Powell’s “blunt” comments

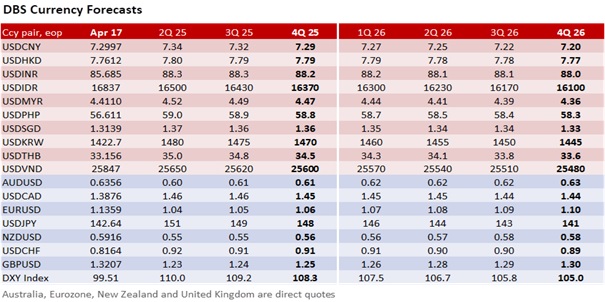

Despite the DXY Index’s 1% fall to a three-year low of 99.26 overnight, we are cautious and mindful that the DXY has yet to break below the intra-day low of 99 seen on April 11. Unlike last week, no de-dollarisation fears were inferred from investors dumping US Treasuries while exiting US equities. Yesterday, investors sought safety in bonds, driving the US Treasury 10Y yield lower a third day by 5.6 bps to 4.277% amid the 2.2% decline in the S&P 500. Markets may reverse again before US stock markets close on Good Friday; the US bond market will close early today in observance of Maundy Thursday.

Fed Chair Jerome Powell affirmed that Trump’s significantly higher-than-expected tariffs would lead to stagflation and pose a challenge to the Fed achieving its dual mandate of price stability and full employment. Apart from the blunt tone, Powell’s comments did not deviate from his colleagues’ narrative for an extended pause. The Fed sees tariffs lifting prices but will refrain from hiking rates as long as long-term inflation expectations stay anchored amid a rising unemployment rate on a slowing economy.

Powell said the Fed was ready to provide dollars overseas, a tacit reaffirmation of the USD’s dominant role as the world’s reserve currency. This comment also implied agreement with Fed Governor Christopher Waller’s recent assessment to look past high inflation and cut cuts if a recession becomes imminent.

ECB preview

Looking beyond its 1% rebound overnight, EUR/USD is still within its three-day range between 1.1260 and 1.1430, and below last Friday’s intra-day high of 1.1473. Apart from the European Central Bank cutting its deposit facility rate by 25 bps to 2.25% today, we expect some concern from ECB President Christine Lagarde regarding the EUR’s recent appreciation as a factor holding inflation down and adding to the headwinds posed by US tariffs. The accompanying ECB Survey of Professional Forecasters should also reflect downgraded growth expectations, affirming that the defence and infrastructure spending under the “ReArm Europe” Plan would not offset the immediate headwinds due to the negative impact of US tariffs.

JPY bulls should be cautious about the US-Japan trade talks

US President Donald Trump has inserted himself into the US-Japan trade negotiations over April 16-18. Trump’s involvement underscored the high stakes and his desire to validate his tariff strategy to achieve trade fairness and reduce deficits. In the discussions, Trump emphasized tariffs, military cost-sharing, and broader trade fairness.

Describing the US tariffs as a national crisis, Japan Prime Minister Shigeru Ishiba told parliament that “haste makes waste,” indicating no rush to reach a deal by making big concessions. Tokyo was also resistant to the US request to include the JPY in the talks, which it preferred to address in separate discussions between their finance ministers. Japan advocated removing additional tariffs such as the 25% duty on autos, auto parts, steel and aluminium, highlighting their detrimental impact on domestic industries and company profits.

The Nikkei 225 Index fell 19.4% to 30793 between March 26 and April 7 before recovering to 34087. The OIS futures do not expect the Bank of Japan to deliver more rate hikes in 2025; the 10Y JGB yield fell to 1.29% from its 1.59% peak in late March. Having fallen sharply from its 159 high in January, USD/JPY is approaching the 140-support level held at the end of 2023 and September 2024.

Quote of the Day

“The great hope of Easter is hope.”

Basil Hume

April 17 in history

The damaged Apollo 13 spacecraft returned to Earth safely in 1970.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.