No Fresh Chickens, No Fries? Tips to Surviving Trade Disruption

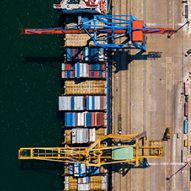

Just when we thought recovery was on the cards for small and medium enterprises (SMEs) in Singapore, new disruptions to global trade – such as the ongoing Ukraine-Russia conflict – are starting to eat into profit margins[1], inflicting rising energy bills and food prices, as well as chronic supply chain issues.

Given the uncertainty of the past few years, it’s no wonder that cash flow is a major concern for SMEs. More than 85% of Singapore SMEs said that ensuring consistent cash flow and managing costs was a high business priority in 2022. To ride out the current wave of disruption, SMEs are also advised to build six to 12 months’ worth of cash reserves as a buffer from slow payments to secure their cash flow.

Difficult? Confusing? It doesn’t have to be. Entrepreneurs can resort to financial solutions like trade finance and term loans, each of which offers specific features that help solve the cash flow problems for SMEs.

Despite their differences, trade finance and term loans don’t have to be mutually exclusive. You should look at trade financing and term loans as complementary tools within your cash flow strategy. While trade loans cater to short-term working capital requirements, term loans can be used for the purpose of meeting your longer-term capital expenditure needs.

Let’s take a closer look at these options and situations where you might want to use them.

Several possibilities with trade finance and term loans

Trade finance[2] helps you manage cash flow mismatches when selling and buying goods. It’s also meant to mitigate credit and country risks inherent in cross-border trade with unknown/new counterparties, making it easier and simpler to do business.

For example, most sellers typically want to be paid upfront before shipping out an order, while buyers would prefer to receive the goods before releasing payment.

In this scenario, a buyer can work with their bank to issue a letter of credit (LC), which essentially promises payment to the seller upon presentation of compliant documents evidencing shipment of goods as per terms stipulated in the LC. Understand what is letter of credit and a transferable letter of credit here. Another mode of payment for shipments involves documentary collections. In this case, a seller can work with their bank to draw a draft or a bill of exchange, which requires the buyer to settle the payment (documents against payment) or accept to fulfil their payment obligations at a specified future date (documents against acceptance) before their bank can release the documents (of title) pertaining to the shipment.

A finance product that you might find quite useful (especially when you are waiting for clients to pay in full is invoice financing. Here, you can work with a bank to borrow against your invoices or your expected incoming payments.

These are just a few examples – read about more trade finance options here.

Term loans, on the other hand, are financial products where entrepreneurs are provided a lump sum of cash, towards purchase of capital goods to be repaid over an agreed fixed schedule and on a fixed or variable interest rate.

While you should opt for trade finance products for specific day-to-day business requirements such as handling a trade finance document, it would be more advisable to take out a term loan for situations requiring major capital outlay. This includes buying new equipment for your factory, renovating your store, expanding to new locations or expansion of business capacity.

With fixed repayment schedules, term loans let you better plan for your operating expenses. The lump sum also adds to your cash reserves and enables you to maintain ownership of your business. There are also several options for term loans that are specific to SMEs’ needs.

Side by side: trade finance and term loans

Term loans and trade finance are not mutually exclusive–they both fit into an entrepreneur’s sound strategy of cash flow management in business to help with their business operations. Here’s a side-by-side overview to explain how they complement each other:

Solution | Trade Finance | Term Loans |

Best used… | To supplement your cash flow, as a bridge to help you pay your obligations while waiting to get paid (and vice versa). | For big-ticket expenses that you can foresee paying off within a certain time period. |

By SMEs in… | Manufacturing, wholesale trading and/or in the services sector. | All industries. |

Assessment | Banks assess credit worthiness and trade cycle to determine the amount and tenor of financing | Bank’s approval is subject to an assessment of creditworthiness and cash-flows associated with the capital expenditure being incurred |

Payment | Depends on the trade cycle | Require regular repayments on a fixed schedule |

Interest rate | Depends on the amount and tenor | May be fixed or variable; unsecured loans (without collateral) may also have a higher interest rate. |

Liabilities | Short-term liabilities are retired through incoming receivables. | Medium to Long Term liability in your balance sheet. |

Conclusion: Term loans and trade finance can both work for you

While both term loans and trade finance add to your cash reserves, they address different needs.

Term loans can help you pay for longer-term capital expenditures like construction and equipment purchases. Trade finance helps you manage cash flow mismatches and mitigate business risks arising from cross-border trade or global trade disruptions and dealing with lesser-known or new counterparties.

There is no standardised approach to cash flow management, as both term loans and trade finance have their advantages to help you get ahead and both can be used concurrently to meet different business objectives for better working capital management.

For example, you might use the proceeds for your term loan to expand capacity. At the same time, you can turn to invoice financing to borrow against accounts receivables and cover that month’s urgent expenses–without having to wait for your clients’ full payments.

SMEs can work with financial institutions that they trust to assess their requirements and find out what options work best for their needs. The best course of action is to open a conversation with a bank and get customised solutions to meet their requirements.