Activate Foreign Markets Trading

Start trading in Foreign Markets online by activating the access via your DBS Vickers trading platform.

Part of: Guides > Your Guide to DBS Vickers Online Trading Account

How to start trading in the United States (U.S.) Markets

To access U.S. markets, you must first complete and submit Form W-8BEN. This form is required for tax reporting purposes. You can submit your form electronically or by mail.

Electronic Submission

- Email the completed Form W-8BEN to [email protected] using your registered email address.

- Upon receipt of your email with softcopy Form W-8BEN, a DBS Vickers representative will contact you for a simple phone verification.

- Ensure your mobile phone number and email address registered on your account is current and accurate.

- To update your profile details, Log in to DBS Vickers Online, under My Profile, select Update Personal Details.

- After completion of the phone verification, your Form W-8BEN will undergo a completeness and signature verification check.

Postal Submission

- Mail the completed Form W-8BEN using the enclosed Business Reply Envelope (BRE).

- Upon receiving your Form W-8BEN, it will undergo a completeness and signature verification check.

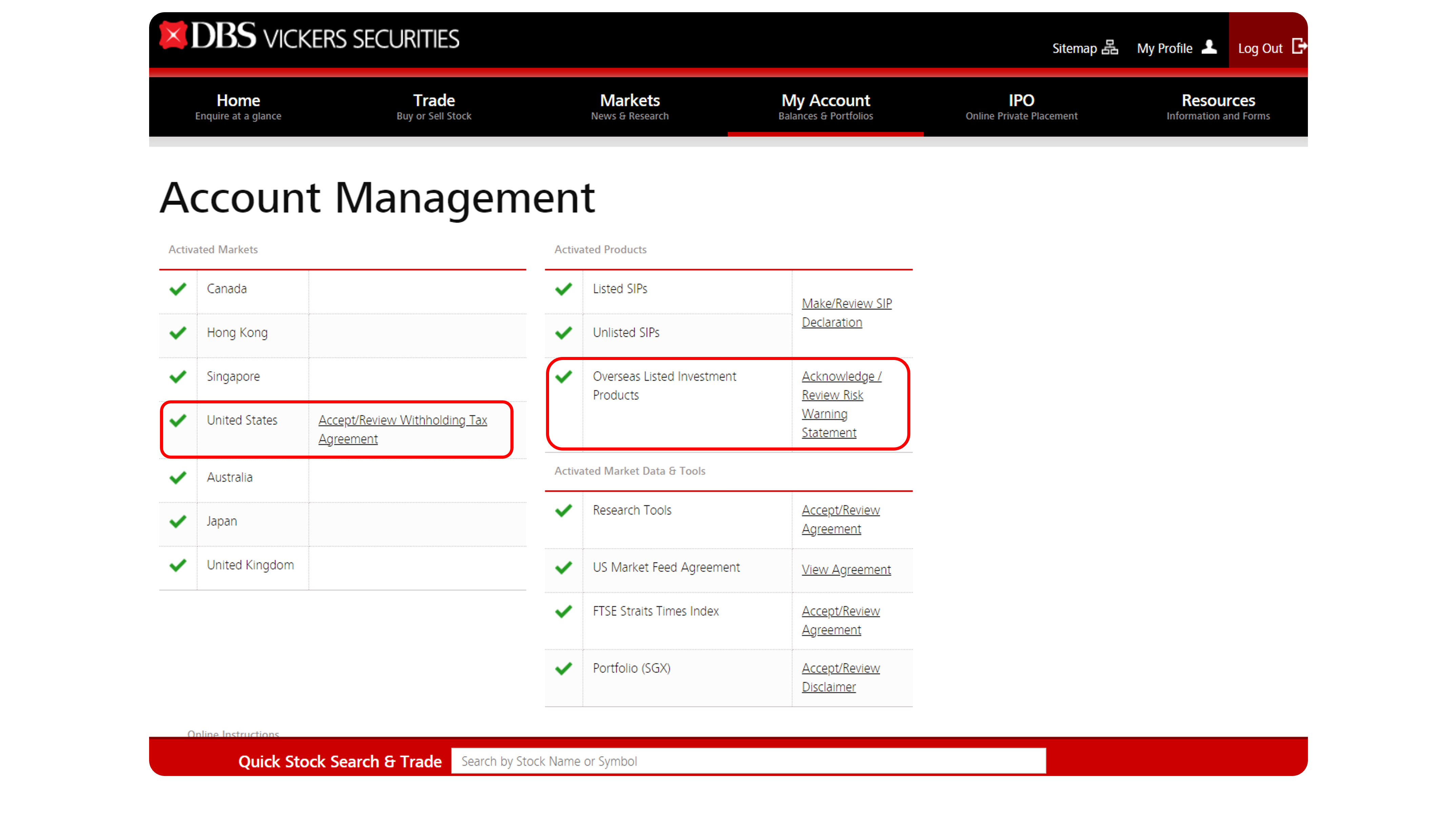

Once your W-8BEN form has been processed, please acknowledge the following agreements to start trading U.S. Markets.

- United States Market (Accept/Review Withholding Tax Agreement)

- Overseas Listed Investment Products (Acknowledge/Review Risk Warning Statement)

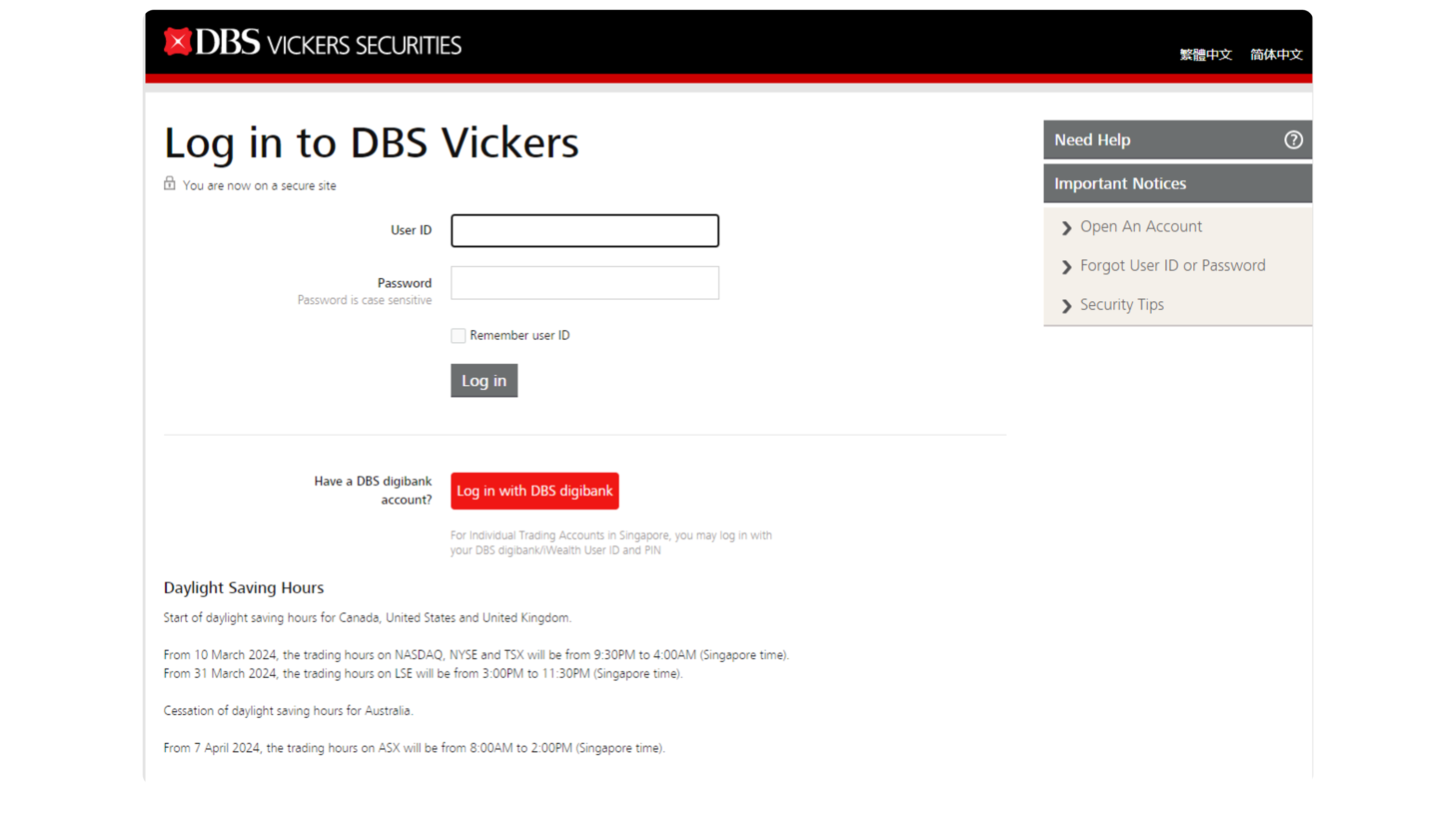

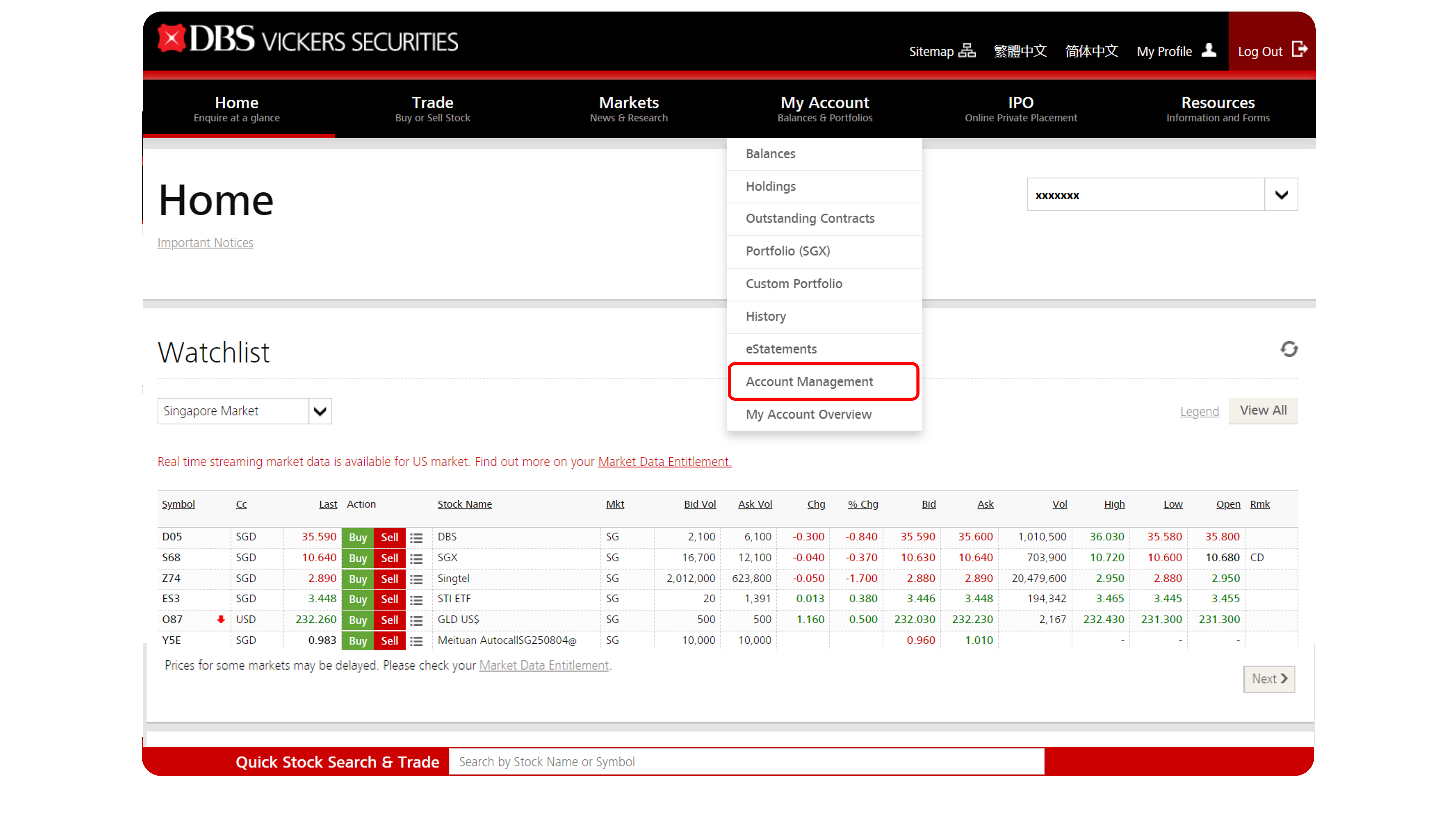

How to activate foreign markets trading

DBS Vickers Online

More information

- Form W-8BEN is a requirement of the U.S. Internal Revenue Service (IRS) to document that an account holder is the beneficial owner of the income and is not a U.S. person. This form has to be completed before placing any trade in the U.S. Markets.

- Re-submission of W-8BEN may be required if you are exempted as a US person and there are changes to your US Indicia (eg US address, contact numbers etc).

- Submission of W-9 is required if you are not exempted as a US Person and there are any changes to your US Indicia. (eg US address, contact numbers etc). W-9 is required if you wish to liquidate your US shares.

- Form W-8BEN E for Corporate accounts is valid for 3 years, starting from the date which the form is signed and submitted till the last day of the third subsequent calendar year.

- Instructions for Form W-8BEN by the U.S. Internal Revenue Service (IRS).

Was this information useful?