- Fed to Remain Dovish12 Dec 2025

- Fed to Remain Dovish12 Dec 2025

- Monetary Policy Divergence05 Dec 2025

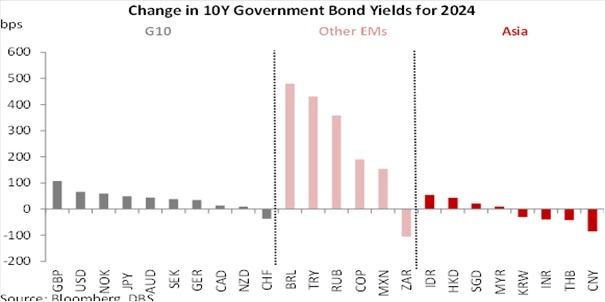

10Y government bond yields across the DM space generally ended higher through 2024 despite meaningful easing across major central banks. In the US, 10Y yields are 65bps higher despite 100bps of Fed easing thus far. Similarly, 10Y Bund yields are up by 34bps despite 100bps of cuts by the ECB and considerably worse economic conditions in the Eurozone, compared to the US. Within the G3, only Japan showed correlation with monetary policy direction as BOJ rate hikes drive JGB yields higher. The takeaway from this episode highlights the importance of drivers beyond monetary policy in driving duration. Between resilient US growth, fiscal worries and inflation upside from Trump’s policies, some term premium has got to be worked into the UST curve. Consequently, some spillover unto the rest of the world is inevitable. These conditions proved challenging across EM space as policymakers face a conflict between supporting domestic growth or preserving currency stability amidst sharply higher US yields and a much stronger USD. Outside of Asia, 10Y local currency EM govvie yields were generally sharply higher. Within Asia, the picture is mixed. Economic weakness in China, Thailand and Korea prompted dovish actions from their respective central banks. With FX weakness within tolerable bounds, 10Y yields in these economies registered declines despite a difficult external environment. On the other end, IndoGBs had a lackluster performance as BI acted prudently and placed greater weight on rupiah stability.

As 2025 kicks off, attention will be paid to the actual policy announcements from the Trump administration. Trump trades did well in 4Q and USTs continued selling off until the last few trading days of the year. Duration worries will likely feature heavily this year, but in the short term, there may be scope for yield retracement if sentiment gets dicey. We suspect that EM will face a challenging backdrop amidst a higher tariff environment. A weaker US economy (and consequently lower rates and weaker USD) is the much-needed respite but it is not clear at this point that this will materialize. Rate movements are likely to be headline driven with the macro backdrop still keeping yields broadly buoyant.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

- Fed to Remain Dovish12 Dec 2025

- Fed to Remain Dovish12 Dec 2025

- Monetary Policy Divergence05 Dec 2025

- Fed to Remain Dovish12 Dec 2025

- Fed to Remain Dovish12 Dec 2025

- Monetary Policy Divergence05 Dec 2025