Common Reporting Standards (CRS)

Common Reporting Standards is an international agreement to exchange financial account information in tax matters to identify account holders who are tax residents of other participating jurisdictions.

Why am I requested to submit a CRS self-certification?

Under the Common Reporting Standard (CRS), Singapore-based financial institutions are required to conduct due diligence to determine the tax residency of their account holders. To do this, we may contact our customers to request information about their tax residency status.

If you are a tax resident in a country with which Singapore has signed an agreement to exchange financial account information, we are required to disclose your account information to the Inland Revenue Authority of Singapore (IRAS).

It is mandatory for all customers to accurately declare their tax residency status.

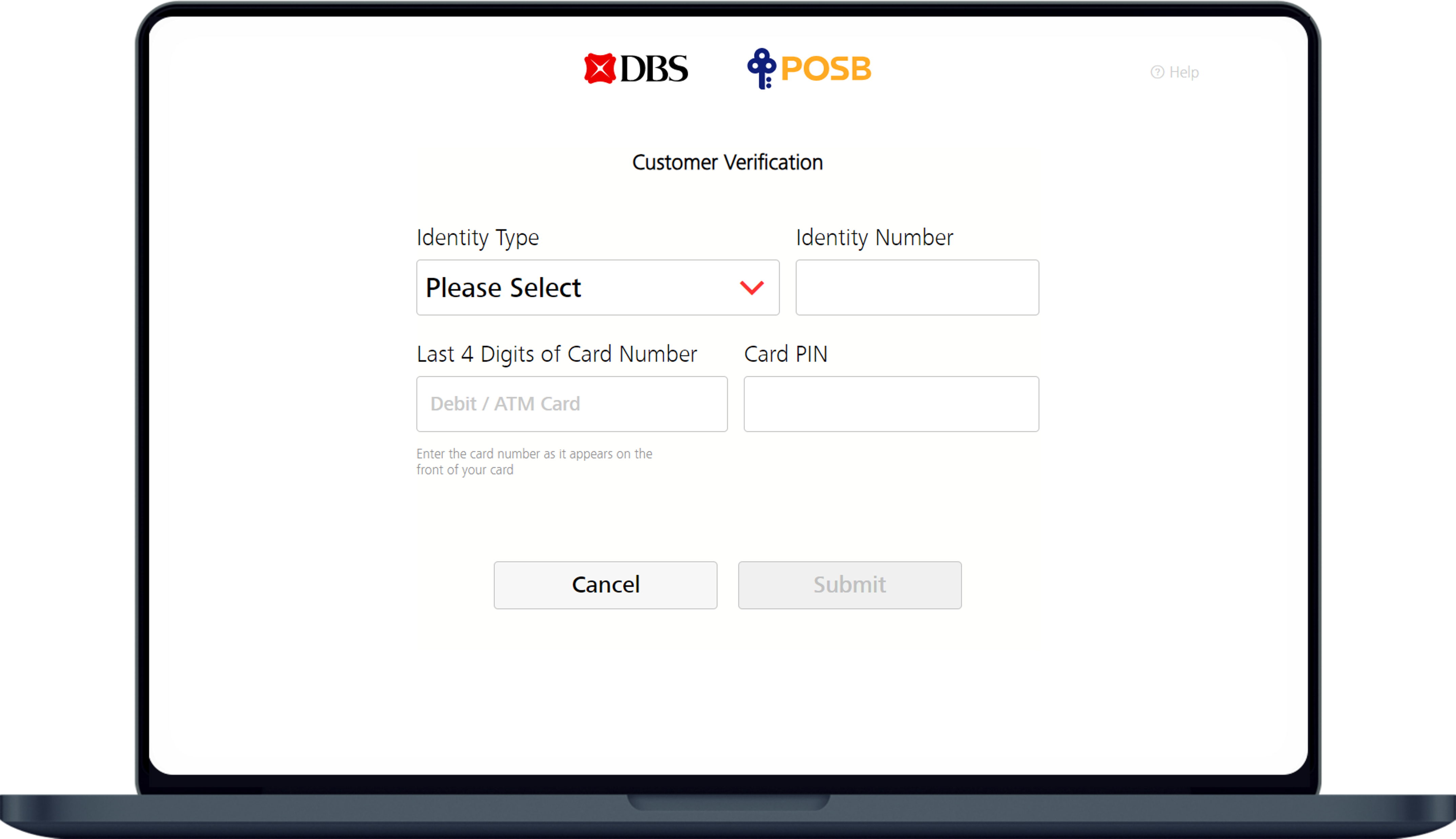

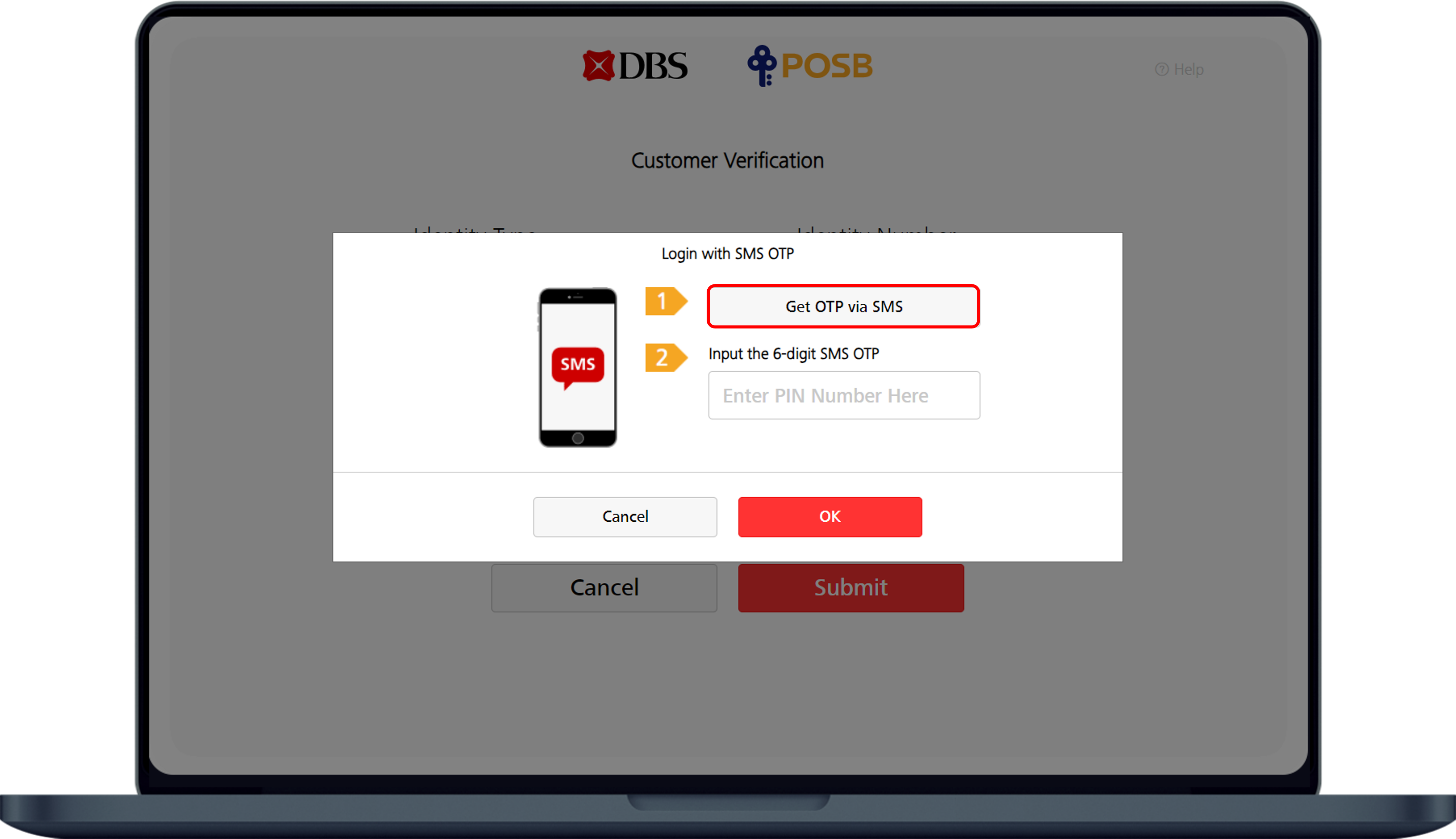

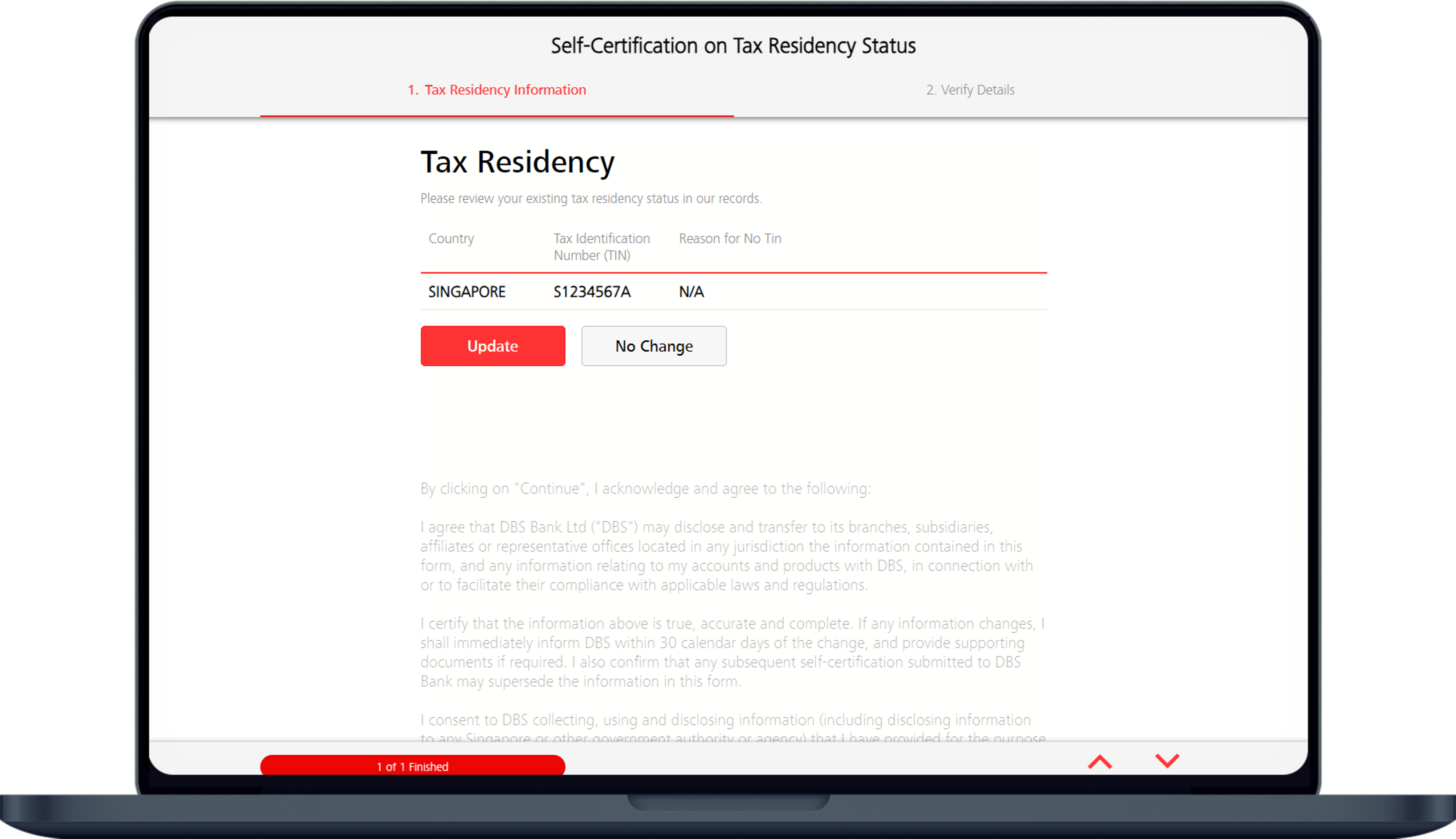

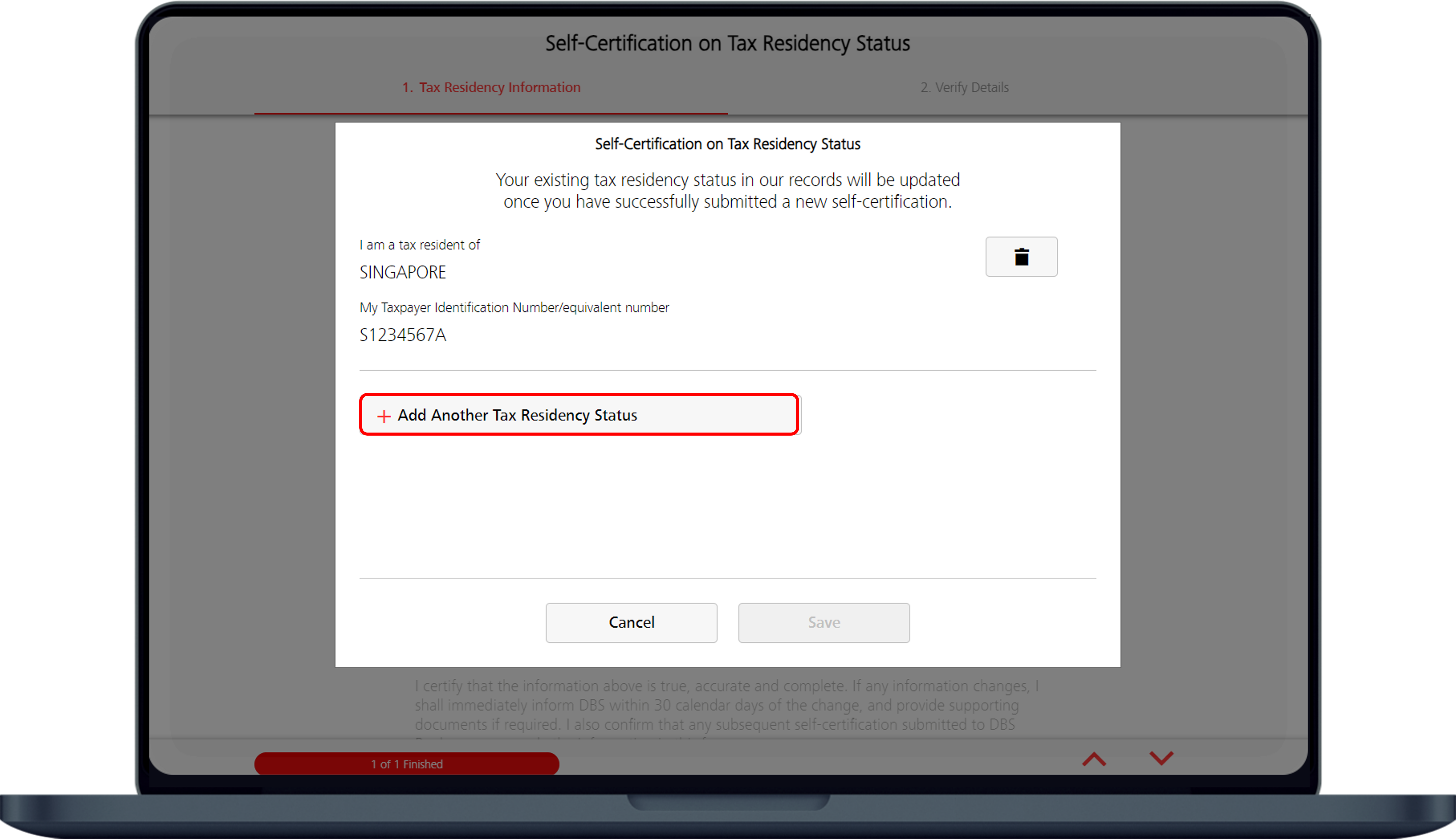

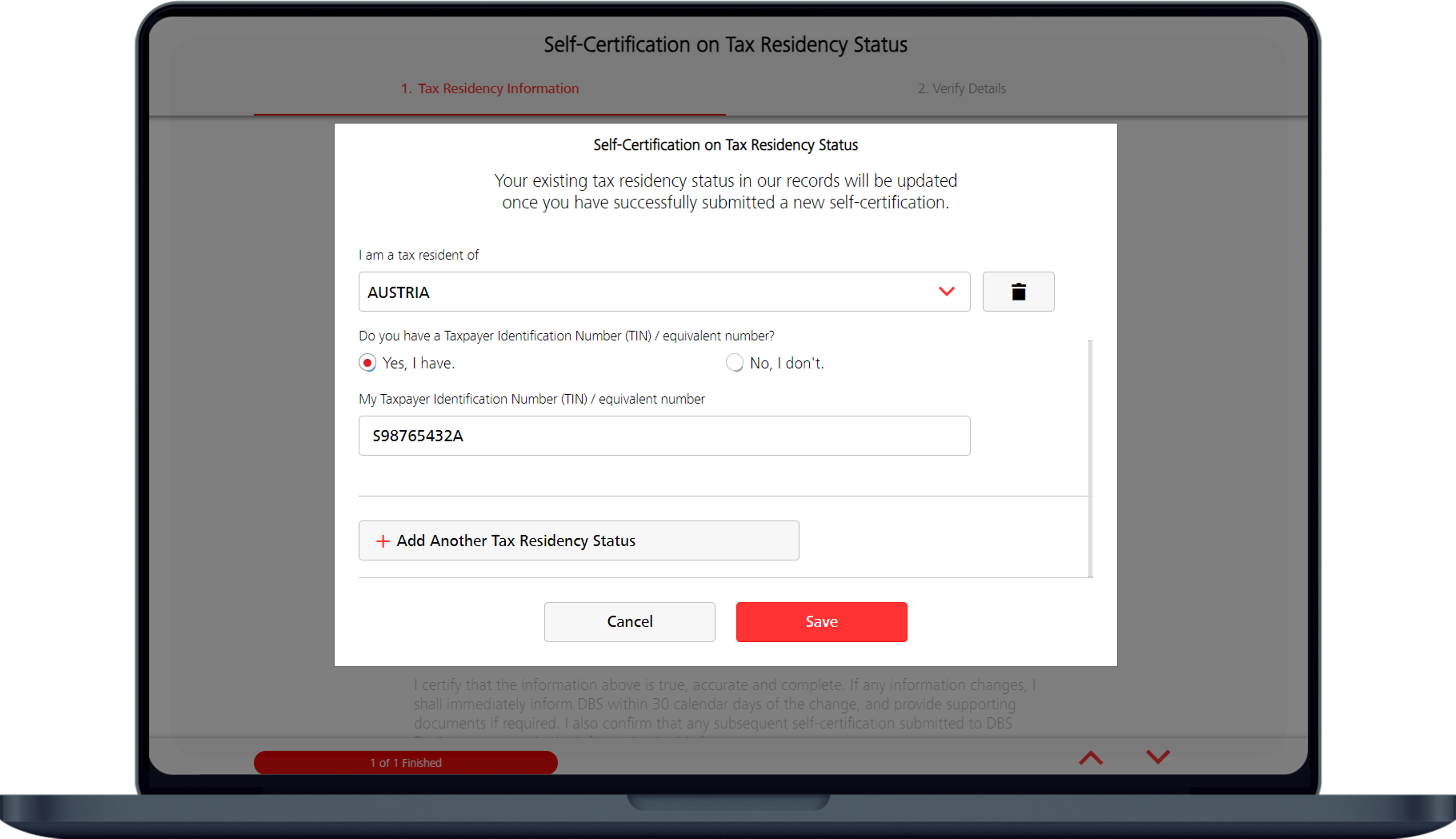

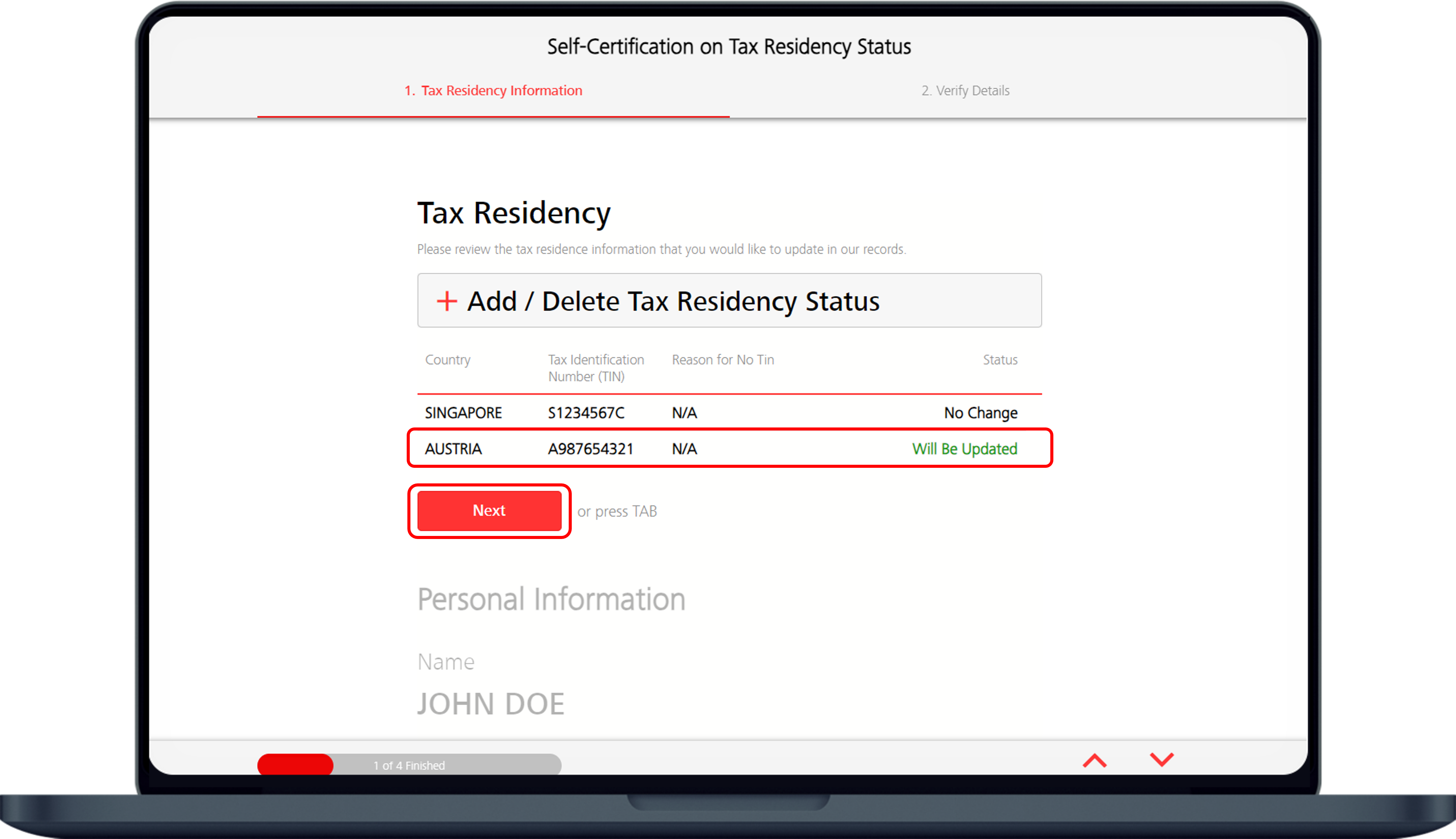

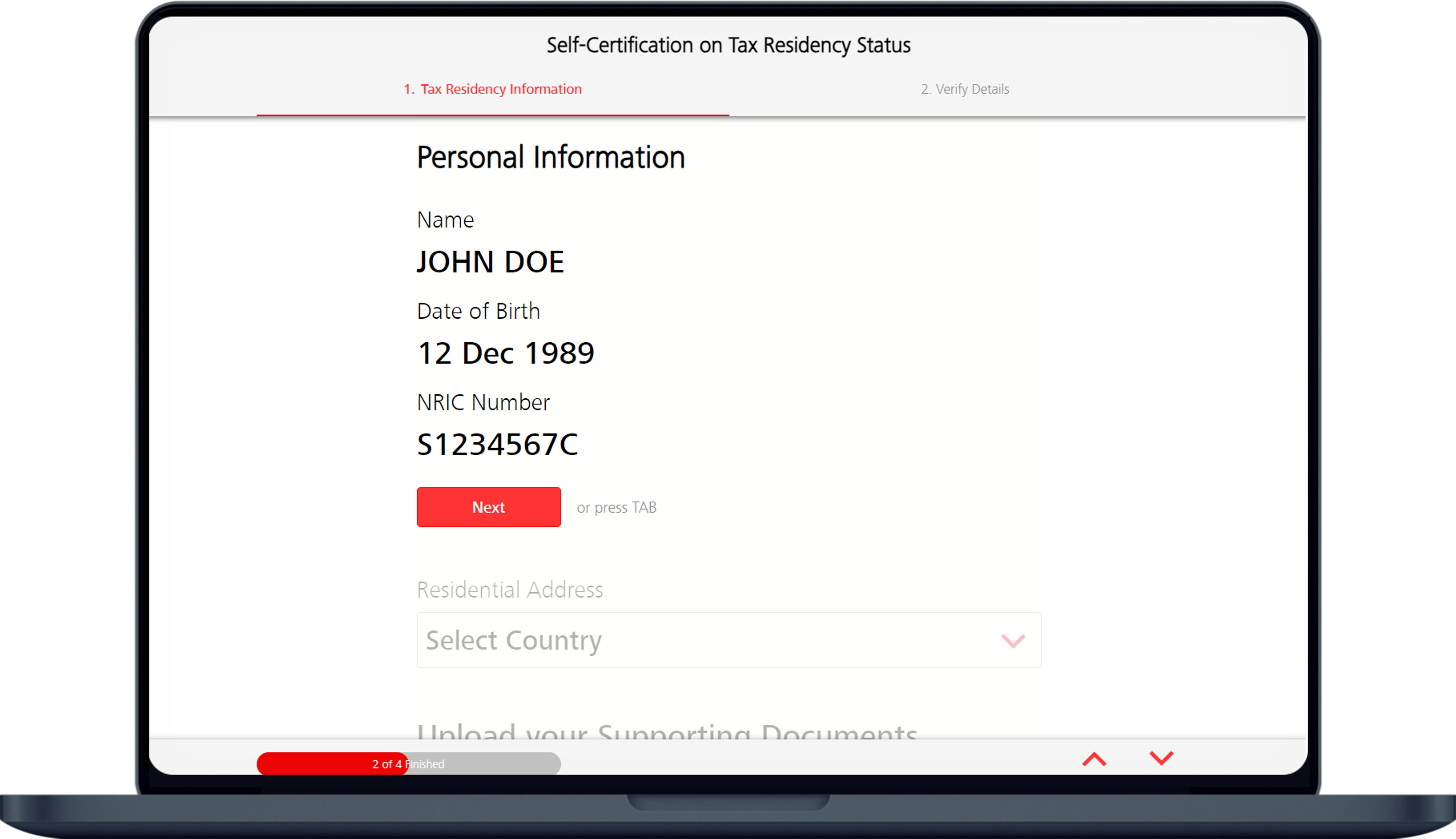

How to submit CRS self-certification online

Online Form

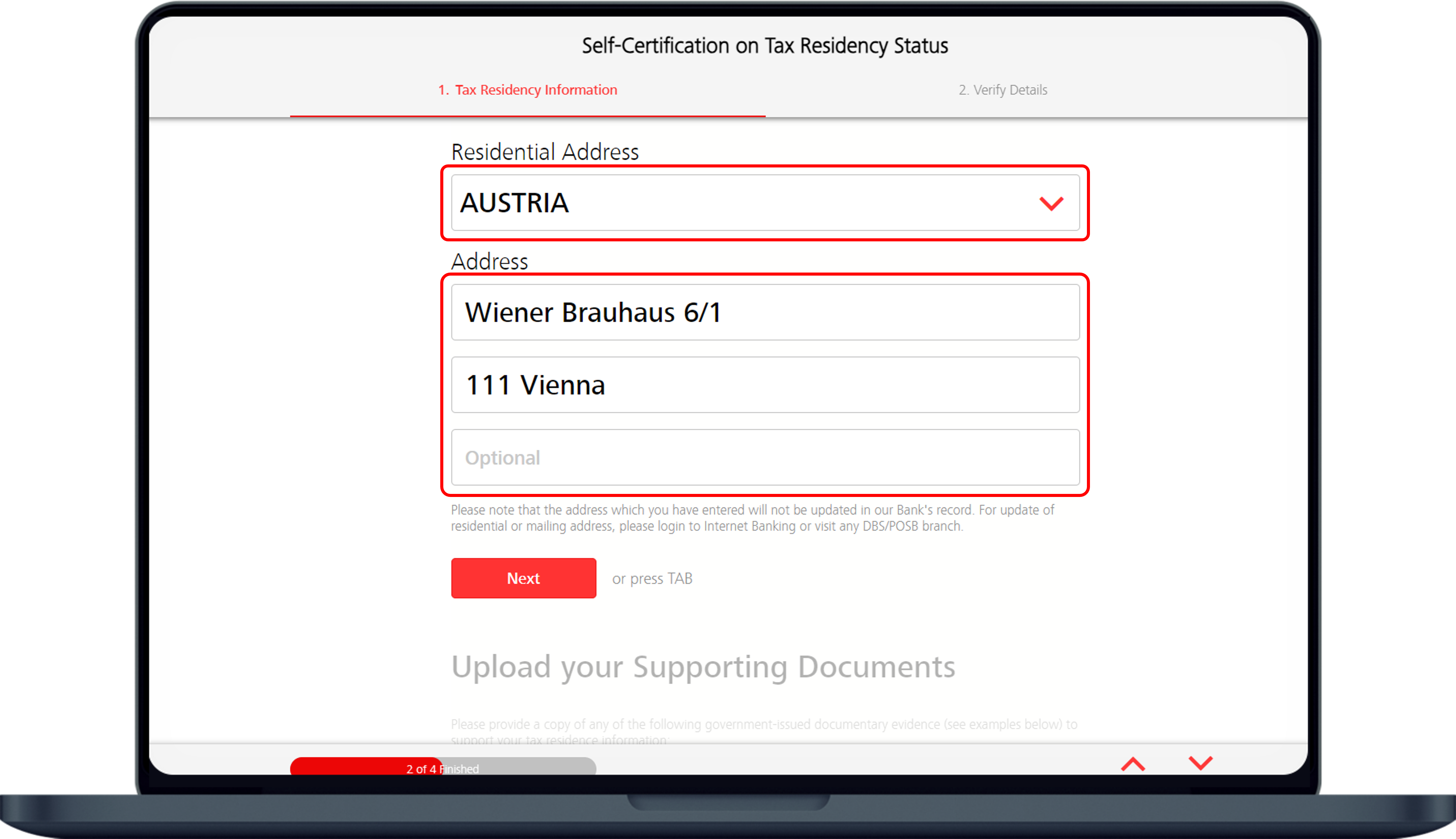

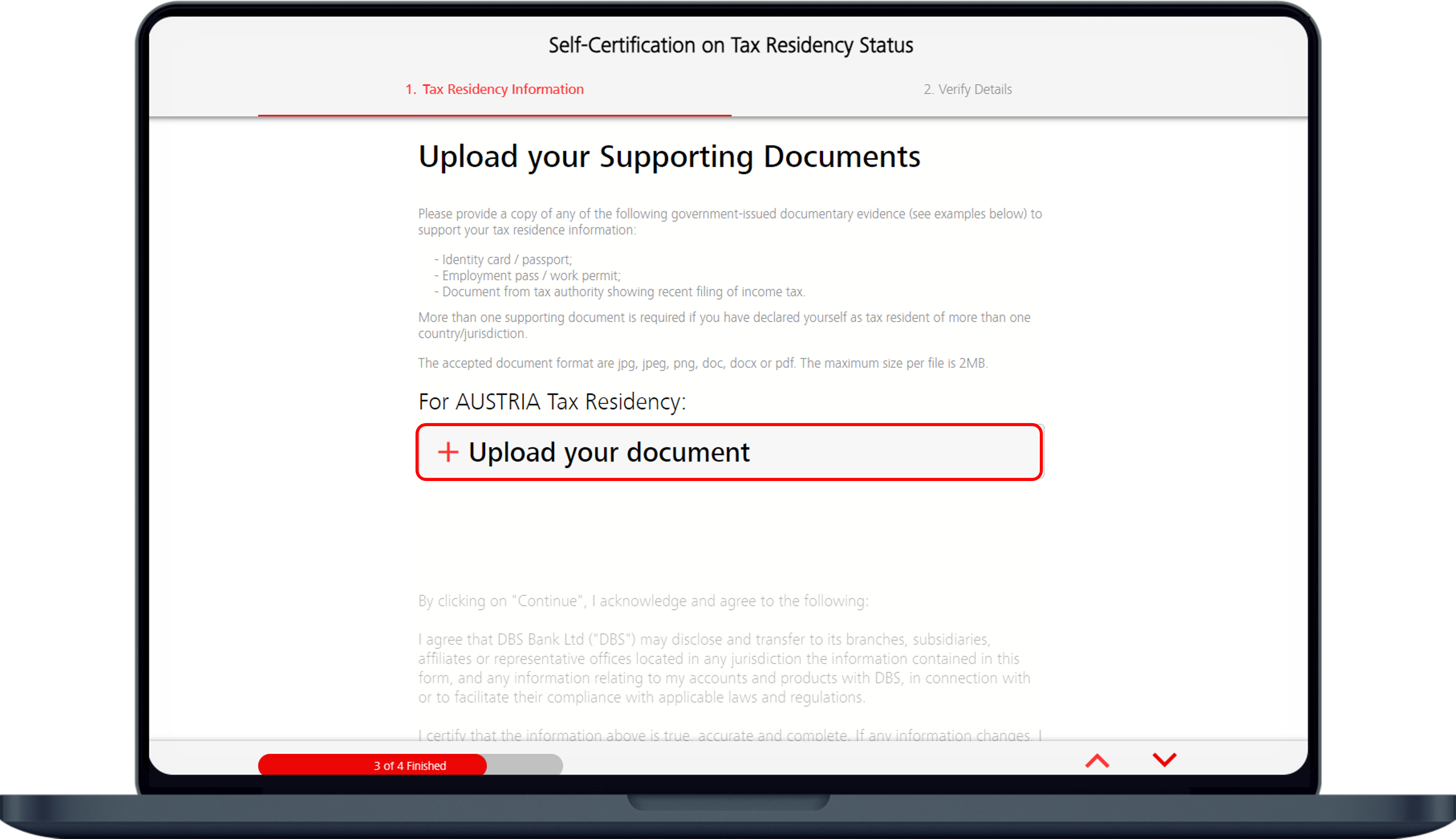

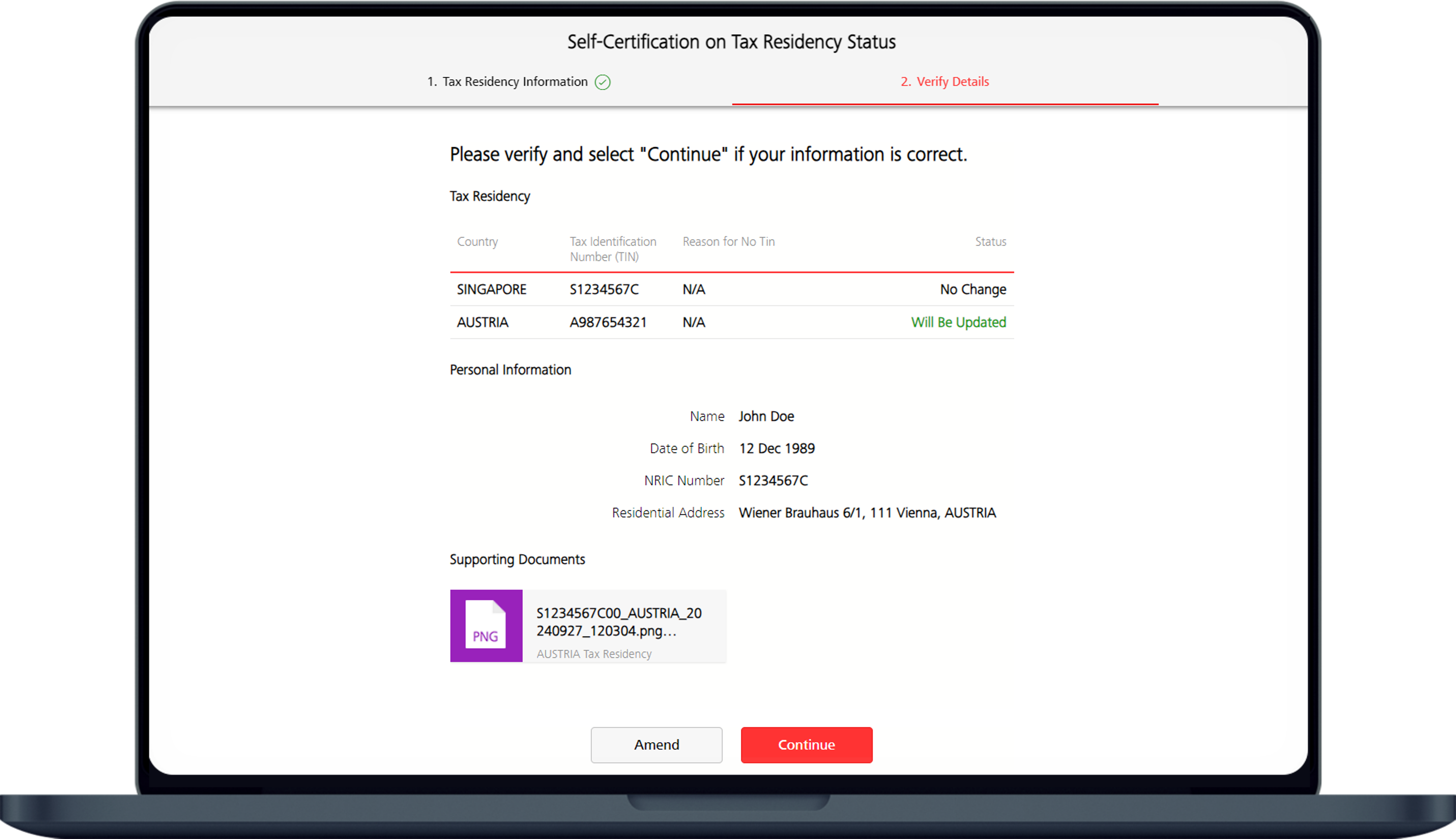

Prepare the following before proceeding to certify your tax residency information online:

- Ensure your mobile number is updated in our system. An OTP will be sent to your mobile number for confirmation. If your mobile number is not updated, learn more on how to Update Mobile Number.

- Taxpayer Identification Number (TIN) or equivalent number

Frequently Asked Questions

How would the Bank treat my case if I do not meet the Bank’s request to submit the CRS Self-Certification?

In addition, IRAS requires financial Institutions to report the account information of certain non-responsive account holders. If you do not respond to your financial institution’s request for information, IRAS may require your financial institution to treat your account as a reportable account.

How do I update my tax residency status if I am below 18 years of age or do not have a valid DBS/POSB ATM or Debit Card?

-

Mail to:

2 Changi Business Park Crescent

#07-05, DBS Asia Hub Lobby B

Singapore 486029 (AH0011) OR - Visit any POSB/DBS Branch with the completed form and your NRIC/Passport for verification.

I received a rejection letter, what should I do now?

If we did not receive a further response from you, the bank will determine your tax residency based on the information held in our records. If we determined that you are a tax resident in a country with which Singapore has signed an agreement to exchange financial account information, we have to disclose your account information to the Inland Revenue Authority of Singapore (IRAS).

How do I determine my tax residency?

- Refer to the Rules Governing Tax Residence published by the different jurisdictions for information on the respective jurisdiction's tax residency rules;

- Check with the tax authority of the jurisdiction which you think you may be a tax resident. (e.g. If you have stayed in Country A for more than 6 months, you can seek a confirmation from the tax authority of Country A on whether you are regarded as its tax resident for the tax year); or

- Consult a tax advisor.

Each jurisdiction has its own rules on defining a tax residency. In general, you will find that tax residence is the country/jurisdiction in which you live. Special circumstances may cause you to be a resident elsewhere or in more that one country/jurisdiction at the same time (dual residency). For more information on this, please contact your tax advisor or the information at the OECD automatic exchange of information portal.

What if my contact information/residential address/passport/FIN is not updated in the bank records?

My passport has been renewed and the passport number has changed. However, I have yet to update the bank records. Which passport number should I indicate?

For more information on Common Reporting Standards (CRS), refer to the OECD, IRAS or the CRS Fact Sheet issued by the Association of Banks in Singapore (ABS).