Fed Chair Jerome Powell hinted that the Fed was getting closer to starting the process of reducing monetary policy. During his panel discussion at the European Central Bank Forum in Sintra yesterday, Powell wanted more of the recent inflation readings that signalled a return to a “disinflationary path” for the US economy. He reckoned that inflation would be in the mid to low twos a year from today. Interest rate futures increased the odds of a Fed cut at the September FOMC meeting to 64.5% from 56% last Friday. While the Fed did not want to lower rates too soon only to have inflation return, Powell acknowledged that lowering rates too late could lose the economic expansion. The Atlanta Fed GDPNow model projected US GDP growth staying low at an annualized 1.7% QoQ saar in 2Q24 vs. 1.4% in 1Q24, significantly lower than the 3.4% in 4Q23 and 4.9% in 3Q23.

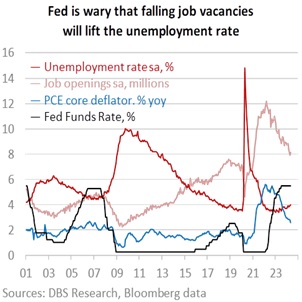

Powell’s comments elevated the significance of this Friday’s US monthly jobs report. He echoed San Francisco Fed President Mary Daly’s warning about the US labour market reaching an inflection point. On June 24, Daly drew attention to the Beveridge Curve, which highlighted the declines in job openings in lifting the unemployment rate. Powell had played down the higher-than-expected 272k (vs. 180k consensus) nonfarm payrolls in May. Instead, he found the increase in the unemployment rate to 4% in May as significant, most likely because it hit the Fed’s projected level for 4Q24.

Economists polled by Bloomberg see Friday’s nonfarm payrolls declining to 190k and the unemployment rate holding at 4% in June. The market’s conviction will increase if today’s ADP Employment stays below 200k in June again, amid a rise in initial jobless claims to 235k for the June 29 week vs. 233k a week ago. Pay attention to the ISM Services PMI survey for declines in its prices paid and employment components, like the earlier ISM manufacturing report. Looking for more evidence that the labour market is cooling, Powell will likely pay attention to the average hourly earnings, which consensus sees declining to 3.9% YoY in June for the first time since June 2021.

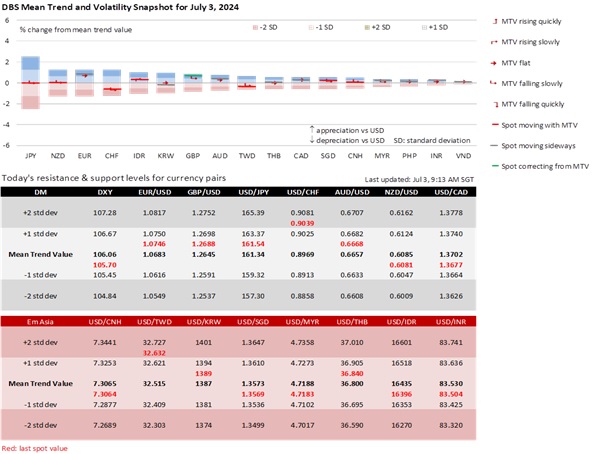

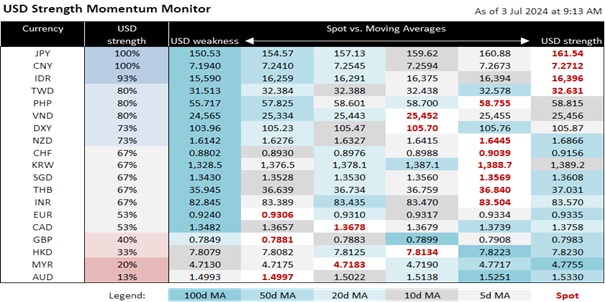

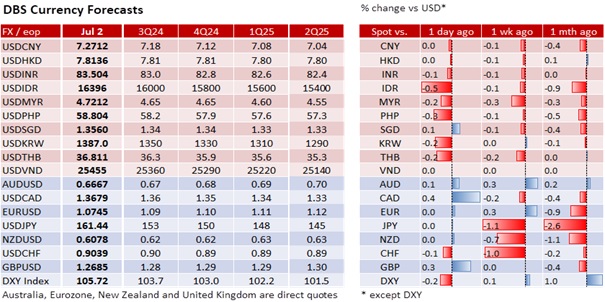

Interestingly, the DXY Index did not push above and retreated below 106 on Powell’s “balanced risks” comments at Sintra, just as it did at the FOMC meeting on May 1. Even so, we are mindful of volatility in the GBP from tomorrow’s UK elections, and the EUR at France’s second round elections on Sunday. Beyond that, a softer US jobs report this Friday and continued declines in US CPI inflation (on June 11) and PCE deflators (on June 26) should keep markets alert to the Fed cut preparation risks at the FOMC meeting on July 30-31. If so, the Bank of Japan meeting on July 31 could take the pressure off the JPY, if the central bank provides unambiguous guidance on the next interest rate increase and the pace of reduction in JGB purchases.

Quote of the day

“I believe success is preparation because opportunity is going to knock on your door sooner or later but are you prepared to answer that?”

Omar Epps

3 July in history

Dow Jones & Company published its first stock average in 1884.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.