- USD/HKD has recently risen towards the upper bound of its 7.75-7.85 range

- This is driven by lower HKD rates relative to USD rates and should revert as HKD liquidity tightens

- The peg remains viable, given HKMA’s ample reserves relative to outflows and the monetary base

- While the RMB has grown as a contender for a HKD peg, important pre-conditions are still unmet

- We see the USD/HKD peg as a desirable and compelling policy choice, with little risks of a change

To read the full report, click here to Download the PDF.

USD/HKD rebounds towards upper bound

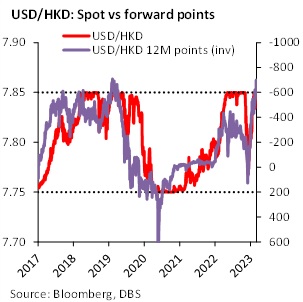

HKD is back in the spotlight, after USD/HKD recently rebounded towards the upper bound of its 7.75-7.85 trading range allowed under the Linked Exchange Rate System (LERS). What has driven this shift? Could it be indicative of any risks of a change in the USD/HKD peg? We answer the latter question by having a broader look at whether the peg remains (i) viable, and (ii) desirable from the point of policymakers.

Relationship between rates and USD/HKD

Historically, spot USD/HKD has mostly been driven by USD-HKD interest rate differentials. Should USD rates exceed HKD rates to a significant degree, it tends to trigger outflows from HKD assets to USD assets in search of higher returns. Hence it is of little surprise to have USD/HKD rising towards the 7.85 upper bound, given the fact that HKD liquidity is ample today while HKD rates are also significantly below that of equivalent tenor USD rates, as indicated by highly negative forward points.

The USD/HKD peg remains perfectly viable…

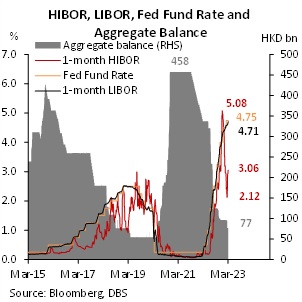

Importantly, the peg system implies an automatic adjustment mechanism for rates. Since the start of the Fed’s tapering and rate hike cycle, the HKMA has extracted HKD385bn from the interbank market by buying HKD and issuing Exchange Fund Bills and Notes. Hong Kong’s Aggregate Balance has thus shrunk from a peak of HKD458bn to HKD77bn, which resulted in 1M HIBOR rebounding from 2.12% to 3.06% of late. Spread against the 1M SOFR counterpart is thus narrowing from 244bps previously to 165bps now. We expect more HKMA intervention with the spot rate approaching 7.85 again. Aggregate Balance will fall below HKD50bn by 2Q, which was a level that stabilized spreads and USD/HKD during the last rate hike cycle in 2019. As higher HIBORs imply higher borrowing costs of shorting HKD, long USD/HKD positions should be unwound over time, with no risk to the USD/HKD peg.

Direct consequence of defending the peg is a rise in HKD rates. This may result in the 12M USD/HKD forward outright trading above 7.85. This does not imply that a de-peg is being priced. During the Asian Financial Crisis, USD/HKD 12M forward outright hit 8.5 as HKD rates soared to 9.97% to ward off speculative shorts. For now, the 12M forward outright is trading well within the 7.75-7.85 convertibility band at 7.78.

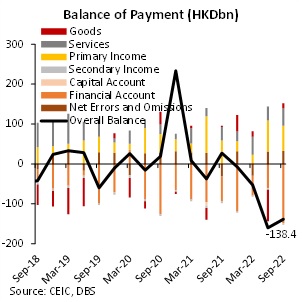

Sustainability of the USD/HKD peg also depends on the pace of capital outflow, which we view as manageable. Hong Kong’s Balance of Payments data recorded a 5th consecutive quarter of decline in 3Q22, with a cumulative HKD358bn of outflows. In fact, the quarterly outflow reached a historical high in 2Q. This was a result of both a structural deficit of the financial account, and a cyclical deficit of goods exports amid stringent COVID policy of China and Hong Kong. Meanwhile, broad money M3 (HKD+FX) has only fallen by 3% from the peak in 2020 (with M3 being somewhat distorted by giant IPOs back then). Compared to the peak in 2021, the current level has edged down by 1%.

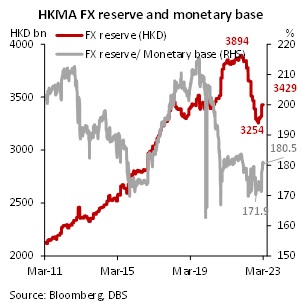

Given the size of BoP outflows and the monetary base, we judge that Hong Kong’s reserve assets are more than sufficient to defend the peg. Foreign reserves have edged lower from USD499bn (HKD3894bn) to USD437bn (HKD3243bn), but still remains ample. The ratio of reserves against the monetary base also stands at 180.4%. Thus, the HKMA has more than sufficient reserves to defend the viability of the USD/HKD peg.

… but is it still as desirable at it was in 1983?

Another important angle beyond the viability of the USD/HKD peg is the desirability of it from the point of policymakers. The peg is now approaching its 40th anniversary, having been introduced in Sep 1983 to stabilize expectations amid depreciation pressures on the then floating HKD. Since then, the peg has proven to serve Hong Kong’s economy well by anchoring monetary credibility and inflation expectations, while also facilitating capital markets activity that has enabled the city to flourish as an internationally oriented financial hub.

That said, it is important to recognize that the last forty years had also seen momentous shifts in the global economic order, not least of which is the ascendancy of China to become the world’s second largest economy. Therefore, it is also opportune to have a critical look at whether the USD/HKD peg remains as desirable today as it had been in the past, and whether change could be necessary.

Our analysis of a desirable exchange rate policy is grounded on three major features of Hong Kong, namely that it is (i) a small and open economy, (ii) highly trade dependent, and (iii) an international financial centre.

The implication of Hong Kong being a small economy with a large tradable sector is that trade in goods and services is vital, with the city importing most of what it consumes. Indeed, external trade in goods and services has grown to become over three times as large as Hong Kong’s GDP since the mid-2000s. Therefore, a stable exchange rate via a currency peg is highly desirable in both facilitating trade, and promoting import price stability.

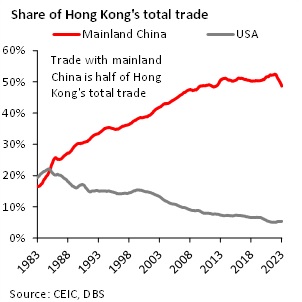

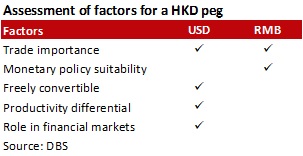

But is the USD still the best currency to be pegged to? Since the USD/HKD peg’s introduction, mainland China has seen its share of Hong Kong’s trade rise from 18% in 1983 to 49% in 2022, while the US share of Hong Kong’s trade has steadily declined from 21% to 5%. Across trade in value-added content based on final demand, China’s share is also much larger compared to the US. The RMB can thus be a strong contender to the USD for insuring price stability, on the condition that PBoC’s monetary policy is also as well-suited to Hong Kong’s economy as the Fed’s.

Ideally, monetary policy settings imported via a currency peg should be appropriate for Hong Kong’s business cycle, so as to moderate growth and avert large domestic price adjustments. If Hong Kong’s growth cycle aligns well with the US, then pegging to the USD and keeping HKD rates close to USD rates is still desirable even if trade with the US has become less important.

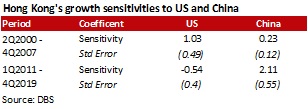

To assess Hong Kong’s correlation with both US’s and China’s business cycles, we perform a statistical analysis of Hong Kong’s quarterly GDP growth rates against US’s and China’s quarterly GDP growth rates. This allows us to determine to what extent is Hong Kong’s growth aligned with or driven by US and Chinese growth respectively.

For 2000 to 2007, our regression analysis found that Hong Kong’s growth is positively correlated to both US and Chinese growth, but its sensitivity to US growth significantly outweighs its sensitivity to Chinese growth. It thus seen that Hong Kong’s business cycle was strongly aligned with the US in the years prior to the 08/09 Global Financial Crisis.

However, the same growth regression from 2011 to 2019 gave a different result (excluding the GFC and pandemic period). Hong Kong’s sensitivity to US growth in the last decade has turned to become statistically insignificant. What’s more, its sensitivity to Chinese growth has risen by close to a factor of 10. Our analysis suggests that China could now be exerting a far larger influence on Hong Kong’s growth than the US, and certainly more than in the past. A high degree of economic dependency on mainland China suggests that the PBoC’s monetary policy stance could be adapted by Hong Kong without risks of economic instability.

Are pre-conditions for an RMB peg met?

Of course, while trade and monetary policy suitability are important considerations for the choice of an exchange rate peg, they are not the only ones. Norman Chan, the previous CE of HKMA, had visited the issue of an RMB peg back in 2013 (see here), and also outlined why pre-conditions for such a peg were not met. A decade on, it is timely to assess if these pre-conditions had been fulfilled, given the economic shifts that have propelled RMB as a contender for the HKD peg.

One pre-condition is that the RMB must be totally and freely convertible, so that RMB assets can be held as backing for the HKD as per the Basic Law. In this regard, the RMB had made progress since 2013, having been qualified as “freely usable” by the IMF and added to the IMF SDR basket since 2016. However, there are still capital control regulations, and the RMB is still not freely convertible for commercial banks and private persons, unlike the USD. If there are speculative pressures on the RMB, it may make an RMB-pegged HKD difficult to trade on concerns of regulatory controls being widened to Hong Kong. Given Hong Kong’s status as an international financial hub, its interest remains best served by pegging to the USD until China’s capital account becomes fully liberalized.

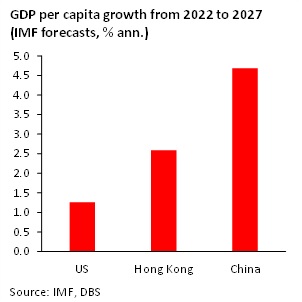

A second pre-condition is that productivity growth differentials between mainland China and Hong Kong should be small to ensure an RMB peg’s sustainability. Exchange rates tend to appreciate for economies with higher productivity growth via-a-vis economies with lower productivity growth. Hong Kong, facing slower productivity growth than the mainland, could face an over-valued HKD if it is pegged to the RMB. This could require painful pay cuts and deflation for Hong Kong to regain competitiveness. On the contrary, a peg to the USD poses no such problem, with US productivity growth likely to be slower compared to Hong Kong’s, based on IMF forecasts of GDP per capita growth over the next 5 years. It is more likely for the HKD to be under-valued, with upward price adjustments being much more palatable.

USD dominance in financial markets remains

Last but not least, the USD still holds a dominant role in capital raising and financial markets. Given deep and liquid US capital markets, international investors are highly comfortable holding USD-denominated assets, and the market for USD financing remains the largest and most developed globally. While the RMB bond market has become increasingly internationalized and foreign participation has also grown in tandem, foreign holdings of RMB bonds are still small at RMB3400bn (USD500bn). This is dwarfed by foreign holdings of US Treasuries and Agency bonds, which amounted to over USD8.7trn as of 2021.

A peg to the USD is thus much more desirable for promoting Hong Kong as an international financing hub for investors, and it is also advantageous for mainland Chinese firms seeking to tap Hong Kong markets for equity or debt financing.

In conclusion, while economic factors have gradually shifted in favour of the RMB since 1983, important pre-conditions are still not met for an RMB peg to be introduced. Furthermore, the USD/HKD peg offers significant advantages in promoting financial activity in Hong Kong, given the dominance of the USD in financing markets. The USD/HKD peg is both viable and desirable, and makes a compelling choice for Hong Kong policymakers. We expect USD/HKD to remain stable within its policy-prescribed 7.75-7.85 range in the foreseeable future.

To read the full report, click here to Download the PDF.