- Treasury yields rose c.50 bps over three days despite risk-off sentiments post-Liberation Day

- Recent events might have triggered a disorderly unwind of treasury basis trades by hedge funds

- There is also rhetoric of China shifting away from USD assets and unwinding long treasury positions

- Continue building high quality income with A/BBB credit in the 2-3Y and 7-10Y buckets

- TIPS are likely beneficiaries of declining economic confidence but rising inflation expectations

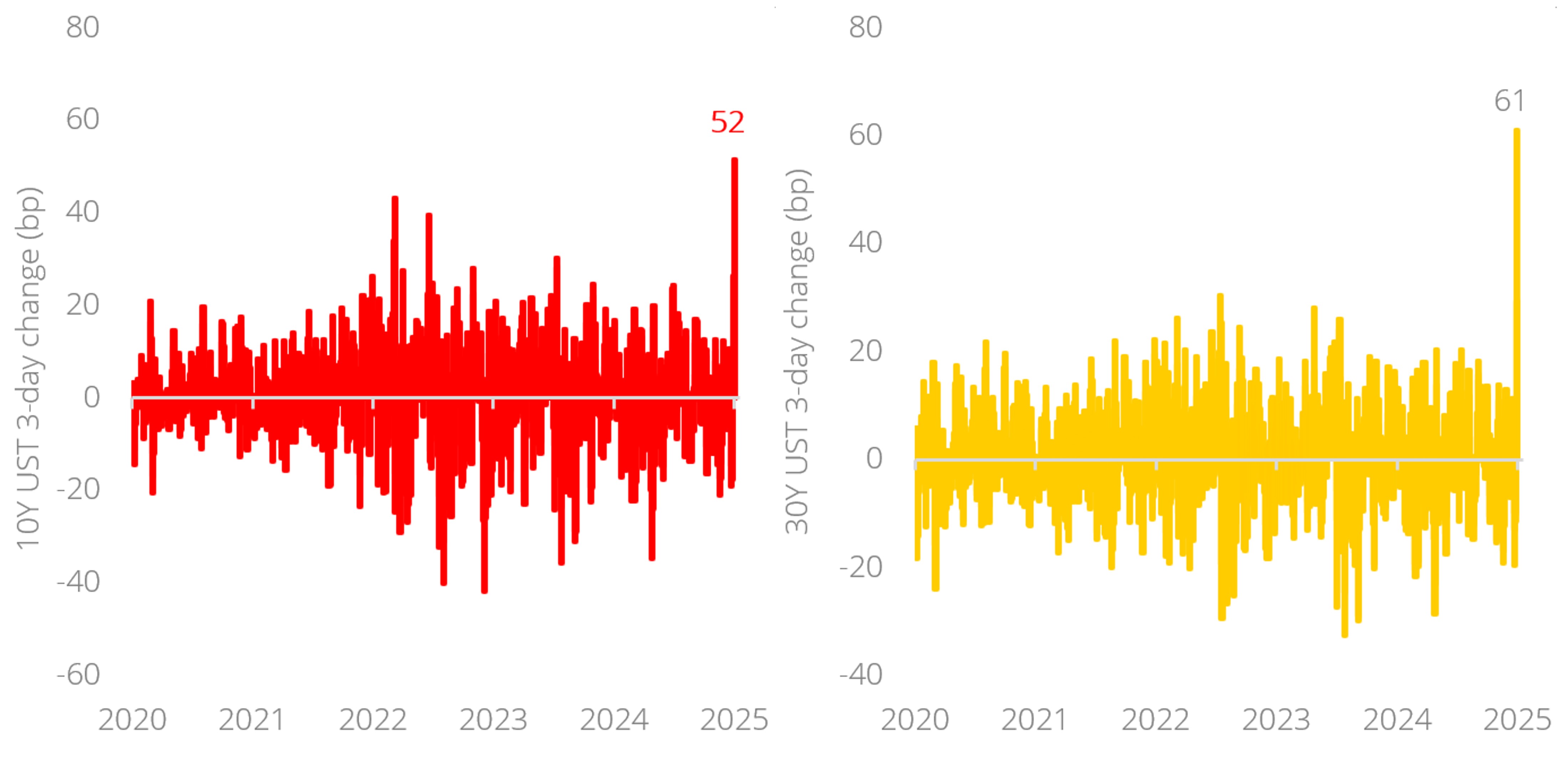

Nothing makes sense. We began our 2Q25 outlook lamenting about how tough it was to be a bond strategist these days. It just got a lot tougher. President Trump’s tariffs have been unmistakably negative for risk assets, judging by the sea of blood that is the global markets this year. Despite the fears however, bond yields spiked overnight – a phenomenon that no one would anticipate in a risk-off event – in pure defiance of any conventional logic in investment theory. Put in context, the US 10Y treasury yield has risen close to 50 bps over just three days, a nearly five-sigma move in the last five years.

All common threads of rationality have been thrown out the window. Did the markets expect tariff-driven inflation and price out rate cuts? Nope, breakeven inflation hardly budged while Fed funds futures still anticipated four cuts by end-2025. Are markets abandoning all assets in a dash for cash à la Covid-crisis? No, the dollar is on the contrary weakening as we speak. When all avenues of rationality have been exhausted, the only explanation for the bond selloff – by process of elimination – begins to stare at us in the face.

Irrationality.

Indiscriminate selling from a basis trade unwind. In an obscure corner of the Hedge Funds universe lies a profitable but highly leveraged trade known as the treasury basis trade, where managers arbitrage on the price differential between a treasury cash security and a treasury futures contract with similar characteristics (known as the “basis”) to make an apparent riskless profit. As such differentials are minute, the bet must be extremely leveraged – sometimes up to 100x – to make any meaningful gains. Profits are made when prices converge as the futures contract approaches expiry. As inconspicuous as this sounds, this basis trade is estimated to be between USD500bn-1tn today.

Figure 1: The rapid changes in UST yields are extremely unusual

Source: Bloomberg, DBS

Why is there even a basis to exploit? The opportunity only arises because treasury futures have a persistent premium over cash bonds due to demand. This demand for futures contracts is fuelled by institutional asset managers who manage credit funds but are benchmarked against global aggregate funds that include large weights in long duration government bonds, due to the bigger sizes of sovereign issuances. As these fund managers are often overweight on credit (which have lower durations than the benchmark), they would cover the duration shorts with futures contracts as this requires a much lower cash outlay than cash bonds.

Hedge funds, recognising this demand, take the opposite short position on the futures contract, but take a long position on the cash treasuries (on leverage) to exploit the difference. The risk is that the cash treasury markets are increasingly teetering off a demand-supply imbalance given the ever-growing US deficit meeting ever-diminishing demand (foreign central banks not buying, US credit downgrade). Therefore, anything that triggers fears in cash bonds (poor auctions, inflationary fears, central bank hikes) results in a disorderly unwind by hedge funds selling the cash bonds to cover the margins on their futures short. Bonds get marked down, widening the basis, which triggers a series of indiscriminate liquidations – moves that could have contributed to the outsized bond selloff over the last few trading sessions.

Searching for other clues. Other narratives include perhaps the shift away from USD assets from China/Japan – some of the larger holders of cash treasuries – as a result from the trade tensions, as well as other treasury long positions being unwound similar to the UK budget crisis in 2022. As with all tumultuous markets, clues to the madness often lies in the outlier performers. Amid the carnage, gold markets were up, perhaps pricing in odds of Fed intervention to ease the dysfunction seen in the treasury markets with quantitative easing, as they had done most recently with the Covid crisis in 2020 and the US banking crisis in 2023. As such, we think that there is a limit to how much yields can spike before the authorities step in to ease financial conditions.

The only thing to fear is fear itself. From a fixed income standpoint, we view indiscriminate selling not as an opportunity to join the madness, but one to continue to build high quality income with A/BBB credit in the 2-3Y and 7-10Y buckets. We continue to see TIPS as a beneficiary of an environment of declining economic confidence but rising inflation expectations from tariffs. With much uncertainty still on the horizon, assets like fixed income that provide contractual coupons remain an investor’s good hope for stable returns for the rest of 2025.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")