GBP/USD crawled higher for a third day by 0.1% to 1.2723 ahead of today’s Bank of England meeting.Despite the UK’s CPI inflation hitting the 2% target in May for the first time in three years, we do not expect the BOE to lower the bank rate from 5.25% due to the UK snap election on July 4. Additionally, CPI core and services inflation remained too high at 3.5% and 5.7%, respectively. Average weekly earnings remained elevated for a second month at 5.9% YoY in April. The UK economy exited its technical recession with the highest GDP growth rate (0.6% QoQ sa in 1Q24) since 4Q21.

However, the BOE could pave the way to remove top-level restriction in monetary policy in the summer if one or more members join the two – Swati Dhingra and Dave Ramsden – who voted for a cut last month. In the Monetary Policy Committee’s May Report projections, the BOE forecasted CPI inflation at 1.9% in two years’ time and 1.6% in three years. The claimant count rate increased to 4.3% in May after holding steady at 4.1% for seven months. The BOE faces a tough balancing act today that will decide if GBP/USD stays in the lower half or moves into the upper half of its 1.2650-1.2850 range set in mid-May. All said, GBP was the most resilient currency in the DXY basket this year, barely changing from the 1.2730 level seen at the end of 2023.

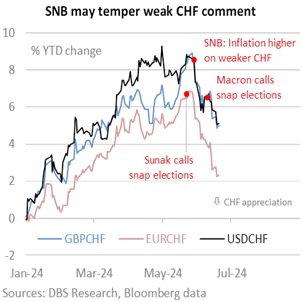

USD/CHF could potentially start consolidating in the 0.8725-0.8895 range seen between mid-February and mid-March. Today, we do not expect the Swiss National Bank to deliver a back-to-back rate cut at its meeting. USD/CHF broke below its two-month range of 0.90-0.92 this month after SNB President Thomas Jordan blamed the CHF’s weakness for the rebound in CPI inflation from 1% YoY in March to 1.4% in April, slightly below the 1.50% policy. Jordan also warned that R-star might be higher than the estimated 0%. The Swiss economy also improved in 1Q24, posting its highest growth since 2Q22. However, the SNB may temper its comments about CHF weakness, noting its haven status from the volatility surrounding the uncertainties of the upcoming snap elections in France (two rounds on June 30 and July 4) and the UK (July 4). For example, EUR/CHF plunged by 4.6% to 0.9480 on June 19 from its 0.9930 peak on May 27, and GBP/CHF by 3.9% from 1.1680 to 1.1220 over the comparable period.

Quote of the day

“Our dilemma is that we hate change and love it at the same time; what we really want is for things to remain the same but get better.”

Sydney J. Harris

20 June in history

In 1991, the German Bundestag voted to move seat of government from the former West German capital of Bonn to the present capital of Berlin.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.