The DXY Index rose 0.7% to a high of 106.92 on geopolitical risks before better tech earnings fuelled a late US stock market rally and lowered the DXY to 106.65 overnight. The S&P 500 Index initially fell 1% but ended the overnight session unchanged at 5917. The US Treasury 2Y yield rose 3.4 bps to 4.31%, its highest level since November 12. After the FOMC meeting on November 6, the futures market has reduced the odds of another 25 bps cut in December from 80% to almost 50%. The US Treasury 10Y yield has risen 70-80 bps to early July levels despite two rate cuts totalling 75 bps in September and November. The Fed and other central banks are still looking to reduce monetary policy restrictions but have turned cautious on growth/inflation uncertainties over Trump’s policy pledges and heightened geopolitical risks.

Following significant gains this year, investors will be tempted to book profits on their Trump Trade ahead of next week’s US Thanksgiving holiday. Markets need to monitor the dangerous escalation in the Ukraine-Russia war, now driven by increased military engagements from both sides, strategic policy shifts, and heightened international involvement.

Russia launched massive missile and drone attacks in Ukraine after North Korea deployed troops to support Russian forces in Ukraine. Kyiv retaliated by firing missiles supplied by the US and the UK, in line with NATO’s stance of allowing Ukraine to use Western-supplied weapons without restriction. Russian President Vladimir Putin responded by amending Russia’s nuclear doctrine, which permitted nuclear retaliation against non-nuclear states that are supported by nuclear powers. The US and several European nations temporarily closed their embassies in Kyiv, citing intelligence of imminent large-scale Russian air attacks. Putin offered to discuss a ceasefire deal with US President-elect Donald Trump. Expectedly, Ukrainian President Volodymyr Zelensky rejected Putin’s demands for Ukraine’s withdrawal from the occupied territories and abandonment of NATO aspirations.

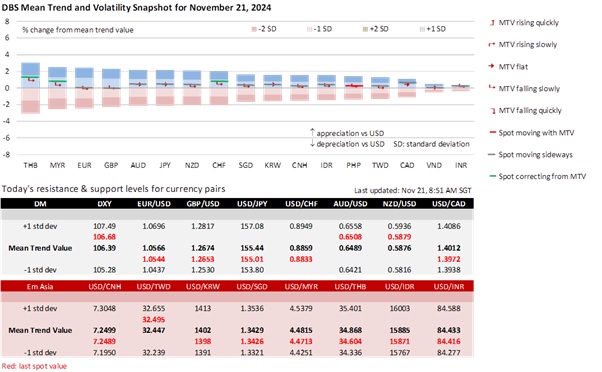

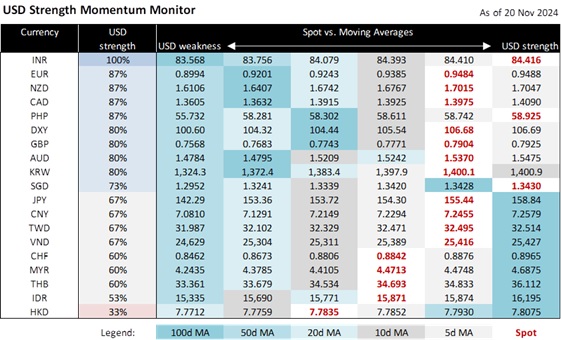

Despite the USD’s rebound on Wednesday, currencies appear supported after their sharp declines to critical levels following Trump’s victory in the US elections. Over the past week, EUR/USD consolidated mostly in a 1.05-1.06 range and GBP/USD between 1.26 and 1.27. USD/JPY, USD/CAD, and AUD/USD pivoted around 155, 1.40, and 0.65, respectively. The USD’s upside appears capped at significant levels for many Asian currencies, for example, USD/CNY at 7.25, USD/KRW at 1400, USD/SGD at 1.35, USD/THB at 35, and USD/MYR at 4.50.

Quote of the Day

“To invent, you need a good imagination and a pile of junk.”

Thomas Edison

November 21 in history

Thomas Edison announced his “talking machine” invention (phonograph) in 1877.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.