US President Donald Trump announced plans to raise all automobiles not produced in the US to 25%, effective April 2nd, the same day as his scheduled announcement of reciprocal tariffs. As the world’s largest importer of autos, the US will see its tariffs significantly impacting major suppliers from Mexico, Japan, South Korea, Canada, and Germany.

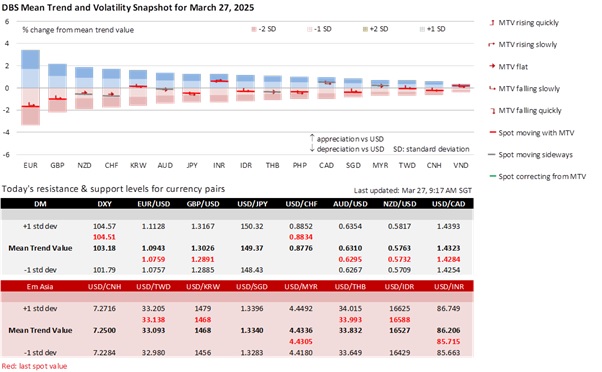

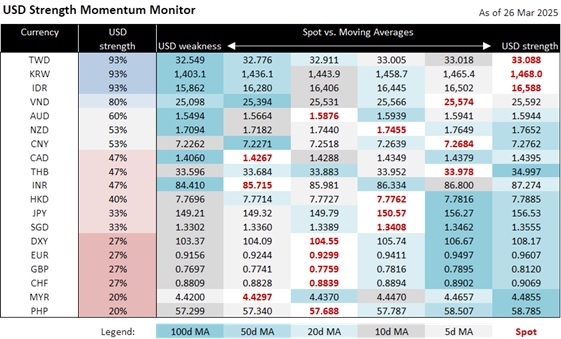

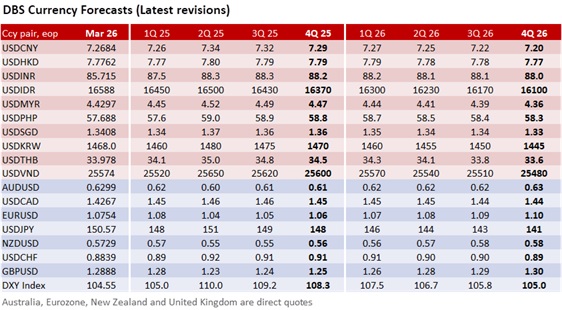

Fears that Trump’s auto tariffs could escalate trade tensions and fuel inflation elevated the USD. The USD Index (DXY) appreciated by 0.4% to 104.55, extending its rise from the 104 handle. US Treasury 10Y yield rose 4 bps to 4.35%, the critical resistance level in March. Chicago Fed President Austan Goolsbee warned that the Fed may take longer to lower interest rates. The University of Michigan reported that inflation expectations over the next 5-10 years climbed for the third straight month, rising to 3.9% in March from 3% in December. Fed Chair Jerome Powell could alter his assessment that tariff-driven inflation could be transitory if the Fed’s 5Y5Y inflation expectations begin to rise.

USD/JPY rose 0.7% to 150.57, closing above the 150 level for the second time this week. Japan will likely resist retaliation against US tariffs on its auto exports to the US. Despite unsuccessful efforts to seek exemptions, the government should continue to pursue diplomatic efforts to resolve trade tensions with the US. If the government starts to closely coordinate with the Bank of Japan on the economic risks posed by auto tariffs, markets may reassess its expectations for a June/July hike, especially after National CPI inflation retreated to 3.7% YoY in February from its two-year high of 4% in January. BOJ Governor Kazuo Ueno indicated plans to keep his options open before the next meeting on May 1st. Hence, expectations of the JPY acting as a haven will unlikely overcome the anticipated drag from Trump’s tariffs on Japan’s growth and rate outlook amid a Fed alert to rising long-term inflation expectations.

EUR/USD finally cracked below the pivotal 1.08 handle it held for two weeks. Trump’s latest tariff on autos will follow those on steel and aluminium. EU Trade Commissioner Maros Sefcovic expects the Trump administration to hit the bloc with reciprocal tariffs of about 20% next week. Investors reckon that the economic stimulation from the “ReArm Europe” Plan would not counterbalance the adverse impact of the US tariffs, particularly in the short term. Europe’s plan to respond with retaliatory tariffs on US goods would further strain transatlantic relations and hurt economic growth on both sides. European Commission President Ursula von der Leyen deeply regretted the US decision to impose tariffs on European automotive exports, vowing to jointly protect workers, businesses, and consumers across the EU.

Quote of the Day

“When you reach the end of your rope, tie a knot in it and hang on.”

Franklin D. Roosevelt

March 27 in history

The modern shoelace with an aglet (a sheath protecting the lace ends) was patented in England by Harvey Kennedy in 1790.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.