose momentum, in part reflecting the lagged effects of Fed tightening. Additionally, while excess pandemic-era savings of around USD2.1 trn helped the US economy defy downturn expectations hitherto, such savings are likely to have depleted in 3Q-4Q23. With household purchasing power declining alongside the run-down of savings, US consumption and import demand from China will soften.

By contrast, shipments to other Asian economies are projected to be the primary driver of growth, building on ongoing regional recoveries and integration trends. Evidence indicates goods cycle downturns across Asia may have bottomed out. South Korea witnessed memory chip exports rebound in October after 16 consecutive months of declines. Taiwan exhibited year-over-year growth in tech exports during Q3, reversing prior contraction. Its inventory-to-shipment ratio of electronic components has also eased from its peak of 2.0 in February to 1.4 in September, implying a pickup in demand. Given Hong Kong's electronics industry represents a whopping 70% of total exports, a recovery across key Asian trading partners could augment Hong Kong's position in regional supply chains through expanded intra-Asian trade. Our view is consistent with HKTDC’s latest 3Q Export Index signalling relative optimism for Asian markets such as ASEAN, Japan and mainland China.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FocusGENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

GENERAL DISCLOSURE/DISCLAIMER (Credit)

Completed Date: 18 Jan 2023 11:04:34 (SGT)

Dissemination Date: 18 Jan 2023 11:04:34 (SGT)

Sources for all charts and tables are DBS Bank unless otherwise specified

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Bank Ltd. This report is solely intended for the clients of DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively, the “DBS Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other factors which we may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or warranty as to the accuracy, completeness or correctness of the research set out in this report. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal or financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group, may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments. The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed, it may not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no obligation to update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a) such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

(b) there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments stated therein.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies) mentioned herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to the commodity referred to in this report.

ANALYST CERTIFICATION

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the companies and their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her compensation was, is, or will be, directly or indirectly, related to specific recommendations or views expressed in the report. The research analyst (s) primarily responsible for the content of this research report, in part or in whole, certifies that he or his associate[1] does not serve as an officer of the issuer or the new listing applicant (which includes in the case of a real estate investment trust, an officer of the management company of the real estate investment trust; and in the case of any other entity, an officer or its equivalent counterparty of the entity who is responsible for the management of the issuer or the new listing applicant) and the research analyst(s) primarily responsible for the content of this research report or his associate does not have financial interests[2] in relation to an issuer or a new listing applicant that the analyst reviews. DBS Group has procedures in place to eliminate, avoid and manage any potential conflicts of interests that may arise in connection with the production of research reports. The research analyst(s) responsible for this report operates as part of a separate and independent team to the investment banking function of the DBS Group and procedures are in place to ensure that confidential information held by either the research or investment banking function is handled appropriately. There is no direct link of DBS Group's compensation to any specific investment banking function of the DBS Group.

COMPANY-SPECIFIC / REGULATORY DISCLOSURES

- DBS Bank Ltd, DBS HK, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS'') or their subsidiaries and/or other affiliates do not have a proprietary position in the securities recommended in this report as of 30 Jun 2022.

Compensation for investment banking services:

- DBSVUSA does not have its own investment banking or research department, nor has it participated in any public offering of securities as a manager or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to obtain further information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact DBSVUSA exclusively.

Disclosure of previous investment recommendation produced:

- DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates may have published other investment recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12 months. Please contact the primary analyst listed on page 1 of this report to view previous investment recommendations published by DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates in the preceding 12 months.

RESTRICTIONS ON DISTRIBUTION

General | This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. |

Australia | This report is being distributed in Australia by DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”) or DBSV HK. DBS Bank Ltd holds Australian Financial Services Licence no. 475946. DBS Bank Ltd, DBSVS and DBSV HK are exempted from the requirement to hold an Australian Financial Services Licence under the Corporation Act 2001 (“CA”) in respect of financial services provided to the recipients. Both DBS and DBSVS are regulated by the Monetary Authority of Singapore under the laws of Singapore, and DBSV HK is regulated by the Hong Kong Securities and Futures Commission under the laws of Hong Kong, which differ from Australian laws. Distribution of this report is intended only for “wholesale investors” within the meaning of the CA. |

Hong Kong | This report has been prepared by a personnel of DBS Bank Ltd, who is not licensed by the Hong Kong Securities and Futures Commission to carry on the regulated activity of advising on securities in Hong Kong pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). This report is being distributed in Hong Kong and is attributable to DBS Bank (Hong Kong) Limited (''DBS HK''), a registered institution registered with the Hong Kong Securities and Futures Commission to carry on the regulated activity of advising on securities pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). DBS Bank Ltd., Hong Kong Branch is a limited liability company incorporated in Singapore. For any query regarding the materials herein, please contact Dennis Lam (Reg No. AH8290) at [email protected] |

Indonesia | This report is being distributed in Indonesia by PT DBS Vickers Sekuritas Indonesia. |

Malaysia | This report is distributed in Malaysia by AllianceDBS Research Sdn Bhd ("ADBSR"). Recipients of this report, received from ADBSR are to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection with this report. In addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report are advised that ADBSR (the preparer of this report), its holding company Alliance Investment Bank Berhad, their respective connected and associated corporations, affiliates, their directors, officers, employees, agents and parties related or associated with any of them may have positions in, and may effect transactions in the securities mentioned herein and may also perform or seek to perform broking, investment banking/corporate advisory and other services for the subject companies. They may also have received compensation and/or seek to obtain compensation for broking, investment banking/corporate advisory and other services from the subject companies. Wong Ming Tek, Executive Director, ADBSR |

Singapore | This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn No. 198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 6878 8888 for matters arising from, or in connection with the report. |

Thailand | This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. For any query regarding the materials herein, please contact Chanpen Sirithanarattanakul at [email protected] |

United Kingdom | This report is produced by DBS Bank Ltd which is regulated by the Monetary Authority of Singapore. This report is disseminated in the United Kingdom by DBS Bank Ltd, London Branch (“DBS UK”). DBS UK is authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. In respect of the United Kingdom, this report is solely intended for the clients of DBS UK, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS UK, This communication is directed at persons having professional experience in matters relating to investments. Any investment activity following from this communication will only be engaged in with such persons. Persons who do not have professional experience in matters relating to investments should not rely on this communication. |

Dubai International Financial Centre | This communication is provided to you as a Professional Client or Market Counterparty as defined in the DFSA Rulebook Conduct of Business Module (the "COB Module"), and should not be relied upon or acted on by any person which does not meet the criteria to be classified as a Professional Client or Market Counterparty under the DFSA rules. This communication is from the branch of DBS Bank Ltd operating in the Dubai International Financial Centre (the "DIFC") under the trading name "DBS Bank Ltd. (DIFC Branch)" ("DBS DIFC"), registered with the DIFC Registrar of Companies under number 156 and having its registered office at units 608 - 610, 6th Floor, Gate Precinct Building 5, PO Box 506538, DIFC, Dubai, United Arab Emirates. DBS DIFC is regulated by the Dubai Financial Services Authority (the "DFSA") with a DFSA reference number F000164. For more information on DBS DIFC and its affiliates, please see http://www.dbs.com/ae/our--network/default.page. Where this communication contains a research report, this research report is prepared by the entity referred to therein, which may be DBS Bank Ltd or a third party, and is provided to you by DBS DIFC. The research report has not been reviewed or authorised by the DFSA. Such research report is distributed on the express understanding that, whilst the information contained within is believed to be reliable, the information has not been independently verified by DBS DIFC. Unless otherwise indicated, this communication does not constitute an "Offer of Securities to the Public" as defined under Article 12 of the Markets Law (DIFC Law No.1 of 2012) or an "Offer of a Unit of a Fund" as defined under Article 19(2) of the Collective Investment Law (DIFC Law No.2 of 2010). The DFSA has no responsibility for reviewing or verifying this communication or any associated documents in connection with this investment and it is not subject to any form of regulation or approval by the DFSA. Accordingly, the DFSA has not approved this communication or any other associated documents in connection with this investment nor taken any steps to verify the information set out in this communication or any associated documents, and has no responsibility for them. The DFSA has not assessed the suitability of any investments to which the communication relates and, in respect of any Islamic investments (or other investments identified to be Shari'a compliant), neither we nor the DFSA has determined whether they are Shari'a compliant in any way. Any investments which this communication relates to may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on any investments. If you do not understand the contents of this document you should consult an authorised financial adviser. |

United States | This report was prepared by DBS Bank Ltd. DBSVUSA did not participate in its preparation. The research analyst(s) named on this report are not registered as research analysts with FINRA and are not associated persons of DBSVUSA. The research analyst(s) are not subject to FINRA Rule 2241 restrictions on analyst compensation, communications with a subject company, public appearances and trading securities held by a research analyst. This report is being distributed in the United States by DBSVUSA, which accepts responsibility for its contents. This report may only be distributed to Major U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to such other institutional investors and qualified persons as DBSVUSA may authorize. Any U.S. person receiving this report who wishes to effect transactions in any securities referred to herein should contact DBSVUSA directly and not its affiliate. |

Other jurisdictions | In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified, professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions. |

DBS Regional Research Offices

HONG KONG DBS (Hong Kong) Ltd Contact: Dennis Lam 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong Tel: 852 3668 4181 Fax: 852 2521 1812 e-mail: [email protected] | SINGAPORE DBS Bank Ltd Contact: Paul Yong 12 Marina Boulevard, Marina Bay Financial Centre Tower 3 Singapore 018982 Tel: 65 6878 8888 e-mail: [email protected] Company Regn. No. 196800306E

|

INDONESIA PT DBS Vickers Sekuritas (Indonesia) Contact: Maynard Priajaya Arif DBS Bank Tower Ciputra World 1, 32/F Jl. Prof. Dr. Satrio Kav. 3-5 Jakarta 12940, Indonesia Tel: 62 21 3003 4900 Fax: 6221 3003 4943 e-mail: [email protected]

| THAILAND DBS Vickers Securities (Thailand) Co Ltd Contact: Chanpen Sirithanarattanakul 989 Siam Piwat Tower Building, 9th, 14th-15th Floor Rama 1 Road, Pathumwan, Bangkok Thailand 10330 Tel. 66 2 857 7831 Fax: 66 2 658 1269 e-mail: [email protected] Company Regn. No 0105539127012 Securities and Exchange Commission, Thailand |

[1] An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

[2] Financial interest is defined as interests that are commonly known financial interest, such as investment in the securities in respect of an issuer or a new listing applicant, or financial accommodation arrangement between the issuer or the new listing applicant and the firm or analysis. This term does not include commercial lending conducted at arm's length, or investments in any collective investment scheme other than an issuer or new listing applicant notwithstanding the fact that the scheme has investments in securities in respect of an issuer or a new listing applicant.