Apply for Renovation Loan

All you need to know on your reno loan for your dream home!

What do I need before applying for a Reno loan?

List of required items

Prepare the following items to be submitted along with your application:

Servicing Account

You will require a DBS/POSB deposit account to service your loan. If you do not have one, learn more on how to Open an Account with us before submitting your Renovation Loan application.

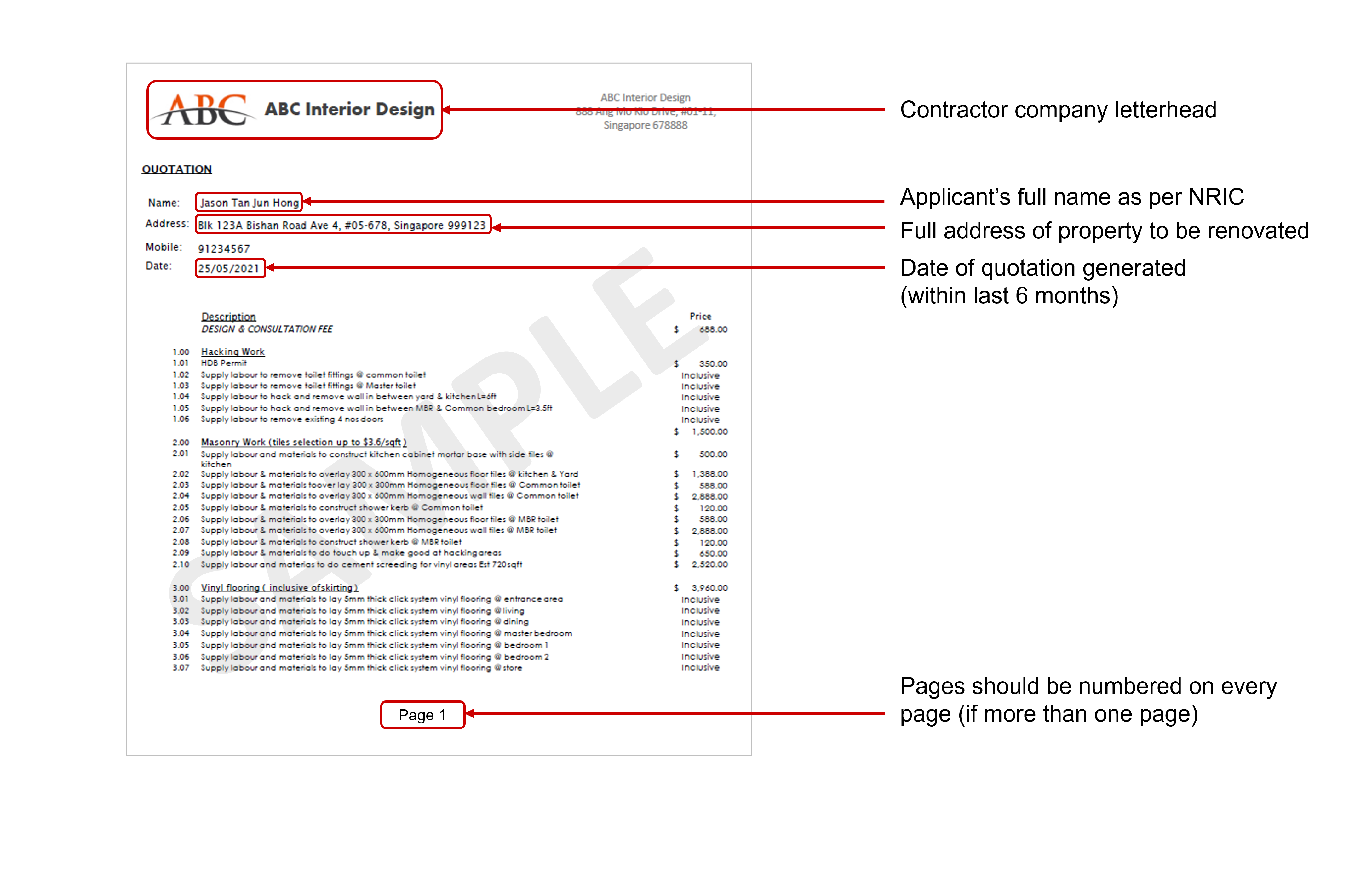

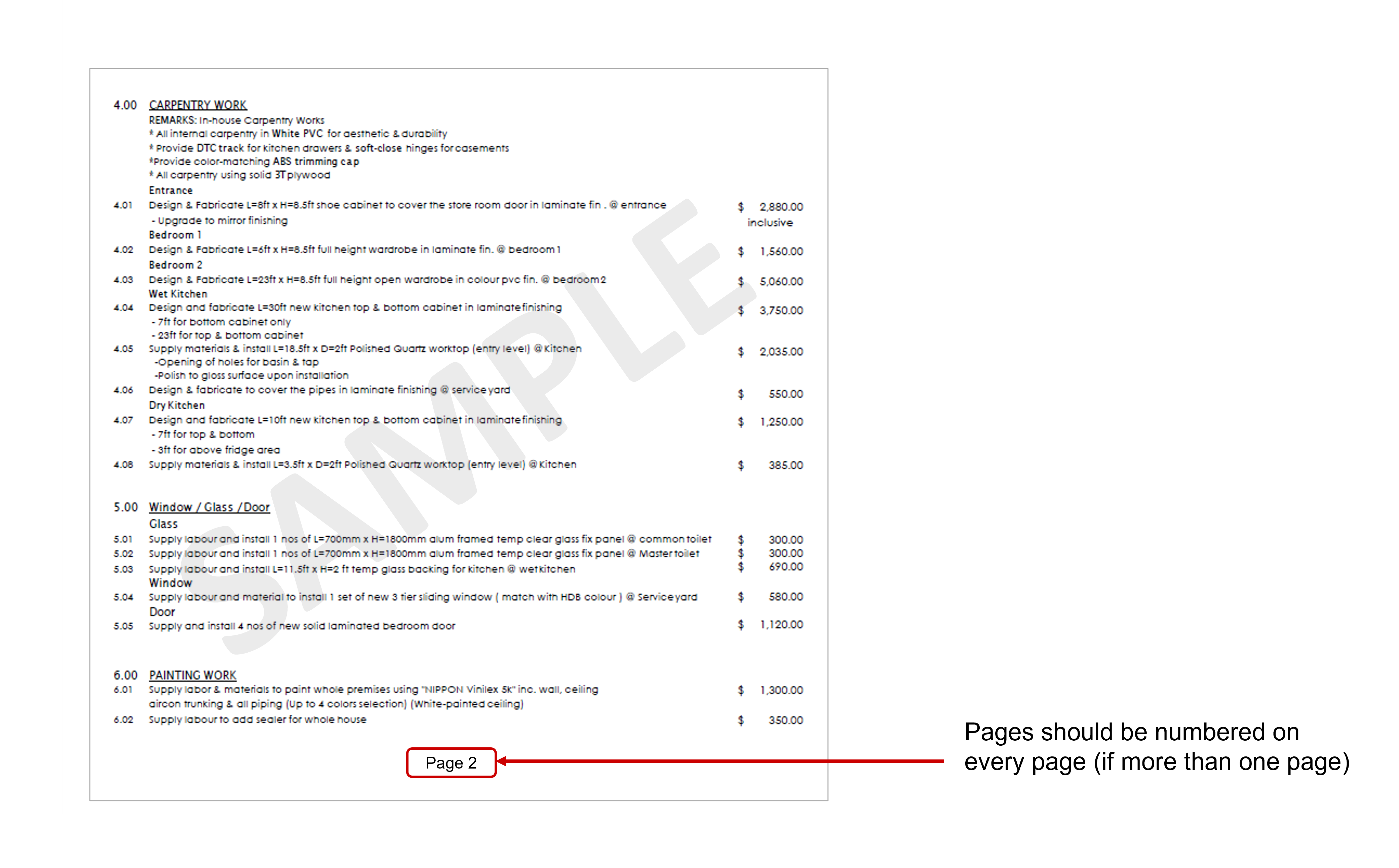

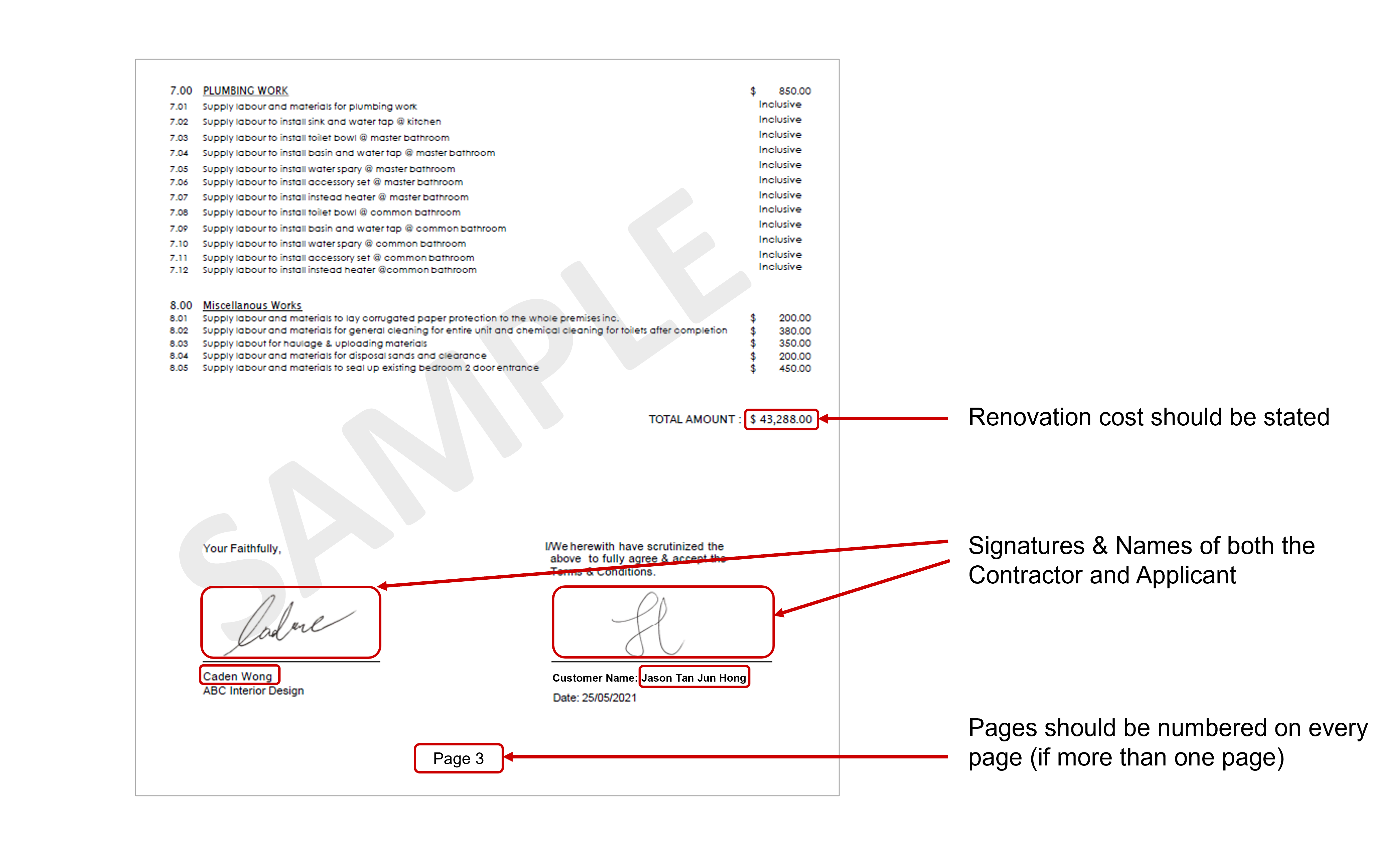

Renovation Quotation

Income Documents

For Employee with length of service more than 3 months

- Latest month’s computerised payslip; OR

- Latest 3 months’ salary crediting bank statements; OR

- Latest 3 months’ CPF Transaction History and

- Latest 1 year Income Tax Notice of Assessment

For Employee with length of service less than 3 months

- Letter of Appointment from Employer

For Variable/Commissioned-based Employees or Self-Employed

- Latest Income Tax Notice Assessment

Proof of Ownership

- Property Tax Bill; OR

- HDB Renovation Permit; OR

- CPF Housing Withdrawal Statement; OR

- HDB Letter of Approval; OR

- Sales and Purchase Agreement (completed status); OR

How to apply for Renovation Loan

For Single Applicants (Online Application)

Document Submission Guidelines

Document Specifications

File Name: No spaces or special characters

Image File Type: jpeg, pdf, or png file extension

Image Size Limit: Up to 5MB per document

For Joint Applicants / Non-owner Borrowers (Form)

- For Joint Applicants or Applicants applying for Renovation Loan on behalf of related party, please fill up the application form and submit your application at any POSB or DBS branch.

Frequently Asked Questions

How much can I borrow for a home renovation loan?

What are the requirements for joint application?

Main Applicant: Minimum income of S$24,000 per annum

Joint Applicant: Minimum Income of S$12,000 per annum (Main Applicant’s parent, spouse, child or sibling)

The lower monthly income (up to 12 times) of the two applicants will be used to compute the loan amount in a joint application. Please note that the maximum loan amount that will be considered is S$30,000.

For example:If your monthly income is S$4,000 and the joint applicant’s monthly income is S$1,500, you can borrow up to a maximum of S$18,000 (S$1500 x 12).

What can I use my renovation loan for?

- Installation of Solar Panels

- Electrical and wiring works

- Built-in cabinets

- Painting and redecorating works (e.g. wallpaper)

- Structural alterations

- External works within compound of the house

- Flooring and tiling

- Basic bathroom fittings

Is a renovation loan an unsecured loan?

However, a renovation invoice/quotation is required to be submitted along with your application to show that the loan is to be used for home renovation works.

How are the handling fee and insurance premium charged?

Approved loan amount: S$10,000

Fees payable:

Handling Fee (2% of S$10,000) = S$200

Insurance Premium (1% of S$10,000) = S$100

What can I expect after applying for a renovation loan?

The approved loan amount will be disbursed in cashier’s orders as indicated in the application.

If additional information or documentation is required, you will receive an email with the details.

We appreciate your patience if the processing time takes longer when there are additional follow-ups required.

What do I do with the cashier’s orders after receiving them?

Can I change my renovation loan amount?

To reduce your Renovation Loan amount, you may use the Service Request form to submit your request.

To increase your Renovation Loan amount, kindly submit a fresh application for the incremental loan amount (minimum S$5,000) using the application form and provide your latest renovation invoice and income documents.