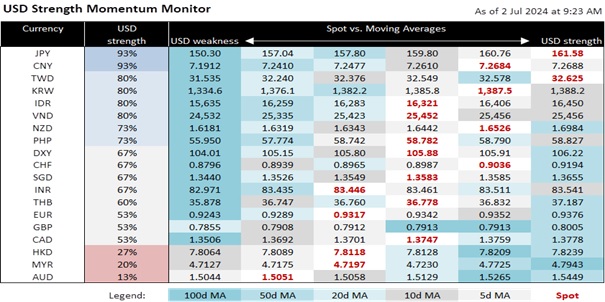

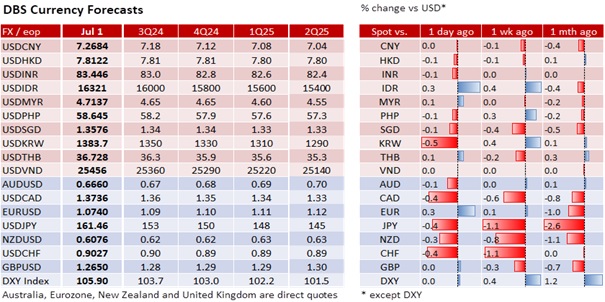

The DXY Index ended the first day of July at 105.82, slightly below Friday’s 105.87. Its most significant component, the EUR, initially spiked and met resistance at 1.0776 (50-day moving average) on the far-right National Rally party failing to secure an outright majority at the first round of the French elections on Sunday. EUR/USD ended Monday at 1.0740, back inside the 1.0650-1.0750 range seen in the second half of June. Similarly, DXY has been consolidating in a 105.3-106.2 range since June 21. While the EUR fears the second round of the French elections (on July 7) will produce a far-right government or a hung parliament, the USD is wary of a weaker US monthly jobs report (on July 5) opening the door increasing the market’s bet for the Fed to lower rates in September. GBP/USD has been within 1.26-1.27 over the past week amid more clarity about the UK elections on July 4, producing a majority government led by the opposition Labour Party.

At its forum in Sintra, the European Central Bank signalled no intentions for a second interest rate cut at its July 18 meeting. ECB President Christine Lagarde wants more time to assess the inflation uncertainties. Although consensus expects CPI inflation to decline to 2.5% YoY in June, it remains in a 2.4-2.6% range since February. Likewise, the anticipated decline in core inflation to 2.8% falls within the 2.7-2.9% range in the previous 3 months. Today, consensus expects the unemployment rate to hold at its lifetime low of 6.4% for a second month in May, following Eurozone economy’s exit from a technical recession in 1Q24.

Today, Fed Chair Jerome Powell may sound less hawkish during his panel discussion with Lagarde and Brazilian central bank governor Roberto Campos Neto in Sintra. Powell will likely be hopeful about US inflation declining in 2H24. He is monitoring the US unemployment rate, which rose in May to the 4% level the Fed projected for 4Q24 in last month’s Summary of Economic Projections. Today, consensus expects JOLTS job openings to decline a third month to 7950k in May, below the 8000 level for the first time since February 2021. Yesterday’s US ISM manufacturing survey showed the prices paid index falling a second month to 52.1 from 57.0 and the employment index declining to 49.3 from 51.1. The Atlanta Fed GDPNow model predicts a soft landing for the US economy; GDP growth to stay low at an annualized 1.7% QoQ saar in 2Q24 from 1.4% in 1Q24.

USD/JPY extended its rise above 160 to 161.46 from another increase in US bond yields and a lack of haven appeal after the first round of French elections. The better-than-expected Tankan Survey in June should keep hopes alive for a second interest rate hike and provide more details on the plan to reduce JGB purchases at the upcoming Bank of Japan meeting on July 30-31. Corporates expect inflation to hold above 2% over the longer term, i.e., 2.3% over the next three years and 2.2% five years ahead. Despite the Japanese economy contracting by 0.7% QoQ sa in 1Q24, large corporates planned to increase capital expenditure by 11.1% in the current fiscal year ending March 2025. The outlook for the manufacturing sector increased to 14, its strongest since September 2021, while that for the non-manufacturing sector stayed firm at 27 for the third quarter. Interestingly, Japanese businesses predicted that USD/JPY would decline to 144.59 for the fiscal year ending March 2025.

Quote of the day

“Every time I thought I was being rejected from something good, I was actually being re-directed to something better.”

Steve Maraboli

2 July in history

In 1916, Lenin said that imperialism was caused by capitalism.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.