Cashline Credit Limit Review

At a Glance

Fast approval

via Myinfo with Singpass

Hassle free application

Easy online submission with few steps

Greater spending power with higher limit

Unlock your financial flexibility

How it works

Here are some simple steps on how to increase your credit limitOn your digibank online

Step 1

Login to digibank online with your User ID & PIN.

Step 2

Under Apply, click on More Application Services.

Step 3

Select Credit Limit Review.

Step 4

Under Proof of Income, select Retrieve Income Data via Myinfo^.

Step 5

Verify and Submit your Credit Limit Review application

^ Credit limit review application using Singpass is only applicable on DBS/POSB digibank online.

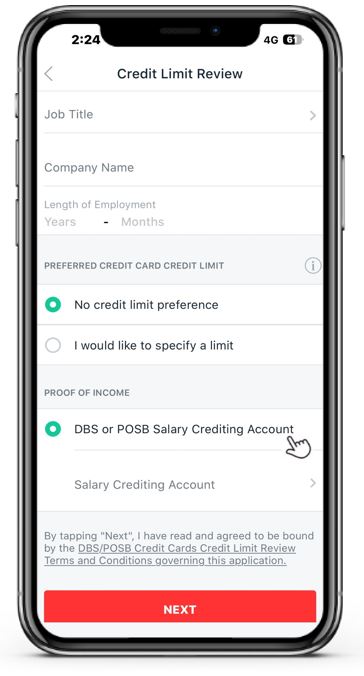

On your digibank mobile

Step 1:

Log in to digibank mobile with your Touch / Face ID or digibank User ID & PIN.

Step 2:

Tap on More.

Step 3:

Under Manage Cards & Loans, tap on Credit Card Limit Review or Cashline Limit Review.

Step 4:

Verify and Submit your Credit Limit Review application.

Required documents

For Singapore Citizens and Permanent Residents

Singpass holders applying via Myinfo with Singpass, no documents are required.

|

Salaried Employee |

|

|

Variable/Commission-based Employees |

|

|

Self-Employed |

|

* Income record/ documents must not be dated more than 3 months prior to date of application.

1 Your salary must be credited via GIRO, to your own DBS/POSB Account for the last 3 consecutive months and your current annual income meets our minimum income criteria. Salary credited into joint account will not be considered.

Apply now

Ready to unlock your financial flexibility with a higher credit limit? Apply for a credit review today with a secure and hassle-free process.

If your account is already suspended, please visit: Reinstatement of Suspended account to update your income and uplift the suspension.

Control your budget easily by setting a spend limit for your credit cards. Use DBS Payment Controls to manage spending limits and secure your credit cards at all times.

Frequently Asked Questions

All principal cardholders can apply for Credit Limit Review. Both Principal and Supplementary Cardholders' consents are required, for Supplementary Cards to enjoy the same permanent credit limit increase.

For supplementary card credit limit review, please apply here.

The credit limit granted will be subjected to the income documents submitted. If your latest income documents submitted reflect an increase in income based on our record, credit limit increase will be subject to our review.

Should your submitted income documents reflect a lower-earned income than what was previously declared, the existing Credit Card or Cashline limit will be reduced to reflect the prevailing earned income.

Yes, the loan will be cancelled if the total outstanding balances on your existing balance transfer or instalment loan exceeds your new credit limit, and any cancellation fees will be applied.

Review and revision of the combined Credit Card account(s) and/or unsecured credit facilities’ credit limit is conducted at DBS's absolute discretion.

ANNUAL INCOME | CREDIT LIMIT |

|---|---|

S$30,000 to S$120,000 | Up to 4X monthly income |

>S$120,000 | Up to 10X monthly income |

Any approved permanent credit limit increase will override the temporary credit limit increase.

You may use Payment Control on digibank app to manage your card (main and supplementary) spending limits, by entering a Preferred Monthly Spend Limit. You may refer to the steps here.

Both Principal and Supplementary Cardholders' consents are required, for Supplementary Cards to enjoy the same permanent credit limit increase.

For supplementary card credit limit review, you may complete and mail the form which can be found here.

Alternatively, you may use Payment Control on digibank app to manage your card (main and supplementary) spending limits, by entering a Preferred Monthly Spend Limit. You may refer to the steps here.