Fixed Deposit Placement

Learn how you can make DBS Fixed Deposit Placements via digibank.

Important information

- DBS Fixed Deposit allows you to place both SGD and Foreign currency within the same account.

- The minimum placement amount and period are:

- For SGD Fixed Deposit, the minimum amount is S$1,000, with a choice of tenors from 1 month onwards.

- For Foreign Currency Fixed Deposit, the minimum amount is S$5,000 equivalent, with a choice of tenors from 1 day onwards.

- For Premier Income Accounts, the minimum amount is S$10,000, with a choice of tenors from 6 months onwards.

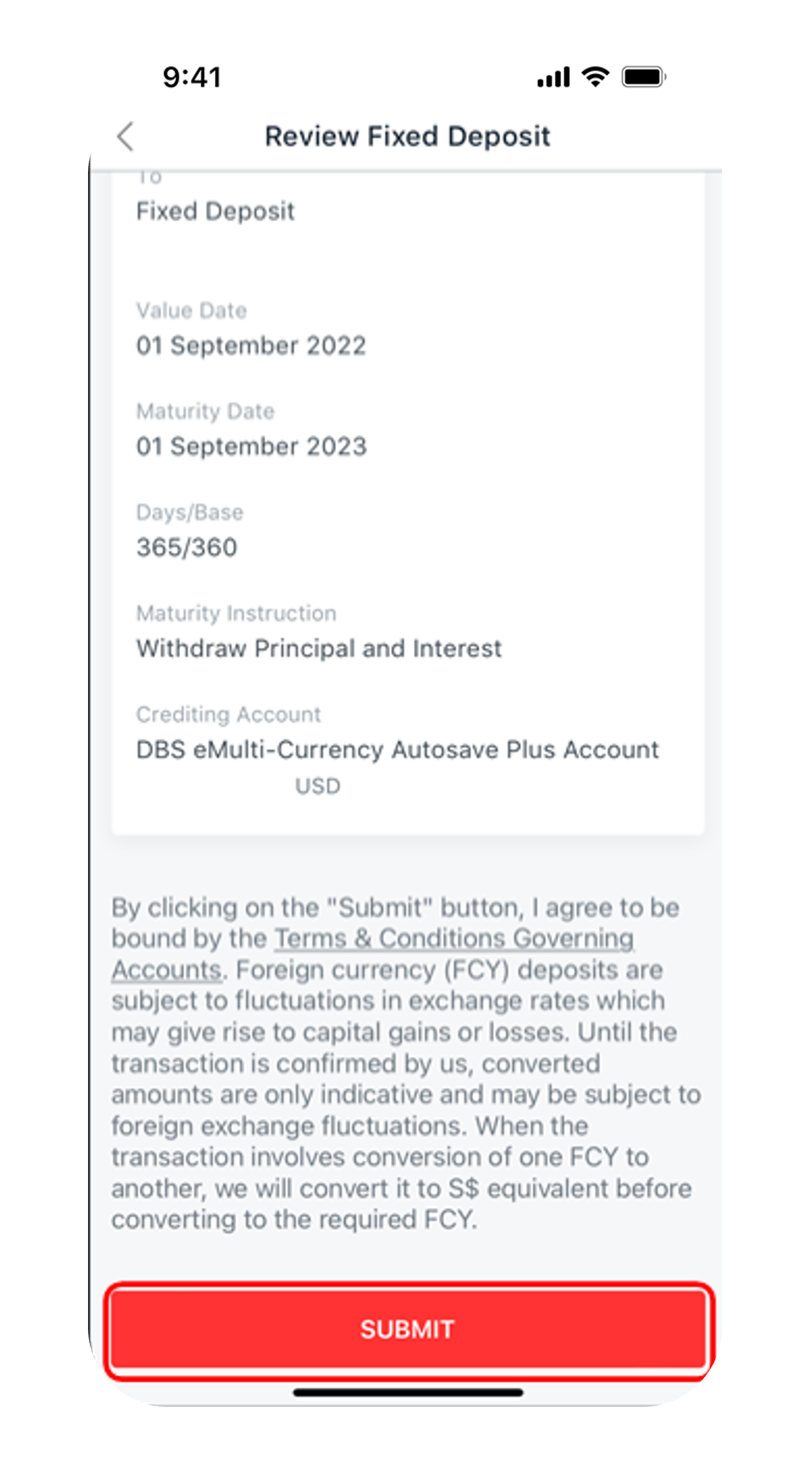

- Upon maturity, the Fixed Deposit placement (including interest) will be renewed automatically based on the same tenor at the prevailing interest rate, unless you provide us with other instructions at least 1 working day before the maturity via digibank. Learn more on how to change your Fixed Deposit maturity instructions.

- SGD Fixed Deposit interest rates for new placements and renewals will be computed based on the Total SGD Fixed Deposit Balances, instead of each placement and/or renewal.

Examples

-

My Fixed Deposit account has 2 placements which sum up to S$100,000 (S$30,000 + S$70,000). What is the applicable interest rate for each renewal?

The total Fixed Deposit account balance is S$100,000 (S$30,000 + S$70,000). Hence, interest rate corresponding to the $100,000 - $249,999 range will apply.

-

I have an existing placement of S$50,000 in my single name Fixed Deposit account and another S$50,000 in a joint Fixed Deposit account. What is the applicable interest rate for each renewal?

The placements are in different SGD Fixed Deposit accounts. Hence, interest rate corresponding to the $50,000 - $99,999 range will apply for each renewal.

-

My Fixed Deposit account has 2 placements which sum up to S$100,000 (S$30,000 + S$70,000). What is the applicable interest rate for each renewal?

- Foreign Currency Fixed Deposit interest rates for new placements and renewals will be based on prevailing interest rates.

How to make a Fixed Deposit Placement

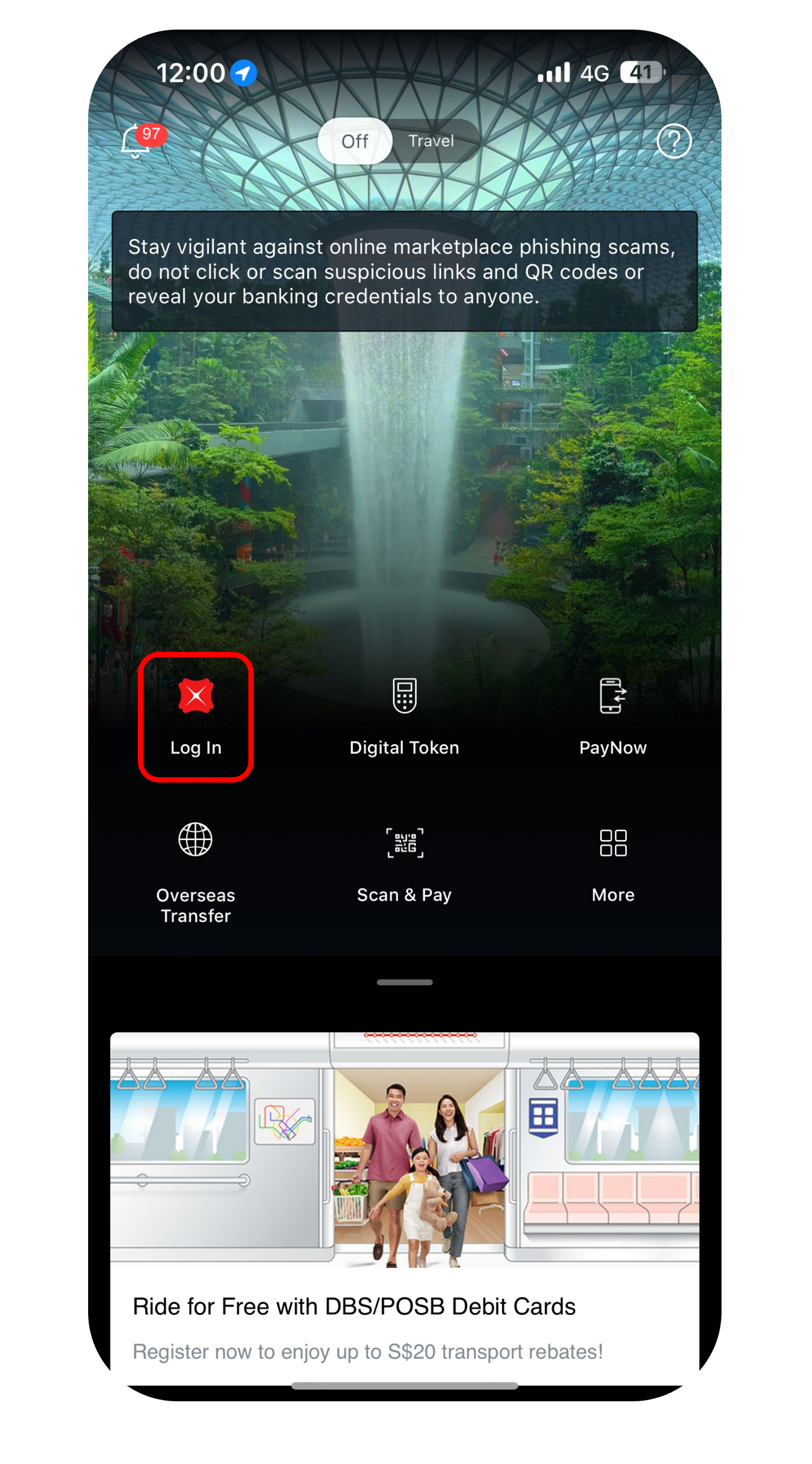

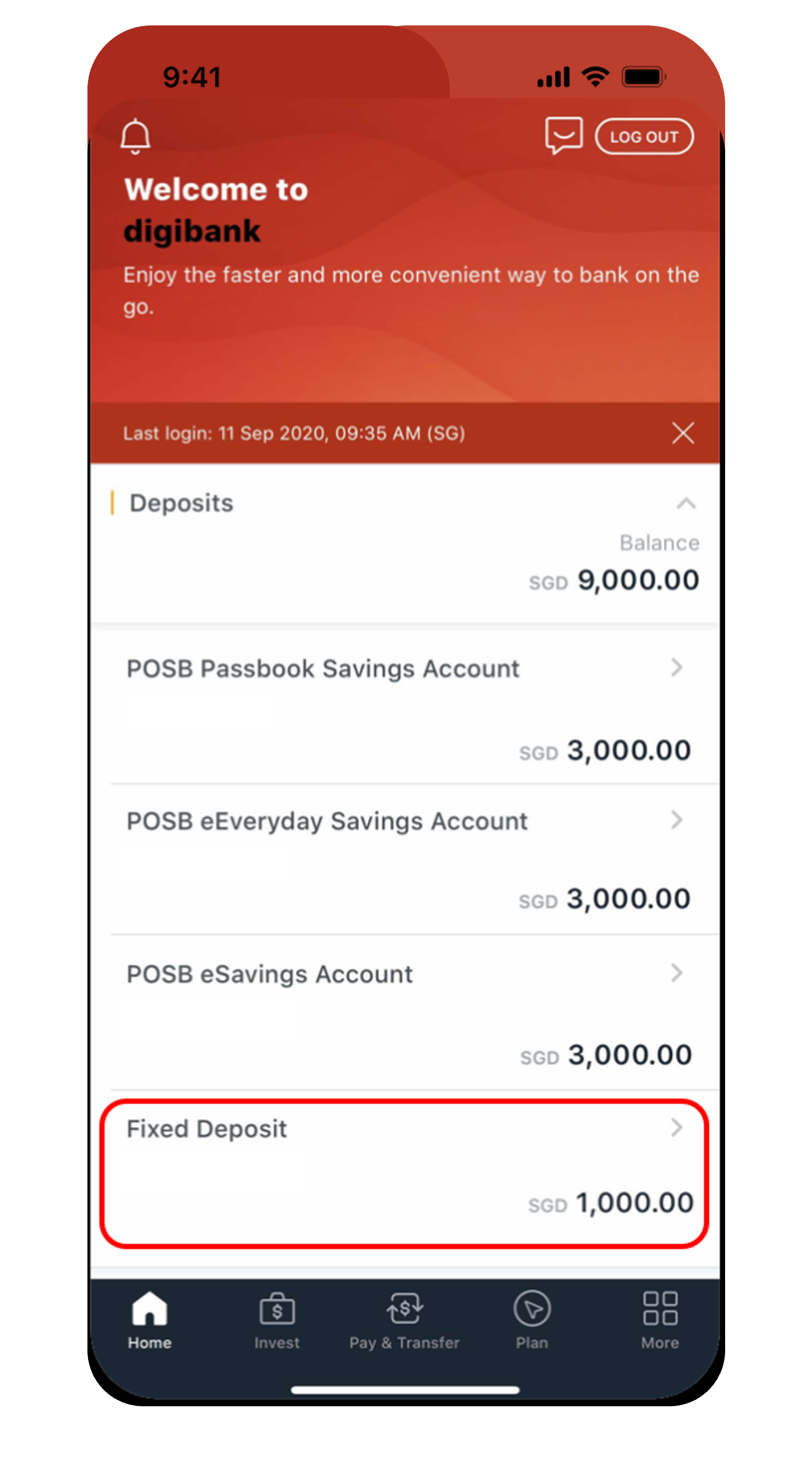

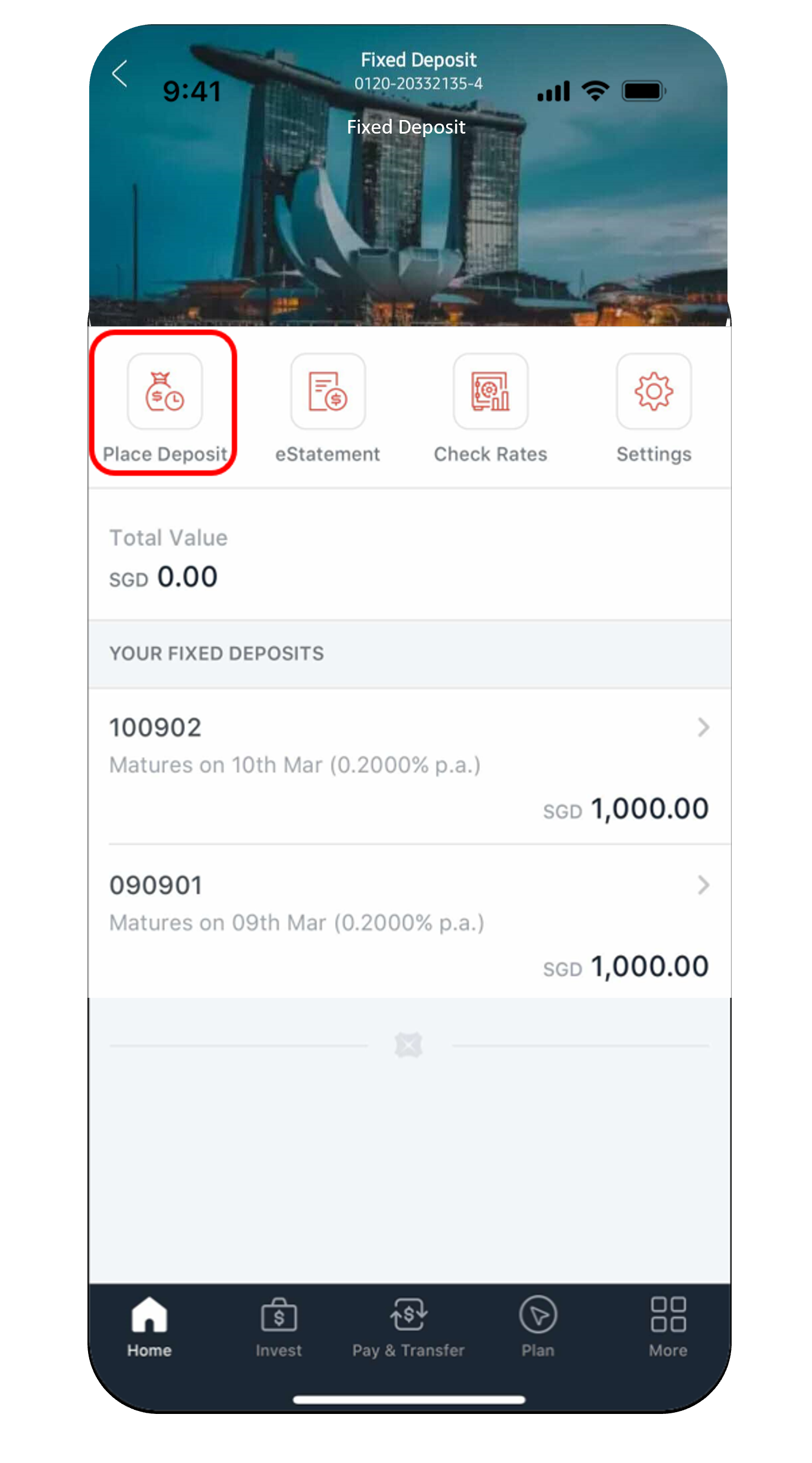

digibank mobile

More information

- SGD fixed deposit placements are available from 3:00 am to 11:30 pm daily, and on the last working day of the month from 3:00 am to 8:30 pm.

- Foreign currency transactions are available during working days from 9:00 am and 9:00 pm (SG local time). On the last working day of each month, foreign currency transactions are available from 9:00 am to 8:30 pm. Working days are from Monday to Friday, excluding Public Holidays.

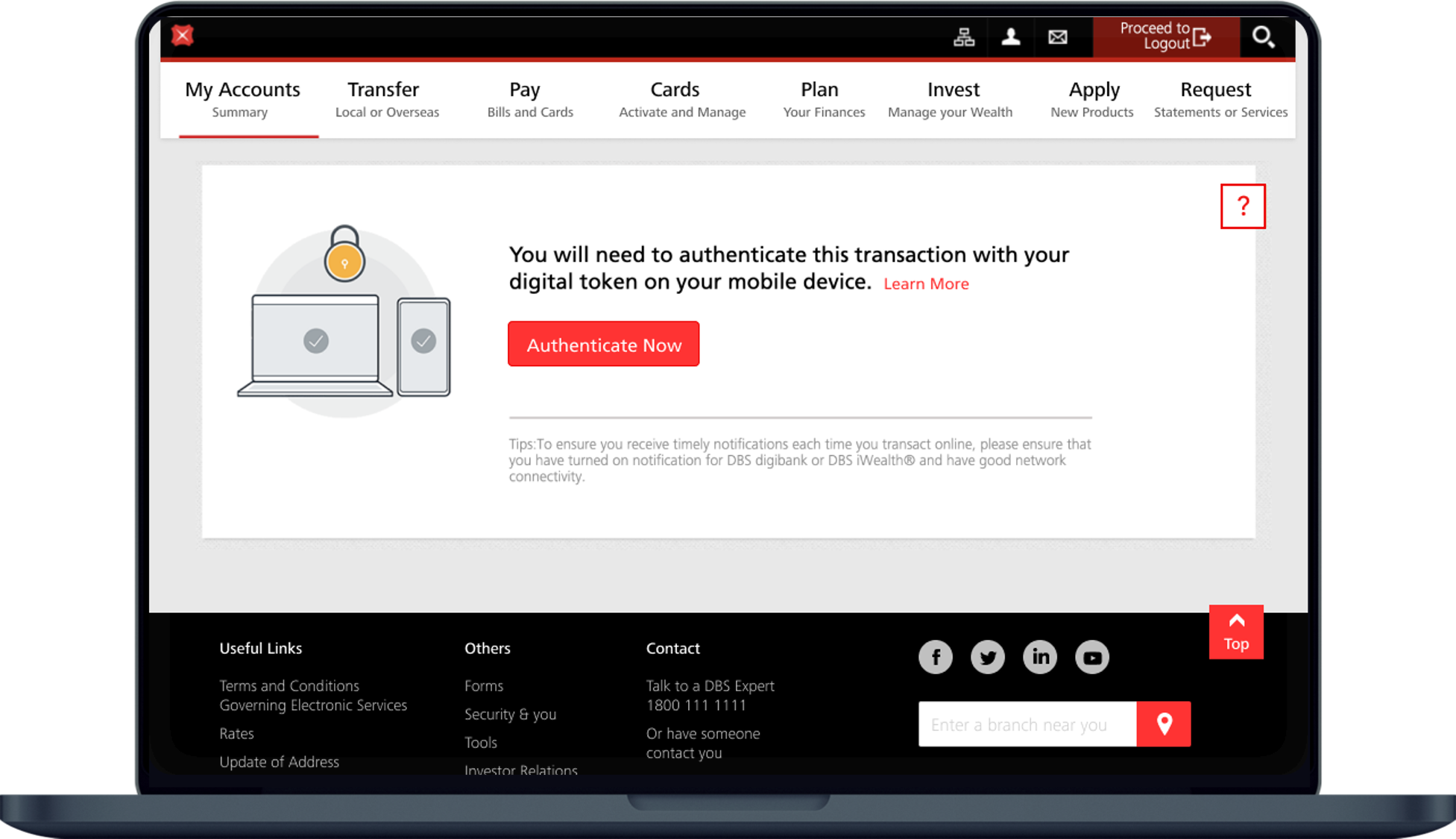

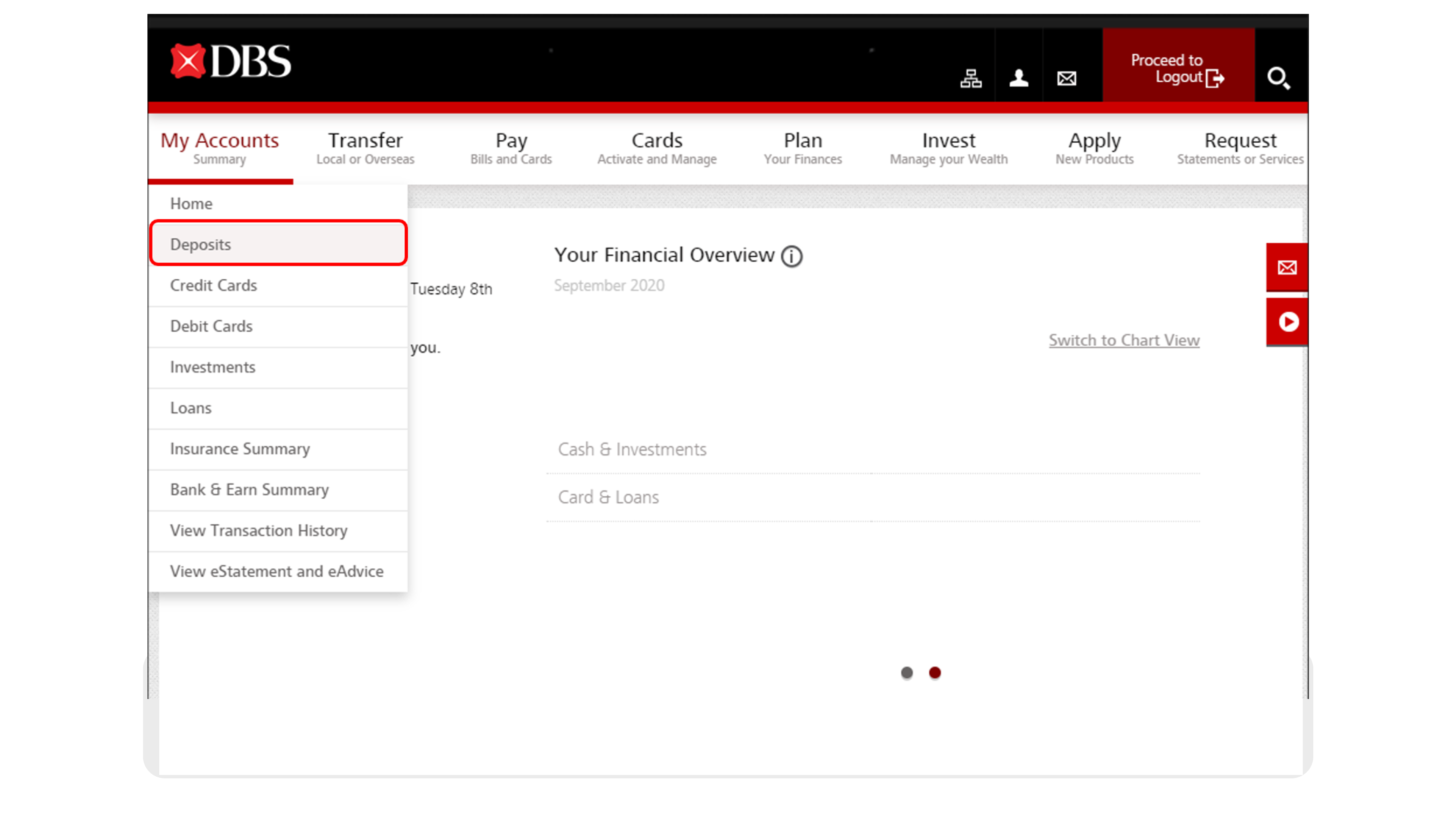

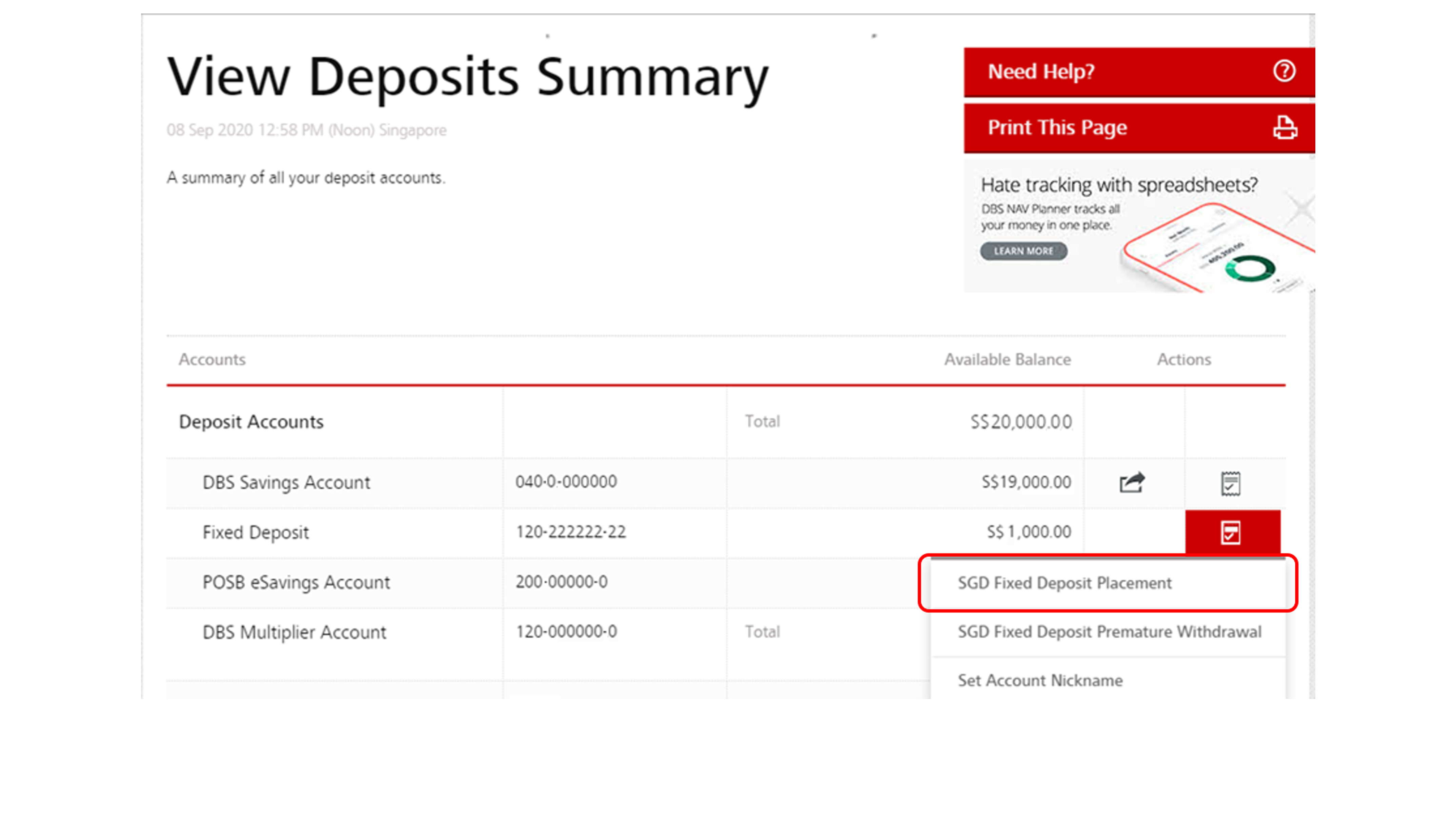

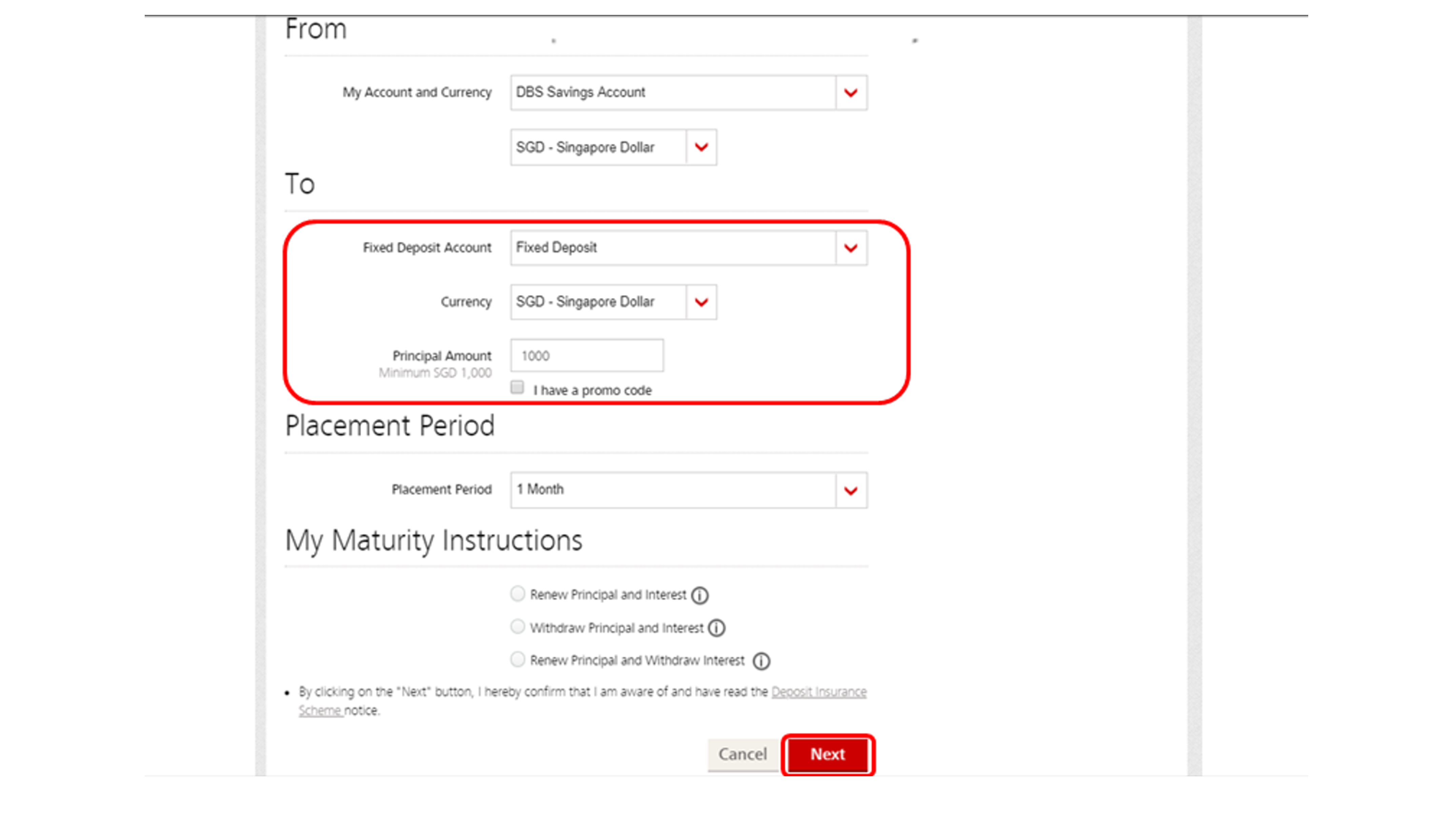

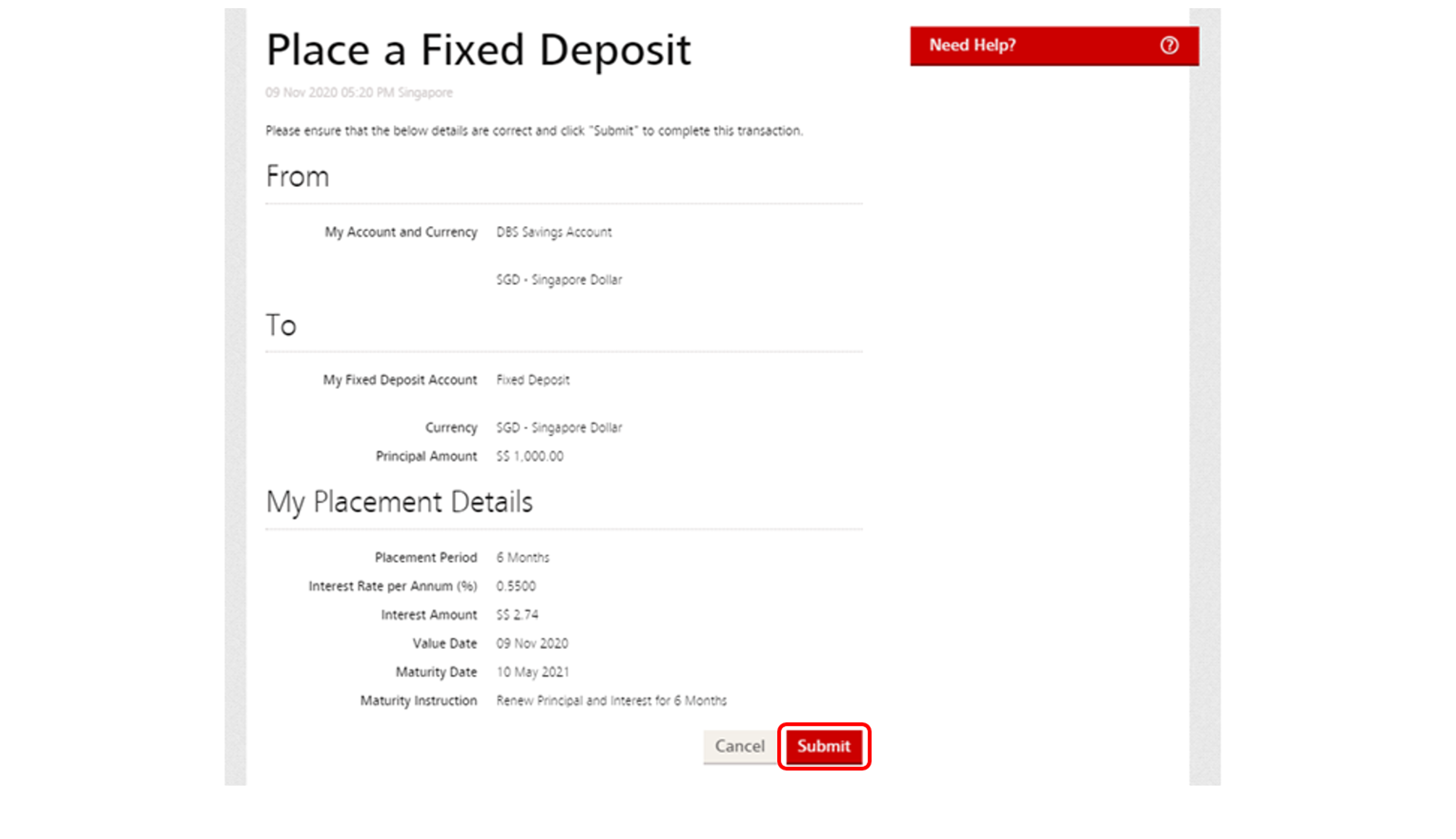

digibank online

More information

- SGD fixed deposit placements are available from 3:00 am to 11:30 pm daily, and on the last working day of the month from 3:00 am to 8:30 pm.

- Foreign currency transactions are available during working days from 9:00 am and 9:00 pm (SG local time). On the last working day of each month, foreign currency transactions are available from 9:00 am to 8:30 pm. Working days are from Monday to Friday, excluding Public Holidays.

digibank mobile (wealth)

- Log in to digibank mobile with your Touch / Face ID or digibank User ID & PIN.

- Complete the Authentication Process.

- Under Invest, select Fixed Deposit.

- Select the Currency and Account you wish to place the fixed deposit in.

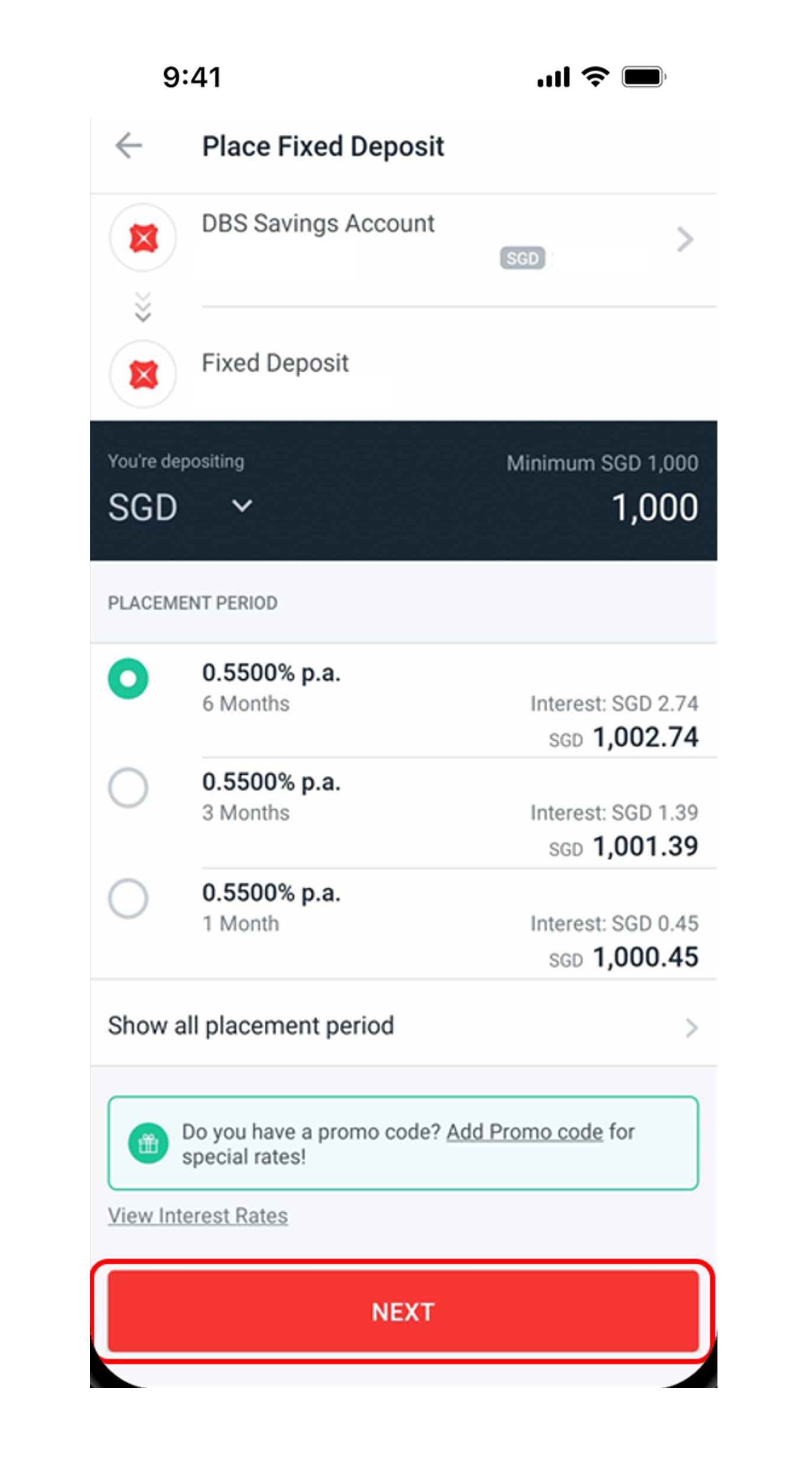

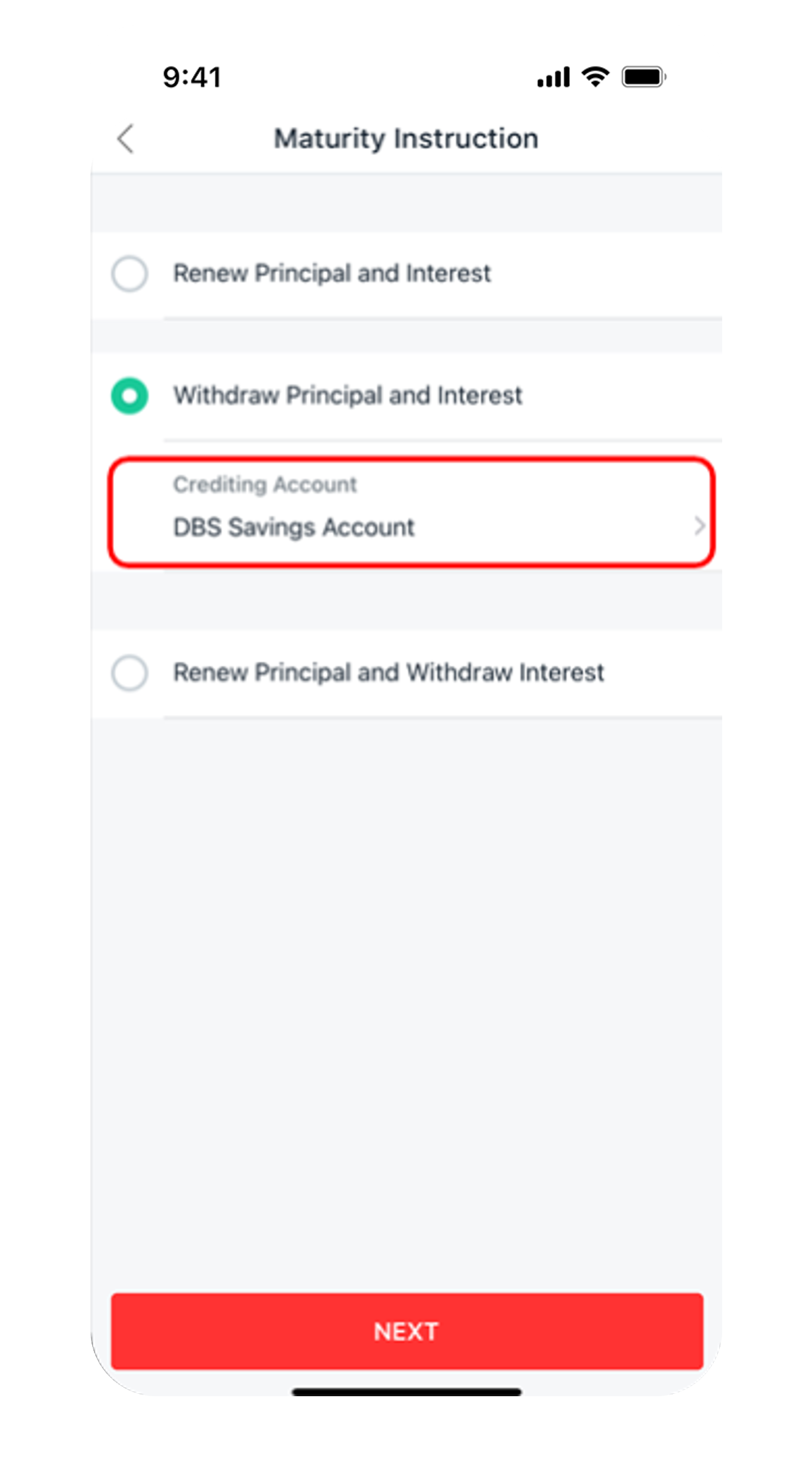

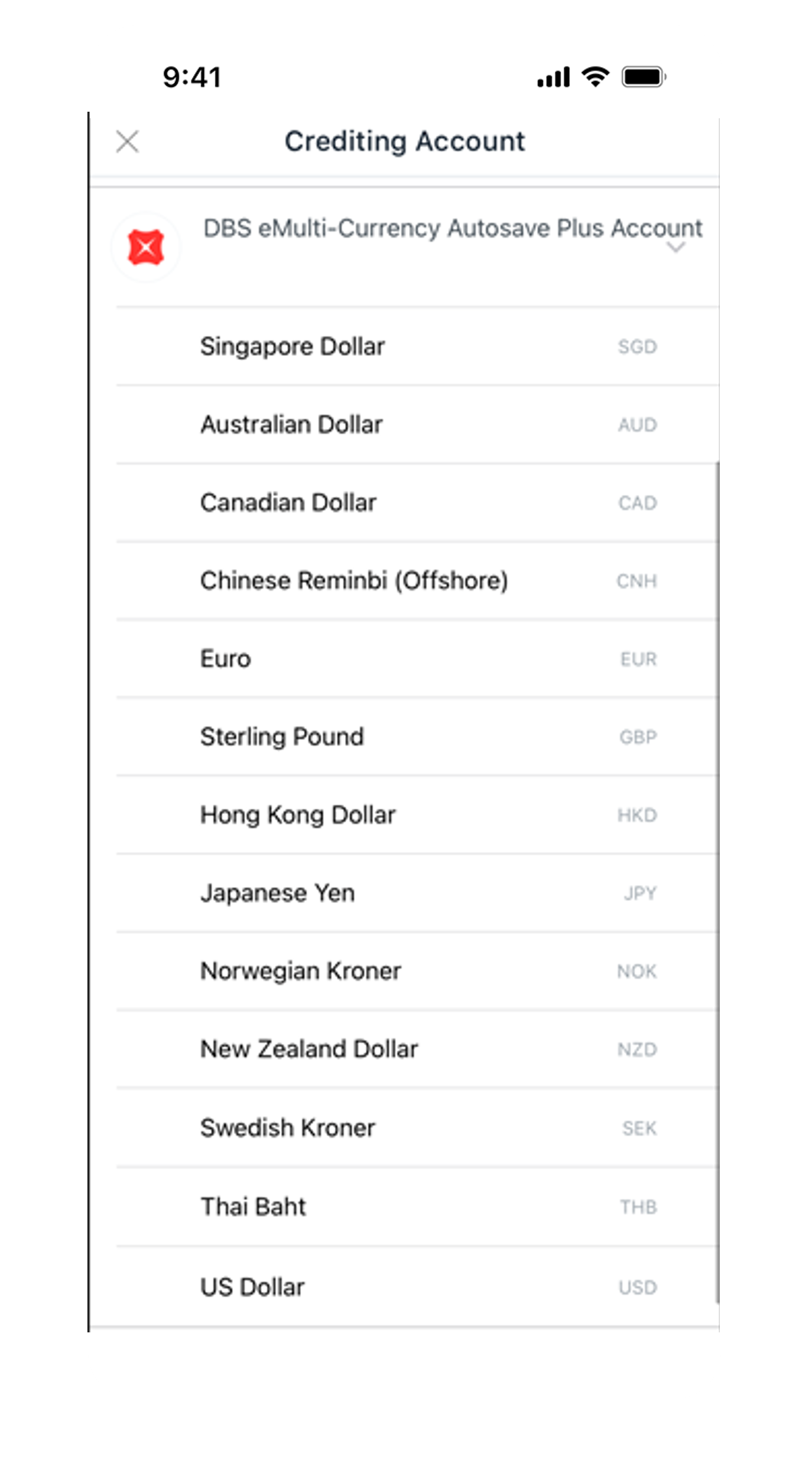

- Enter the Amount, select Placement Period, Maturity Instructions and tap Review.

- Verify your details and tap Submit to submit your Fixed Deposit placement request.

More information

- You can place Fixed Deposits in 11 different currencies: SGD, USD, HKD, GBP, CAD, CNH, AUD, EUR, JPY, NZD & CHF

(CHF is only available for DBS Treasures Private Clients and DBS Private Banking Clients). - Available timings for Online Fixed Deposit placement:

Currency Available Timing for Placement (Singapore time) SGD 24 hours by 7 days USD, HKD, GBP, CAD, CNH, AUD, EUR, JPY, NZD and CHF - Between 10:00 am and 11:59 pm on working days. Working days are from Monday to Friday, excluding Singapore public holidays.

- For 1-day placement period, the service is unavailable from 9:30 pm to 1:00 am daily.

digibank online (wealth)

- Log in to digibank online with your User ID & PIN.

- Complete the Authentication Process.

- Under Invest on the top menu, select Fixed Deposit.

- Select your Portfolio, Currency, Amount, Placement Period, Maturity Instructions and click Next.

- Verify details and click Submit to place a fixed deposit.

- Placement status (both successful or unsuccessful) will be displayed on the completion page, and you will be notified via Email, SMS and Inbox alerts as well.

More information

- You can place Fixed Deposits in 11 different currencies: SGD, USD, HKD, GBP, CAD, CNH, AUD, EUR, JPY, NZD & CHF

(CHF is only available for DBS Treasures Private Clients and DBS Private Banking Clients). - Available timings for Online Fixed Deposit placement:

Currency Available Timing for Placement (Singapore time) SGD 24 hours by 7 days USD, HKD, GBP, CAD, CNH, AUD, EUR, JPY, NZD and CHF - Between 10:00 am and 11:59 pm on working days. Working days are from Monday to Friday, excluding Singapore public holidays.

- For 1-day placement period, the service is unavailable from 9:30 pm to 1:00 am daily.

Was this information useful?