- US & Europe: Balance sheets of the Fed and ECB remain outsized despite Quantitative Easing

- Singapore: 3Q23 growth came in at 1.1% y/y and 1.4% q/q sa, better than advance estimate

- Indonesia: Despite a small miss in the 3Q GDP numbers, BI expects 4Q growth to be strong

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Fed Easing on the Cards19 Jul 2024

- Inflection Point in Fed Policy12 Jul 2024

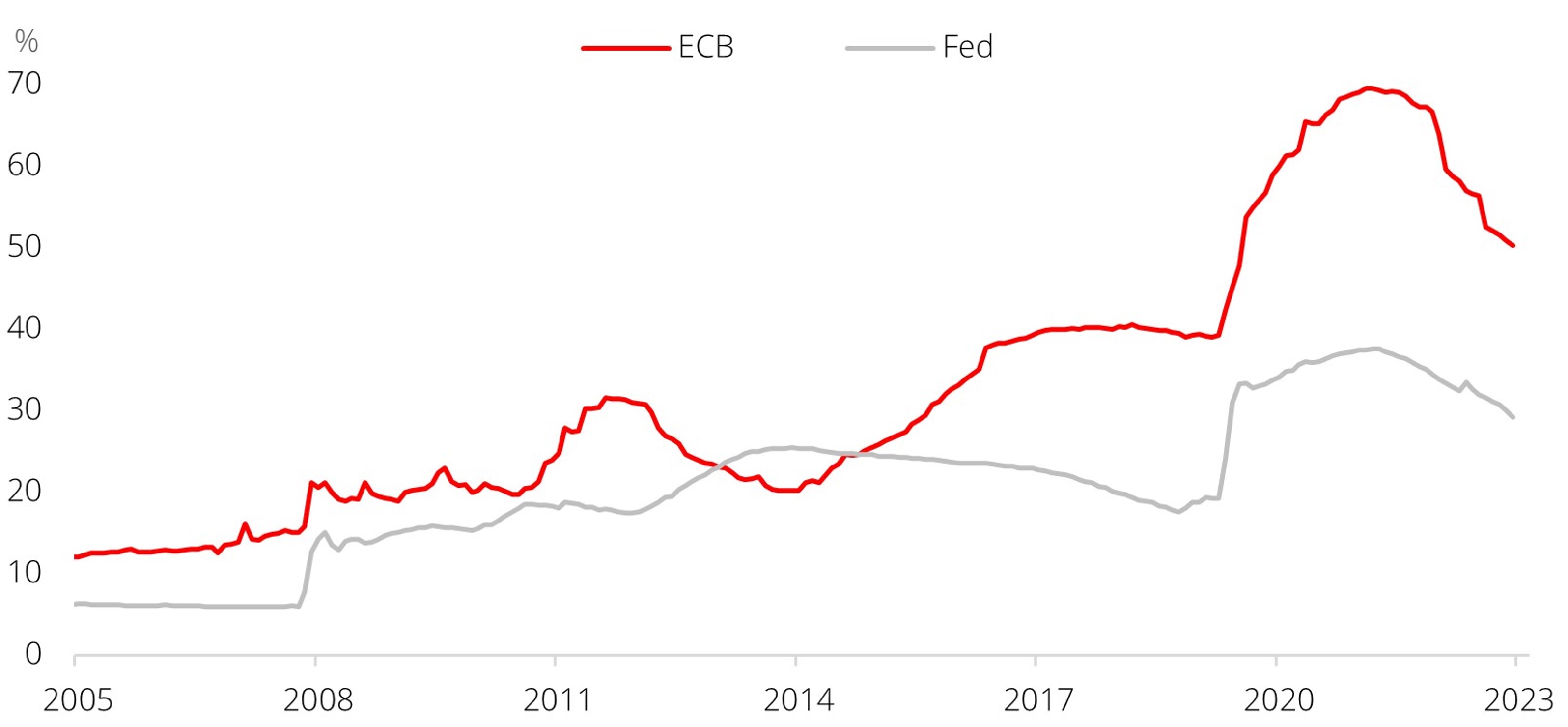

US & Europe: Fed and ECB Balance sheets remain substantial. Despite steady quantitative tightening (QT), the balance sheets of the two largest central banks in the world remain enormous. After nearly a year and a half of QT, the Fed balance sheet stands at nearly USD8t, which amounts to 30% of US GDP. The corresponding figure for the European Central Bank (ECB) is 50% of the Euro Area GDP, despite an accelerated QT programme relative to that of the Fed.

Quantitative easing (QE) has become a key part of the monetary policy toolbox of major central banks this century. It is clear that with their power to print money and purchase assets, central banks are capable of boosting asset prices, resolving liquidity crises, and reducing deflation risks.

However, bloated central bank balance sheets, built through purchasing financial assets and injecting bank reserves, come with their share of complications and costs. Research by Bank for International Settlements (BIS) and Fed officials have shown that they lead to a financial system where banks are over-reliant on central banks for funding. That, in turn, could distort banks’ incentives to manage liquidity and portfolio risks. QE has also been associated with exacerbating inequality, as such monetary operations favour those with significant ownership of financial assets and property, leaving the rest behind.

At the other end of the operational spectrum, shrinking the balance sheet, which in theory is welcome as it signals normalisation of economic conditions, also comes with its share of risks. As rates rise, central banks take on capital losses on their holding of fixed income assets. Additionally, central banks stepping away from bond buying or holding while there are large fiscal funding needs could end up destabilising the government debt market. Case in point is the US, where there has been a marked rise in volatility in Treasury markets, even as recent easing of long-term interest rates has given the markets some relief.

In our view, G2 central bank balance sheets need to continue to shrink for months and years as the level of balance sheet sufficient for the market’s liquidity needs is several trillions lower. For instance, the current monthly rate of the Fed’s balance sheet reduction will take it from the present level of USD7.8t to around USD6.5t by the end of 2024, still more than ample by historical standards, necessitating further consolidation through 2025 and beyond.

However, complications abound. If growth slows next year and rate cuts are warranted, could they continue alongside QT? That would require the Fed to differentiate between the impact of balance sheet operation from interest rate policy. Can QT continue if bond yields turn volatile or soar? These tough choices lie ahead for the Fed and ECB.

Figure 1: Balance sheet as a share of GDP

Source: Bloomberg, DBS

Download the PDF to read the full report which includes insights on Singapore and Indonesia.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Fed Easing on the Cards19 Jul 2024

- Inflection Point in Fed Policy12 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Fed Easing on the Cards19 Jul 2024

- Inflection Point in Fed Policy12 Jul 2024