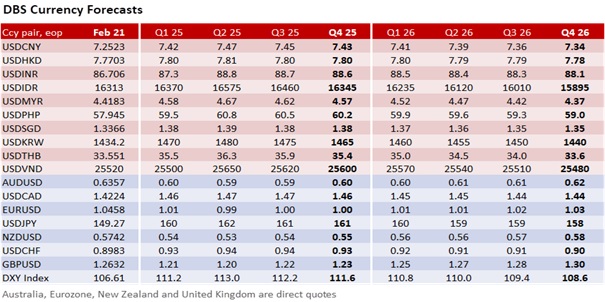

We maintain our outlook that the USD will reaffirm its haven status in the first half of this year. The factors contributing to the greenback’s decline in January-February appear temporary. They include US President Donald Trump’s delay of tariffs, US equities stalling with Fed cut expectations, and untenable optimism regarding Trump’s initiatives to conclude the war in Ukraine and secure a new trade deal with China.

Assuming no further delays, Trump’s extensive list of tariff commitments is set to take effect, beginning with 25% tariffs on Canada and Mexico goods next week. Trump’s reciprocal tariffs risks escalating trade tensions if the affected countries retaliate. US Treasury Secretary Scott Bessent has acknowledged that stalled US disinflation and the Fed’s ongoing balance sheet run-off could delay plans to extend the duration of government debt issuance. The Fed expects US PCE inflation (on February 27) to mirror the surprises in CPI and PPI inflation.

This morning’s EUR appreciation on the exit polls indicating the CDU/CSU securing the most votes (28.6%) in Sunday’s German federal elections should be short-lived. EUR/USD remains confined within last week’s 1.04-1.05 range. CDU leader Friedrich Merz, poised to become Chancellor, hopes to establish a government by Easter (April 20). Forming a stable and effective coalition government will be difficult because the CSU does not favour the Greens (12.3%). The Free Democratic Party (4.9%) paid dearly for bringing down the last coalition government led by the Social Democratic Party, which won the least votes (16.3%) since WW2. Exit polls show the far-right Alternative for Germany party (AfD) gaining almost twice as many votes (20.4%) from the last elections in 2021, alongside more votes for the Left Party (8.5%) and the BSW (4.9%). Forming a coalition in a fragmented Bundestag will likely result in policy compromises that dilute the effectiveness of economic reforms needed to address Germany’s sluggish economy and the political responses to Ukraine. Nonetheless, the new German government will likely maintain its firm commitment to Ukraine’s sovereignty and resist peace initiatives that exclude Ukraine and the EU or make concessions to the US and Russia. Ukraine’s bid for NATO membership, as part of a broader peace agreement, continues to face opposition from Russia.

Trump’s hope for a new comprehensive trade deal with China will necessitate substantial negotiations and reconciliations from both countries. An initial phone call between Bessent and Chinese Vice Premier He Lifeng underscored the complexities of US-China tensions. In a media interview, Bessent described the CNY as a difficult currency to value, citing capital controls and uncertainties around foreign investors’ ability to repatriate funds. While these comments did not explicitly call for a revaluation of the CNY, they implicitly encouraged foreign companies in China to reshore to the US, going beyond the Phase One Trade Deal that focused primarily on China increasing more US imports to address trade imbalances. Recent modifications of the US State Department’s online fact sheet on US-China relations have elicited strong protests from Beijing, intensifying scepticism regarding Washington’s sincerity in resolving trade tensions based on mutual respect, peaceful coexistence, and win-win cooperation.

Quote of the Day

“Reality is merely an illusion, albeit a very persistent one.”

Albert Einstein

February 24 in history

In 2020, scientists identified the first animal that did not need oxygen to breathe – a tiny parasite living in salmon tissue, reported in journal PNAS.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.