Inside out - An Interview with Gunung Capital

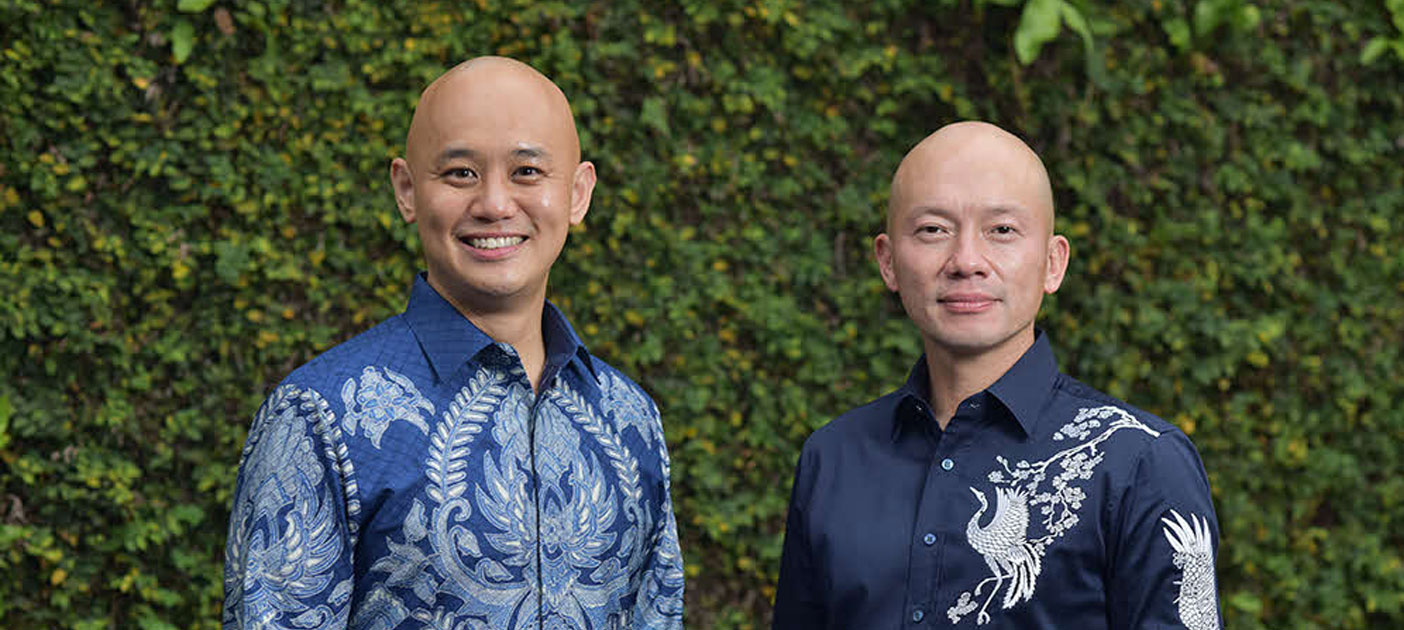

Kimin Tanoto, CEO

Kelvin Fu, Managing Partner

Meet our client who took part in Climate Impact X’s inaugural auction

Climate Impact X (CIX) completed a pilot auction of a portfolio of high-quality carbon credits in November 2021. The auction successfully cleared 170,000 carbon credits from eight recognised natural climate solutions (NCS) projects curated to form a diversified portfolio, at USD 8.00 per tonne. Each of the NCS projects, spanning reforestation and avoided deforestation initiatives – across Africa, Asia and Latin America – demonstrate the high-performance of carbon sequestration and high levels of verified co-benefits, such as supporting biodiversity, along with social and economic development in local communities.

A client, Gunung Capital, a private investment management company, was one of the participants in this inaugural auction. Gunung Capital management team’s vision is to help the world better protect the environment by investing and supporting carbon markets, encouraging adoption of decarbonization technology and related innovation, establishing carbon credits as a recognized emerging asset class, and ultimately funneling more capital into sustainable

Kimin Tanoto, CEO of Gunung Capital, said: “We are delighted to support this important auction of carbon credits led by CIX, which represents our first purchase of this vital tool in addressing global climate change as we grow our portfolio of ESG assets. We are confident that by investing in high quality carbon markets, being a responsible stakeholder, and backing climate action, we are showing leadership as an asset manager that will serve as an example for others. As a private investment management company, we are focused on impact investments guided by ESG frameworks with a vision to help the world better protect the environment.”

Kelvin Fu, Managing Partner at Gunung Capital, said: “This purchase of carbon credits marks an important milestone in our commitment to encouraging the adoption of decarbonisation technology and related innovation, establishing carbon credits as a recognised emerging asset class, and ultimately funnelling more capital into sustainable enterprises. We look forward to partnering with more global investors, institutions, policy makers, and non-governmental organizations in future.”

What is your approach when it comes to balancing your investment and sustainability journeys?

Our approach to investing comes from investing our own capital in developing and operating assets acquired, and understanding the importance of providing an integrated solution for any project we embark on to achieve net-zero goals.

We know game-changing transformation does not happen overnight, so our approach avoids the volatility of short-term investment and provides a platform to invest in daring projects with long-term value. Through intensive due diligence, a deep bench of experienced executives, determined partnerships defined by capital, as well as experiential and operational expertise, we aim to deliver substantial returns down the road.

Our investment teams provide effective oversight of the whole investment process, improving business ecosystems, and establishing good corporate governance to keep companies on track for success, returns, and results. While ensuring our goals are aligned with UN SDGs, our teams analyze, calculate, and draw insights for growth and continuous development from management and hiring to corporate culture and merit-based performance reviews.

Applied across the entire value chain, our investment approach and methodology deploy techniques and tools to increase the top line or cut costs by identifying, quantifying and delivering value in waves of services. From deal origination and intensive due diligence to cash improvement and asset efficiency, our primary aim is to optimize long-term financial, social and environmental value for our company, partners, investors, shareholders and communities.

With investment experience navigating the political, social, and cultural intricacies of Indonesia, China, Europe, and the United States, we have access to markets, connections in the region, fluency in several relevant languages, international business culture and management skills acquired from top-tier global educational institutions.

Our manufacturing and business-building background give us a unique understanding of the value chain and the importance of controlling all aspects of it, particularly in Indonesia. For viable end-to-end solutions and responsible stewardship, we retain strategic oversight and control to all pieces of the project.

We support achieving carbon reduction goals through adoption and implementation of comprehensive emission reduction strategies, turning climate action into long term business opportunities for organizations around the world. Firm-wide, we have policies and processes in place to ensure our long-term success and allow us to sustain the interests of our stakeholders.

Can you share one highlight of sustainability journey so far?

At our steel business, Gunung Raja Paksi, which is the largest privately-owned steel group in Indonesia, we implemented a programme of change management and deep value creation in 2019. The same year, we took the company public and have been working since on a decarbonisation roadmap that we will be sharing later this year. Not only has the group become far more profitable throughout COVID, it is also far more sustainable. However, much more investment will still be needed in the years ahead to complete the decarbonisation journey that we are proud to have started.

We are now building a reputation as an asset management / private equity firm that has a consistent approach to value creation and delivers attractive returns across diversified regions, businesses, and sectors. Leveraging our experience at our own portfolio companies, we are able to support other companies in achieving their carbon reduction goals through the adoption and implementation of comprehensive emission reduction strategies and turning climate action into long term business opportunities.

What has been done with CIX

Do you intend to continue participating with Climate Impact X?

Yes, we are planning to continue participating with CIX. Our strategy has now expanded to include:

- Supporting the transition towards low-carbon projects and companies’ plans to go net-zero by providing companies with high quality carbon offsets, as well as bundling carbon offsets with sustainable products that will then go through independent certification to achieve “carbon neutral” certification.

- Investing in carbon projects directly. These projects will be across varying stages of the lifecycle of the project from initiation and validation to issuance, and they will be diversified across regions and project type.

How has DBS Private Bank helped you so far in your sustainability journey?

DBS is one of four founding members of Climate Impact X (CIX) along with SGX, Standard Chartered, and Temasek, which aims to help drive environmental impact at scale. Thanks to our relationship with DBS, we were able to complete our first purchase of high-quality carbon credits in November last year, which is an important part of our ESG investment strategy at Gunung Capital.

About Gunung Capital

Gunung Capital is a private investment management company focused on impact investments guided by environmental, social, and governance (ESG) frameworks. The management team’s vision is to help the world better protect the environment by investing and supporting carbon markets, encouraging adoption of decarbonization technology and related innovation, establishing carbon credits as a recognized emerging asset class, and ultimately funneling more capital into sustainable enterprises.

Partnering closely with global investors, policy makers, non-governmental organizations and enterprises, Gunung Capital is committed to dealing with climate change and making the future of transformation capital flow more seamlessly and efficiently.