Plan with digibank

At a Glance

When it comes to personal finances, many individuals have the tendency to think that their money eventually "has a way of working itself out".

To that we say, why leave your finances to chance, when you can leave it to DBS? Here's what you get when you plan with us.

Understand Your Money Better

Consolidate your finances, set goals & plan towards building emergency savings, basic insurance coverage & investing 50% of your networth.

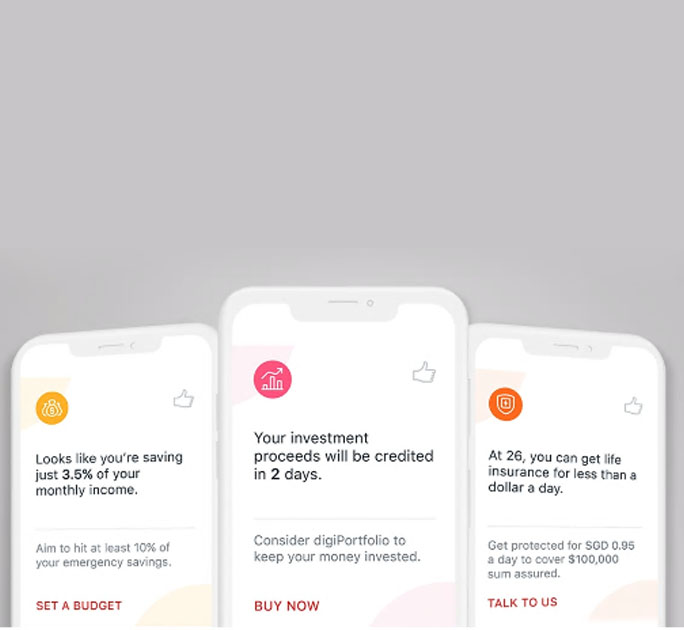

Get Personalised Advice & Solutions

Identify gaps & boost your finances with custom tips and hand-picked investments & insurance to suit your changing needs.

Level up Your Financial Smarts

Get personalised ideas, market updates & insights from our CIO. Expand your financial acumen with articles, events & expert-led seminars.

Find Your Focus

Personal Finance is truly personal. Whether you are a savvy saver, investment guru or retirement dreamer, pick your financial focus and your dashboard will be customised to help you plan towards your goals!

Be Financially Prepared

Here at DBS, we have a saying when it comes to your personal finances: Before you set sail on your financial journey, know what boat you've built for yourself. Be confident that your boat can survive any storm, and keep up to date with the winds of change.

Three tips to be financially prepared:

1. Understand your finances and income streams

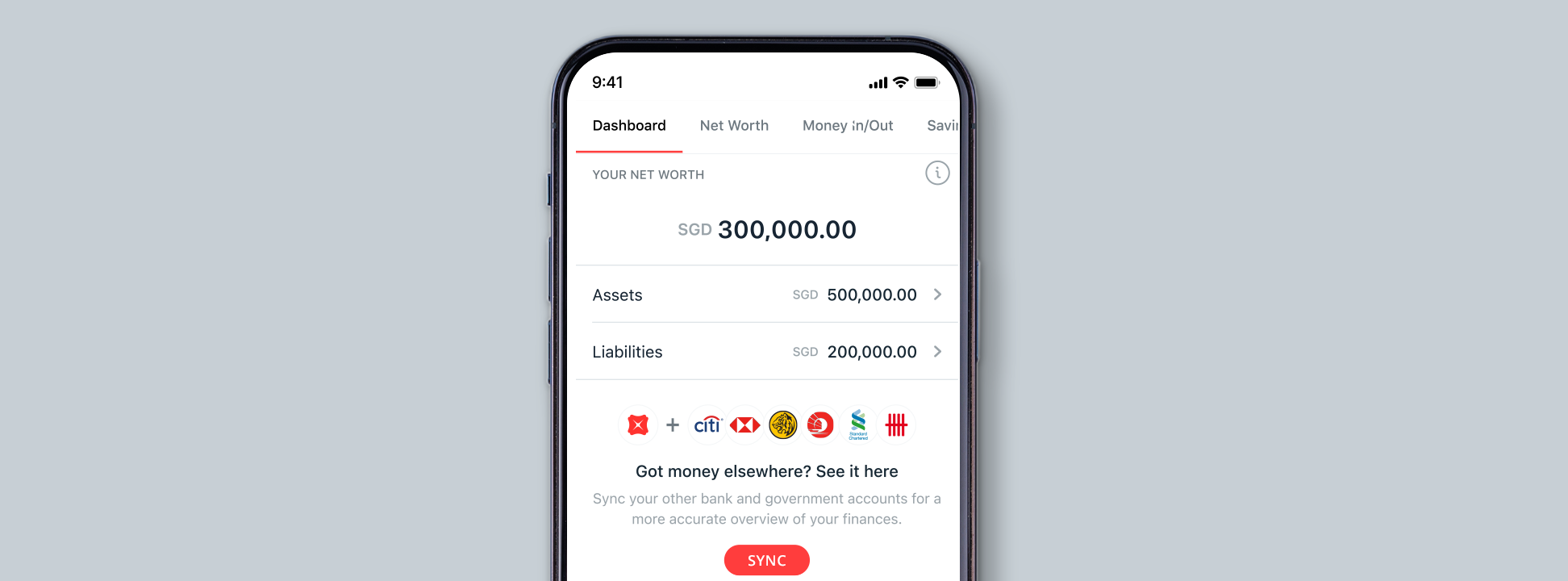

Consolidate all your money—from your cash savings, to your funds in government accounts like CPF, investments in your CDP account and even savings and insurance from outside of DBS in your digibank—for a one-stop view. You can do so by manually entering your financial details, or by simply connecting digibank with Singpass via SGFindex.

2. Test your financial plan

Stress-test your financial health against rising costs, inflation, and unexpected situations.

3. Get expert knowledge

Learn to boost your finances with trusted, real-time knowledge from our experts.

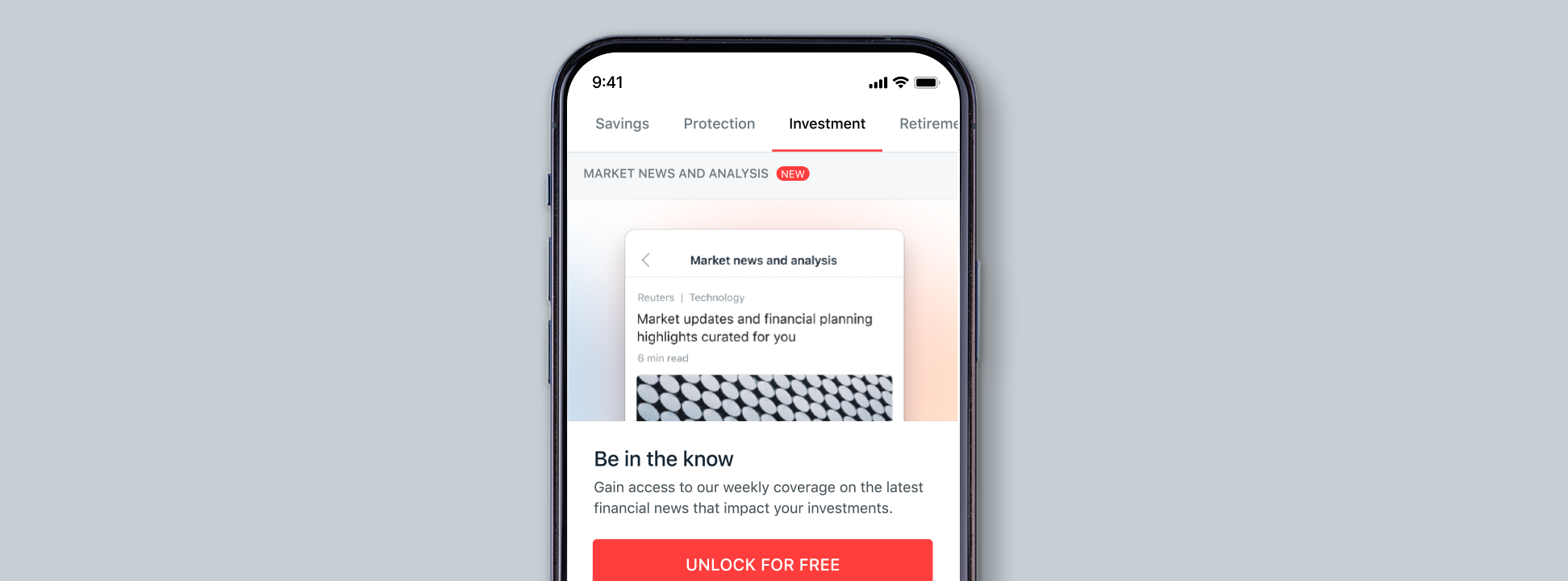

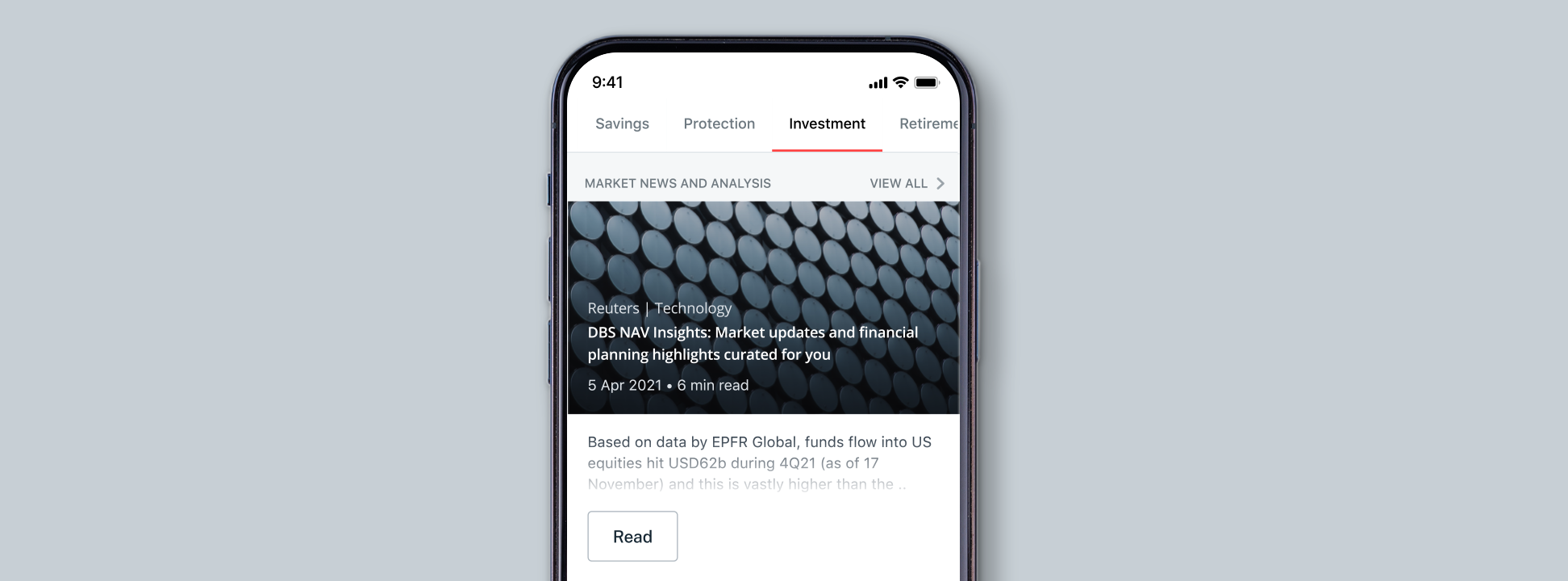

Level Up Your Smarts

Two tips to always be in the know:

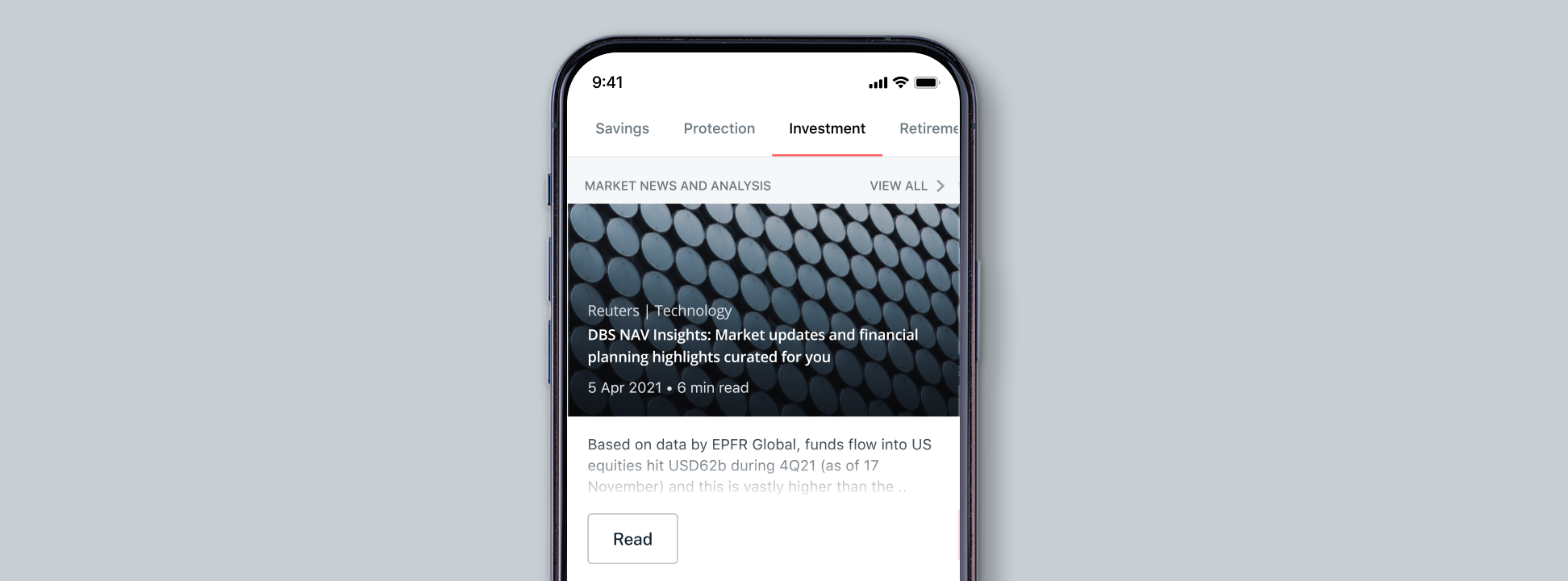

1. Access CIO Insights & Market Updates Weekly

Gain access to our weekly coverage on the latest financial news that impact your investments, with insights and ideas on what you can do from our Chief Investment Office in the Invest tab. What’s more, we’ve curated our content to simplify and make sense of market developments, so whether you are a new or seasoned investor—investing and financial planning will be easier for you.

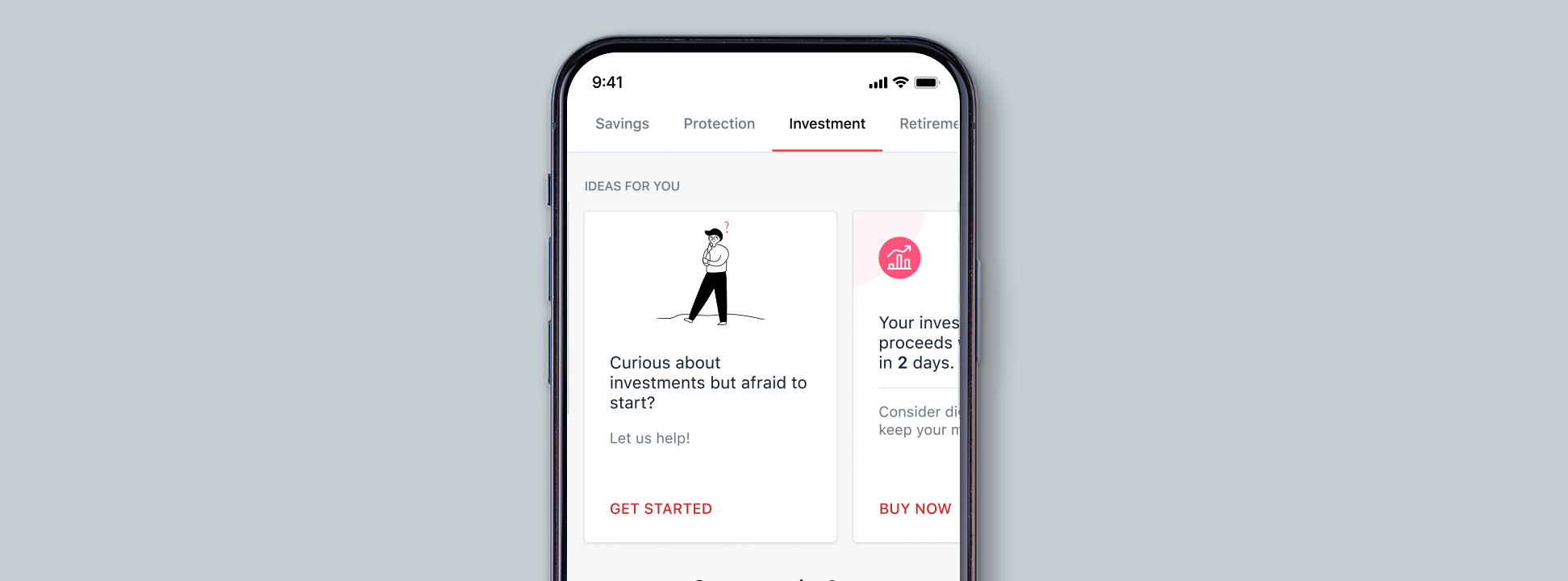

2. Ideas For You

Tap into expert knowledge that anticipates your needs and helps you decide your next best course of action to grow your money and stay financially fit.

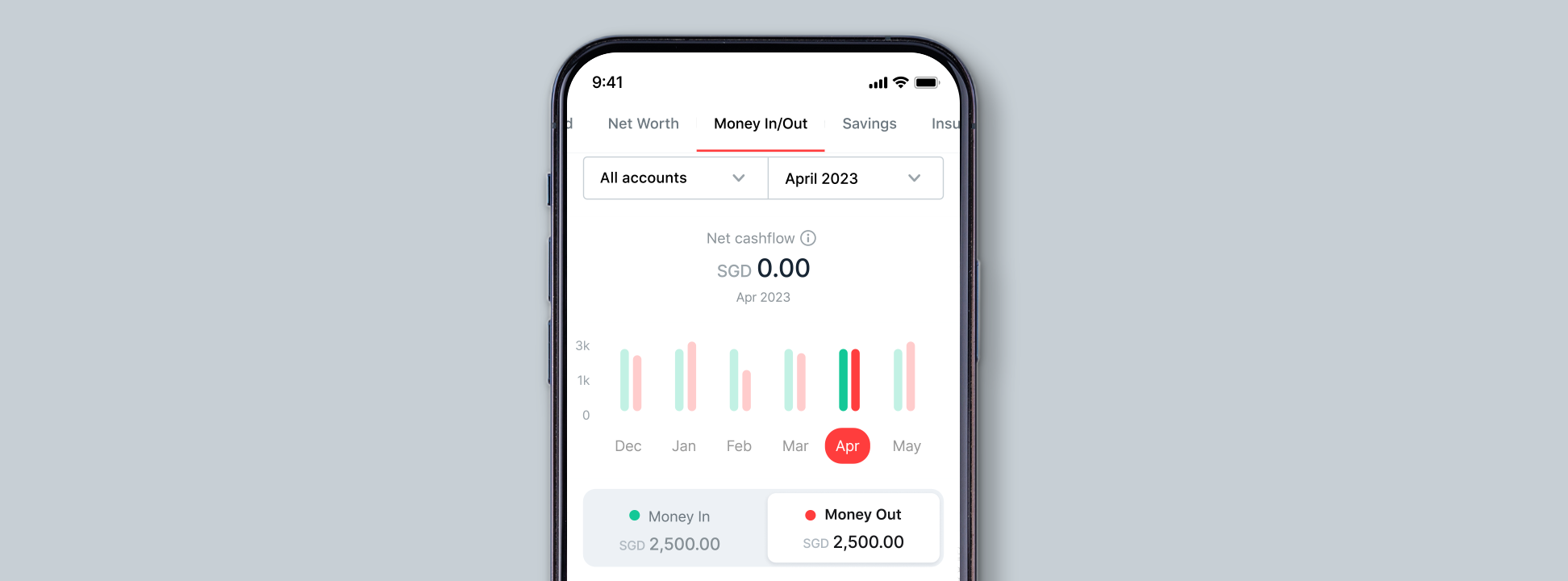

Understand Your Money

The key to starting or growing your savings is to first have a well-planned budget. One that tells you how much you can spend each month, and more importantly—how much you can save. Once you’re able to consistently put money aside for your savings, the next step is to know how much to save.

1. Get a consolidated view of your finances

First, get a comprehensive view of your funds, even those outside of DBS, in one place. You can manually input your details into digibank or connect effortlessly with Singpass as part of SGFinDex.

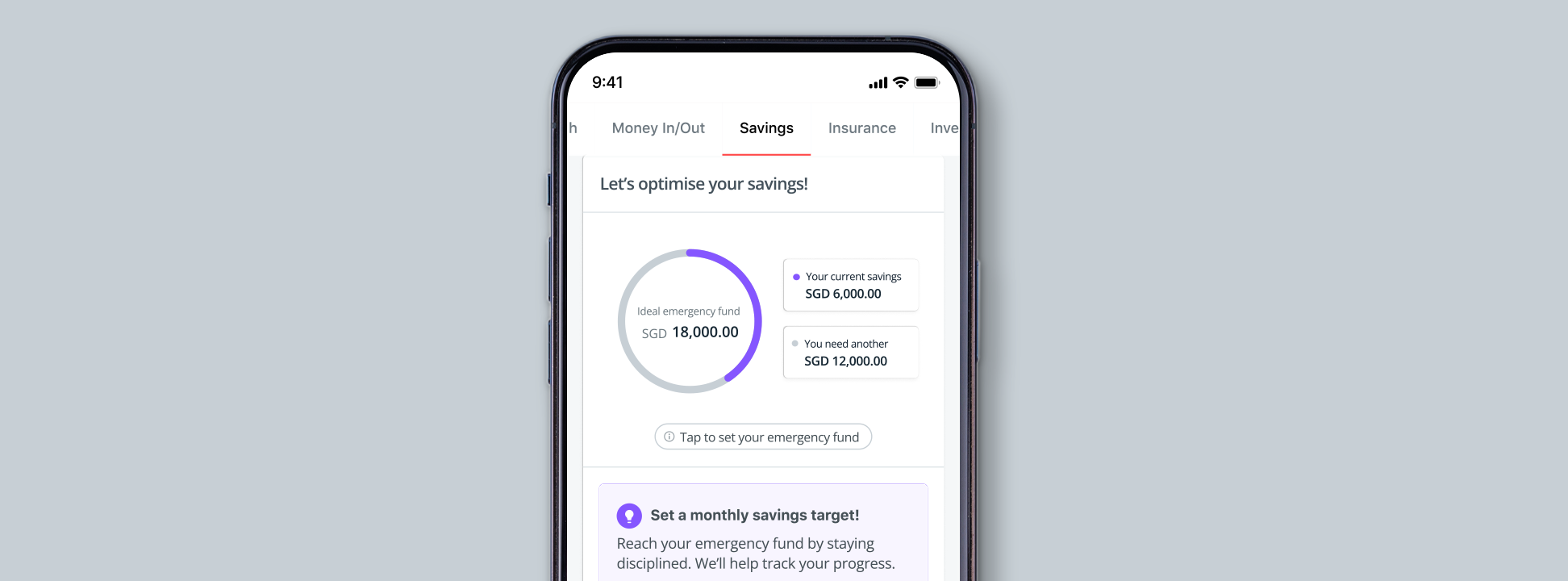

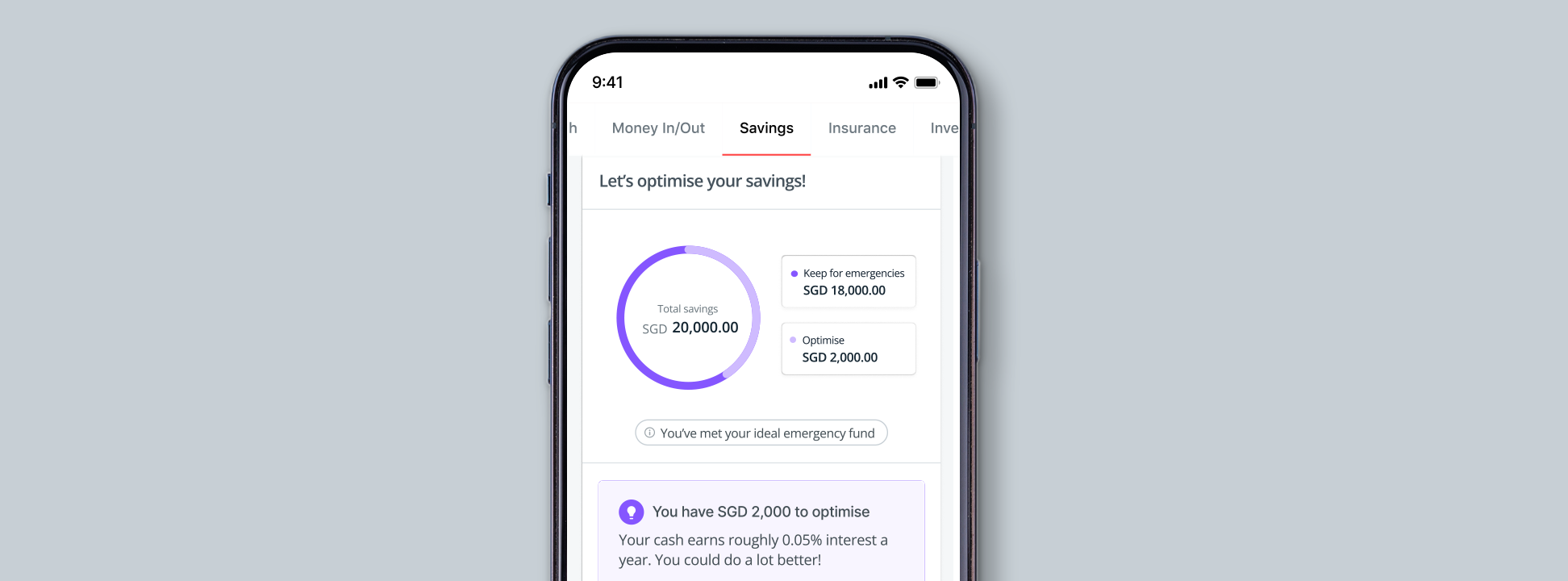

2. Set a savings target and build your emergency fund

Next, find out if you have enough emergency savings. Although three to six months is recommended, we would encourage gig workers or people with more dependants to keep at least 12 months of savings.

3. Optimise your savings by growing your money

Finally, set a savings target and we will show you what to do with it. Remember, don’t leave your finances to chance (leave it to us!).

Think of insurance as a hedge to protect yourself from any potential loss to your finances. Besides, every boat shouldn’t leave the harbour without a lifeboat.

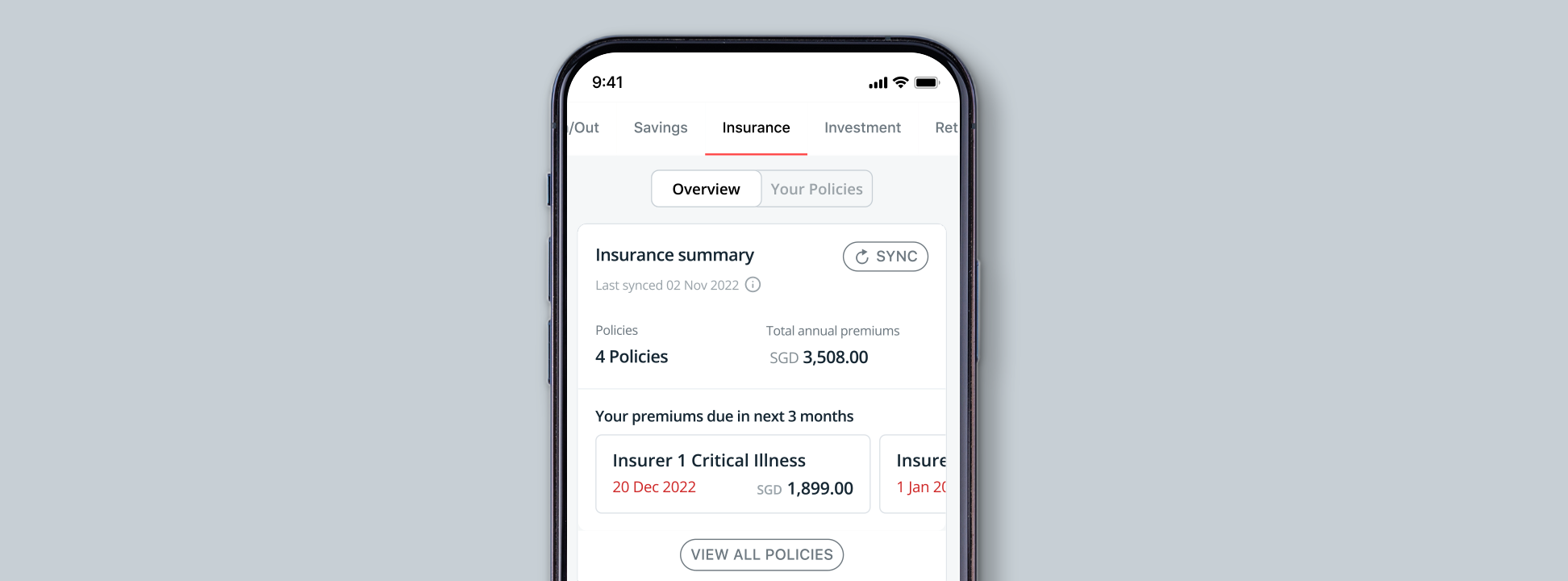

1. Consolidate and view all your insurance policies & coverage

First things first, check yourself. Are your insurance needs properly met? To find out, simply link your insurance plans to digibank and never lose sight of your coverage again. We will do all the heavy lifting and pull all your policy details, funds, and projected future policy value.

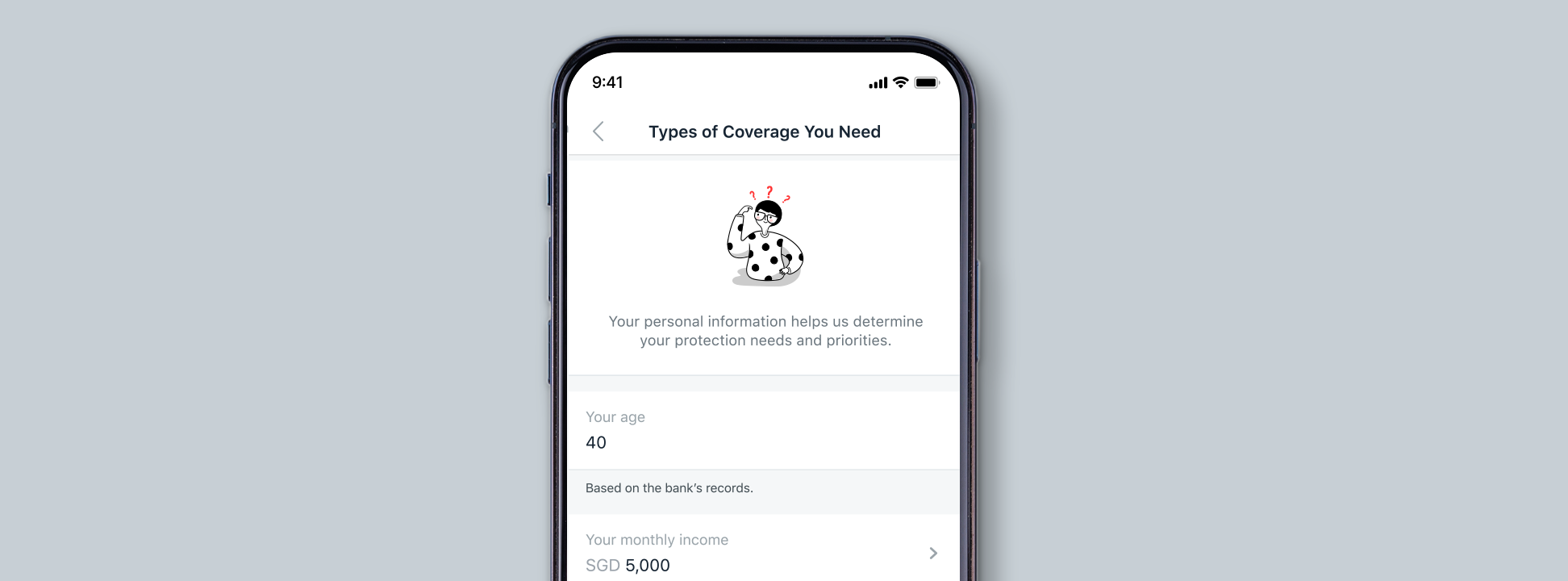

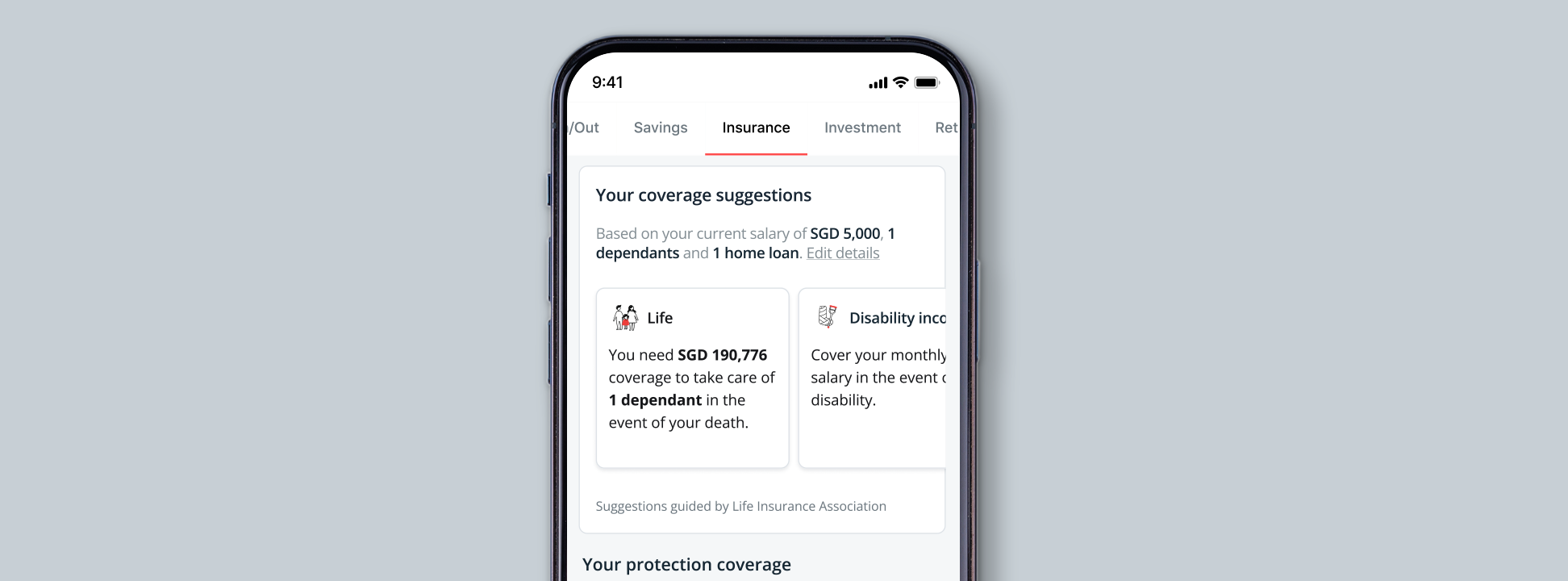

2. Get automatic and calculated insurance suggestions based on you and your dependants’ needs

Next, understand how much money you need by adding your monthly requirements and dependants. With this, we can help you spot gaps, and even check if you’re over-insured(which is a real thing).

3. Prioritise your needs

Get coverage suggestions prioritised for your current and future requirements.

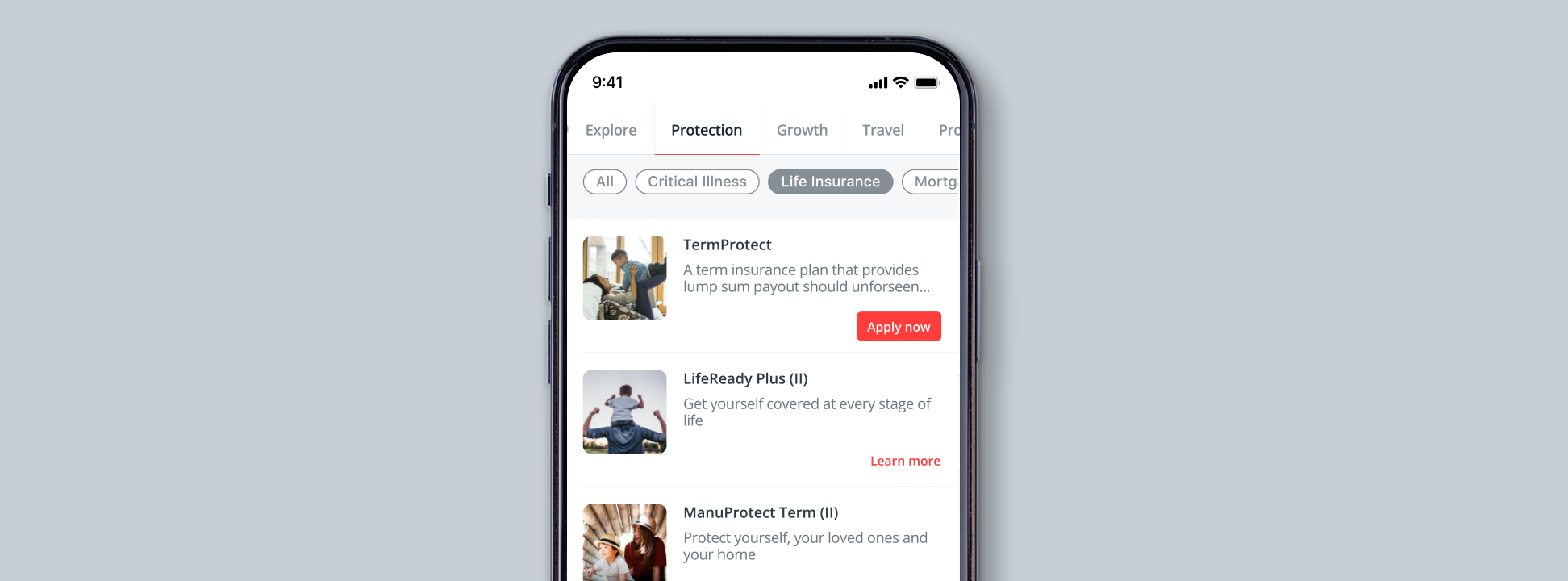

4. Plug your gaps and buy policies directly from digibank

We will suggest the best course of action for you based on your current life stage.

When it comes to your investments, you should never leave them to self-proclaimed "gurus". Leave it to us, but know your own risk levels - something you can find out with a quick assessment you can take on digibank.

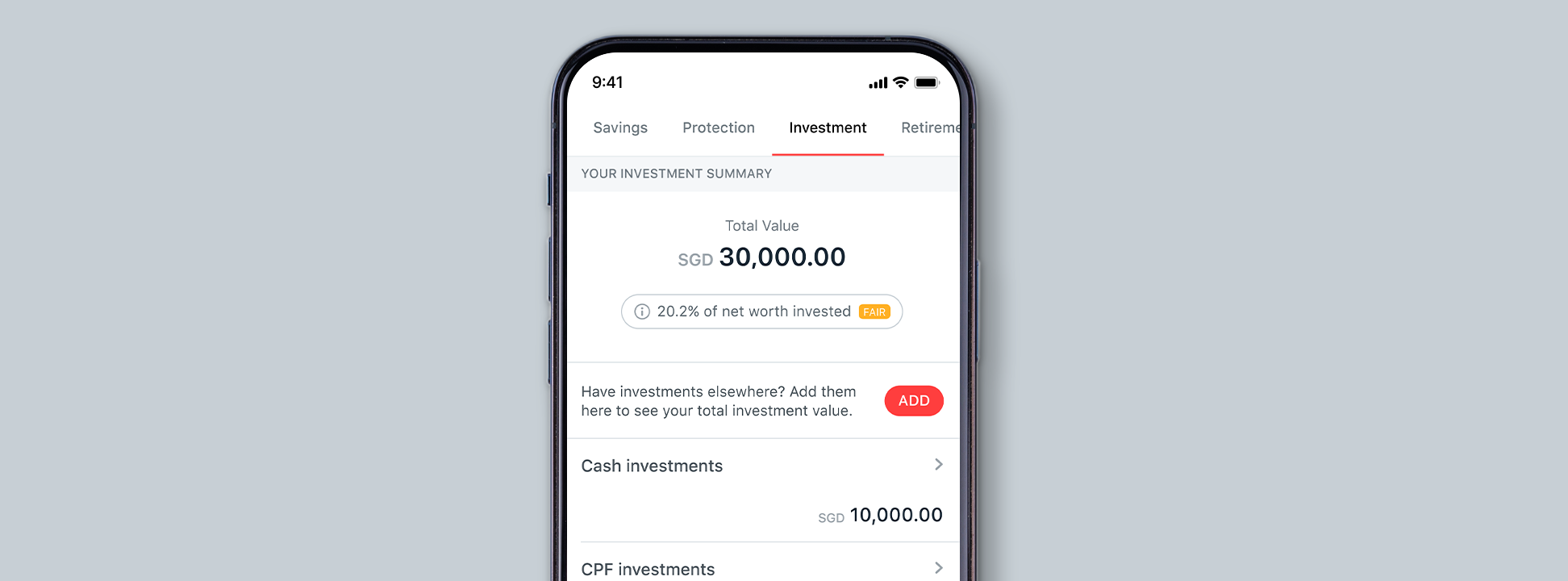

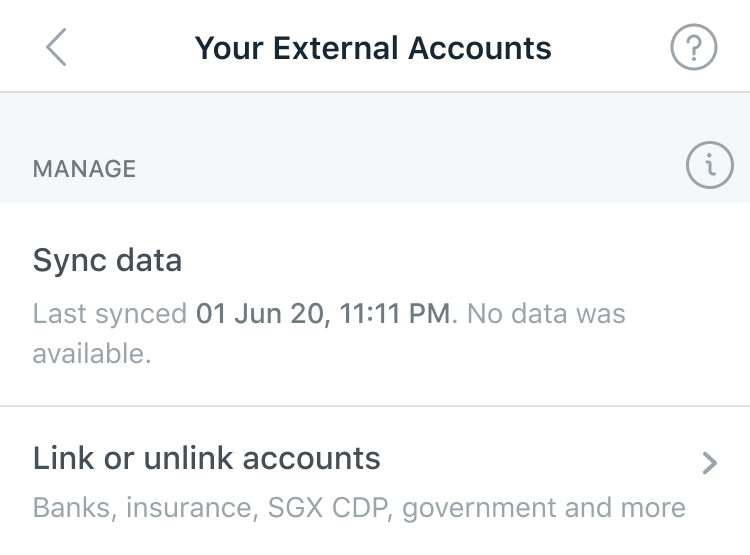

1. Sync your investments to see them in one place

Be sure to consolidate your investments to check that you are on track towards investing 50% of your net worth. If you're not, we will nudge you with investment ideas to help you get there.

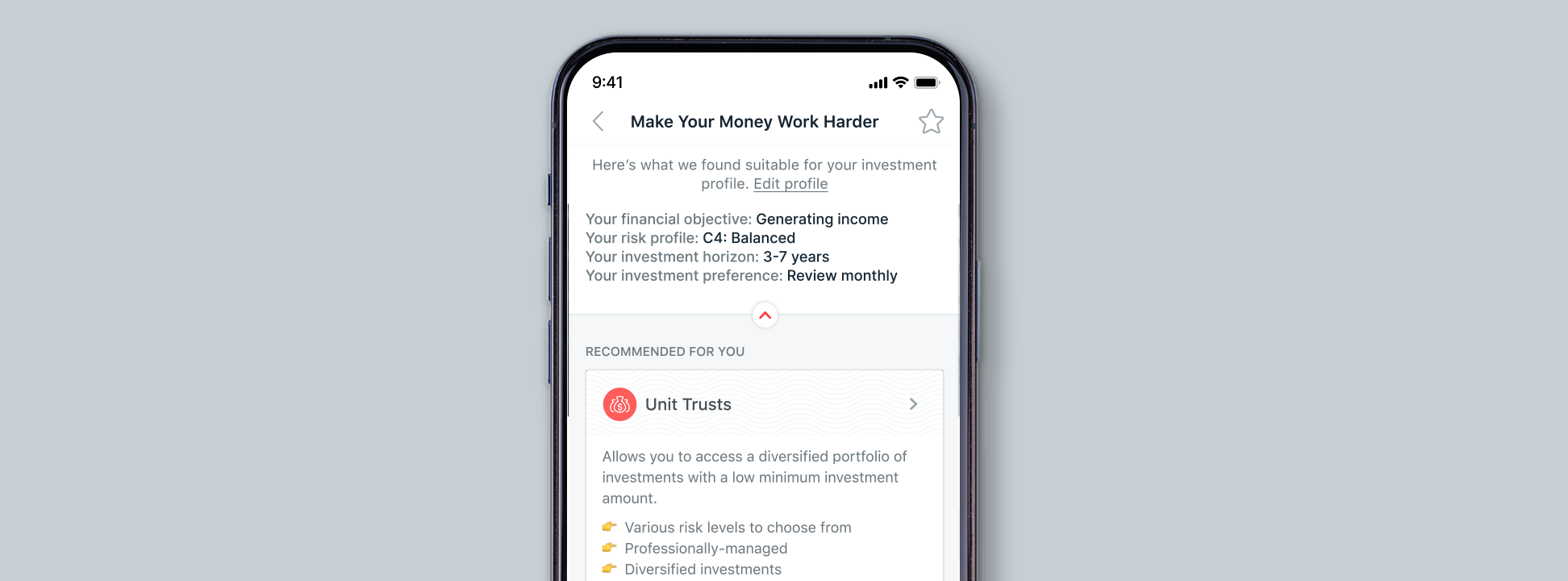

2. See what investments are suitable for you

Take our short questionnaire to find out what your investment profile is and get personalised investment recommendations.

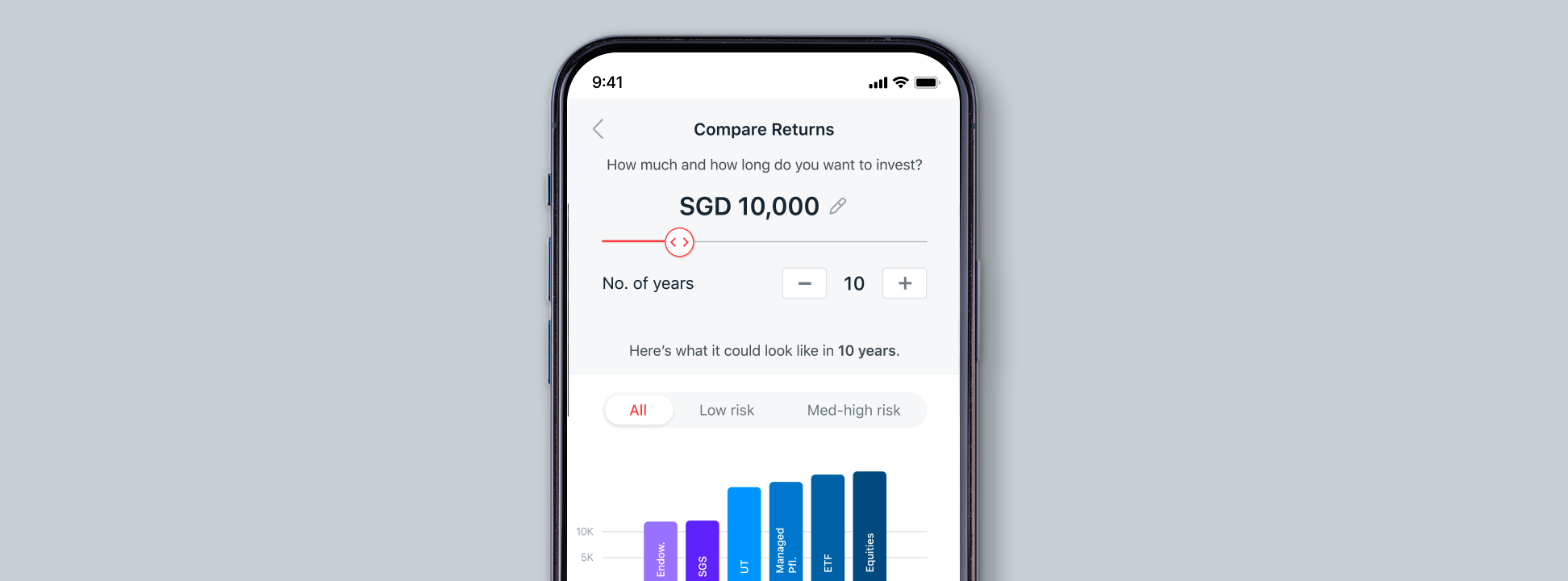

3. Compare returns

Tell us how much and how long you would like to invest and we will show you how much returns you can get from different investment types.

4. Stay up-to-date with market conditions

Equip yourself with the latest insights so you can invest like a pro.

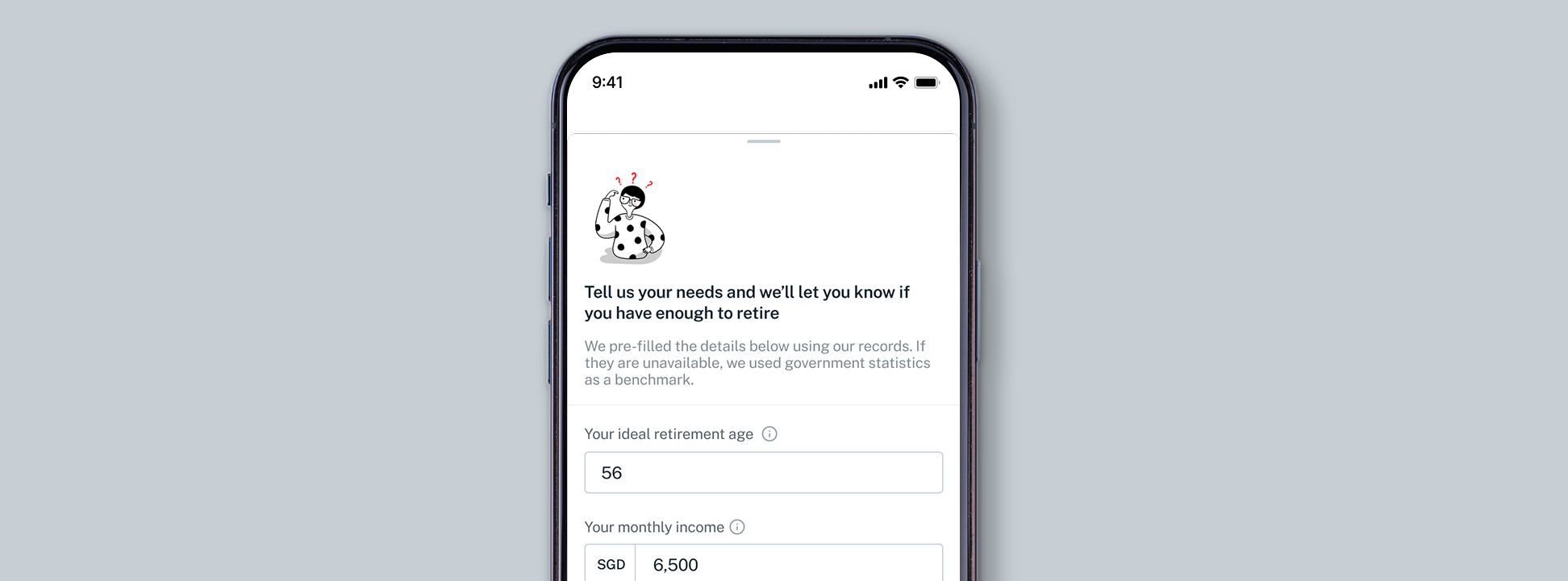

Did you know most Singaporeans have made some preparation for retirement—be it in CPF, savings, property, investments, insurance or retirement payouts? With that said, only 43% are confident that they are adequately prepared for retirement.

Here’s how you can ensure you’re fully-prepared for retirement:

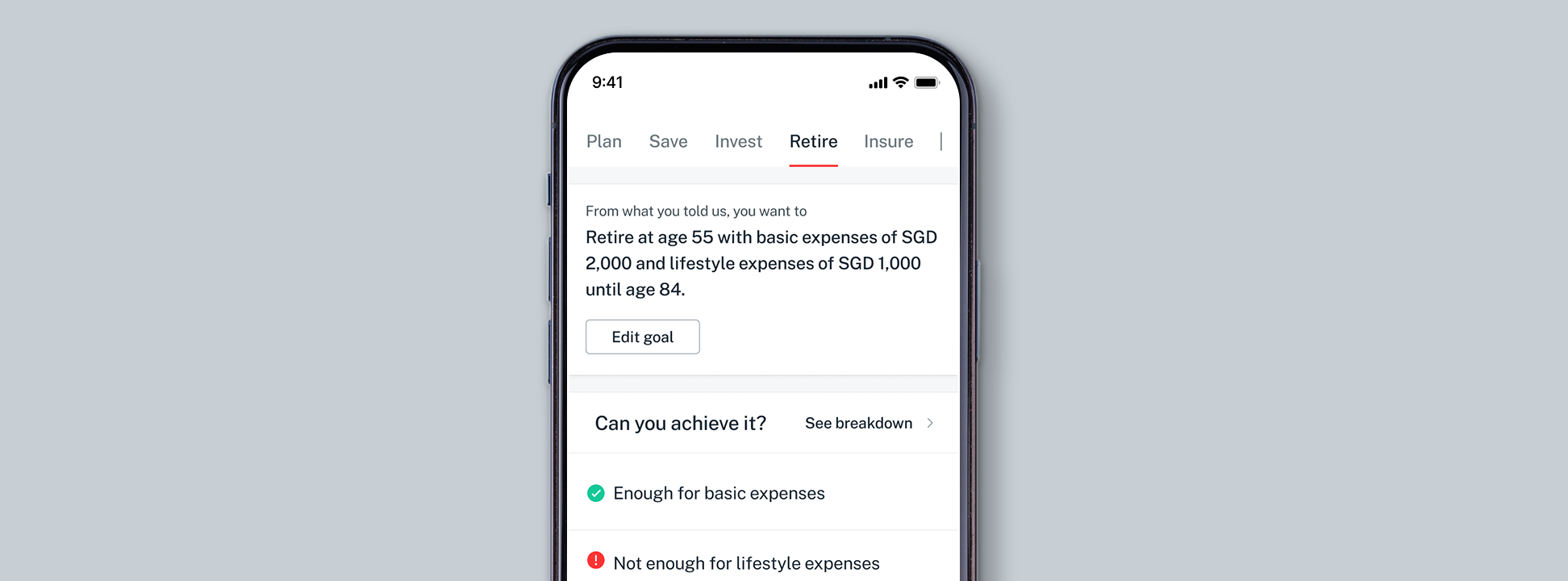

1. Set a retirement goal

2. Get your basics right

Prioritise your basic needs before allocating the rest of your retirement funds to meet your lifestyle needs.

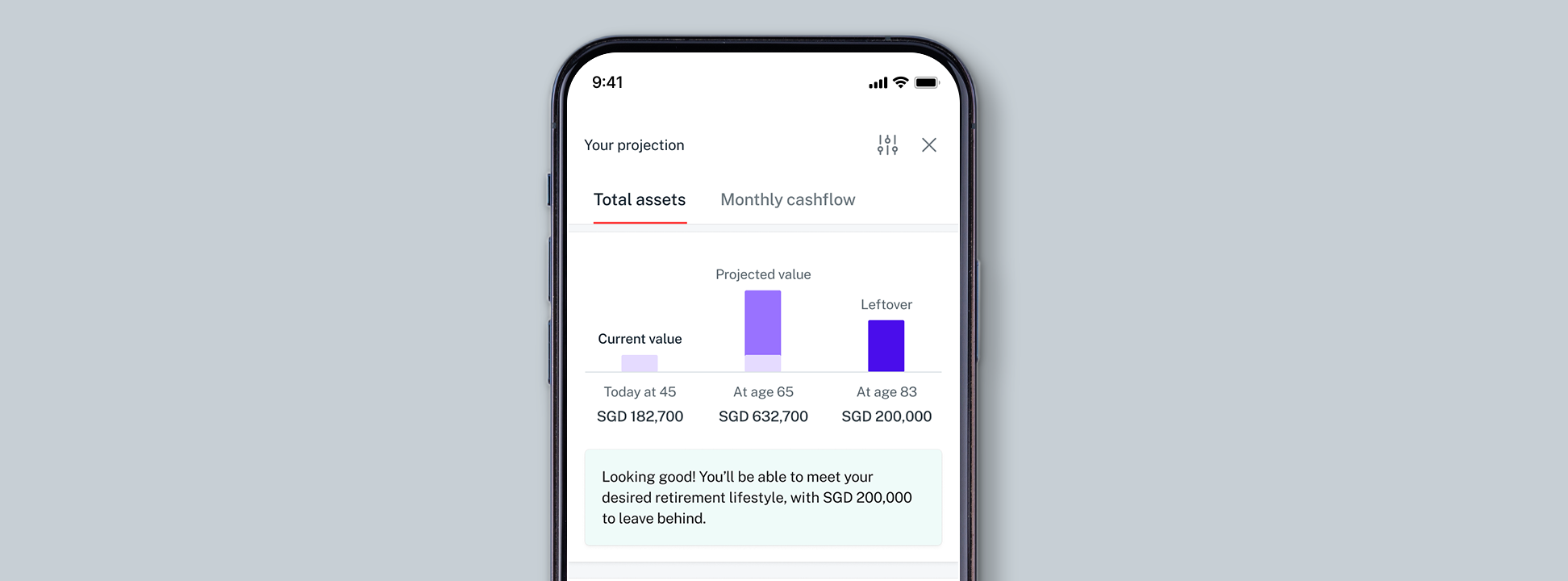

3. See your retirement at a glance

Identify shortfalls and see if you have enough assets to leave a legacy.

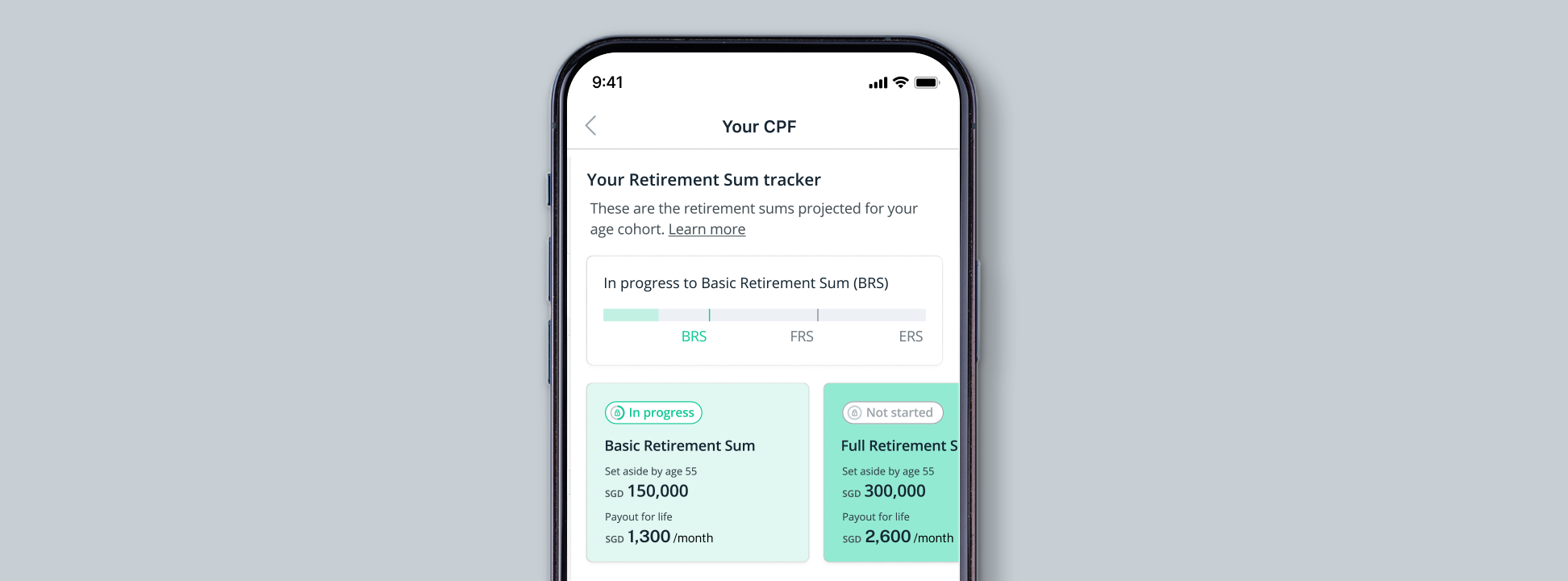

4. Track your retirement progress

See where you stand against projected CPF Retirement Sums.

Frequently Asked Questions

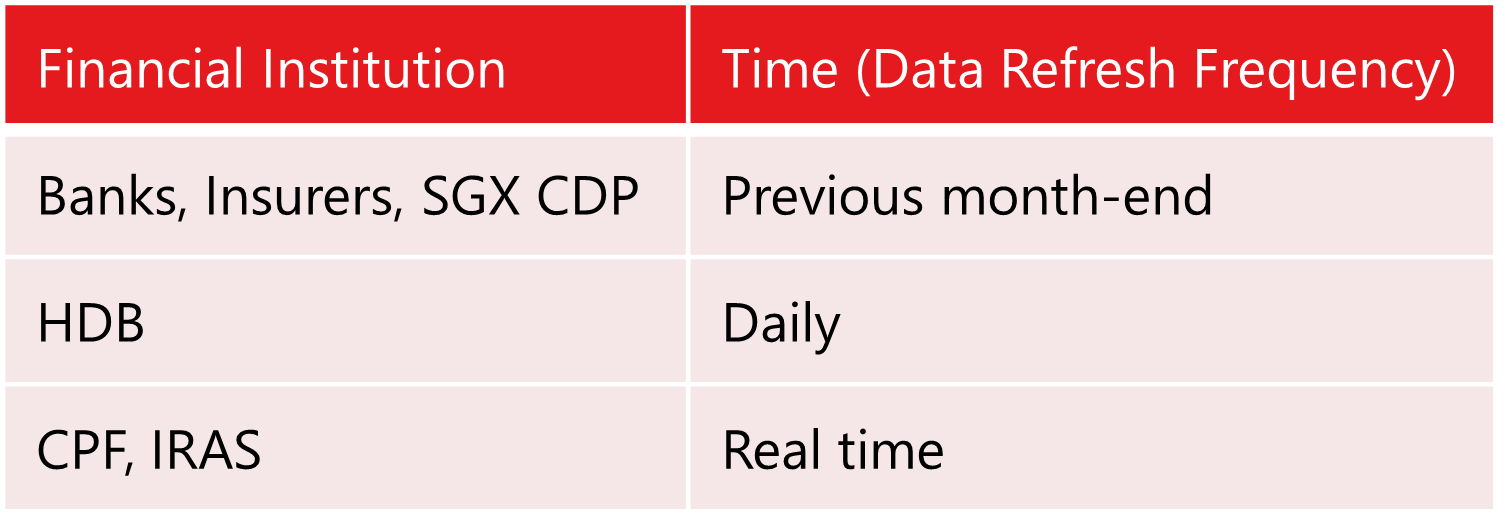

All banks' and insurers' financial information shared is as of the previous month-end or previous monthly statement balance, where applicable.

CPF and HDB information is latest as at the day you connect or refresh.

Your information is updated only when you tap on the 'SYNC' button within the Plan tab on DBS/POSB digibank.

Found in Net Worth, Insurance, Save and Plan Settings.

No, you'll only be able to view your information from banks, Insurers, CPF, HDB and IRAS. You won't be able to perform any transactions.

The consent period lasts 1 year (365 days), starting from the day you successfully connect your first financial institution. For example, if you provide consent on 1 Jan 2021 for Bank A to release your information and subsequently provide consent for Bank B on 1 Mar 2021, consent for both will expire on 31 Dec 2021.

If you change your mind about having your accounts linked, you can revoke consent for any bank at any time.

Information will only be shared through SGFinDex after you provide your consent to link your participating financial institution with SGFinDex and also request for information retrieval of the linked accounts through financial planning applications/websites such as the Planab on DBS/POSB digibank.

Your information can only be retrieved upon your instruction to do so. When you retrieve your information from other financial institution through the Plan tab on DBS/POSB digibank, your DBS financial information will NOT be automatically shared with other institution in return.

SGFinDex does not store or have access to your financial information.

You can refresh your data by clicking on the 'SYNC' button found through the Plan tab on DBS/POSB digibank or the 'Link or unlink accounts' button from the Plan Settings page.

Nevertheless, you can still use Bank A, B or C financial planning applications/ websites to retrieve and consolidate data from both Bank B and Bank C, in addition to your MyInfo data.

View all Frequently Asked Questions

Thank you. Your feedback will help us serve you better.

Was this information useful?

Related

Some useful reading

Useful Links

- DBS Investment Disclaimer

- Types of Investments by MoneySense

- Investing in Specified Investment Products by MoneySense

- Investment Solution Partners / Product Providers

- Terms & Conditions Governing Accounts

- Terms & Conditions Governing Electronic Services

- Terms & Conditions Governing Investment in Funds

- Best Execution Policy