- JPY and RMB have weakened significantly and are increasingly misaligned from economic fundamentals.

- We see a non-trivial risk of market intervention by Japan, especially if JPY weakness continues.

- If intervention does occur, we expect it to effectively impact the JPY exchange rate.

- China also has policy space to reinforce RMB stability, and should continue doing so.

- Both JPY and RMB face more asymmetric risks from policy biases.

Risks from wider currency misalignments

All Asian currencies have underperformed the USD this year, but North Asian FX stand out with their relative underperformance despite their stronger current account positions. Misalignments from fundamentals are now large enough for intervention risks to become nontrivial for the JPY, and for the RMB to be anchored by forceful policy guidance. Policy could continue to keep USD/JPY and USD/CNY restrained, amid a renewed surge in US long-term yields.

Within Asia, North Asian currencies including the JPY, CNY, and KRW are amongst the worst performers. Their sharper depreciation is also not aligned with the fundamentals, as Japan, China, and Korea all have larger current account surpluses compared to other Asian economies.

The net result is that JPY, CNY, and KRW real effective exchange rates (REER) have all fallen significantly below their 5Y average levels. Even after incorporating the impact from other factors through our DBS Equilibrium Exchange Rate (DEER) model, we estimate that both JPY and CNY are markedly lower (>10%) than their long-term fair value. It is not difficult to assess that both JPY and CNY are increasingly misaligned from longer-term fundamentals.

A major driver for such large misalignments, rare in the past, is the widening of rate differentials compared to the USD. Tellingly, both BOJ and PBOC have stayed dovish this year. BOJ has kept its short-term policy rate at a negative 10bps, while the PBOC has also cut its 1Y MLF rate by a cumulative 25bps this year to 2.50%. They stand in sharp contrast to the Fed, which had raised the Fed Funds rate by a cumulative 100bps year-to-date. Given the higher yield offered by USD assets, carry-seeking financial flows have become a key factor for North Asian FX losses this year.

Negative impact from excessive FX weakness

Any excessive currency misalignment from fundamentals due to interest rate differentials can have serious, and potentially painful, real economic consequences—a fact highlighted by Tobin (1978). In Asia, the 97/98 Asian Financial Crisis is remembered as one painful episode, where sharp depreciation created financial instability and real economic harm, given Asia’s then high FX-denominated debt burden.

Today, external debt is smaller in Asia, but the lesson of containing excessive FX volatility has remained in the minds of policymakers.

FX volatility can pose other problems even without external debt. Export and import businesses are highly vulnerable to exchange rate volatility, given the slow adjustment of goods flows to exchange rates, unlike that for financial flows. If exchange rates weaken sharply and unexpectedly, some businesses could suffer a squeeze in profitability, being unable to pass rising input prices to customers.

Households may also face hardship due to the rising costs of imported goods, as wages are often slow to adjust upwards. Policy support measures for households could in turn lead to unwelcome fiscal pressure.

High FX volatility also raises uncertainty that could hurt consumption and investment, especially for economies with a larger share of external trade and foreign investment. It could also result in higher credit risk for SMEs, as they do not usually hedge FX risks.

Finally, one-sided currency speculation may also unravel in a disruptive manner when monetary policy inevitably shifts. One example is the Fed’s tapering of asset purchases in 2013, which resulted in large outflows from EMs and elevated financial market volatility. Leaning against excessive currency speculation can be a macroprudential move that helps to limit economic and financial stability risks.

Policy capacity for currency management

What could be done to resist the negative effects of large currency misalignments? Tobin proposed that policymakers reduce speculation by “throwing some sand in the well-greased wheels” via a small tax on FX transactions. Today, policymakers follow Tobin’s direction with a mix of window guidance, capital flow management, and outright FX purchases or sales in markets, which can be construed as a market intervention. Asian countries have always demonstrated a more active approach to FX policy compared to the West. Asian FX reserves are larger compared to Western countries, standing at USD7.0trn today. Moreover, China and Japan hold the bulk of these reserves at around USD3.1trn and USD1.1trn respectively. With both JPY and CNY becoming markedly misaligned from fundamentals today, risks of stronger policy actions via market intervention cannot be discounted. Indeed, Japan has already proven its willingness to intervene in JPY markets back in Sep-Oct 2022 to support the JPY.

Estimating Japan’s FX policy reaction function

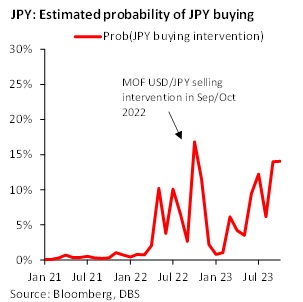

Given sustained JPY weakness and Japan’s cautious rhetoric on volatility, risks of a market intervention need to be duly assessed. Ito and Yabu (2020) had analysed Japanese foreign exchange interventions from 1971 to 2018, estimating a policy reaction function for interventions based on three factors: 1/ monthly change in USD/JPY, 2/ deviation in USD/JPY from its 5-year moving average, and 3/ a binary lag variable indicating if intervention happened in the previous month.

Their analysis found that the influence of each factor is not always significant over time, especially in later years when international attitudes on currency intervention changed. Seeking a more up-to-date estimate of Japan’s reaction function in recent years, we expand on this policy reaction analysis based on just the 2000-2023 period, which crucially included the recent JPY buying intervention in Sep/Oct 2022.

Following Ito and Yasu, and using monthly FX purchase and sales data from MOF, we model Japan’s intervention activity with an ordered probit model.

A better proxy of JPY fundamental misalignment is our JPY DEER valuations, which are percentage deviations from our DEER fair value. The caveats are that our DEER fair values are estimated and only available ex-post, but the series would be more reflective of the latent JPY’s misalignment from fundamentals.

Comparing Japan’s previous market interventions with our JPY DEER valuations, we found that JPY selling intervention had only occurred during periods of DEER over-valuations, and vice-versa. The authorities’ assessments of JPY misalignments, as revealed by their market intervention activity, are thus fully aligned with our DEER estimates.

Our model results indicate that an overvalued JPY is positively associated with JPY-selling by MOF, and vice versa. Furthermore, the size of the coefficient using the DEER deviation is twice as large as that for USD/JPY’s deviation from its long-term moving average, implying a stronger predictive ability. Our model’s pseudo R-squared also rose sharply to 0.241, improving by a factor of 3. We also tested if carry costs could be a consideration for market interventions. Our analysis found no significant role played by rate differentials in Japan’s interventions.

Given that the probit model is non-linear, interpretation of coefficient estimates is not straightforward. Rather, we focus on the output showing the conditional probability of JPY-buying intervention, against the probability of seeing no intervention.

The probability of JPY-buying intervention rose sharply in Oct 2022 to 16.8%, when there was actual market intervention. As of Oct, we see that the probability of JPY buying intervention has already risen to 14.1% and is nearing the 2022 high. Risks of JPY intervention remain small but are becoming non-trivial.

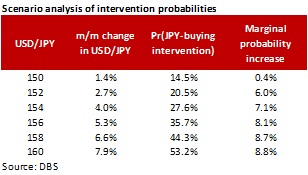

We also assess the dynamically changing risks of JPY-buying intervention under different scenarios for USD/JPY ranging from 150 to 160. If USD/JPY is to rise to 152, the probability of intervention rises significantly to a one-in-five chance. Furthermore, the probability of intervention increases at a faster rate as USD/JPY moves further and further above 150. JPY-buying intervention becomes the most likely outcome (>50% probability) when USD/JPY reaches 160.

Can JPY market intervention be successful?

Even if interventions are to occur, there will be questions on whether interventions can produce the desired effect or not. Japan faces more difficulties in conducted interventions compared to other EM Asian countries such as China, given its market and institutional differences.

For a start, the JPY market is a deep one with over USD1.2trn of transactions done annually according to the BIS 2022 Triennial Central Bank Survey. In contrast, the RMB market has only USD530bn of transactions. Furthermore, Japan has no capital controls, while China still maintains some capital controls to limit financial outflows.

These two factors suggest that any FX market intervention by Japan would have to be of a larger scale that that for China to achieve the same effect on the exchange rate.

Furthermore, Fatum and Yamamoto (2014) found that small interventions have no discernible effect on the JPY exchange rate, and only large interventions (>USD 679m per day) can significantly influence the exchange rate.

Scaling Fatum and Yamamoto’s threshold for large intervention based on the growth in JPY FX transactions since 2004, Japan will need to intervene in size of at least USD2.11bn per day (or USD46.4bn per month) to have any impact on the JPY. The 2022 JPY-buying interventions amounting to almost USD63bn indicate that Japanese policymakers are cognisant of the size to be effective. Japan’s stock of FX reserves is also large enough to sustain such large-sized FX interventions for over a year, if needed.

As such, we do not doubt that Japan will be able to successfully impact the JPY exchange rate if they choose to intervene.

China reinforces guidance for RMB stability

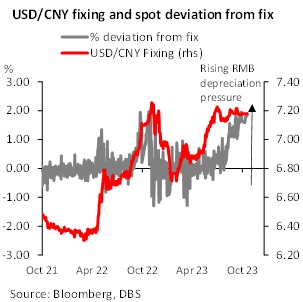

For China, it faces a similar issue as Japan with the RMB getting increasingly misaligned from fundamentals, weighed by slower growth. Chinese policymakers are cognisant of the negative impact from excessive RMB weakness, and are also looking to reinforce RMB stability.

Unlike Japan, China has more channels to utilize in supporting RMB, on top of direct FX sales. For one, it has issued guidance to Chinese state-owned banks to refrain from RMB speculation, which is duly followed. Second, existing capital controls are enforced to limit financial outflows. Third, China is steering the RMB using the central parity/fixing mechanism, with CNY fixings continuously set on the strong side since July. As USD/CNY is only allowed to trade a maximum of 2% away from the fixing, USD/CNY is effectively anchored by a stable fixing. Notably, the volume of RMB transactions has fallen amid these measures, as the exchange rate is now less reflective of demand and supply.

We believe Chinese policy measures should sustain and stabilize USD/CNY within the 7.30-7.40 range for the rest of the year. The anchoring of the RMB has also been done with little cost to China’s FX reserves, which has declined by just USD 89bn across Aug-Sep, and with valuation effects already accounting for half of the fall.

Positioning for policy smoothing in Asian FX

Our analysis for both JPY and CNY suggest that risks for JPY intervention are nontrivial, while China could maintain its posture of strong support for the RMB for a prolonged period. Thus, further, significant depreciation in JPY and RMB looks less likely, even if a recovery is now likely deferred to 2024 amid still strong US growth and a wide US-Asia rate gap.

All in, the JPY and the RMB could see more resilience amid an increased policy bias to lean against further weakness.

To read the full report, click here to Download the PDF.

Topic

Explore more

E & S FocusGENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

GENERAL DISCLOSURE/DISCLAIMER (Credit)

Completed Date: 18 Jan 2023 11:04:34 (SGT)

Dissemination Date: 18 Jan 2023 11:04:34 (SGT)

Sources for all charts and tables are DBS Bank unless otherwise specified

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Bank Ltd. This report is solely intended for the clients of DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively, the “DBS Group”) have not conducted due diligence on any of the companies, verified any information or sources or taken into account any other factors which we may consider to be relevant or appropriate in preparing the research. Accordingly, we do not make any representation or warranty as to the accuracy, completeness or correctness of the research set out in this report. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal or financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group, may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments. The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed, it may not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no obligation to update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a) such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

(b) there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments stated therein.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies) mentioned herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to the commodity referred to in this report.

ANALYST CERTIFICATION

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the companies and their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her compensation was, is, or will be, directly or indirectly, related to specific recommendations or views expressed in the report. The research analyst (s) primarily responsible for the content of this research report, in part or in whole, certifies that he or his associate[1] does not serve as an officer of the issuer or the new listing applicant (which includes in the case of a real estate investment trust, an officer of the management company of the real estate investment trust; and in the case of any other entity, an officer or its equivalent counterparty of the entity who is responsible for the management of the issuer or the new listing applicant) and the research analyst(s) primarily responsible for the content of this research report or his associate does not have financial interests[2] in relation to an issuer or a new listing applicant that the analyst reviews. DBS Group has procedures in place to eliminate, avoid and manage any potential conflicts of interests that may arise in connection with the production of research reports. The research analyst(s) responsible for this report operates as part of a separate and independent team to the investment banking function of the DBS Group and procedures are in place to ensure that confidential information held by either the research or investment banking function is handled appropriately. There is no direct link of DBS Group's compensation to any specific investment banking function of the DBS Group.

COMPANY-SPECIFIC / REGULATORY DISCLOSURES

- DBS Bank Ltd, DBS HK, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS'') or their subsidiaries and/or other affiliates do not have a proprietary position in the securities recommended in this report as of 30 Jun 2022.

Compensation for investment banking services:

- DBSVUSA does not have its own investment banking or research department, nor has it participated in any public offering of securities as a manager or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to obtain further information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact DBSVUSA exclusively.

Disclosure of previous investment recommendation produced:

- DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates may have published other investment recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12 months. Please contact the primary analyst listed on page 1 of this report to view previous investment recommendations published by DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates in the preceding 12 months.

RESTRICTIONS ON DISTRIBUTION

General | This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. |

Australia | This report is being distributed in Australia by DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (“DBSVS”) or DBSV HK. DBS Bank Ltd holds Australian Financial Services Licence no. 475946. DBS Bank Ltd, DBSVS and DBSV HK are exempted from the requirement to hold an Australian Financial Services Licence under the Corporation Act 2001 (“CA”) in respect of financial services provided to the recipients. Both DBS and DBSVS are regulated by the Monetary Authority of Singapore under the laws of Singapore, and DBSV HK is regulated by the Hong Kong Securities and Futures Commission under the laws of Hong Kong, which differ from Australian laws. Distribution of this report is intended only for “wholesale investors” within the meaning of the CA. |

Hong Kong | This report has been prepared by a personnel of DBS Bank Ltd, who is not licensed by the Hong Kong Securities and Futures Commission to carry on the regulated activity of advising on securities in Hong Kong pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). This report is being distributed in Hong Kong and is attributable to DBS Bank (Hong Kong) Limited (''DBS HK''), a registered institution registered with the Hong Kong Securities and Futures Commission to carry on the regulated activity of advising on securities pursuant to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). DBS Bank Ltd., Hong Kong Branch is a limited liability company incorporated in Singapore. For any query regarding the materials herein, please contact Dennis Lam (Reg No. AH8290) at [email protected] |

Indonesia | This report is being distributed in Indonesia by PT DBS Vickers Sekuritas Indonesia. |

Malaysia | This report is distributed in Malaysia by AllianceDBS Research Sdn Bhd ("ADBSR"). Recipients of this report, received from ADBSR are to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection with this report. In addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report are advised that ADBSR (the preparer of this report), its holding company Alliance Investment Bank Berhad, their respective connected and associated corporations, affiliates, their directors, officers, employees, agents and parties related or associated with any of them may have positions in, and may effect transactions in the securities mentioned herein and may also perform or seek to perform broking, investment banking/corporate advisory and other services for the subject companies. They may also have received compensation and/or seek to obtain compensation for broking, investment banking/corporate advisory and other services from the subject companies. Wong Ming Tek, Executive Director, ADBSR |

Singapore | This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn No. 198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 6878 8888 for matters arising from, or in connection with the report. |

Thailand | This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. For any query regarding the materials herein, please contact Chanpen Sirithanarattanakul at [email protected] |

United Kingdom | This report is produced by DBS Bank Ltd which is regulated by the Monetary Authority of Singapore. This report is disseminated in the United Kingdom by DBS Bank Ltd, London Branch (“DBS UK”). DBS UK is authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. In respect of the United Kingdom, this report is solely intended for the clients of DBS UK, its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS UK, This communication is directed at persons having professional experience in matters relating to investments. Any investment activity following from this communication will only be engaged in with such persons. Persons who do not have professional experience in matters relating to investments should not rely on this communication. |

Dubai International Financial Centre | This communication is provided to you as a Professional Client or Market Counterparty as defined in the DFSA Rulebook Conduct of Business Module (the "COB Module"), and should not be relied upon or acted on by any person which does not meet the criteria to be classified as a Professional Client or Market Counterparty under the DFSA rules. This communication is from the branch of DBS Bank Ltd operating in the Dubai International Financial Centre (the "DIFC") under the trading name "DBS Bank Ltd. (DIFC Branch)" ("DBS DIFC"), registered with the DIFC Registrar of Companies under number 156 and having its registered office at units 608 - 610, 6th Floor, Gate Precinct Building 5, PO Box 506538, DIFC, Dubai, United Arab Emirates. DBS DIFC is regulated by the Dubai Financial Services Authority (the "DFSA") with a DFSA reference number F000164. For more information on DBS DIFC and its affiliates, please see http://www.dbs.com/ae/our--network/default.page. Where this communication contains a research report, this research report is prepared by the entity referred to therein, which may be DBS Bank Ltd or a third party, and is provided to you by DBS DIFC. The research report has not been reviewed or authorised by the DFSA. Such research report is distributed on the express understanding that, whilst the information contained within is believed to be reliable, the information has not been independently verified by DBS DIFC. Unless otherwise indicated, this communication does not constitute an "Offer of Securities to the Public" as defined under Article 12 of the Markets Law (DIFC Law No.1 of 2012) or an "Offer of a Unit of a Fund" as defined under Article 19(2) of the Collective Investment Law (DIFC Law No.2 of 2010). The DFSA has no responsibility for reviewing or verifying this communication or any associated documents in connection with this investment and it is not subject to any form of regulation or approval by the DFSA. Accordingly, the DFSA has not approved this communication or any other associated documents in connection with this investment nor taken any steps to verify the information set out in this communication or any associated documents, and has no responsibility for them. The DFSA has not assessed the suitability of any investments to which the communication relates and, in respect of any Islamic investments (or other investments identified to be Shari'a compliant), neither we nor the DFSA has determined whether they are Shari'a compliant in any way. Any investments which this communication relates to may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on any investments. If you do not understand the contents of this document you should consult an authorised financial adviser. |

United States | This report was prepared by DBS Bank Ltd. DBSVUSA did not participate in its preparation. The research analyst(s) named on this report are not registered as research analysts with FINRA and are not associated persons of DBSVUSA. The research analyst(s) are not subject to FINRA Rule 2241 restrictions on analyst compensation, communications with a subject company, public appearances and trading securities held by a research analyst. This report is being distributed in the United States by DBSVUSA, which accepts responsibility for its contents. This report may only be distributed to Major U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to such other institutional investors and qualified persons as DBSVUSA may authorize. Any U.S. person receiving this report who wishes to effect transactions in any securities referred to herein should contact DBSVUSA directly and not its affiliate. |

Other jurisdictions | In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified, professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions. |

DBS Regional Research Offices

HONG KONG DBS (Hong Kong) Ltd Contact: Dennis Lam 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong Tel: 852 3668 4181 Fax: 852 2521 1812 e-mail: [email protected] | SINGAPORE DBS Bank Ltd Contact: Paul Yong 12 Marina Boulevard, Marina Bay Financial Centre Tower 3 Singapore 018982 Tel: 65 6878 8888 e-mail: [email protected] Company Regn. No. 196800306E

|

INDONESIA PT DBS Vickers Sekuritas (Indonesia) Contact: Maynard Priajaya Arif DBS Bank Tower Ciputra World 1, 32/F Jl. Prof. Dr. Satrio Kav. 3-5 Jakarta 12940, Indonesia Tel: 62 21 3003 4900 Fax: 6221 3003 4943 e-mail: [email protected]

| THAILAND DBS Vickers Securities (Thailand) Co Ltd Contact: Chanpen Sirithanarattanakul 989 Siam Piwat Tower Building, 9th, 14th-15th Floor Rama 1 Road, Pathumwan, Bangkok Thailand 10330 Tel. 66 2 857 7831 Fax: 66 2 658 1269 e-mail: [email protected] Company Regn. No 0105539127012 Securities and Exchange Commission, Thailand |

[1] An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

[2] Financial interest is defined as interests that are commonly known financial interest, such as investment in the securities in respect of an issuer or a new listing applicant, or financial accommodation arrangement between the issuer or the new listing applicant and the firm or analysis. This term does not include commercial lending conducted at arm's length, or investments in any collective investment scheme other than an issuer or new listing applicant notwithstanding the fact that the scheme has investments in securities in respect of an issuer or a new listing applicant.