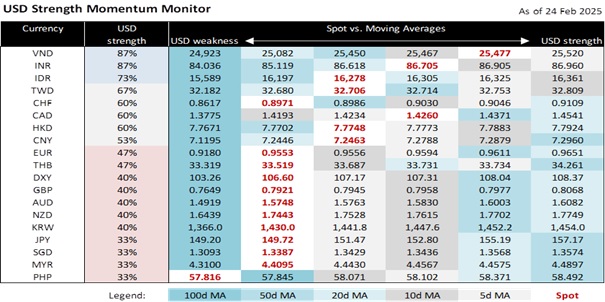

We remain wary of upside risks in the USD. US President Donald Trump reminded markets that the 30-day suspension of the proposed 25% tariffs on imports from Canada and Mexico was set to conclude next week. Also likely to take effect is the 25% tariff on steel and aluminium on March 12 and the 25% tariff on automobiles, semiconductors, and pharmaceuticals on April 2. Barring another delay in tariffs, markets should be short-covering after underpricing the risks of Trump’s hawkish trade policies. The DXY Index, which ended 0.3% higher to 106.60 overnight, is some ways below 110 or the level seen on February 3, the original date for the tariffs on Canada and Mexico.

USD/CAD rose a second day by 0.3% to 1.4260; the currency pair has been struggling around the 1.42 level after hitting the year’s low of 1.4151 on February 14. Over the weekend, Bank of Canada Governor Tiff Macklem warned that a US-Canada trade war could lower long-term economic growth by 2.5% through exports, consumption, and investment. With GDP growth below 2% YoY since 2Q23, US tariffs could tip the Canadian economy into recession. With the BOC suspecting that underlying inflation may be lower than indicated by the price gauges, markets may be underestimating the willingness of the BOC to keep lowering rates. The OIS market has priced in two additional 25 bps cuts this year, in April and July. All said, we remind readers that USD/CAD, after hovering for a month around 1.44, surged to 1.48 on February 3, the original date that Trump’s tariffs were supposed to take effect.

The EUR’s post-German election relief rally was short-lived. EUR/USD failed to overcome the psychological 1.05 level for the third time this year. CDU/CSU won 28.5% of the vote share at the German elections on February 23, with its leader, Friedrich Merz, set to become the new German Chancellor. Merz is targeting to form a government by Easter (April 20) but his choices are limited to the unpopular Social Democrats or the Greens, parties with significant policy differences with the CDU/CSU. The far-right Alternative for Germany (AfD) will be a formidable opposition after capturing 20.8% of the votes, its highest ever, and a third of the seats in the Bundestag. EUR/USD traded briefly below 1.02 on February 3.

USD/SGD rebounded to 1.3390 after hitting the year’s low of 1.3312 yesterday. Apart from the USD’s strength, the SGD was weighed by significantly lower-than-expected inflation, which validated the central bank’s decision to slightly reduce the slope of the SGD NEER policy band on January 24. CPI inflation fell to 1.2% YoY in January, below the official average forecast range of 1.5-2.5% for 2025. Likewise, the MAS core inflation declined to 0.8% YoY, also beneath this year’s 1-2% forecast range. The Ministry of Trade and Industry expects GDP growth to slow to 1-3% in 2025 after posting an impressive 4.4% growth in 2024. According to our model, the SGD NEER was 0.5% above the mid-point of its policy band, which is consistent with the official expectation for slower GDP growth and benign inflation this year. USD/SGD hit 1.37 on February 3.

Quote of the Day

“I am a tariff man, standing on a tariff platform.”

William McKinley

February 25 in history

Australia’s first currency, the holey dollar, was introduced in 1814.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.