Up to 50% travel savings with DBS/POSB Cards

Before your next trip, make sure you primary link your DBS Visa Debit card to one of your multi-currency accounts.

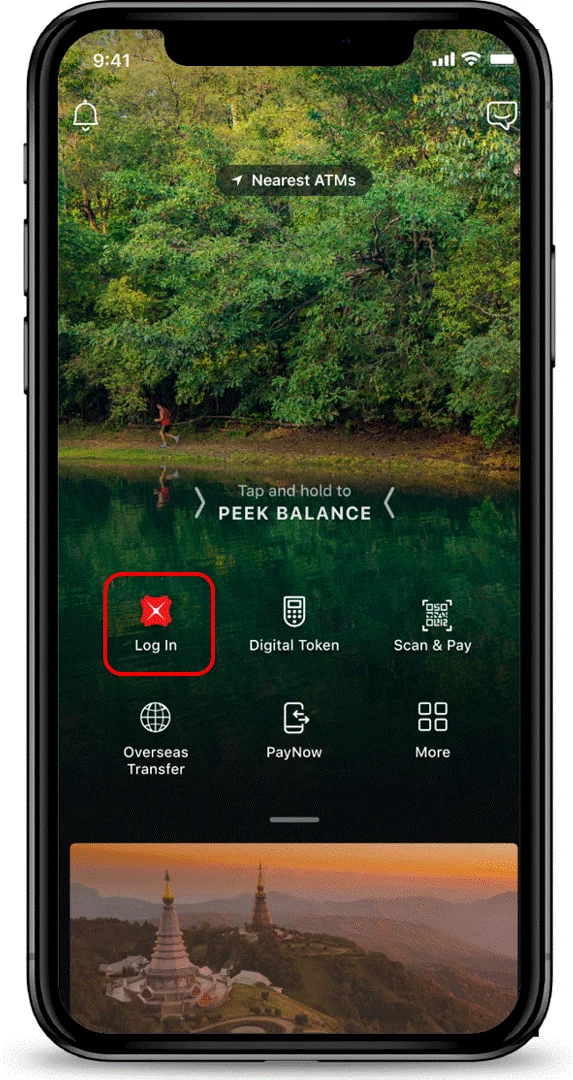

Step 1

Launch your digibank app

Step 2

Select ‘More’ tab

Step 3

Select ‘Link card to account’

Step 4

Choose the DBS Visa Debit Card

Step 5

Select primary account to use

Step 6

Choose the Multiplier Account or My Account

Here's how to exchange currency without any fuss:

Step 1

Launch your digibank app.

Step 2

Select 'Pay & Transfer' tab.

Step 3

Tap on 'Exchange Currency'.

Step 4

Select the multicurrency account you wish to exchange from. Next, scroll and select the Transfer Currency and enter the Amount to be transferred.

Step 5

Review the exchange transaction and tap on 'Exchange Now'.

Step 6

Your foreign currency exchange is completed.

You may enable/disable the magnetic stripe on your card(s) via digibank or any DBS/POSB ATM in Singapore:

The risk of unauthorised transactions occurring on the Card is higher when the magnetic stripe is enabled for overseas use, as the magnetic stripe information can be easily copied.

With Payment Controls, you can take manage your travel budget by managing your monthly card spending limit easily.

Step 1

Launch your digibank app

Step 2

Select More tab

Step 3

Under 'Manage Cards and Loans', select 'Payment Controls'

Step 4

Select your card and tap on 'Set a Monthly Spend Limit'

(Note: Spending limit is within each billing cycle)

Step 5

Toggle 'Switch On' to set limit

Step 6

Enter 'Preferred Monthly Spend Limit' and tap 'Confirm'

Step 7

You have set your monthly limit for this card

You can also set daily spending limits on your DBS Visa Debit Card effortlessly.

Step 1

Launch your digibank app

Step 2

Select 'More' tab

Step 3

Under 'Transfer Settings', select 'ATM/Debit Card Limits'

Step 4

Review details, and tap 'Change Daily Limit Now' to complete

Step 5

Select "Debit Card Limit'

Step 6

Select 'Card', and indicate the limit you wish to update, tap 'Next'

Step 7

Review details, and tap 'Change Daily Limit Now' to complete

You can change your Card’s primary account linkage to other Savings or Current Account. Find out more here.

If you prefer to only use your Visa, MasterCard or UnionPay Debit card(s) for PIN-based NETS and ATM transactions and would like to disable the contactless feature, you may do so on digibank. Find out more on how to customise your Card Functions here.

Disabling the contactless feature will not affect your NETS and ATM transactions.

Click here for other Card Enquiries.