CAD’s recovery stalled ahead of BOC meeting and elections

USD/CAD rose for the first time in five days by 0.6% to 1.3956. USD/CAD has been unable to break below 1.3830 after its plunge (driven by a “death cross” formation) from 1.4275 to 1.3875 over April 9-11. The next resistance levels are 1.40 and 1.4050 or the 38.2% and 50% Fibonacci retracement levels of this month’s decline.

Despite the consensus for the Bank of Canada to keep rates unchanged at 2.75% today, the OIS market has not ruled out a surprise cut, which it assigned a 40% probability. CPI inflation cooled to 2.3% YoY in March from 2.6% in February, while the average of the BOC’s two preferred core inflation rates moderated to 2.85% from 2.9%. The net change in employment turned negative in March; the -32.6 reading was the worst since January 2022. Companies have slowed or halted investment and hiring because of Trump’s tariffs. According to a BOC Survey, 66.5% of consumers and 32% of businesses expect a recession over the next year. The BOC quarterly monetary policy report should reinforce the highly uncertain outlook confronting the Canadian economy. Last month, BOC Governor Tiff Macklem said the BOC might present a range of growth estimates instead of a single forecast because of the flip-flopping in America’s tariff policy.

As for Canada’s federal election on April 28, polls indicate that the Liberals have a better chance of securing a majority than the opposition Conservatives. However, the polls also showed that the Liberals, led by Prime Minister Mark Carney, would be better suited to managing Canada’s complex relations with the Trump administration and the Conservatives in addressing domestic economic issues, namely, the cost-of-living worries. A Labour victory would lead to policies that strengthen Canada’s economic independence and resilience from the US economy, promote sustainable energy development, reinforce national defence, affordable housing initiatives, financial support for consumers, and middle-class tax relief.

EUR takes a breather

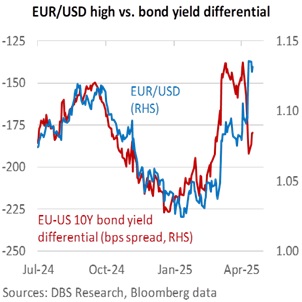

EUR/USD depreciated 0.6% to 1.1282, below 1.13 for the first time in three days. EUR/USD can trade lower and realign with the significantly narrower EU-US 10Y yield differential this month. The US yield has eased in the past two sessions, driven by the efforts of US Treasury Secretary Scott Bessent to reaffirm America’s commitment to a strong dollar policy. If so, this could return focus to the Eurozone’s tough economic outlook.

We expect the European Central Bank to cut its deposit facility rate by 25 bps to 2.25% at tomorrow’s meeting. The OIS market sees the ECB lowering rates again to 2% in June and 1.75% in September, the floor of its estimated neutral range of 1.75-2.25%. Although the ECB does not target the exchange rate, ECB President Christine Lagarde will likely point to the EUR’s recent appreciation as a factor holding inflation down and adding to the headwinds posed by US tariffs.

The accompanying ECB Survey of Professional Forecasters should also reflect downgraded growth expectations, affirming that the defence and infrastructure spending under the “ReArm Europe” Plan would not offset the immediate headwinds due to the negative impact of US tariffs. Trump’s tariffs weighed heavily on investor sentiment in Germany. According to the ZEW Survey, expectations collapsed to -14 in April from +51.6 in March, its first negative reading since October 2023. The outlook for the next six months fell across all industries, with the weakest readings in automobile (-76.5), steel (-52.9), chemical and pharmaceutical (-42.2), and mechanical engineering (-40.8).

Quote of the Day

“Caution is the eldest child of wisdom.”

Victor Hugo

April 16 in history

The Organization of European Economic Co-operation was formed in 1948.

Topic

Explore more

E & S Macro StrategyGENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.