Looking for a new office or factory to expand your business? Or require more business capital to boost your cash flow needs?

Boost your capital!

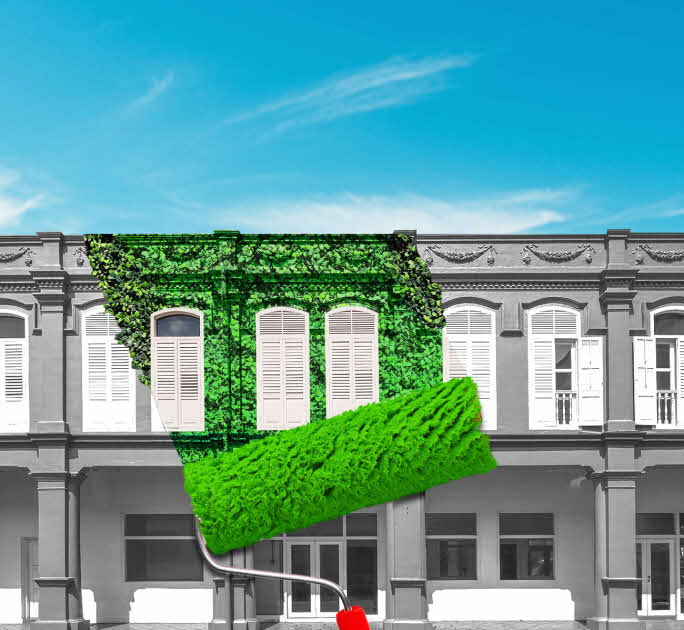

Get up to 80% of your property value and up to 100% of your business renovation cost when you finance or refinance your property with us. Learn more about Eco Renovate loan that provides access to financing on renovation works which incorporates sustainable materials, fixtures or equipment here.

Loan amount is approved based on the bank’s assessment.

Competitive interest rates in the market

Enjoy competitive interest rates in the market when you apply today.

Flexible loan packages

In addition to the fixed rate loan promotion package, you also have the option of a SORA*-pegged loan package if it suits your business needs better.

Take up to 25 years to repay

Enjoy a flexible repayment period of 1 to 25 years.

Try our commercial property loan calculator below to estimate your monthly payments.

* SORA (Singapore Overnight Rate Average ) is the average rate of all interbank lending transactions made in Singapore between 8am and 6.15pm. It is published by 9am the next business day on the MAS (Monetary Authory of Singapore) website.

Find out what is SORA and how it will apply to Business Property Loan. Click here

Learn more about the interest rate benchmark reform, including SORA.

| Fixed rate package | SORA-pegged package |

| Fixed rate for the first 2 years | 3-month compounded SORA rate^ as published by the Monetary Authority of Singapore |

| Fixed instalments for the first 2 years | No repapering of loans in the future when SORA becomes the standard interest rate |

^This is computed by compounding the daily published SORA rate over the historical 3-month period.

View this application checklist for supporting info you may need to prepare.

We will email your guarantors to endorse your application.

Once your application is received, our relationship manager will contact you with a conditional offer.

Upon submission, you’ll also receive an email with details on how to check updates about your application.

When everything is in order, you’ll receive the final offer for your sign-off.

If you apply using ACRA or MyInfo Business, we can retrieve most of the required information so most businesses do not need to provide financial documents. However, additional information may be required on a case-by-case basis.

Additional information you may need to prepare are:

- Address, floor size, and tenure of property

- Valuation or price of property

- Option to purchase, if available

- Latest 2 years financial statements

- Latest 3 months bank statements

Not required if DBS is your main operating bank

| Are there any fees for repaying my loan earlier? | |

| If you choose to refinance your loan within the lock-in period, there will be some charges. For details, contact your relationship manager. |

| Can I buy or refinance an overseas property? | |

| Absolutely! Contact us so we may assist you with your business expansion plans. |

| Can I finance the renovation works done on my property? | |

| Yes. You can enjoy up to 100% financing of your renovation costs with our Eco Renovate loan bundle when you finance or refinance your property with us. Eco Renovate Loan provides financing for renovation works which incorporates sustainable materials, fixtures or equipment. Read more here. |

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?