US equities were mixed overnight despite the 0.6% rebound in the Nikkei 225 Index. The Dow declined 0.4%, the S&P 500 was flat, and the Nasdaq Composite rose 0.2%. The VIX Volatility Index initially fell below 19 but ended the session at 20.71, above last Friday’s 20.37 close. Brent crude oil prices rose a fifth session by 3.3% to USD 82.30 per barrel on fears of spiralling tensions in the Middle East. The leaders of the US, the UK, France, Germany, and Italy issued a joint statement calling on Iran to stand down its ongoing threat of a military attack against Israel over the latter’s assassination of a Hamas political leader in Tehran on July 31. The US, Egypt, and Qatar have scheduled urgent talks to reach an Israel-Hamas ceasefire and hostage release deal on August 15 in Doha or Cairo. The US has sent a guided missile submarine and an aircraft strike group to the Middle East as a deterrent.

The US Treasury 2Y and 10Y yields declined by 3.6 bps each to 4.02% and 3.90%, respectively. The New York Fed’s 1Y inflation expectations measure fell to 2.97% in July, below 3% for the first time since November 2020. The futures market is looking past the higher US CPI inflation expected tomorrow, believing that the higher unemployment rate will fuel recession fears and push the Fed to deliver a larger 50 bps cut to 4.75-5.00% in September. Speaking today, Atlanta Fed President Raphael Bostic will likely join his colleagues in advocating a 25 bps rate reduction on a soft landing scenario instead.

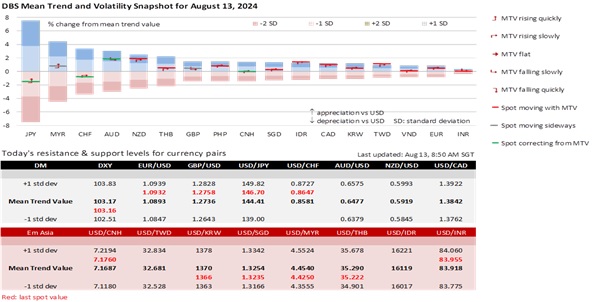

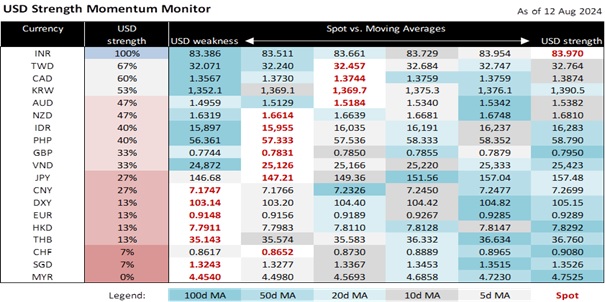

The DXY Index consolidated in a tight 103-103.3 range in the past four sessions following the market’s capitulation from the unwinding of yen carry trades on August 5. USD/JPY failed to break above 148, though it held above the 146.50 level it fell from on August 5. USD/CHF ended around 0.8650 after retracing its two-day plunge from 0.87 to 0.8430 triggered by the US jobless rate on August 2. JPY and CHF are torn between reprising their haven roles on Middle East risks or upside surprises in tomorrow’s US CPI inflation. EUR/USD consolidated in a tight 1.09-1.0950 range in the past five sessions, while GBP/USD did not deviate far from 1.2760 in the past two sessions. Amidst the subsiding risk aversion, the commodity-led AUD and NZD currencies recovered to above the 0.6550 and 0.5985 levels they fell from after the US monthly jobs report on August 2.

Quote of the day

”When I let go of what I am, I become what I might be.”

Lao Tzu

13 August in history

Barbed Wire Sunday in 1961. East Germany closed the border between the eastern and western sectors of Berlin.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.