This morning’s knee-jerk sell-off in the EUR/USD towards 1.08 on France heading towards a hung parliament could be limited. Markets should be relieved that France averted the worst outcome at Sunday’s runoff elections, i.e., an outright majority for the far-right National Rally Party. According to CNN, the IPSOS estimate projected the left-wing Leftist New Popular Front alliance taking first place with 172 to 192 seats, followed by President Macron’s centrist party in second place with 150 to 170 seats, and a surprise third place for the National Rally Party with 132 to 152 seats. Whichever party forms the coalition government needs 289 out of the 577 seats in parliament. The French Constitution does not allow another snap election for another year until June 2025.

Drawing on a similar experience in Germany, EUR/USD rose from 1.1950 to 1.2370 during the half year it took to swear in a new coalition government led by Chancellor Merkel in March 2018 from the German federal elections in September 2017. The EUR’s rise was fuelled by global trade volume growth, which improved to 4.7% in 2017 from 1.8% in 2016. In April this year, the World Trade Organisation saw world merchandise trade expanding by 2.6% in 2024 after a 1.2% contraction in 2023. Unless France forms a coalition government led by the far left, fears of a sharp increase in public spending lessened after the European Commission opened an excessive deficit procedure over France breaching budget deficit rules.

With the UK and French elections concluded, the focus now shifts to the US Presidential Elections in November. Apart from the immediate mounting pressure on President Joe Biden to withdraw his candidacy due to his age, America’s unsustainable fiscal situation also became a significant worry for the greenback.

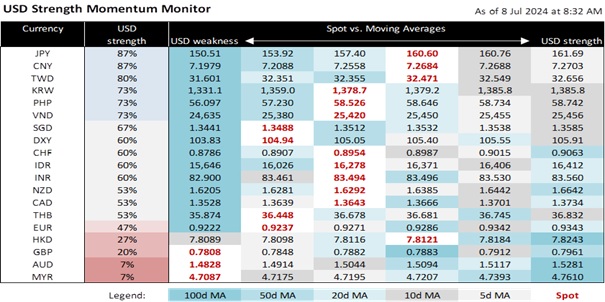

Fed Chair Jerome Powell’s semi-annual testimony to the Senate Banking Committee on July 9 could take the DXY Index below 104.75, its 100-day moving average. The futures market is betting that cooling US inflation and jobs data will provide the Fed the confidence to lower interest rates in September. On July 11, consensus expects US CPI inflation to slow a third month to 3.1% YoY in June from 3.3% in May. Last Friday, the US unemployment rate increased again to 4.1% in June after hitting 4% in May, the Fed’s target for 4Q24. The US economy is no longer exceptional after slowing to an annualized 1.4% QoQ saar in 1Q24 from 3.4% in 4Q23. The Atlanta Fed GDPNow model forecasts 2Q24 real GDP growth staying low at 1.5% vs. its earlier 3.1% estimate at the FOMC meeting on June 12.

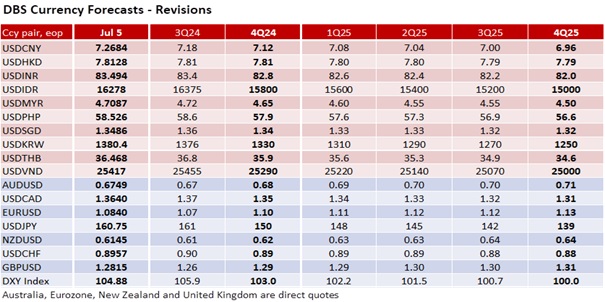

NZD/USD will likely rise to test 0.62, the significant resistance level it failed to break sustainably above in February, March, and June. NZD/USD rebounded strongly to 0.6145 last week after finding solid support around 0.6070 (100-day moving average). On July 10, we expect the Reserve Bank of New Zealand to keep the official cash rate unchanged at 5.50%. Although CPI inflation fell to 4% YoY in 1Q24 from 4.7% a quarter earlier, it remained above the RBNZ’s 1-3% target range. The OIS market priced in a 96% probability for a rate cut in November, most likely taking its cue from the RBNZ’s forecast for CPI inflation to return within target by the end of 2024.

Quote of the day

“Markets are constantly in a state of uncertainty and flex and money is made by discounting the obvious and betting on the unexpected.”

George Soros

8 July in history

In 1497, Portuguese navigator Vasco da Gama departed on his first voyage and became the first European to reach India by sea.

Topic

Explore more

E & S Macro StrategyThe information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.