Tuesday was very volatile for the US dollar.

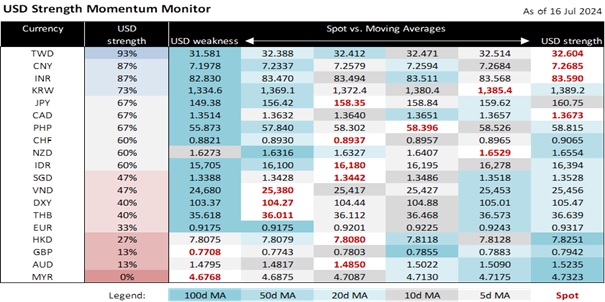

The DXY Index rose from 104.25 to 104.40 during the Asian session. Investors in external-led Asian economies considered a second Trump presidency damaging for global trade. Presidential candidate Donald Trump has pledged to impose a 60% tariff on all Chinese imports if re-elected. Following an assassination attempt on his life, Trump picked Ohio Senator JD Vance as the Republican vice-presidential nominee. Vance branded China as the biggest threat to America and supported broad-based tariffs on Chinese goods. Vance favoured reshoring American manufacturing to reduce reliance on China and agreed with Trump that the USD should be weaker to support American exports.

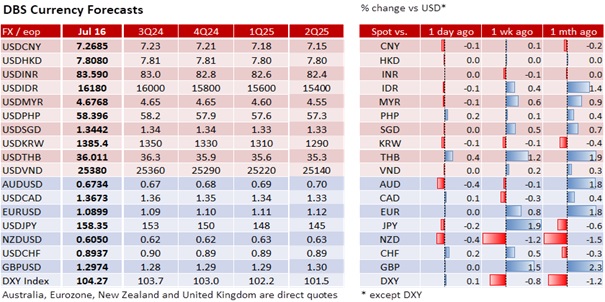

DXY fell to 104.20 during the European session. The IMF’s World Economic Outlook Update partially offset the Trump-led pessimism over the world economy. IMF maintained the forecast for world growth at 3.2% for 2024 but upgraded 2025 to 3.3% from the 3.2% projected in April. The IMF projected a recovery in world trade growth to 3.25% in 2024-2025 from quasi stagnation in 2023. For 2024, it downgraded US growth by 10 bps to 2.6%, upgraded Europe by 10 bps to 0.9%, and the UK by 20 bps to 0.7%. China received the largest upgrade among the biggest economies by 40 bps each in 2024 and 2025 to 5.0% and 4.5%, respectively.

DXY spiked to 104.50 on the better-than-expected US retail sales before drifting back to 104.20 over the rest of the US session. US advance retail sales were unchanged month-on-month in June vs. expectations for a 0.3% decline. May was revised to 0.3% from 0.1%. However, retail sales slowed to 2.3% YoY in 1H24 vs. 3.5% in the same period last year. Fed Governor Adriana Kugler reiterated it would be “appropriate “to begin easing monetary policy later this year” on evidence of more disinflation and softening employment. The futures market increased the odds of a Fed cut in September to 103.5% from 101% the previous day. The US 10Y Treasury yield eased by 7.2 bps to 4.16%, its lowest close since March 12. For the US bond market, Fed cut expectations mattered more than the Trump Trade because markets still see the Fed lowering rates before the US Presidential elections.

In conclusion, the DXY’s fluctuations represented the mix of US political developments and economic data affecting its outlook. Although investors worry about a second Trump presidency and its implications for global trade, particularly with China, economic updates provided some counterbalance. While political developments stirred investor sentiment, the anticipation of Fed cuts had a more profound impact on bond markets, underscoring the influence of monetary policy expectations on the USD’s trajectory.

Quote of the day

“Leaders don’t look for recognition from others, leaders look for others to recognize.”

Simon Sinek

17 July in history

Dow Jones closed above 2,500 for the first time in 1987. Black Monday emerged three months later on October 19.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.