Manage Your Car Loan

Are you unsure of how to manage your car loan? Let us help you out! Learn how to retrieve important details about your car loan, including your outstanding payment amount, and discover the best methods for making payments.

Note: Effective December 10 2024, the Standard Terms and Conditions governing for Hire Purchase Agreements will be updated. Refer to the latest terms and conditions.

How to check your car loan information

DBS digibot

How to check your full settlement amount

DBS digibot

How to repay your car loan

There are various channels which you may repay your car loan with us. The most convenient method would be via DBS digibot.

DBS digibot (DBS/POSB One-time payment)

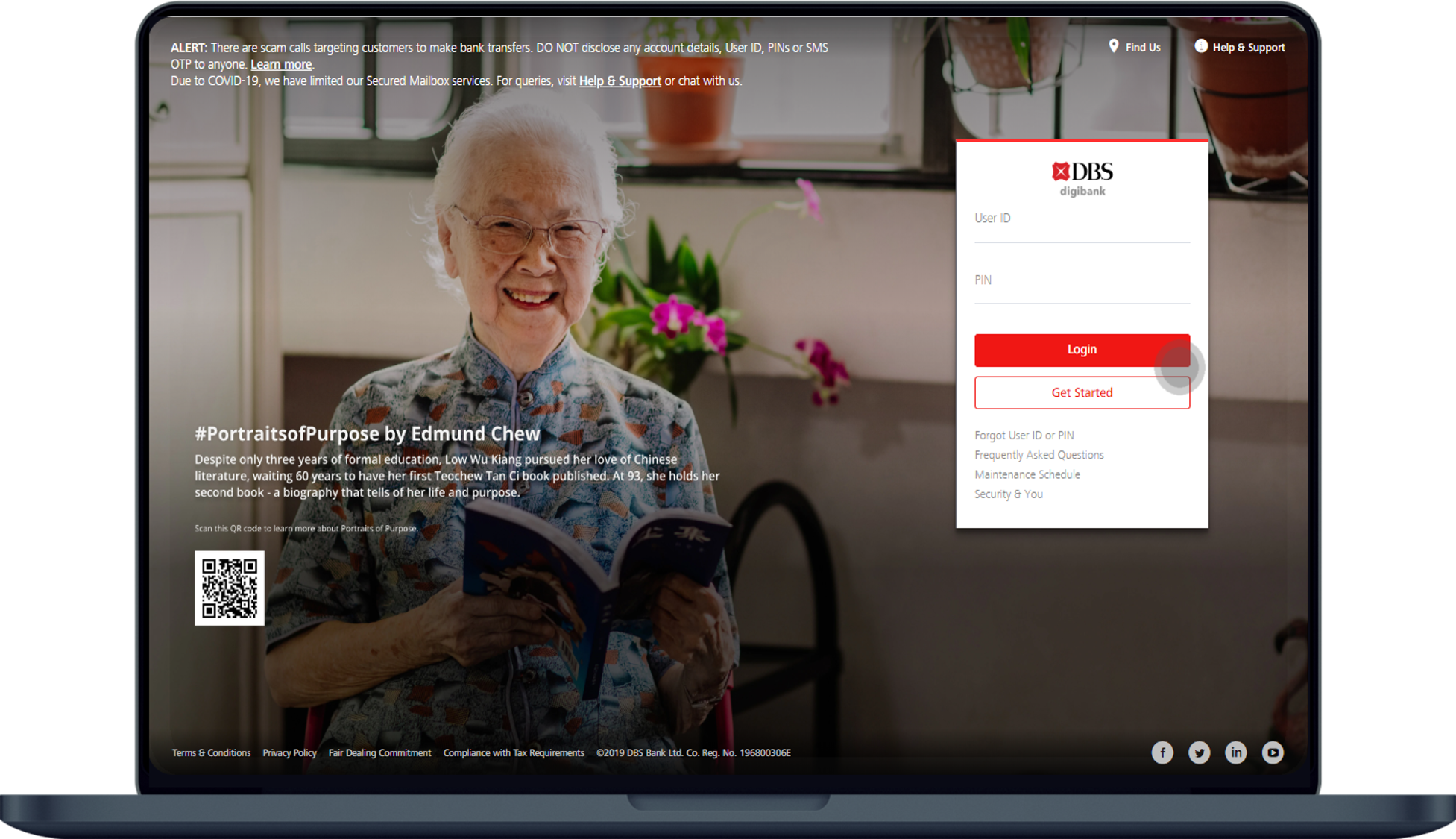

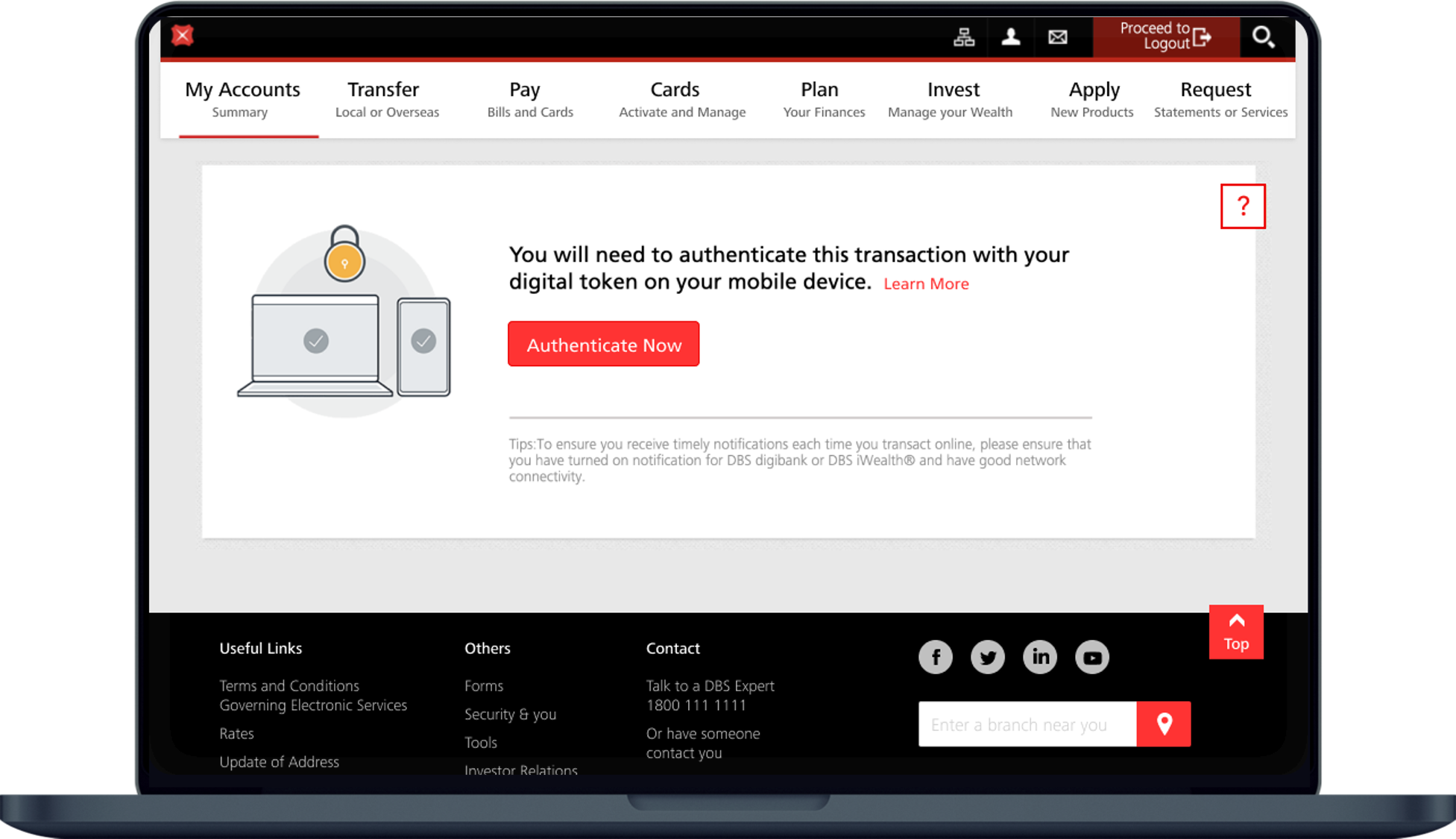

digibank online (Giro arrangement for DBS/POSB accounts)

Other banks’ online banking (FAST Transfer)

Make make payments via other banks’ online banking (FAST Transfer).

Indicate the following beneficiary’s Details:

Indicate the following beneficiary’s Details:

- Bank name: DBS Bank

- Account No: 0010011324

How to request for statement of account

DBS digibot

How to request for Hire Purchase Agreement

DBS digibot

Frequently Asked Questions

When can I expect an update on my car loan application?

You will receive an update on your car loan application within 3 working days, provided that all documents are in order.

When is my first instalment due and how much will I have to pay?

You can check for due dates and payment amounts by entering “My Car Loan information” via our digibot. You may also refer to the Hire Purchase Agreement.

How will I know when my GIRO arrangements have been set up?

You can check GIRO status by entering “My Car Loan Information” via our digibot.

Giro Setup Time:- DBS/POSB accounts: Setup is immediate.

- Other Banks accounts: Processing time is at least 3 weeks.

Please continue to use an alternative payment method (e.g., Digibank online) until you receive confirmation that your GIRO application has been approved.

- GIRO is not allowed for DBS Trust Minor/POSBkids Trust/POSBkids (personal)* / My Account*/ SAYE Accounts.

How will I be notified of my GIRO commencement date?

You can check for GIRO commencement date by entering “My Car Loan Information” via our digibot.

For other bank account setups, a GIRO approval letter will be mailed to you.

The monthly instalments will be debited from your account within 3 working days from your instalment due date.

Will I receive a monthly notification before my instalment due date?

We currently do not offer instalment due date reminders. As the instalment amounts are fixed and due on the same day each month, you can check these details by simply visiting our digibot and entering “My Car Loan Information”.

Can I pay off my car loan before the end of the loan term?

Yes, you can. However, there are fees and charges that may apply if you redeem your DBS Car Loan early:

- 1% of the original loan amount

- 20% of the remaining interest rebate.

When can I transfer the ownership of my car after I have made the full payment? (This is also commonly known as the release of FORM B)

FORM B will be released based on the mode of payment:

- 1 working day for cash payment/fund transfer.

- 2 working days for cheque/cashier’s order.

Why do I still see my Hire Purchase (HP) account in my digibank online/ digibank mobile after the loan has been paid off?

-

Your Hire Purchase (HP) account will be closed 2 weeks after full payment.

What can I expect after I have redeemed my loan?

The bank will release the vehicle ownership back to you. A final statement of account will be mailed to your registered mailing address within 10 business days.

Was this information useful?