Contribution to Supplementary Retirement Scheme (SRS) Account

For customers to be eligible for tax relief in 2025, contributions must be made before 7pm via digibank on Tuesday, 31st December 2024.

Part of: Guides > Your Guide to digibank

Important information

- Please ensure that your SRS contribution does not exceed your balance contribution limit available. Do note that in the case of the contribution amount exceeding the balance contribution limit available, the entire amount will be refunded to your funding account.

Maximum Annual Contribution Limit

| Singapore Citizens / PRs | S$15,300 |

| Foreigners | S$35,700 |

Annual Foreigner Declaration

Increase your SRS contribution limit

- For Foreigners, please declare your Foreigner status at the branch to update your SRS contribution cap for the year.

(Note: This declaration needs to be done yearly as the SRS contribution limit will reset on 1st Jan every year.) - Please ensure you bring along your relevant original copy of the identification documents for verification at any Branch or Financial Planning Branch.

- Identification Document:

- Valid Passport

- For Malaysian - Valid Malaysian IC

- Proof of Employment (if you are working in Singapore)

- Valid Employment pass / In Principal Approval (IPA) issued by Ministry of Manpower (To update your Foreign Identification Number)

- Identification Document:

- Locations of Financial Planning Branch:

- DBS Takashimaya

- DBS Raffles Place

- DBS NEX

- POSB Eastpoint

- POSB Woodlands West

- POSB Yishun Central

- POSB Rivervale Plaza

- POSB Yew Tee Point

- POSB Hillion Mall

- POSB Jurong East Central

How to make a contribution to SRS account

There are various channels through which you may make a SRS contribution with us.

Contribution via digibank mobile

Important: For customers to be eligible for tax relief in YA 2025, contributions must be before 7pm on Tuesday, 31st December 2024 via digibank mobile.

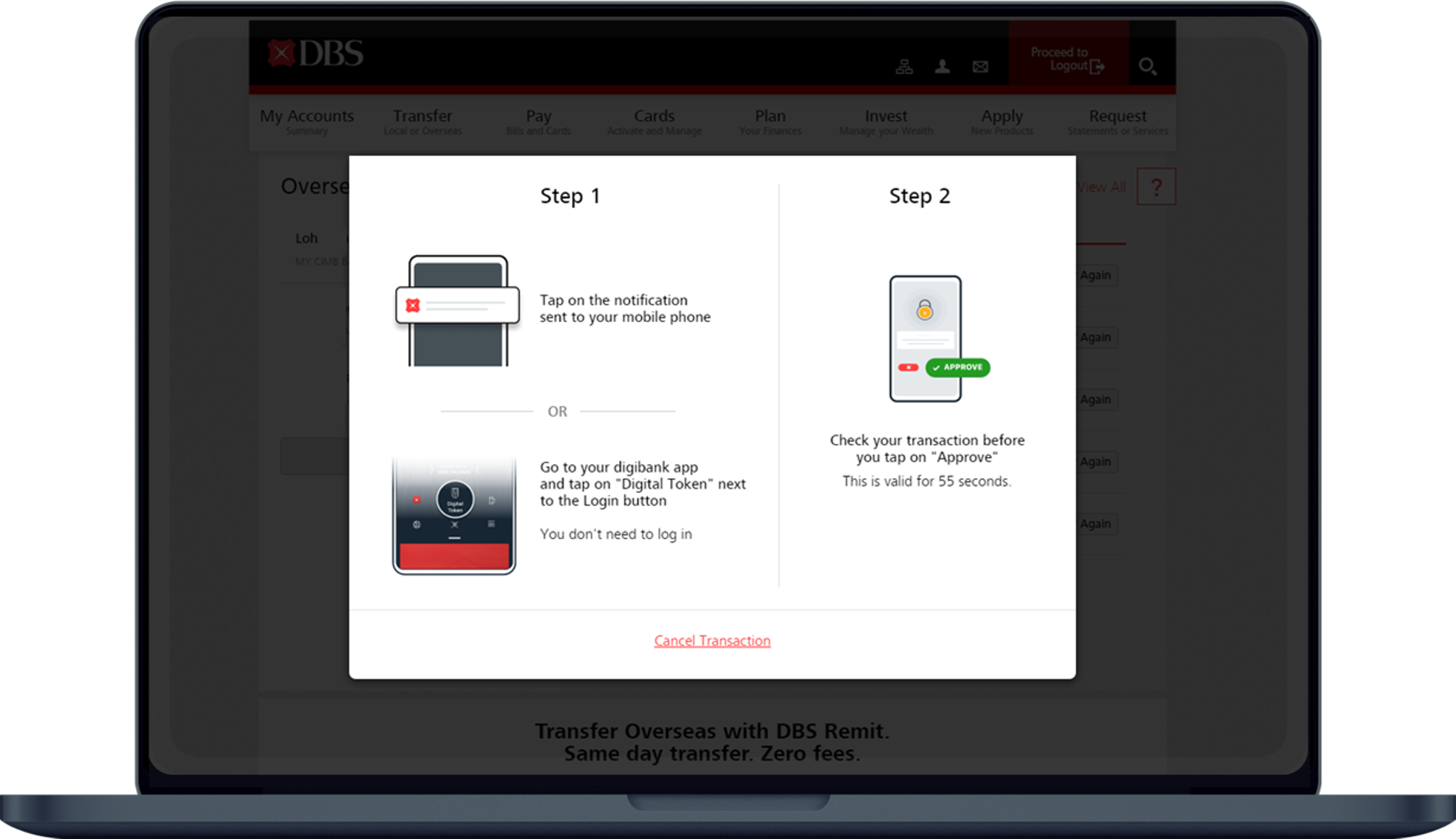

Contribution via digibank online

Important: For customers to be eligible for tax relief in YA 2025, contributions must be before 7pm on Tuesday, 31st December 2024 via digibank online.

Contribution via Branch

Important: For customers to be eligible for tax relief in YA 2025, contributions must be made before branch closure hours 3:30pm on Tuesday, 31st December 2024 via any DBS/POSB Branches.

- Visit any DBS/POSB Branches with your NRIC/Passport.

- Foreigners must declare their foreigner status at the branch to qualify for the foreigner annual contribution limit for SRS.

Contribution via Cheque

Important: For customers to be eligible for tax relief in YA 2025, contributions must be deposited before 11.30am on Tuesday, 31st December 2024 via cheque. For foreigners, please declare your foreigner status at the branch if you have not done so for the year 2024 before depositing the cheque.

- Issue a local cheque in your name.

- Write your SRS Account no. at the back of the cheque.

- Deposit your cheque at any DBS/POSB Branches or Cheque Deposit Box located islandwide.

More information

- Terms and Conditions Governing SRS

- Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Was this information useful?