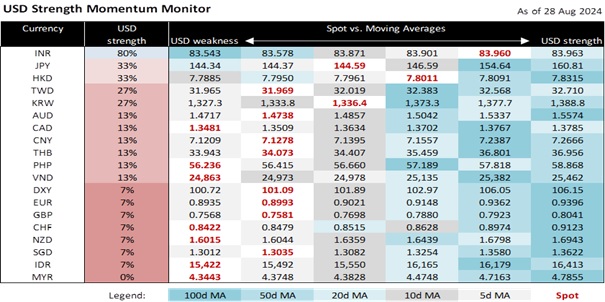

The USD rebounded slightly with DXY bumping back towards 101. Caution over equities could have contributed to some position paring in USD shorts, with a US mega semiconductor company reporting earnings that are not quite overwhelming. Atlanta Fed Bostic, a voting FOMC member, also stated that he would want more data to be sure if it is time to cut, and would err on the side of waiting longer given still strong employment. The contrast with Powell’s speech at Jackson Hole may hint at a slower pace of rate cuts than priced by markets. USD could thus see a period of consolidation unless jobless claims surprise on the upside.

The JPY held on to earlier gains, with USD/JPY consolidating around mid-144. Markets will watch Tokyo CPI tomorrow closely, as BOJ Governor Ueda had expressed that further rate hikes could come if the Japanese economy moves in line with forecasts. Meanwhile, equity risks and tensions around the Middle East could keep the JPY supported on safe haven bids. On the political front, former Foreign and Defense Minister Kono Taro announced his plans to run in the Sep 27 LDP leadership election, and stated that it is appropriate for the BOJ to continue normalizing monetary policy as long as inflation remains in line with the Bank’s expectations. He also said it is time to discuss how to balance the budget as interest rates rise.

USD/CNH is consolidating around 7.13, with RMB being a laggard compared to the gains seen for both JPY and KRW after Powell’s Jackson Hole speech last Friday. While China had maintained its 1Y MLF rate at 2.30%, market expectations of further rate cuts remain. China will report its manufacturing PMI on Saturday, and a continuation of sub-50 readings could restrain the RMB against overt appreciation. Meanwhile, weaker than expected earnings in a mega Chinese retail company this week had raised worries that the Chinese consumer is cutting back on consumer goods spending. Sentiment towards Chinese equities could soften, and portfolio inflows could become less supportive of the RMB.

Quote of the day

”You can make money two ways – make more or spend less.”

John Hope Byrant

29 August in history

In 1862, the US Department of the Treasury formed the division, now known as US Bureau of Engraving and Printing, to print newly issued paper currency.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.