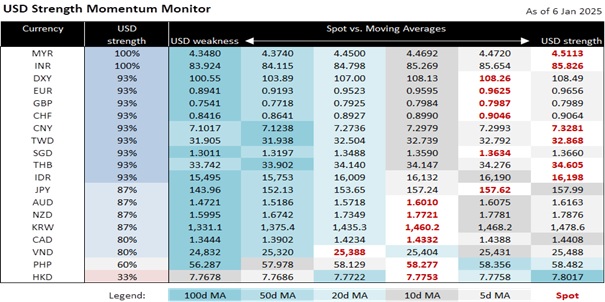

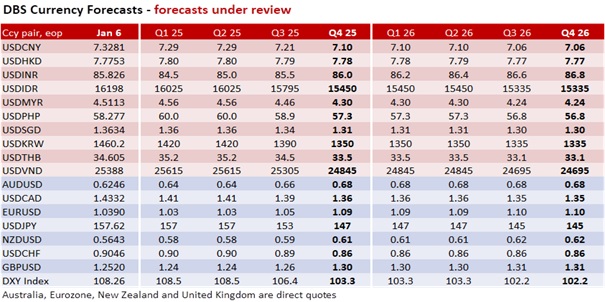

The market initially brought the DXY Index lower by 1.1% to 107.75 on an unverified US newspaper report that the incoming Trump administration was mulling a narrower approach to tariffs, focused on selected critical sectors. The US Treasury 10Y yield declined by 24 bps to 4.573% from Friday’s 4.598% on the belief that Trump’s aides recognized the inflation risks associated with his universal tariff plan. However, the 10Y yield rebounded after Trump denied the report as fake news, ending the session 3.3 bps higher to 4.63%. DXY pared Monday’s losses to 0.7% at 108.24, its lowest close since December 30. The S&P 500 Index initially rose by 1.3% to 6021 before paring overnight gains to 0.6% at 5975.

Monday’s episode was reminiscent of the markets following Trump’s nomination of Scott Bessent as Treasury Secretary on November 22. Trump Trades had already lifted the DXY to 108, above the two-year range between 99.6 and 107.3. Believing that the well-respected hedge fund manager would be more market-friendly and pragmatic in steering Trump’s aggressive trade policies, speculators sold the DXY to 105.7 on November 29. However, Trump’s subsequent tariff threats on Canada, Mexico, China, the EU, and BRICS nations reinforced his willingness to pursue confrontational trade policies against both rivals and allies. DXY resumed its appreciation to a new high of 109.4 on January 2.

The two events emphasized a pattern. Markets would briefly respond positively to prospects of moderation in Trump’s unpredictable and polarizing policies. However, markets would also quickly adjust when Trump reinforced tariffs as central to his “America First” agenda of economic nationalism and domestic protectionism.

Canadian Prime Minister Justin Trudeau’s resignation announcement yesterday highlighted how Trump’s tariff threats could exacerbate internal political challenges. Trudeau’s approval ratings have plummeted from his inadequate response to Trump’s 25% tariff threat and Canadian exports to the US, adding to public discontent over economic management, namely, cost-of-living issues and deficit spending. Chrystia Freeland’s resignation as finance minister highlighted internal divisions within the ruling Liberal Party. Canada is headed for more political uncertainties. Parliament was prorogued until March 24, with Trudeau remaining prime minister until a new Liberal Party leader was elected. The opposition Conservative Party, which is eyeing the elections due in October, has capitalized on the tariff crisis to advocate a more confrontational stance towards the US. The political vacuum poses a challenge when Trump’s tariffs take effect at the start of his second term on January 20. Trump Trades lifted USD/CAD above its two-year range between 1.31 and 1.39 to 1.45. A sustained break above the 2016 high of 1.4580 could send towards the 1.50-1.60 highs of the early 2000s.

Quote of the Day

“Beware of false knowledge; it is more dangerous than ignorance.”

George Bernard Shaw

January 7 in history

Brunei became the sixth ASEAN member in 1984.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.