How can Singapore SMEs win while facing global trade disruption?

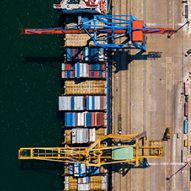

The last few years have been a wild ride for small and medium-sized enterprises (SMEs) in Singapore. The COVID-19 pandemic contributed to the ongoing disruption to global trade, such as supply chain ruptures in major world ports[1].

Analysts fear that the disruption could be a long-term trend, not just a blip: nations that have formerly welcomed international business have shown signs of turning inward, protecting their domestic enterprises at the expense of global trade. This trend was already apparent prior to the pandemic, with world trade in merchandise growing by only 1.2% in 2019[2] just before to the COVID-induced 5.3% drop in 2020[3].

For SMEs in Singapore, these international barriers pose serious challenges. Our smaller domestic market relative to our neighbours requires Singaporean entrepreneurs to think globally, building trade connections across international borders. How can SMEs overcome these barriers to global trade and succeed?

How global trade disruption affects SMEs

Without access to deep resources, SMEs have a tougher battle to overcome regarding global trade. A paper from the Organisation for Economic Co-Operation and Development laid out some of the challenges SMEs face during times of crises, including higher dependence on credit, with fewer financing options; less diversification in their economic activities; and lower capitalisation[4].

These factors can be concerning for SMEs, as the effects of trade disruption begin to hit home. For starters, SMEs may expect to pay higher supply chain costs, as predicted by a Chartered Institute of Procurement & Supply paper[5]. In June 2021, for example, the average price of a 40-foot shipping container hit a record high of SGD$9,673 (US$6,957), up 305.7% from the previous year[6].

SMEs exercising caution amidst unpredictable times

In the wake of these developments, many Singapore SMEs have become more cautious about international trade, taking a “wait and see” approach.

A recent DBS SME Pulse Check Survey found that over 85% of SMEs considered “ensuring consistent cash flow and managing costs” as a high business priority in 2022; one in five respondents were most concerned about supply chain disruptions, even as a majority expressed optimism about business prospects for the year ahead.

With more SMEs exercising caution over cash flow and costs, expanding their overseas presence may take a back seat to consolidate operations at home. While it’s easier on the bottom line, this also reduces opportunities for SMEs.

In due time, caution will no longer be an option for Singapore SMEs; they will need the right resources to help them expand and seize overseas opportunities without fear.

Sustain business growth through trade finance solutions

Obstacles to expanding overseas and diversifying operations are not as daunting as it seems. Trade finance, far from being a barrier, can be a “secret weapon” for SMEs searching for overseas opportunities: increasing access to liquidity, simplifying transactions, and overcoming gaps in know-how and networking that might have otherwise been difficult to overcome.

New SMEs exporting goods overseas, for instance, can bridge the trust gap with potential overseas buyers, by asking them to provide an Export Letter of Credit (LCs) issued by their local banks.

With Export LCs, Singapore SMEs selling to overseas markets can feel more assured as any risks of non-payment will be assumed by the bank issuing the Export LC. Additionally, SMEs can ask their bank to provide an LC confirmation if they are concerned about creditworthiness and country risks.

Another solution SMEs can tap is to request for their banking partner to advance LC payments before the letter of credit is due. Known as LC Negotiation / Discounting, businesses can lean on the bank’s risk appetite to receive immediate cash, improving their cash flow to fund production and purchases from their buyers.

To reduce risk of non-payment even further, SMEs can rely on Accounts Receivable Purchase (ARP) services. The issuing financial institution can take on the risk of non-payment - purchasing their receivables and giving SMEs fast access to working capital of up to 90% of the receivables’ value. DBS customers with ARP financing also benefit from the product’s export credit insurance option, which provides up to 100% credit cover in the event of the buyer’s insolvency or protracted default. This gives ARP customers added breathing room to manage business risks and nurture growth in the face of uncertainty. SMEs who do not have the need for an ARP can still obtain Export Credit Insurance via trade credit insurers or brokers.

Finally, SMEs taking on a global market might suffer from “impostor syndrome”, feeling out of their depth in an unfamiliar environment. Fortunately, export advisory services from bank partners can help provide greater clarity and assurance in an uncertain foreign export services - 75% of Singapore medium-sized enterprises prefer to work with “a trusted and reliable banking partner with a long track record of supporting businesses.”

Conclusion: the pendulum swings back

SMEs can take some comfort in the possibility that the current global trade disruption is only a hiccup in the medium term. Experts believe that the present situation is only one swing of the pendulum, priming the global economy for a healthy recovery where supply chains are expected to bounce back[7].

As easing of border restrictions reopens global trade, SMEs should prepare for new business operations and accelerated cross-border activity.

Tap into trade financing to facilitate your expansion efforts.