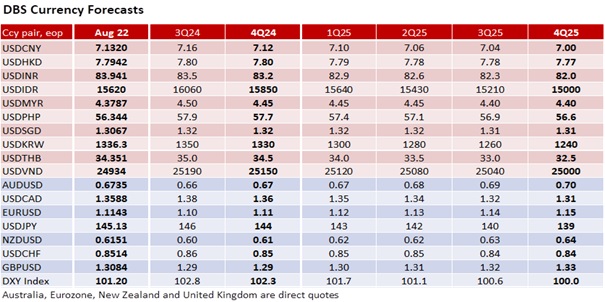

The USD has been on an easing path since last Thursday with the DXY slipping towards 101. Overnight, the BLS significantly revised down annual payrolls by 818k in its preliminary estimate, which amounts to 68k fewer jobs per month than initially reported. It is the largest downward benchmark revision to payrolls since 2009, and can only reinforce the case for a September rate cut. Also, FOMC minutes for the July meeting confirmed that the “vast majority” of members see a Sep cut as appropriate, with upside risks to inflation having diminished. With the US labour market not quite strong, and US CPI last week easing below 3%, Fed Chair Powell could well signal the start of a rate cut cycle in his Jackson Hole Economic Symposium speech tomorrow.

The JPY has seen broad gains this week, with both USD/JPY and EUR/JPY slipping to 145 and mid-161 levels. News of a buyout offer for a Japanese mega convenience store company by an overseas firm had likely bolstered JPY sentiment since Monday, with the deal possibly valued above USD40bn given its market cap. JPY traders may now pay more attention to the possibility of M&A deals for other Japanese firms, given the still large valuation differences between Japanese and overseas equities, and a historically cheap JPY. Meanwhile, BOJ’s Ueda will appear in a Diet hearing tomorrow with regards to the July monetary policy decision that shook global financial markets. With the Nikkei having largely recovered losses, Ueda may comfortably maintain his stance that further rate hikes could still be needed if forecasts are attained, while underscoring that financial stability will be a factor in policy considerations too.

The onshore USD/CNY, offshore USD/CNH, and CNY fixing have all converged to around 7.13 amid an alleviation of RMB depreciation pressures. We had argued that a softer USD will be conducive for RMB gains. That said, RMB could lag regional peers, as sentiment in China’s housing market remains drab, while concerns over LGFV debt have also returned amid short-term refinancing risks. While LPR rates were left unchanged this week, there is still scope for calibrated cuts going forward which should restrain against overt RMB gains.

Quote of the day

”To handle yourself, use your head. To handle others, use your heart.”

Eleanor Roosevelt

22 August in history

The first complete ring around Neptune was discovered in 1989.

Subscribe here to receive our economics & macro strategy materials.

To unsubscribe, please click here.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.