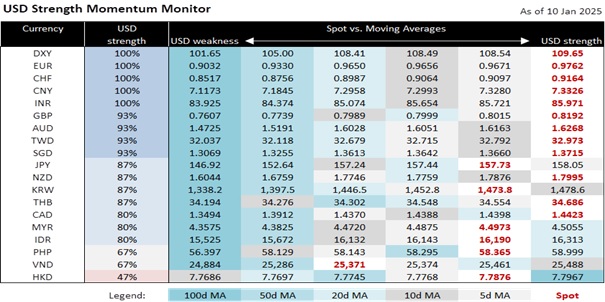

We have revised our currency outlook to reflect a more rapid appreciation in the USD in the first half of this year. Implied currency volatility has increased over the past month, particularly for the GBP and the major currencies. The DXY Index’s upward momentum, fuelled by the Trump Trade rally, has remained intact after it broke above its two-year range.

The US economy continues to show remarkable resilience compared to the stagnation in Europe and the lacklustre Chinese economy amid heightening global uncertainties driven by the incoming Trump administration’s unpredictable trade and foreign policies. The Fed has adopted a cautious stance on disinflation and rate cuts, with the futures market pricing in only one cut this year, now delayed to June. Meanwhile, markets anticipate other central banks will implement more aggressive rate cuts than the Fed, further widening the US yield differentials against its peers. In China, the government temporarily halted government bond purchases after yields fell to record lows due to strong demand outpacing supply.

Following last Friday’s stronger-than-expected US nonfarm payrolls, surprises in this Wednesday’s US CPI inflation could further lift the USD. Consensus expects headline inflation to rise to 2.9% YoY in December from 2.7% in November and core inflation to stay unchanged at 3.3% for a third month. US equities continued their sell-off after the University of Michigan’s one-year inflation expectations increased to 3.3% in January vs. consensus to stay unchanged at December’s 2.8%.

This week will be eventful because the US Senate has scheduled confirmation hearings for several of President-elect Donald Trump’s cabinet nominees. Scott Bessent’s hearing as Treasury Secretary on January 16 will be of particular interest to financial markets. Bessent’s “3-3-3” economic plan aims to 1) reduce the budget deficit to 3% of GDP within Trump’s term through fiscal reforms; 2) stimulate 3% economic growth through deregulation and reshoring initiatives; and 3) achieve energy independence by increasing daily domestic oil and gas production to 3 million barrels. Markets will closely watch for indications of a pragmatic and measured approach to implementing Trump’s agenda.

During his hearing as Secretary of State on January 15, Marco Rubio, known as a leading China hawk in Congress, will align with Trump’s confrontational and assertive stance on foreign policy, particularly against major geopolitical adversaries. Similarly, Pete Hegseth’s hearing as the Secretary of Defense on January 14 will be monitored, especially in light of Trump’s recent controversial comments about potentially using military force to acquire Greenland and control the Panama Canal.

Trump’s inauguration as the 47th President of the United States on January 20 looms large. His immediate plans include imposing a 25% tariff on goods from Canada and Mexico and an additional 10% tariff on imports from China. All three countries have indicated their intentions to retaliate with tariffs on US goods, raising the risk of a trade war unless all sides engage in diplomatic negotiation to de-escalate tensions.

Quote of the Day

“Power without legitimacy tempts tests of strength; legitimacy without power tempts empty posturing.”

Henry Kissinger

January 13 in history

In 1975, US Secretary of State Henry Kissinger hinted at military action against oil countries in case of “actual strangulation of the industrialized world” in the wake of the oil shock.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.