500

Please enter only a-z,A-Z,0-9,@!>$&-()',./Let's bank safely together

Scammers and fraudsters constantly find ways to trick consumers into giving up their banking details to provide access to their accounts. Being aware of their scam methods can help keep you safe...

6 security tips to protect yourself online

Banking online can be safe if you stay vigilant. Learn how to protect yourself against scams with these 6 simple security tips!

Be Web Wise - Think before you Act

- Be careful of links and attachments sent through emails or SMS or posted online on social media sites. Such links and attachments may lead to phishing pages or install malware onto your device without your permission.

- Always go to our website by typing https://www.dbs.com.sg to ensure you’re reaching DBS's website.

TIP: If you wish to visit a webpage, it is safer to type the URL on the address bar of your browser than to click on it from an email or another site. - Stay current with latest news, check our Security Alerts & News frequently to be in the know of the latest threats and scams targeting DBS and POSB customers.

- Avoid performing online transactions on public or shared devices or devices that you suspect are compromised.

- Never reply to unsolicited emails or SMSes. Responses to such emails or SMSes could be used by fraudsters to socially engineer information or trick users into performing unwanted actions.

- Verify any odd or suspicious requests through official contact numbers or channels. Ensure that you're communicating directly with official DBS accounts on social media, especially when asking for assistance.

Stay Alert – Be Informed

- As part of the E-Payment User Protection Guidelines, ensure your Transaction Alerts are enabled so that you can be informed instantly of transactions on your account via SMS or email.

- Read the transaction details in the SMS or email alerts carefully. Validate that the messages, for example, check that the account number is correct, or the transaction reflects your request. Do not provide a One-Time Password (OTP) or DBS digital token authorization if the details in the SMS or email alerts do not match the transaction you initiated. Inform the bank immediately if in doubt.

- Check your transaction history regularly for any abnormal transaction and notify us immediately, if you notice unknown transactions appearing on your account.

Personal Banking: 1800 339 6963 or +65 6339 6963 (Overseas)

Business Banking: 1800 222 2200 - Keep your contact details updated with the Bank. Learn more.

- When accessing digibank, never leave your session unattended and log out after use.

Healthy Device – Keep it updated & protected

- Avoid jailbreaking or rooting your devices. Doing so makes your device more prone to security vulnerabilities like viruses and malicious software.

- Protect your device, web browser and Operating System (OS) with the latest anti-virus software

- For optimal app stability and security, ensure that you update your device’s operating system (OS) to the latest version.

- Be mindful of the applications you install on your devices. Install apps from official app stores such as Apple App Store or Google Play Store. Unofficial app stores may modify and inset malware into legitimate, non-malicious apps.

- When installing applications, verify that the permissions granted to the application are necessary and avoid downloading unnecessary applications as these applications may contain malicious code or social engineering scams.

- Regularly backup critical data.

Download the ScamShield App (For Singaporean customers only)

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council, and more information can be found at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield’s in-app reporting function.

Aware - Be mindful of what you share

- Be aware of what information you share and how it can be used by a receiving party.

- Avoid sharing personal details such as your identity card information, address, phone number, DBS account details, or other personal information unnecessarily.

- Consider setting your social network profile to private or use custom audience settings. This way, only people you invite can see what you post.

- Consider using a nickname instead of your real name. This can help reduce the chances of you being harassed online.

- When using public Wi-Fi, avoid accessing websites that require you to login. Consider limiting your activities to only non-sensitive ones. Enable security settings such as 2FA whenever possible adds an additional layer of security.

- Stop and consider before sharing any posts as information posted may cause harm to yourself or people around you.

Responsible - Be a good citizen

- Review your privacy settings and practice good social media etiquette. Enable security settings such as 2FA whenever possible as an additional layer of security

- Think before sharing and post online, what you share online can be re-shared and made public by others. You cannot take it back or delete it later.

- Treat others the way you would like to be treated. Practise kindness in both the physical and digital world.

- Be cautious when you come across promotional offers that sound too good to be true.

- Apply a healthy dose of scepticism if you read any news articles that are sensational and discern if the articles come from a credible source.

Protect Your Information

- Secure your device with a strong password, PIN or a relevant mechanism to prevent unauthorised use.

TIP: A strong password is one that is difficult to guess and contains a mix of letters, numbers or symbols. You can use this on top of your device’s biometric security feature (if available). - Never disclose your digibank User ID, PIN & One-Time Password (OTP) to anyone. DBS will never request for your PIN, password or OTP.

- Avoid providing your account details (such as passwords and PIN) to third-party financial aggregator applications as these applications may not be secure.

- Avoid registering other people’s biometrics such as facial or fingerprint registration on your devices if you use biometrics to access DBS applications.

- Use a different PIN or password for web-based services such as email, online shopping or subscription services.

Latest Campaigns

Stay updated on the latest security news that might affect the way you bank online.

SPF x DBS Red Flags Ep 1 – How to spot a phishing scam

Past Videos

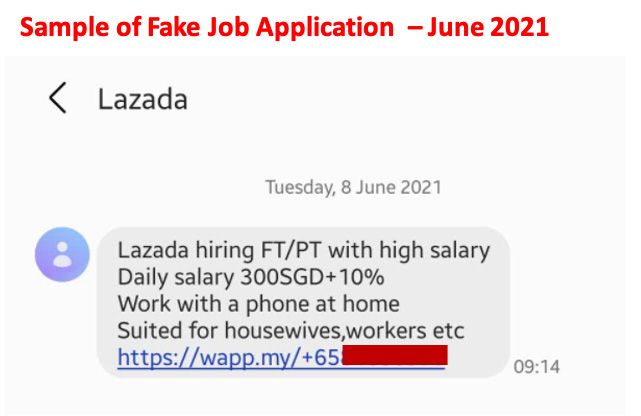

SPF x DBS Red Flags Ep 2 – How to spot a job scam

SPF x DBS Red Flags Ep 3 – How to spot an e-commerce scam

SPF x DBS Red Flags Ep 4 – How to spot an investment scam

What happens during a tech support impersonation scam

Don’t get phished

#BSHARP – Protect Your Information

#BSHARP – Be Web Wise

#BSHARP – Stay Alert

Recent Scams & Frauds

Stay updated on the latest security news that might affect the way you bank online.

Social Media Advertisement Phishing and Mobile Malware Alert

Scammers are using fake social media ads to trick you into downloading mobile malware to take over your phone and steal your banking credentials and funds.

Date: 06 September 2024

What this scam looks like:

Scammers use fake social media ads with attractive offers to trick you into downloading and installing third-party apps through unofficial app stores or links.

Protect Yourself:

If it seems too good to be true, it's likely a scam.

- Always use DBS' official website and mobile apps to conduct DBS bank-related requests.

- Avoid giving apps more permissions than necessary, such as accessibility services, viewing and sending SMSes, or full control to your devices.

- Enable automatic updates for your devices and apps to keep them updated with the latest security patches. Android users are advised to not disable Google Play Protect.

- When in doubt, contact DBS Bank immediately.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Turn on transaction alerts and contact DBS Bank immediately if you spot any unauthorised transactions.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.pageIndia: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

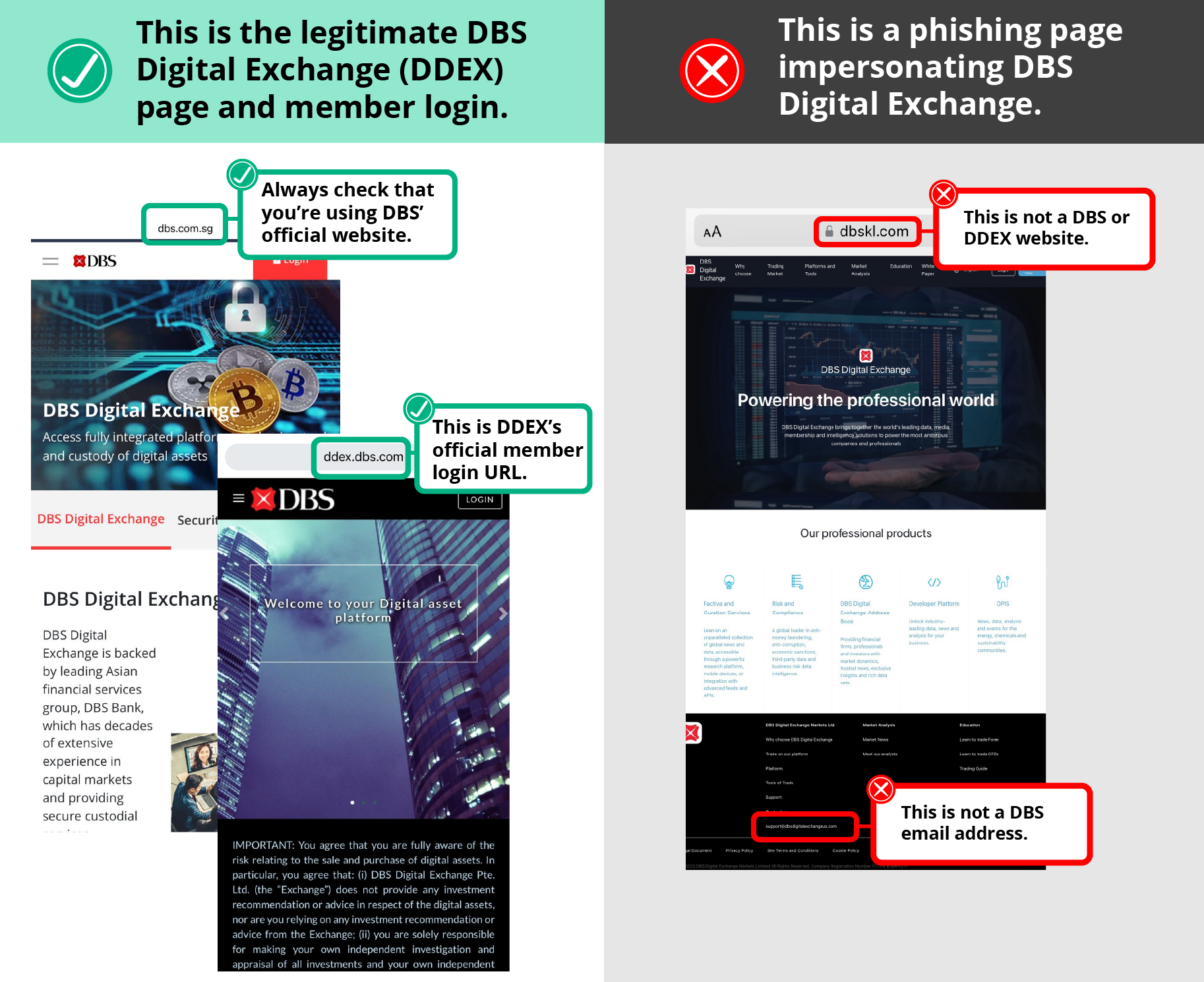

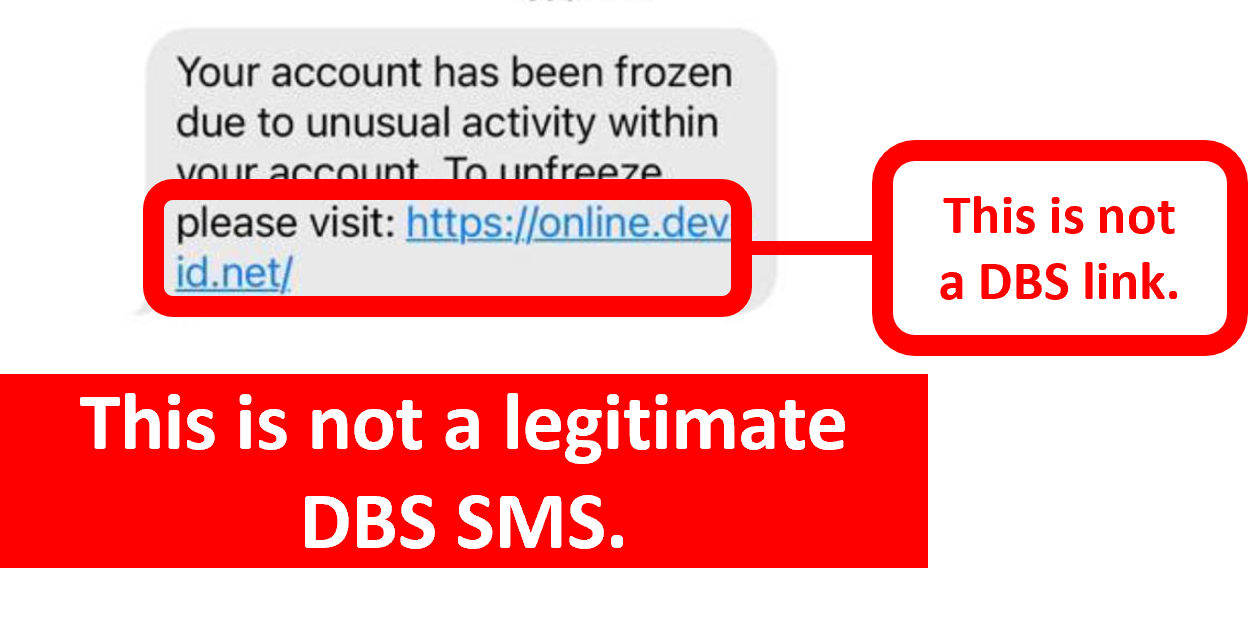

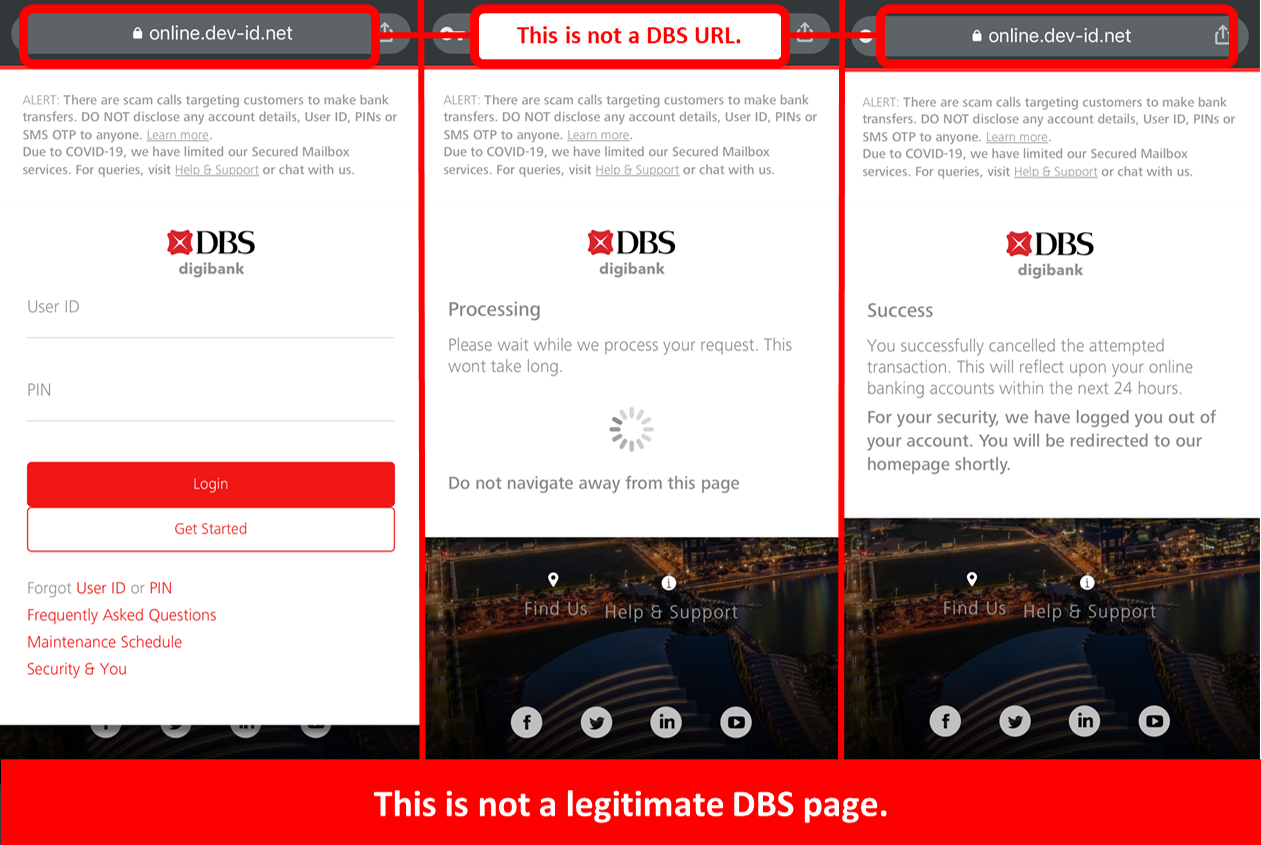

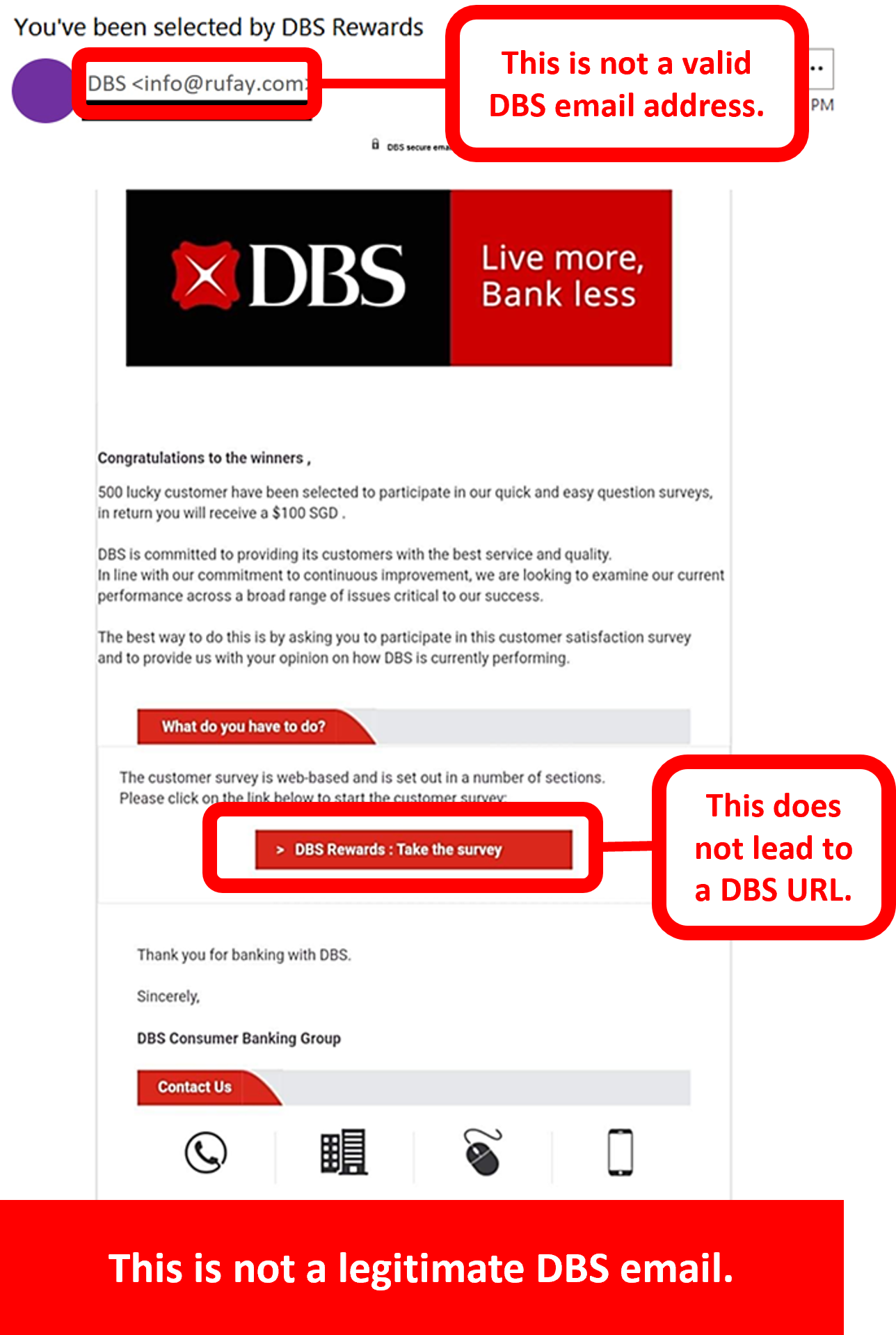

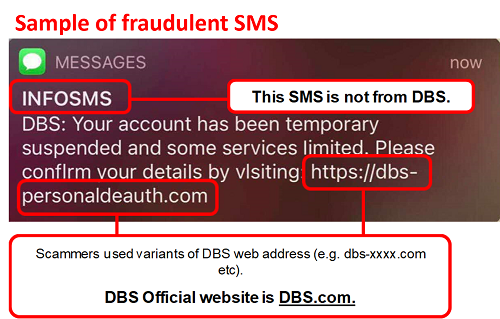

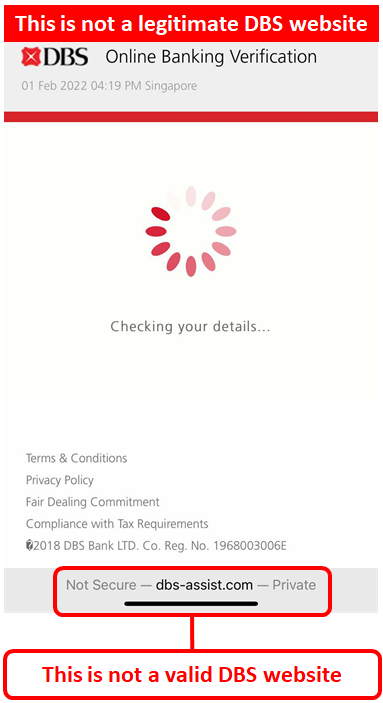

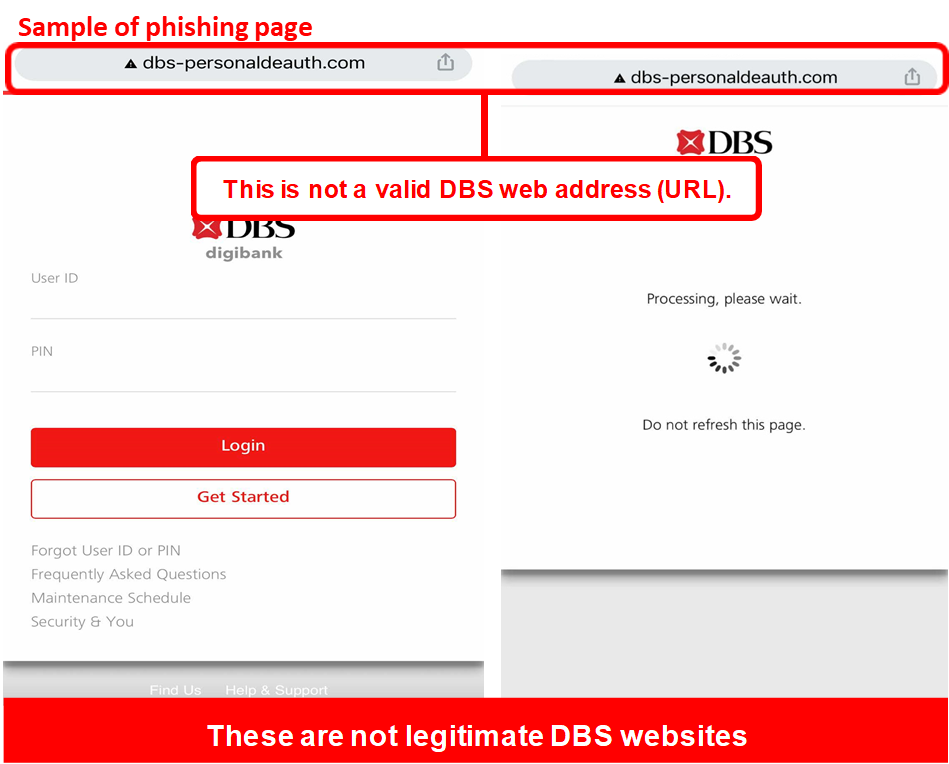

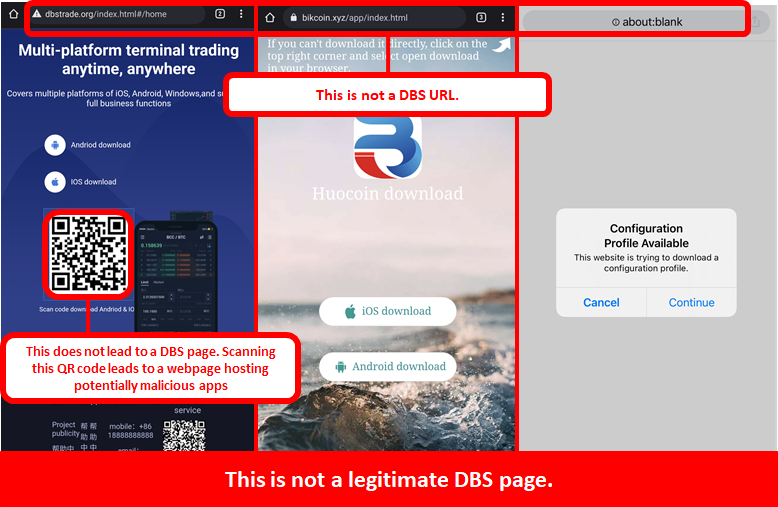

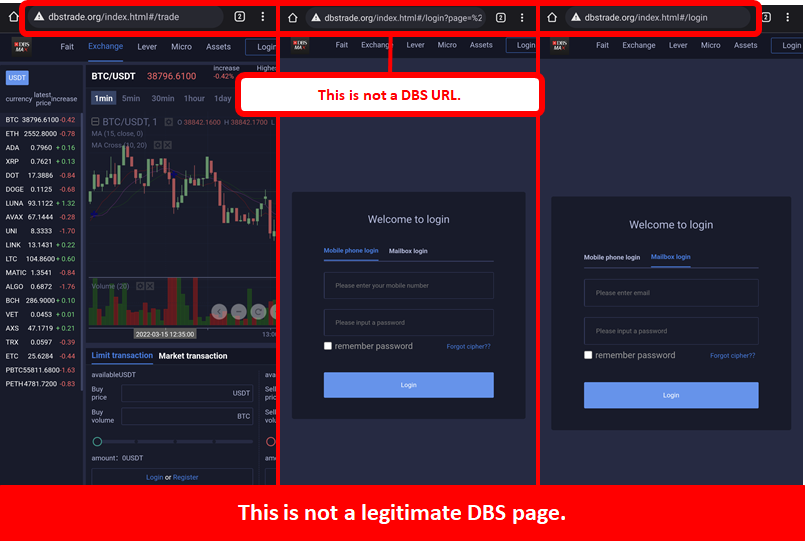

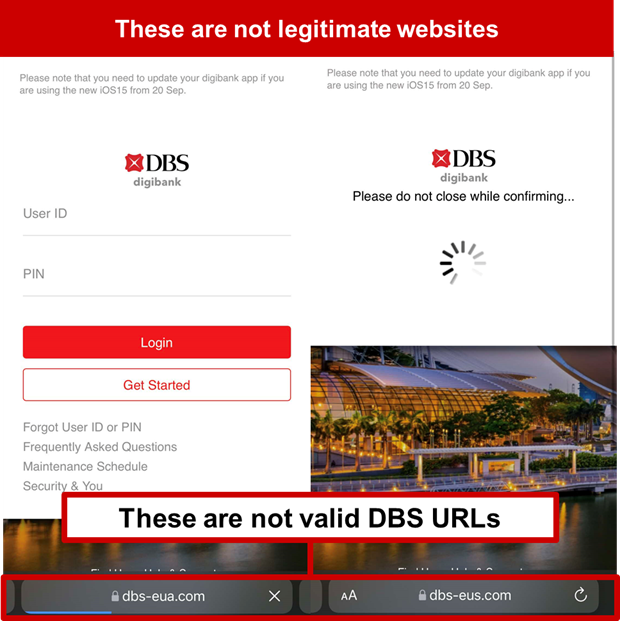

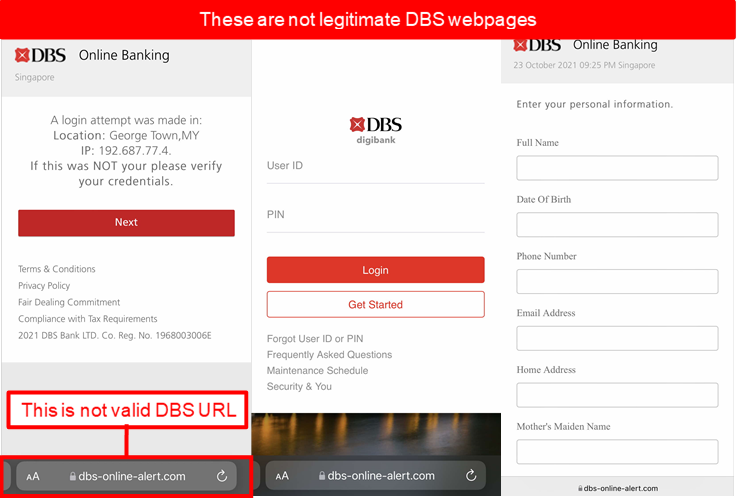

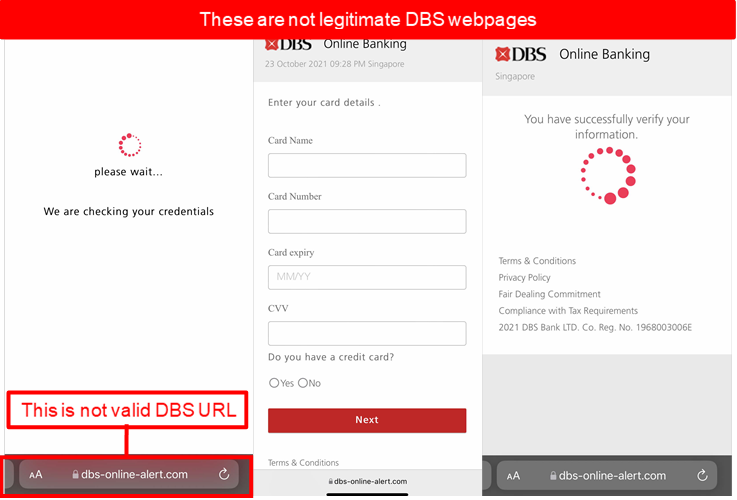

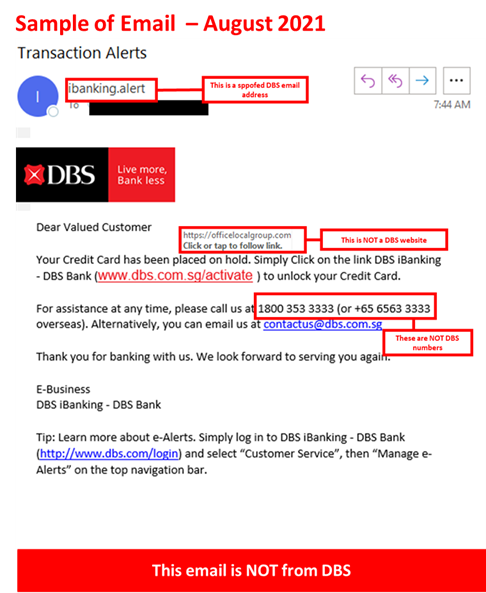

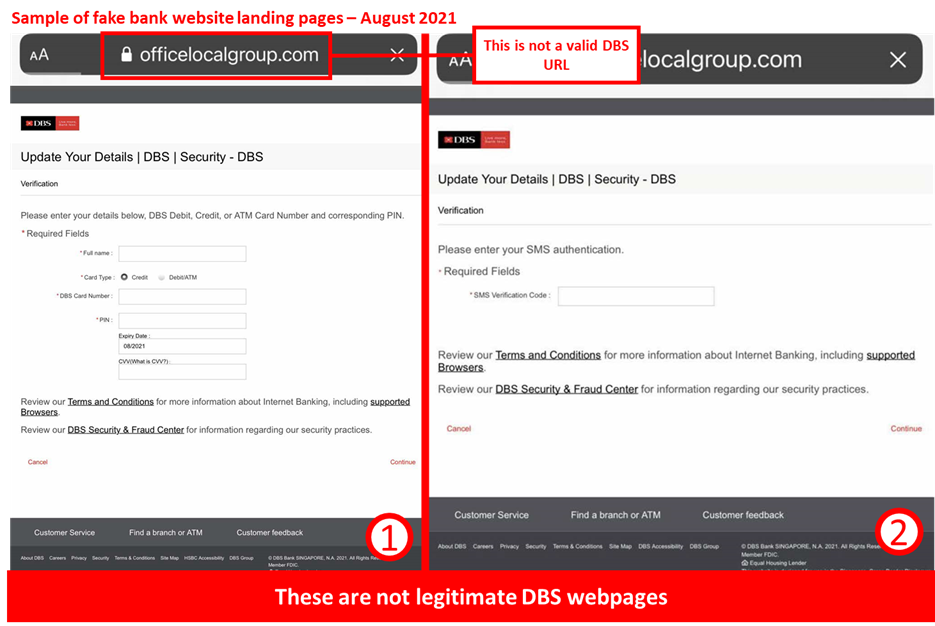

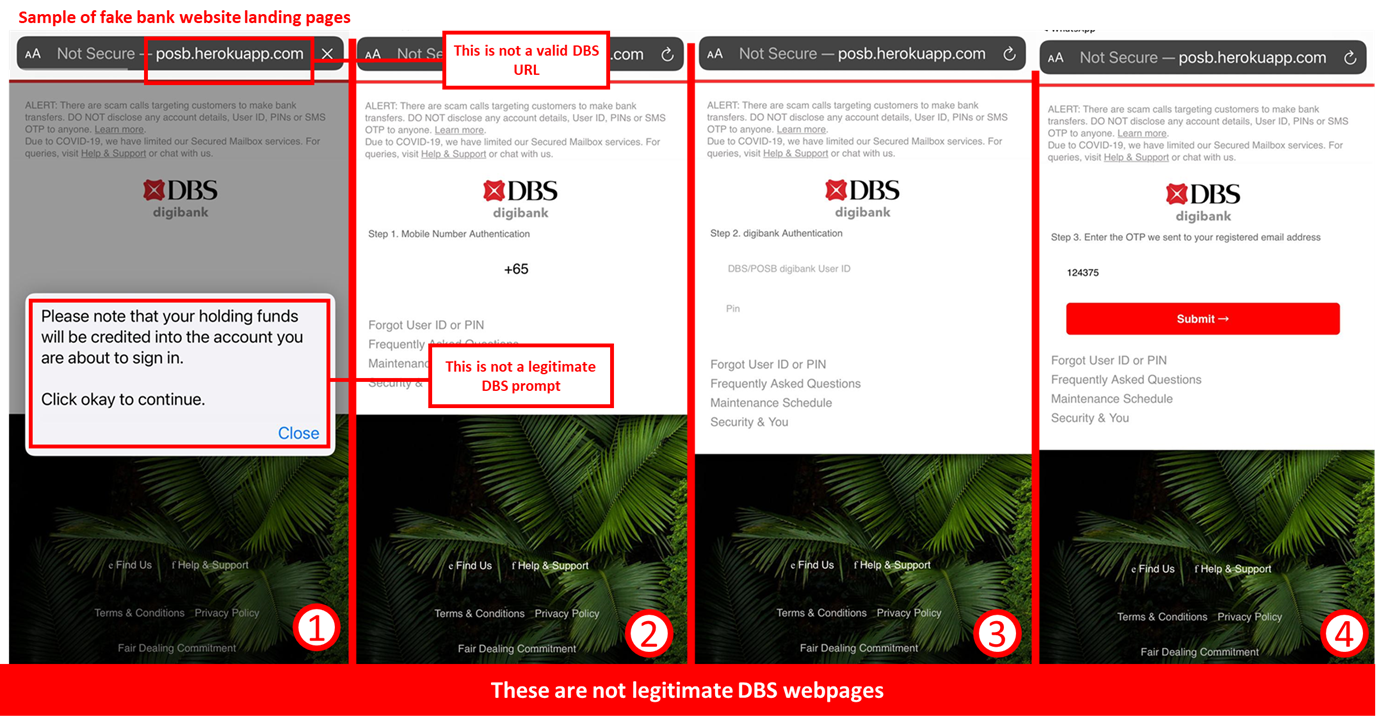

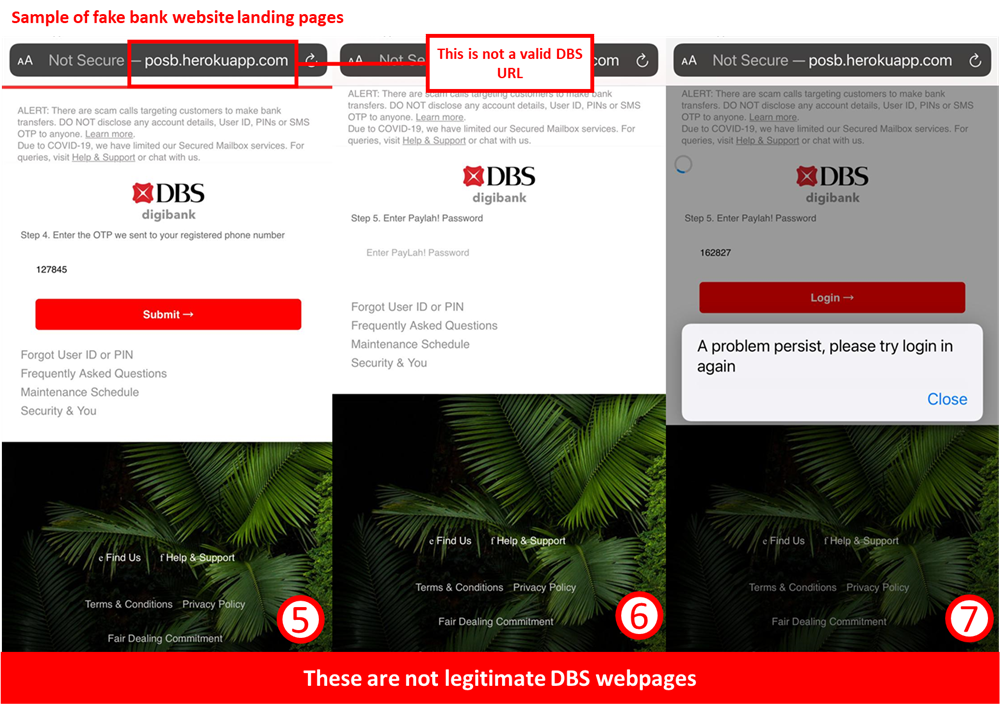

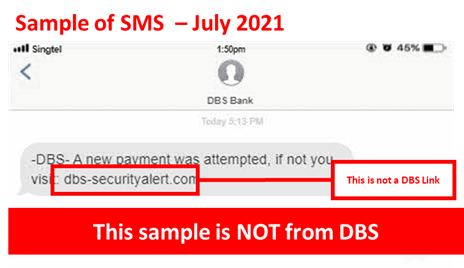

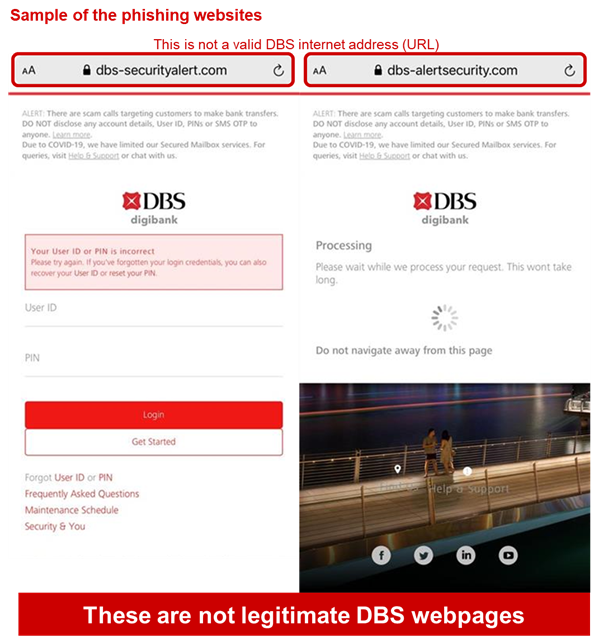

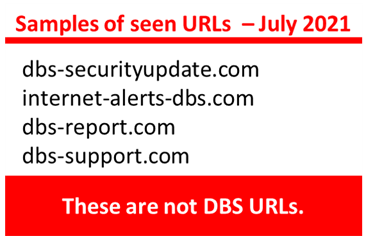

Phishing Alert

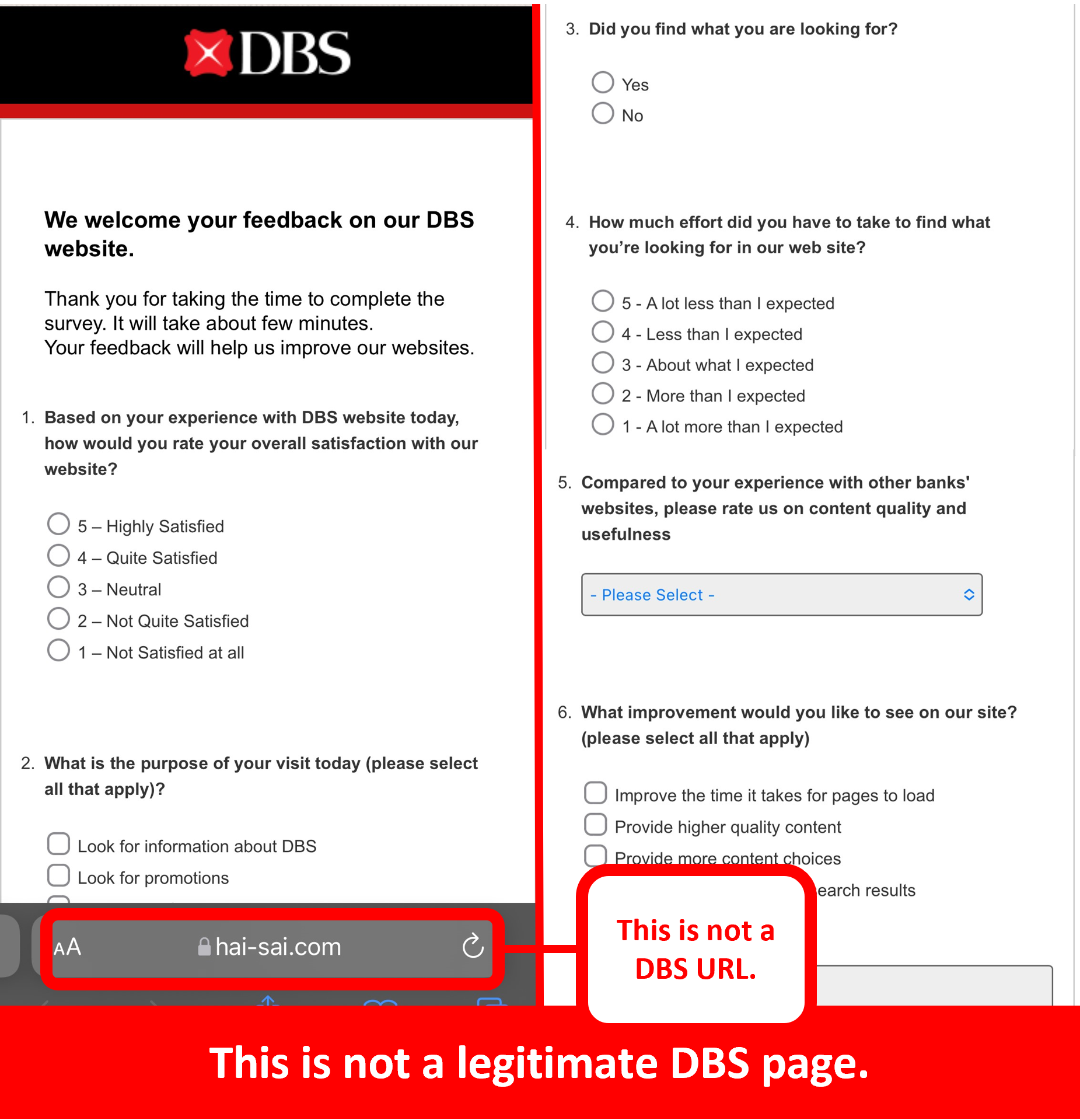

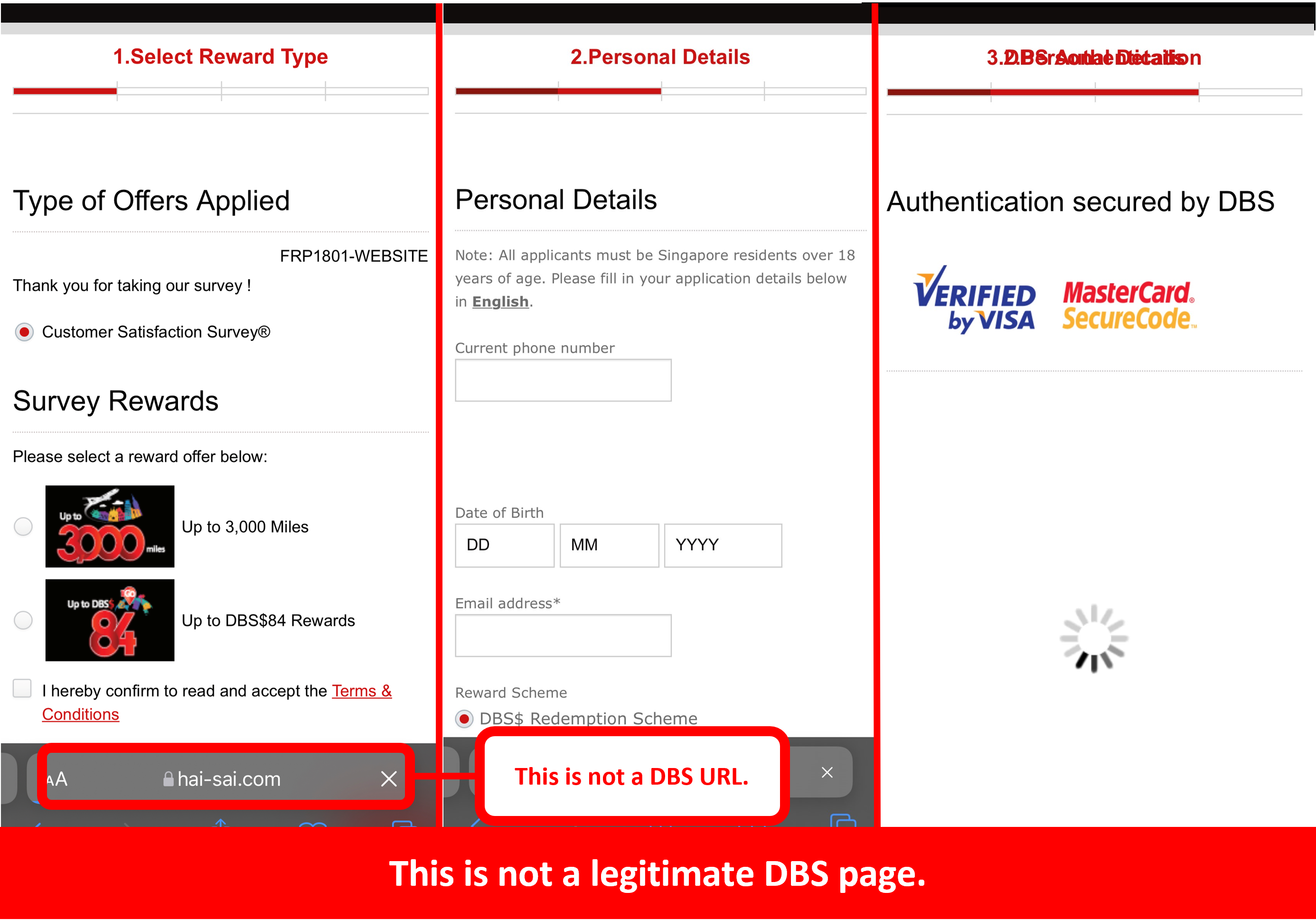

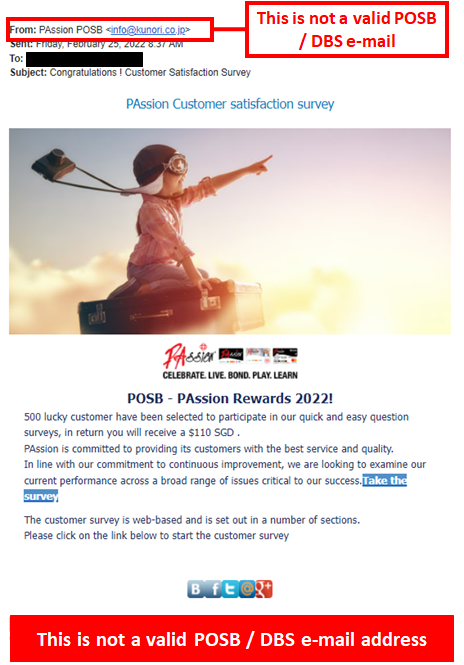

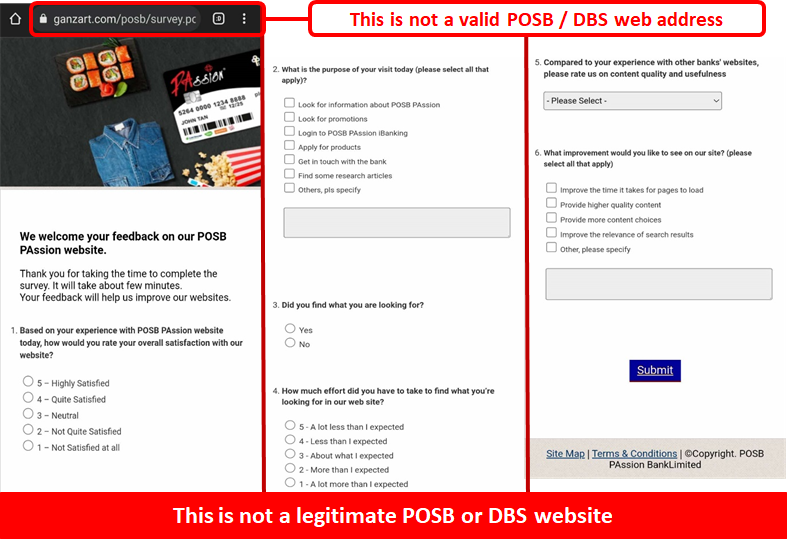

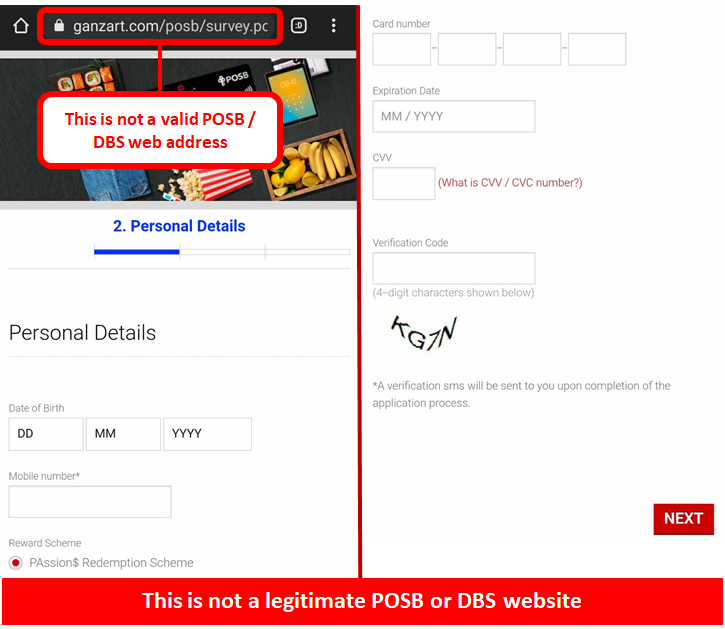

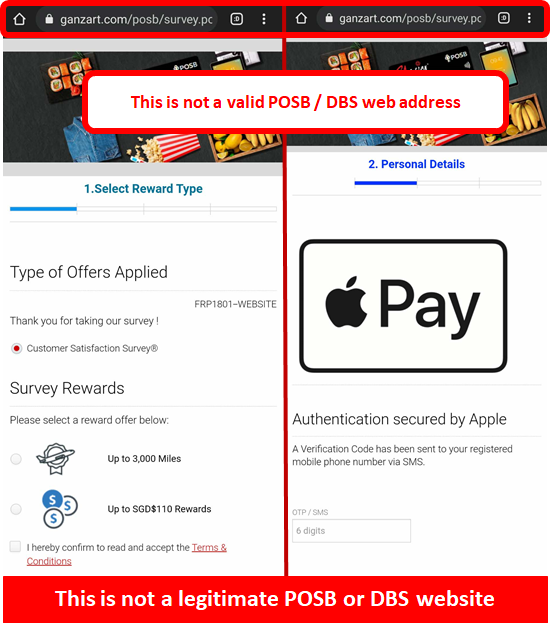

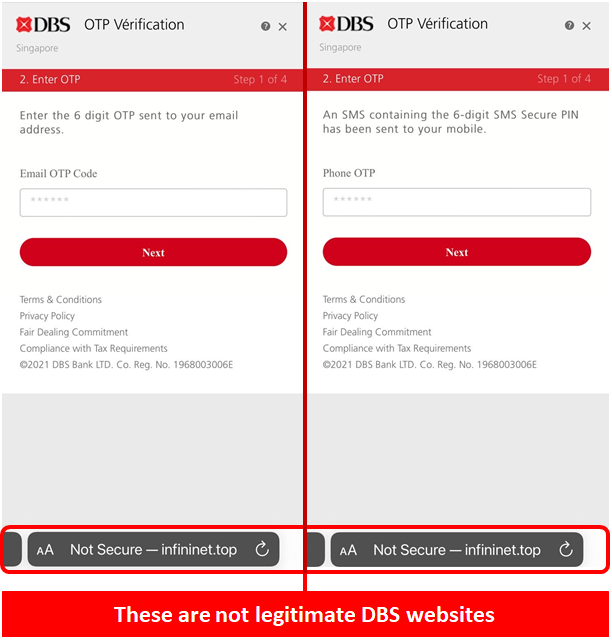

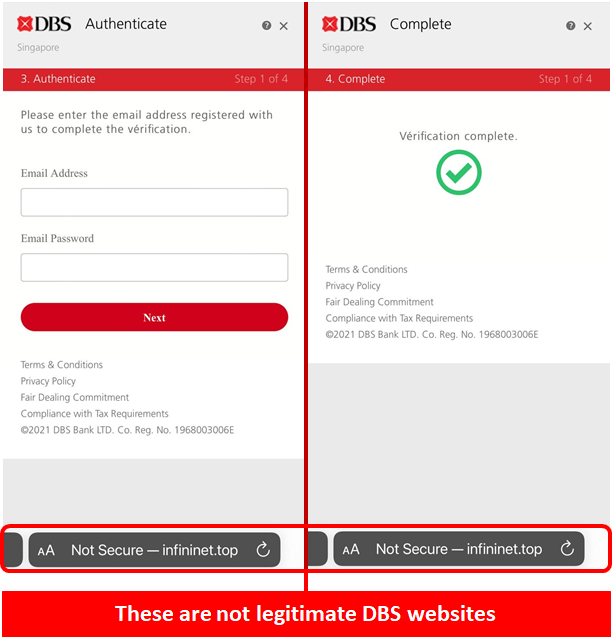

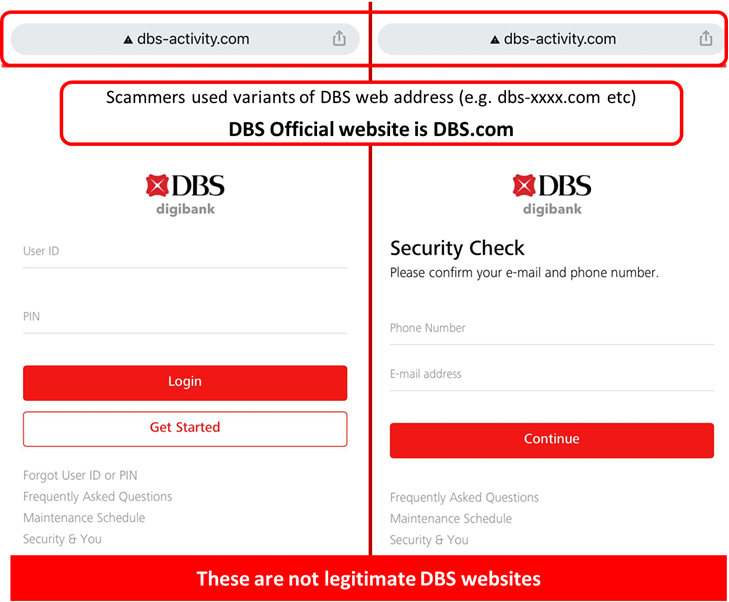

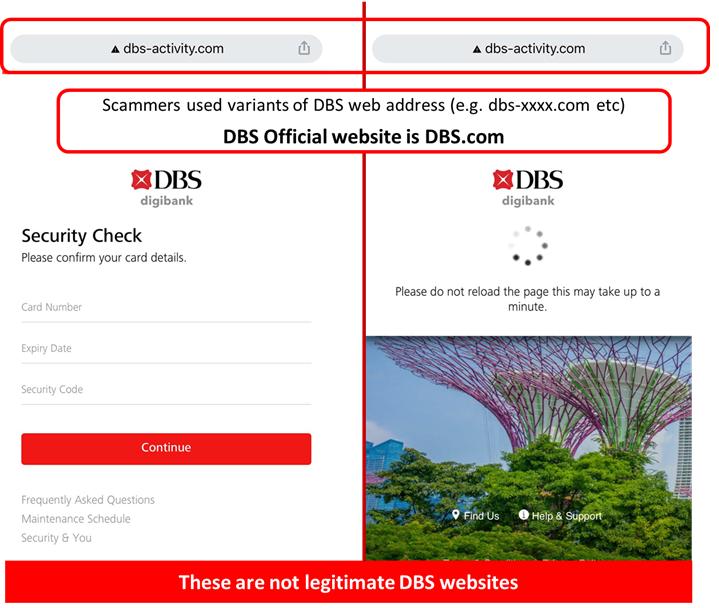

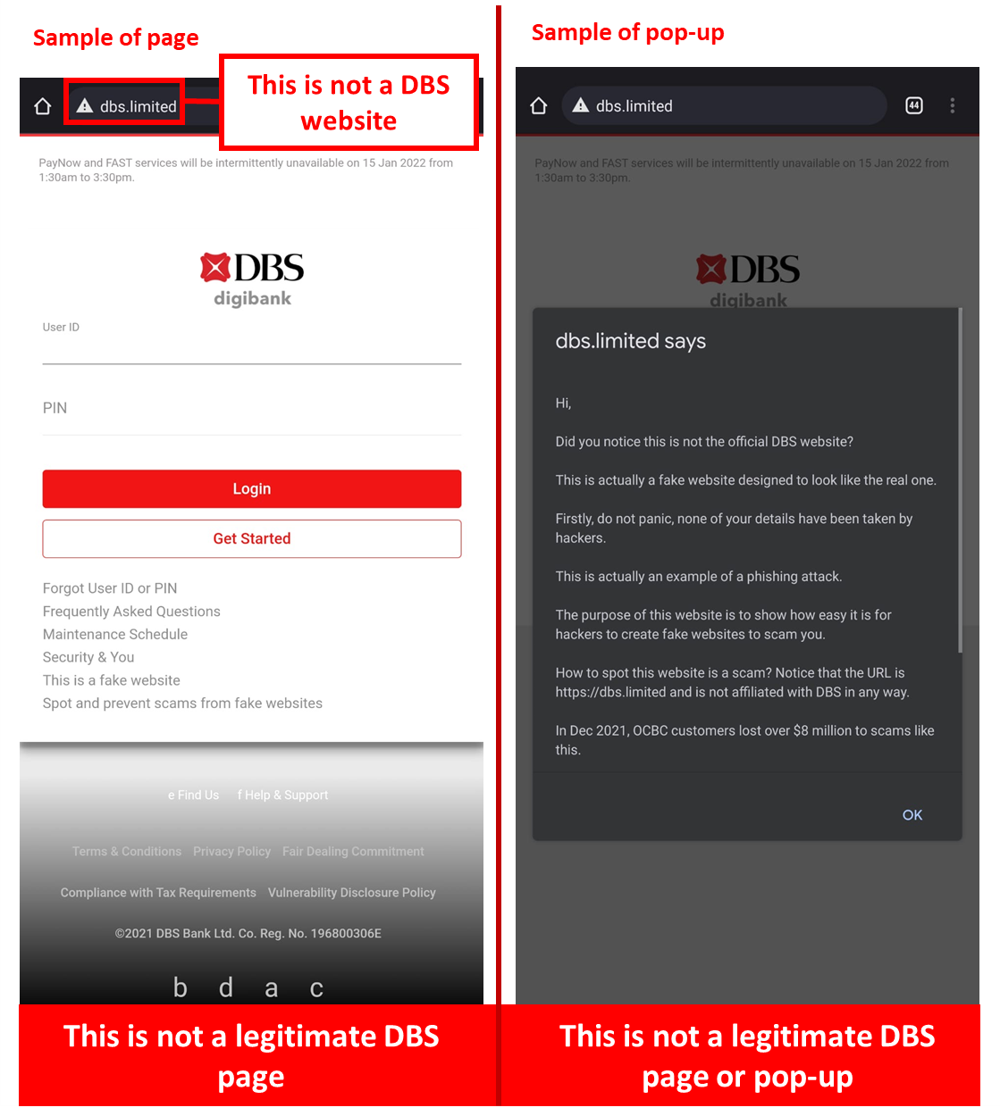

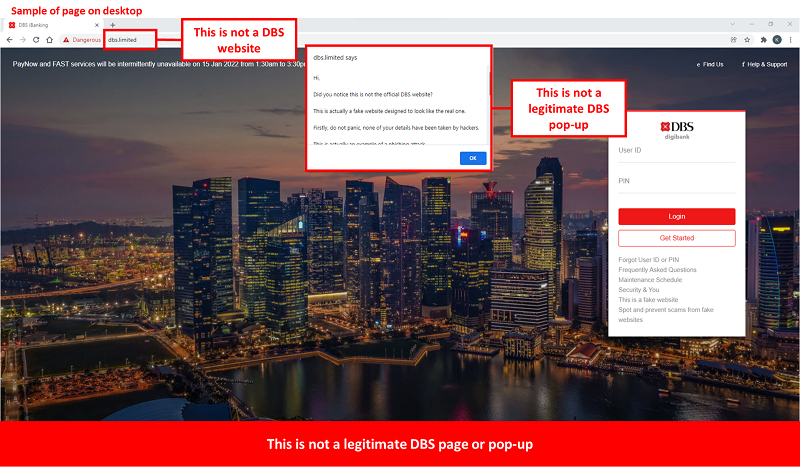

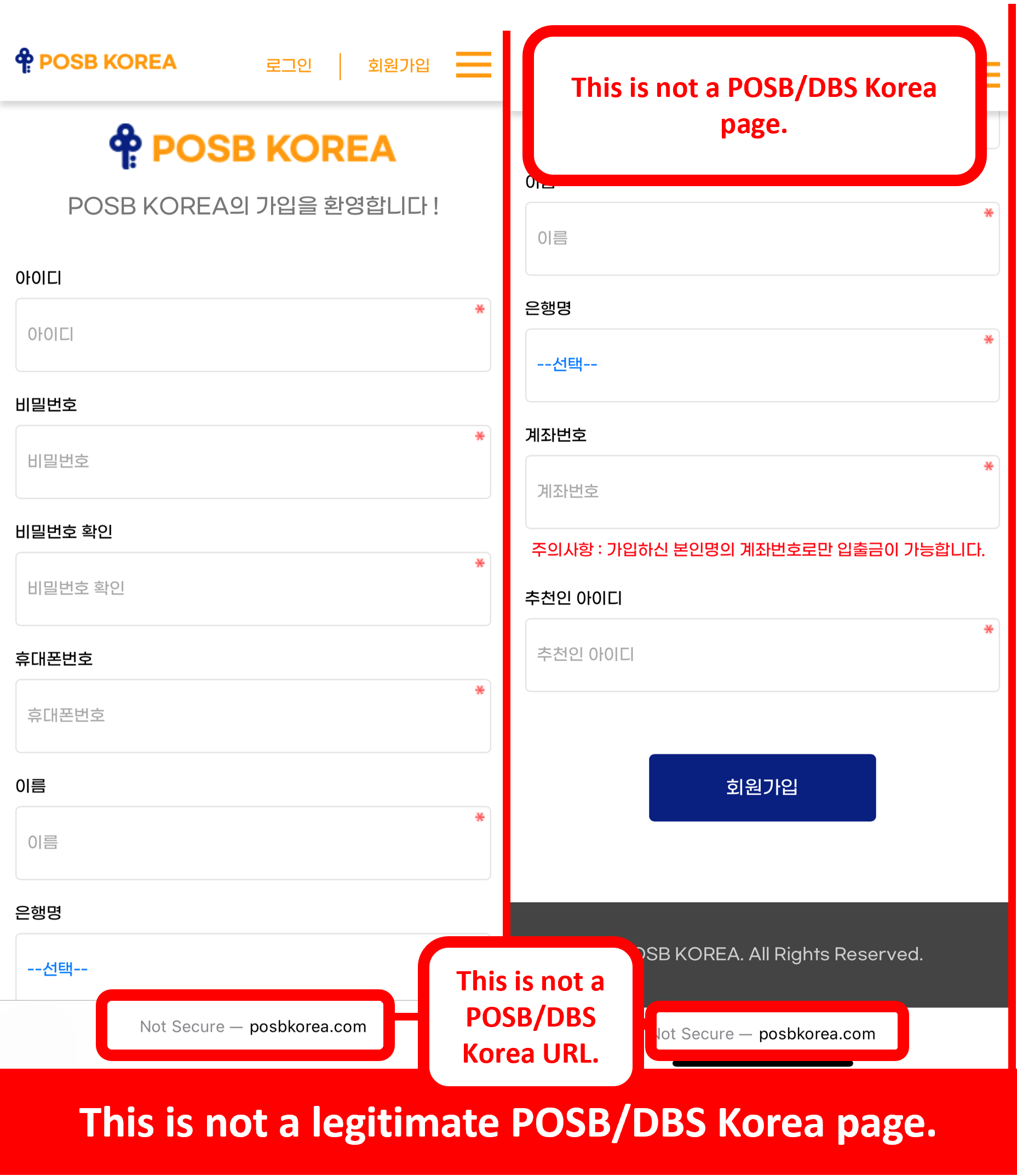

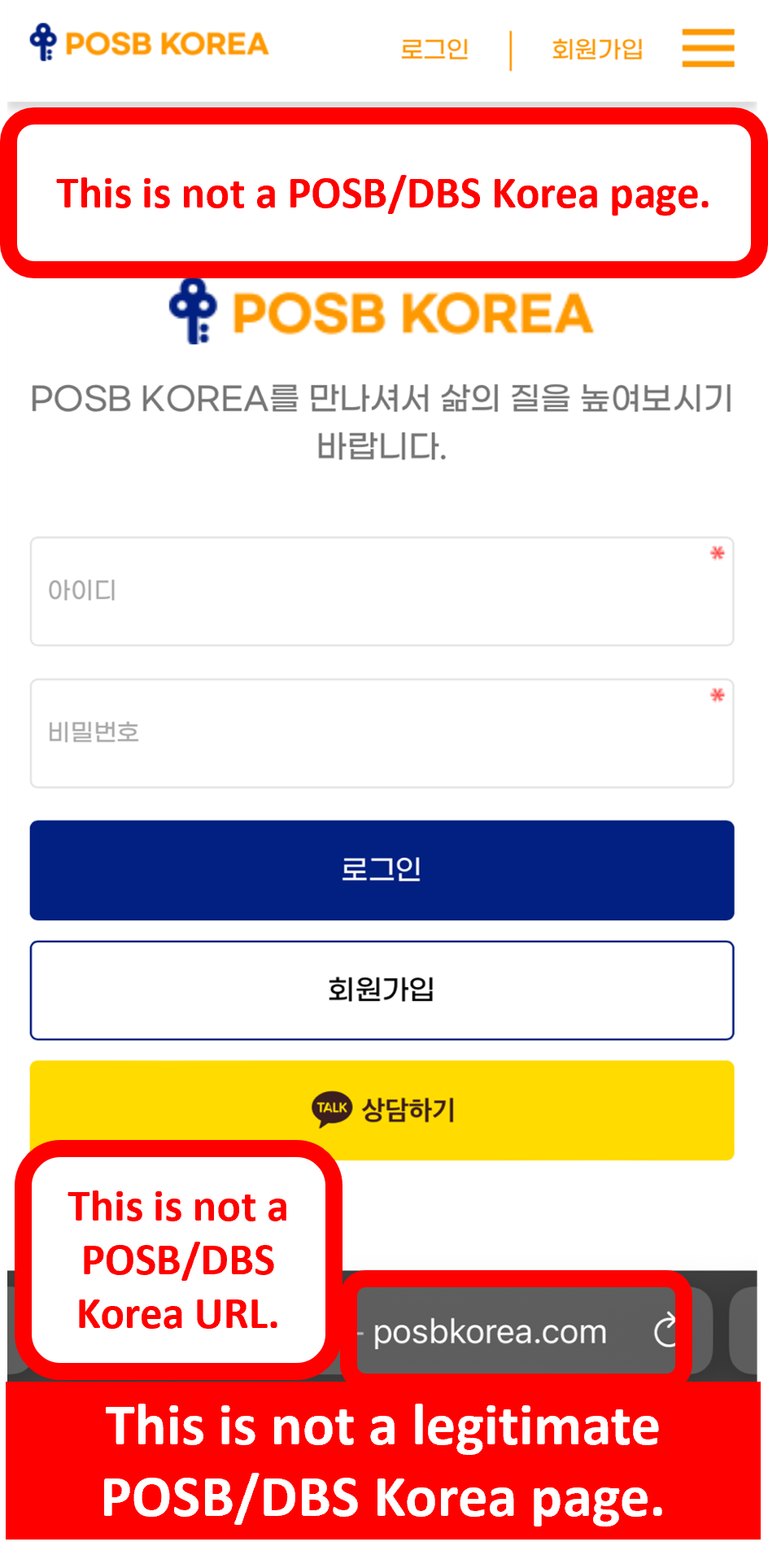

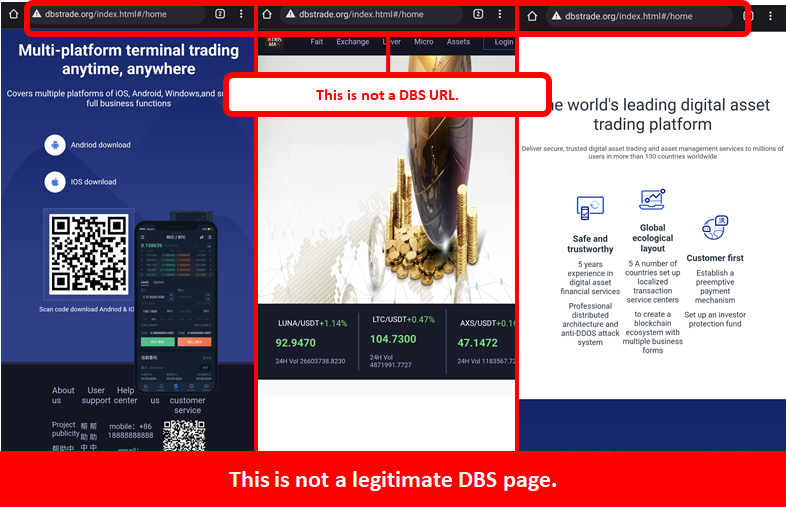

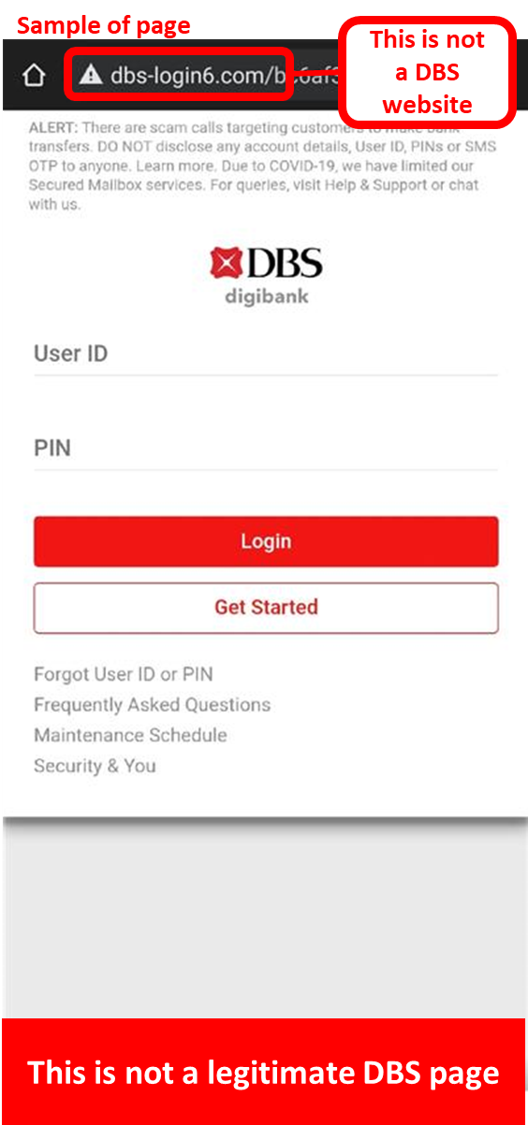

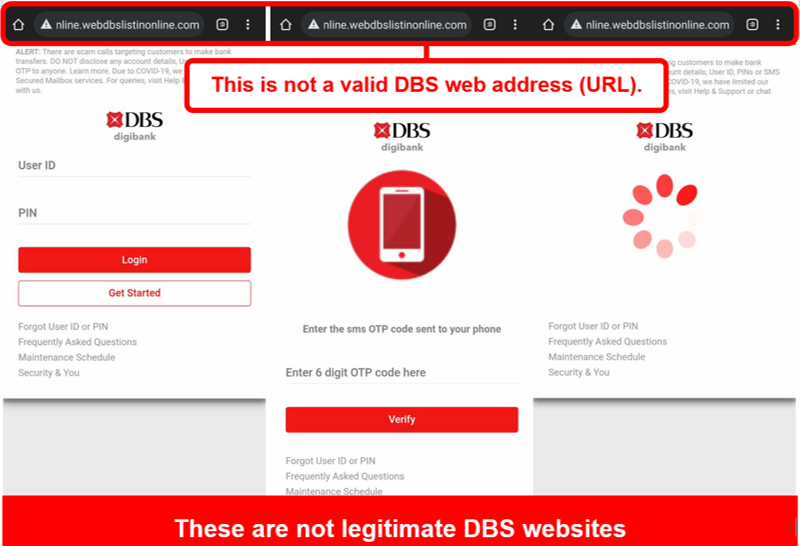

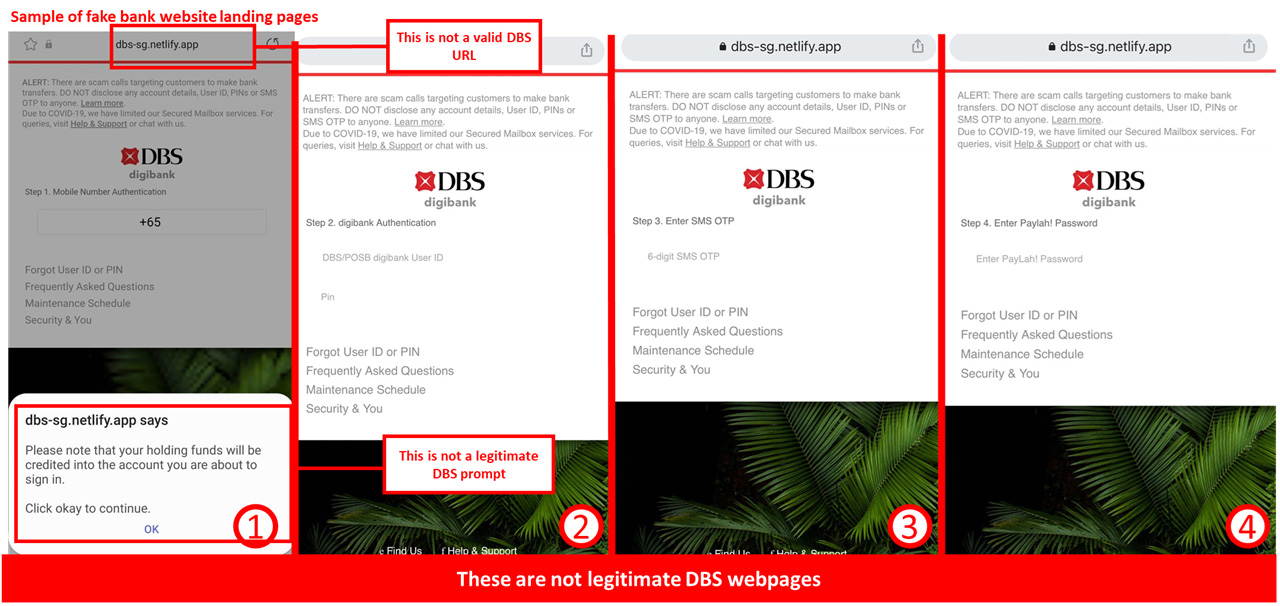

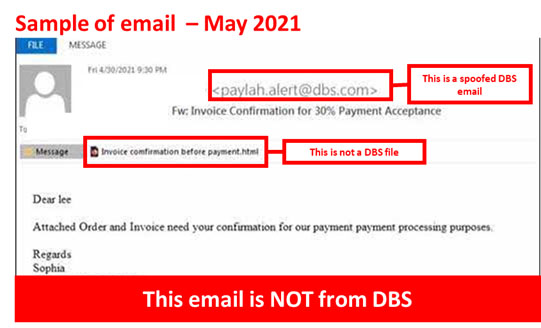

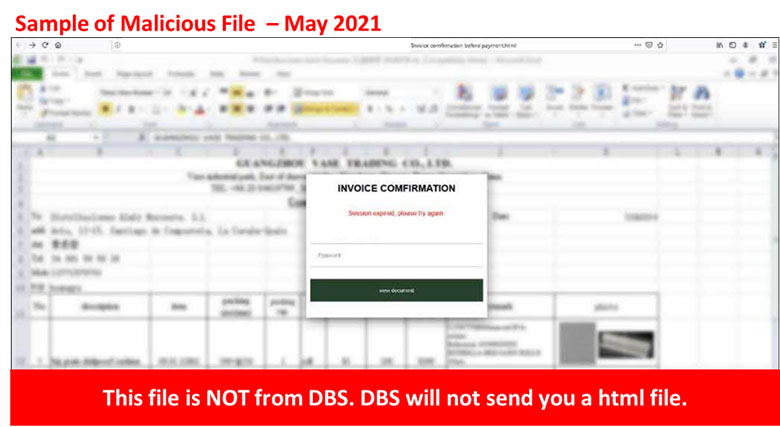

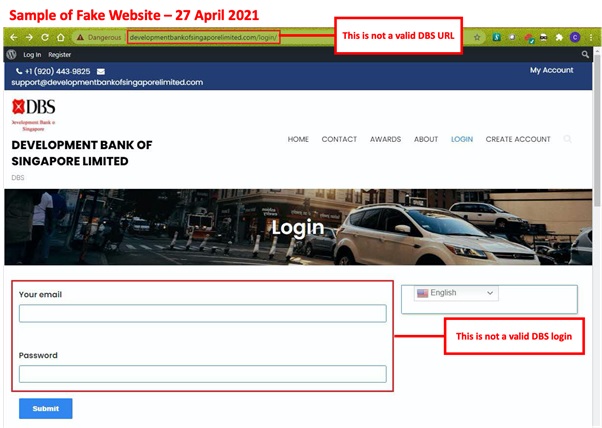

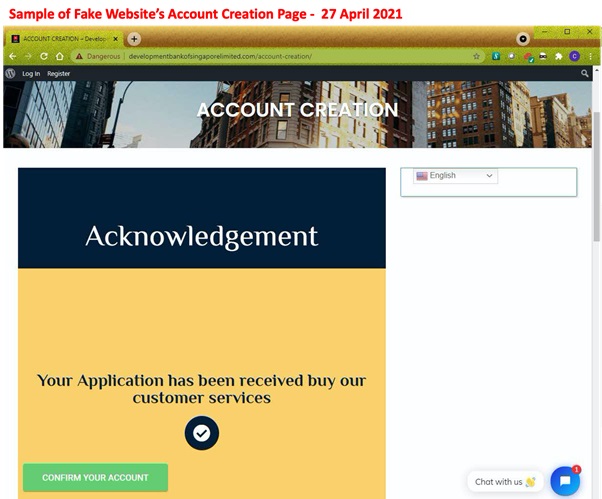

Scammers are targeting you through DBS-themed phishing websites to steal your personal information.

Date: 25 July 2024

What this scam looks like:

Scammers use phishing sites to impersonate DBS Bank. These phishing sites may imitate official DBS services, such as DBS iBanking, PayLah!, and DBS Digital Exchange.

These sites aim to steal your sensitive information or get you to transfer money or cyrptocurrency to a fake investment platform or the scammer' wallets.

Protect Yourself:

If it seems too good to be true, it's likely a scam.

- Always use DBS' official website and mobile apps to conduct DBS bank-related requests.

- Never provide your DBS card details, digibank credentials, OTPs, or Digital Token approvals to unverified sources.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any investment-related deals.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.pageIndia: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

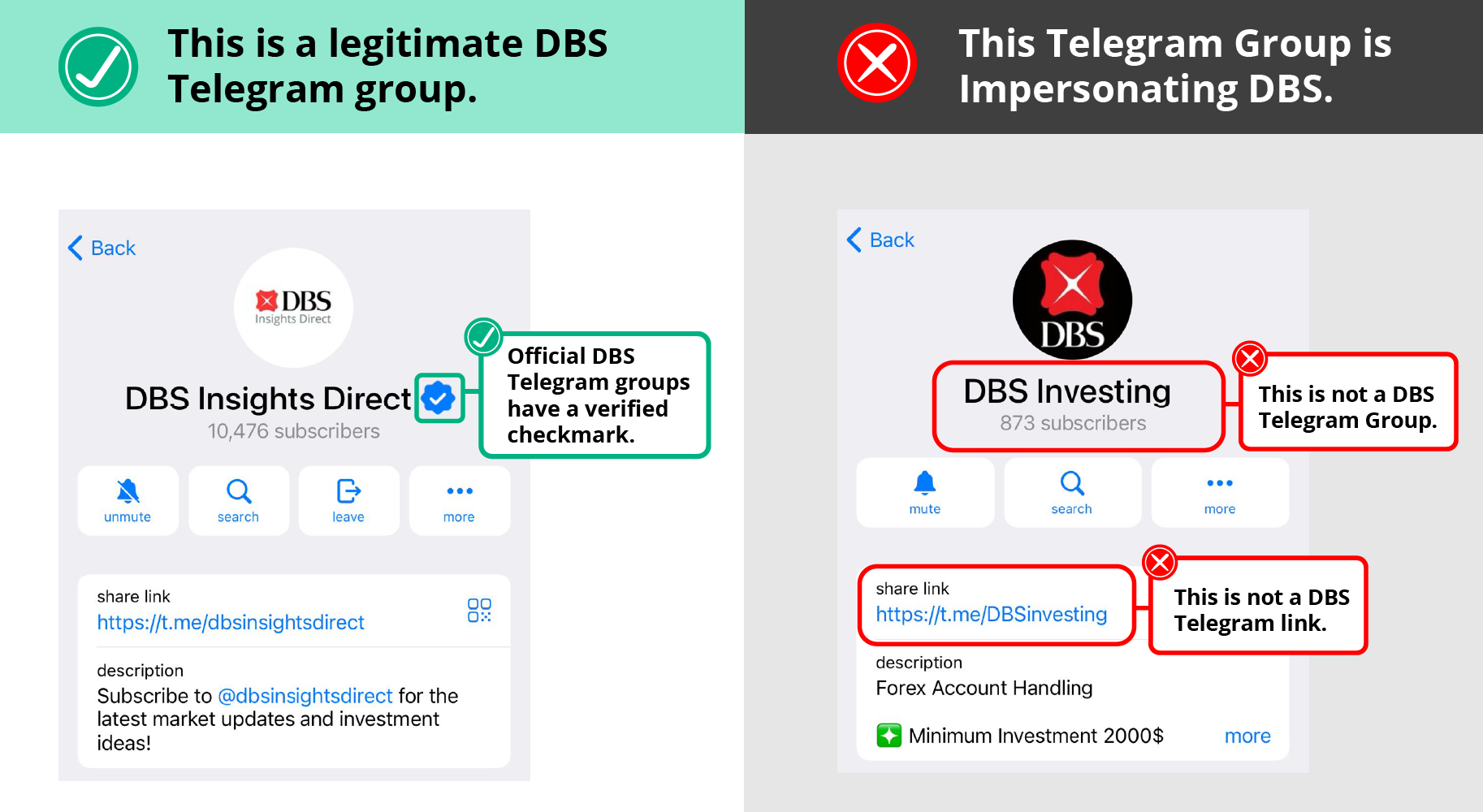

Impersonation Alert

Scammers are targeting you through Telegram groups to steal your money.

Date: 12 July 2024 (Updated on 17 July 2024)

What this scam looks like:

Scammers impersonate DBS through Telegram groups. These Telegram groups claim they're DBS investment or finance groups while mimicking DBS' branding and using fake members and messages appear legitimate.

Using your fear of missing out on a seemingly good deal, these scammers pressure you to invest without doing additional checks. If you fall victim to this scam, they will ask you to conduct a bank transfer to a fake investment platform or transfer cryptocurrency to the scammers' wallets.

Protect Yourself:

If it seems too good to be true, it's likely a scam.

- Look out for the official checkmark for DBS Telegram groups. These are the only official DBS Telegram groups.

- Ensure that you're using the official DBS app and websites.

- When in doubt, contact DBS Bank immediately.

- Always verify directly with DBS Bank for any investment-related deals.

Remember:

- DBS staff will never ask you for your login details, card information, OTPs, or Digital Token requests.

- Emails and SMSes from DBS will never include clickable links.

- Use DBS’ official digibank app regularly to verify that your Digital Token is tied to your approved device. When in doubt, contact DBS Bank immediately.

Contact us immediately if you suspect you're a victim of fraud.

Singapore: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: https://www.dbs.com.hk/personal/contact-us.pageIndia: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

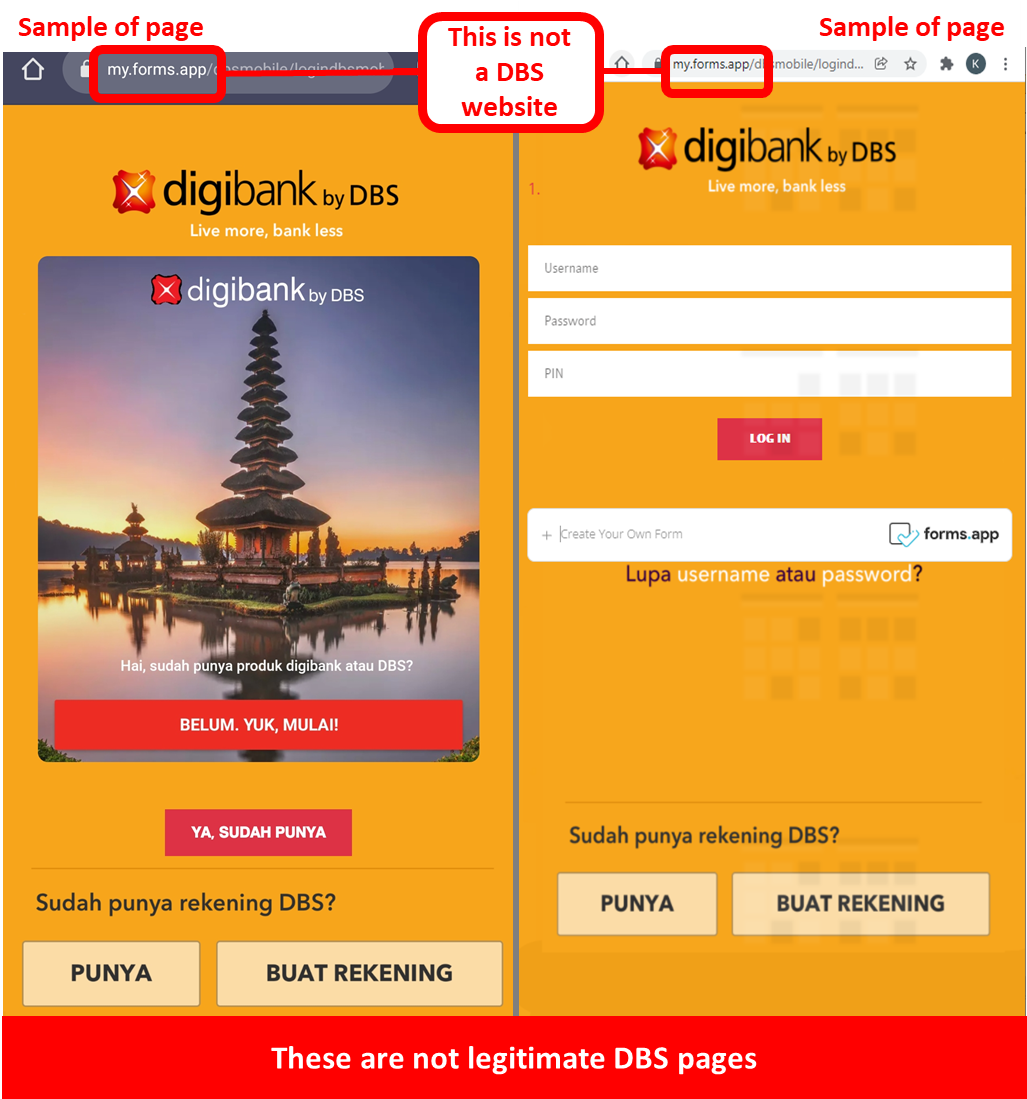

QR Phishing Alert

Date: 15 April 2024

Description: Be on the lookout for DBS-themed phishing emails and messages using QR codes. These emails may offer promotions or claiming there are unauthorised fund transfers or credit card payments on your account.

Scanning these QR codes leads to phishing websites designed to steal your sensitive information such as mobile number, DBS digibank or PayLah! login details, Digital Token approvals, or OTPs. Using your DBS digibank or PayLah! login details and SMS OTPs, the scammers will take over your account, steal your funds, or activate your DBS Digital Token or PayLah! account on their device.

Always verify directly with DBS Bank should you receive such emails or messages. Be wary of unverified QR codes and always check if the link in the QR by checking through a QR scanner that displays and asks for your permission before visiting a website.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

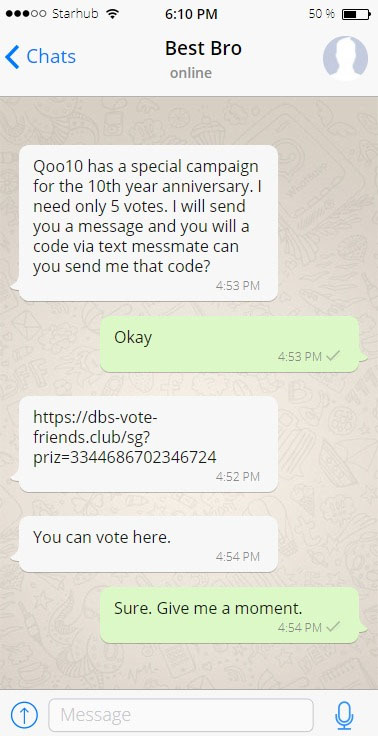

Voice Phishing Alert

Date: 12 April 2024

Description: Beware of scammers impersonating DBS Bank staff and government officials through voice phishing calls. These calls may claim there are unauthorised fund transfers or credit card payments on your account and seek your assistance in the investigation.

These scammers ask for sensitive information such as your personal details, DBS digibank credentials, OTPs, or ask you to transfer funds to their bank accounts.

To increase the believability of this scam, the scammers provide a case number or identification, such as photo of a staff pass. Victims of this scam are told not to divulge details of the investigation to anyone, including official bank staff.

Always verify directly with DBS Bank should you receive such calls. DBS and other governmental agencies will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Tech Support Scam Alert

Date: 06 March 2024

Description: Be vigilant against fraudulent tech support websites that impersonate reputable brands like Microsoft or Apple. These phishing sites often claim that your devices are infected with malware, is performing poorly or was used for illegal activities.

Victims are encouraged to install remote access software such as TeamViewer or AnyDesk or software embedded with malwares on the victims’ devices on the pretext of resolving the technical issue. Victims are coerced into accessing their bank accounts and granting controls of the victims’ devices to the scammers. This allows the scammers to take control of your bank accounts and make unauthorized fund transfer from your accounts.

Always verify the contact information on the Brand’s official website and check that you are accessing the Brand’s official website. Do not install any software when asked by unverified sources and never login to your bank account during a remote access session even if the DBS staff or a government official.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

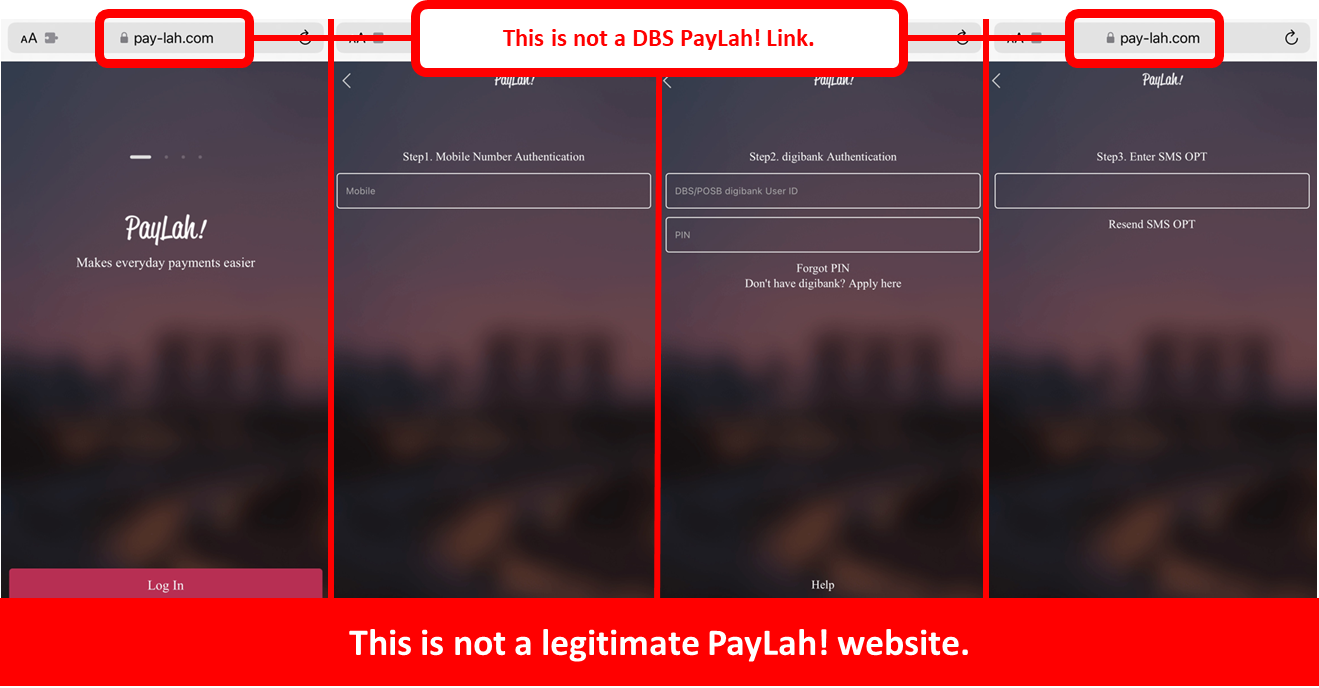

Ride for Free DBS Promotion Phishing Alert

Date: 05 March 2024

Description: Be on the lookout for phishing SMSes impersonating DBS' Ride for Free promotion. These phishing SMSes include a link to a phishing website to steal your sensitive information such as such your mobile number, login details, and SMS OTPs.

Using your Paylah! or DBS digibank login credentials and SMS OTPs, scammers will take over your account, steal your funds, or activate your PayLah! account or DBS Digital Token on their device.

PayLah! is a mobile app and cannot be accessed through a website. Always check that you're visiting https://www.dbs.com or use our official mobile apps to log-in or check for offers.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Social Media Ads Phishing Alert

Date: 1 March 2024

Description: Be on the lookout for investment-themed phishing ads on social media. These ads may use well-known figures such as politicians and industry leaders to catch your attention. These ads contain links to phishing websites and ask for your sensitive personal information.

Scammers could use your information to seem more legitimate and trick you into making unwanted fund transfers, credit card purchases, or steal your banking login details.

Always check that you're visiting https://www.dbs.com or use our official mobile apps to log-in or check for offers. It's better to be safe than sorry, so take the time to keep your personal information and finances safe.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Mobile Malware Advisory for iOS users

Date: 16 February 2024

Description: Beware of scammers specifically targeting Apple iPhone and iPad users using mobile malware. This malware is designed to collect sensitive information (e.g. facial recognition data, identity documents etc) and intercept SMS messages. Scammers make use of this facial data, combined with ID documents and the ability to intercept SMS, to gain unauthorized access to the victim’s banking account.

The scammers distribute this malware via TestFlight, Apple’s mobile application testing platform, or social engineer potential victims to install a Mobile Device Management Profile (MDM) which would allow the scammer complete control over the victim’s device and access to the victim’s banking account for unauthorized banking transactions.

Some signs of infection to look out for includes:

- Battery drain. Excessive battery drain could be a sign that malware running in the background.

- Increased data usage. Malware consumes data and changes to your data usage could be a sign.

- Unfamiliar apps or app permissions. Malware may install new apps, disguise themselves as new apps, or enable more permissions than necessary.

- Slow device performance or overheating. All apps use system resources, but a slower and hotter device could be a sign of malware.

- Strange behavior, such as calls or messages you didn't make. If your device is making calls or sending messages without your permission, it's a red flag for malware.

- Suspicious or unfamiliar MDM profiles. The MDM profiles listed at Settings > General > VPN & Device Management does not look familiar or even suspicious.

If you suspect that your device is infected by malware, do this immediately:

- Turn on airplane mode on your phone or turn off your phone.

- Call DBS immediately so we may help you.

- Check and remove any suspicious MDM profiles by going to General > Settings > VPN & Device Management.

- Verify that apps only have permissions that they should.

To Protect Yourself:

- Only download mobile apps from official app stores like Google Play Store and Apple App Store.

- Official app stores have security measures to minimize your risk of installing a malicious app. However, always check the reviews and ratings of apps to ensure their trustworthiness. Never sideload apps from third-party websites, emails, SMSes, or social media. Be wary of MDM profiles and TestFlight application installations from unknown parties.

- Pay attention to the permissions an app asks for and use a reputable mobile security software.

- Think twice if an app requests accessibility permissions, full control over your device, or access to sensitive information like SMS and emails. These requests are often red flags for malicious activities. Consider using reputable mobile security software to detect and block any malicious apps or alert you to potential risks.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Voice and Postal Mail Phishing Alert

Date: 30 January 2024

Description: Beware of scammers impersonating DBS Bank staff through voice phishing calls. These voice phishing calls may offer loans, investment services or various bank products at attractive rates. These scammers will solicit sensitive information such as your home address, mobile number, DBS digibank login credentials and OTPs.

These scammers may also send you postal mail impersonating DBS Bank. These letters mimic DBS' branding and letterhead, often resembling confidentiality agreements, forged bank statements, or other official documentation.

Stay vigilant and refrain from sharing personal information with unsolicited contacts to safeguard yourself against potential fraud.

If you give these scammers your Paylah! or DBS digibank login credentials and SMS OTPs, scammers may be able to access your account, steal your funds, or activate your DBS Digital Token on their device. Should these scammers activate the stolen DBS Digital Token on their device, they will gain full control of your DBS digibank account and conduct fund transfers without your permission.

If you have provided your Username and PIN code to anyone, including non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- When in doubt, contact DBS Bank immediately.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

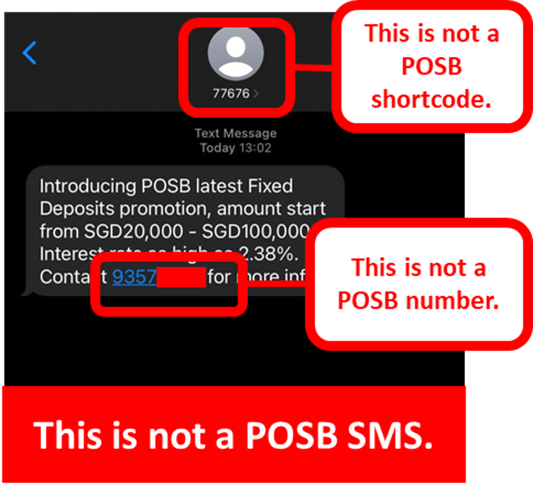

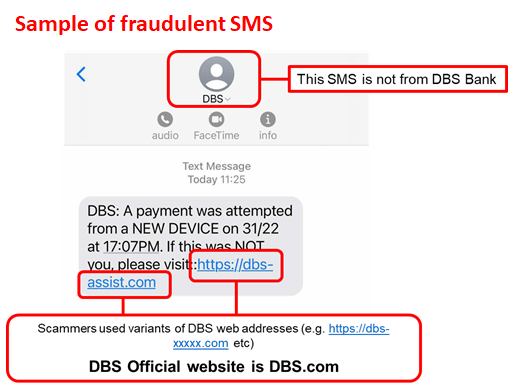

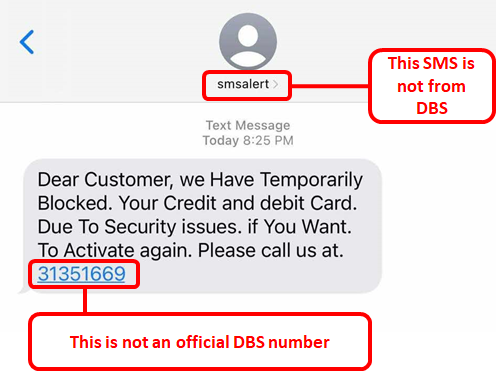

SMS Phishing Alert

Date: 14 January 2024

Description: Beware of scammers using Paylah! themed phishing SMS messages to steal your DBS login credentials and OTPs. These SMS claim there are unauthorised login attempts or transactions and provide a link to a PayLah! phishing website. These phishing websites will ask for your mobile number, DBS digibank login credentials and OTPs.

Using your Paylah! or DBS digibank login credentials and SMS OTPs, scammers may be able to access your account, steal your funds, or activate your DBS Digital Token on their device. If these scammers activate the stolen DBS Digital Token on their device, they will gain full control of your DBS digibank account and conduct fund transfers without your permissions.

SMSes from DBS Bank will never include clickable links. Always verify the authenticity of the websites and never provide your details such as your login credentials or PINs on these sites.

If you have provided your Username and PIN code to any non-DBS websites or mobile applications,

- Make use of our Safety Switch allows you to block access to your funds immediately (https://www.dbs.com.sg/personal/support/bank-ssb-safety-switch.html)

- change your PIN code immediately (https://www.dbs.com.sg/personal/support/bank-ibanking-reset-pin.html)

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

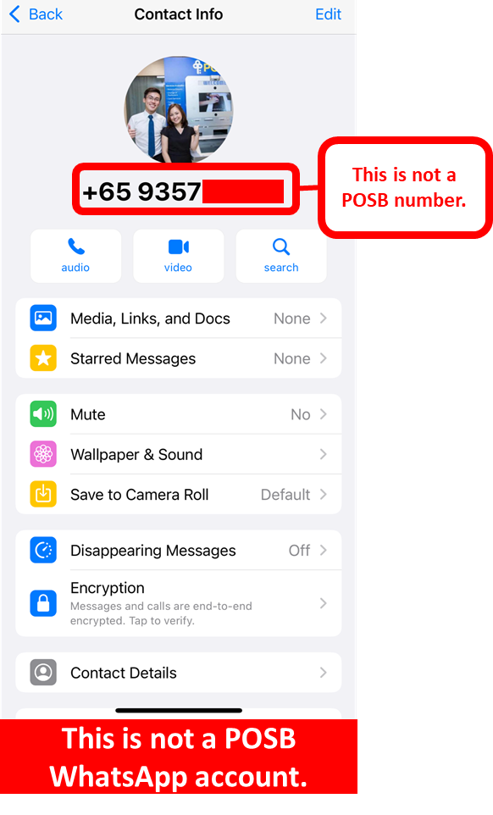

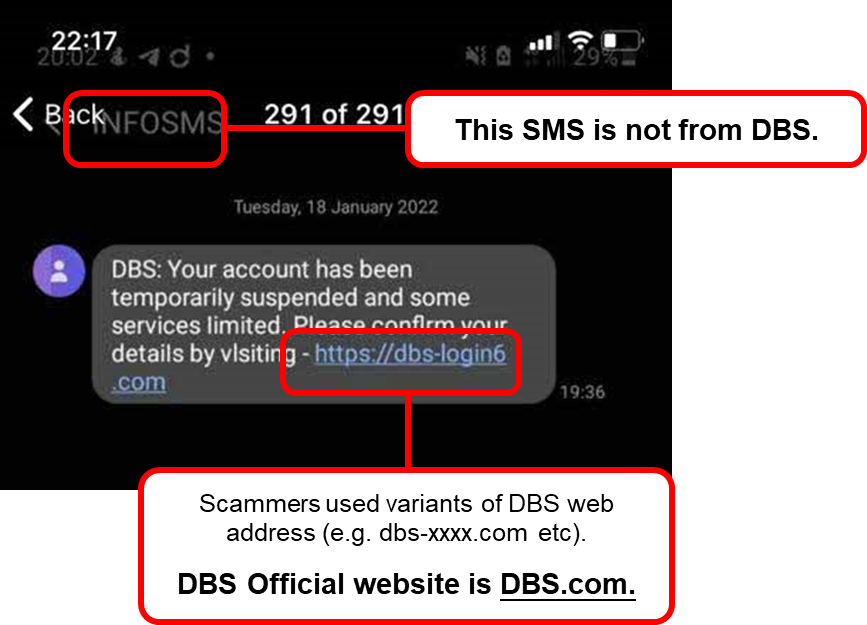

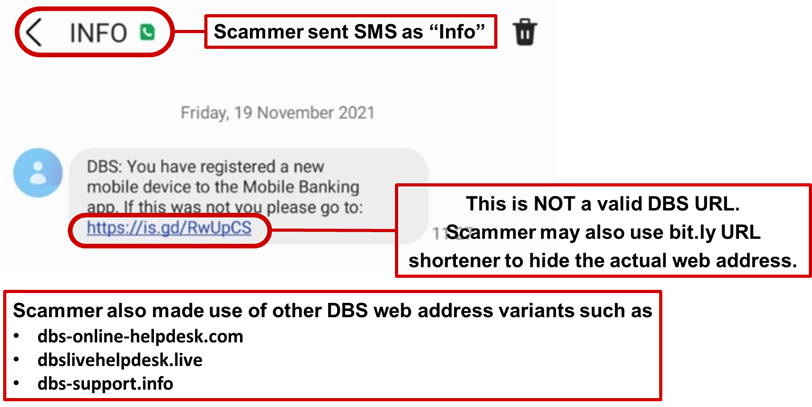

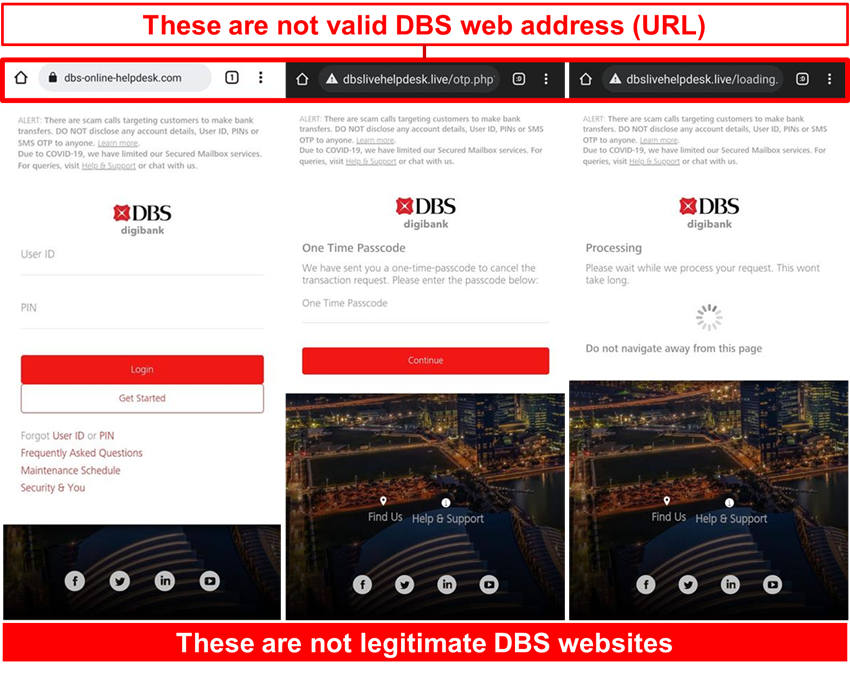

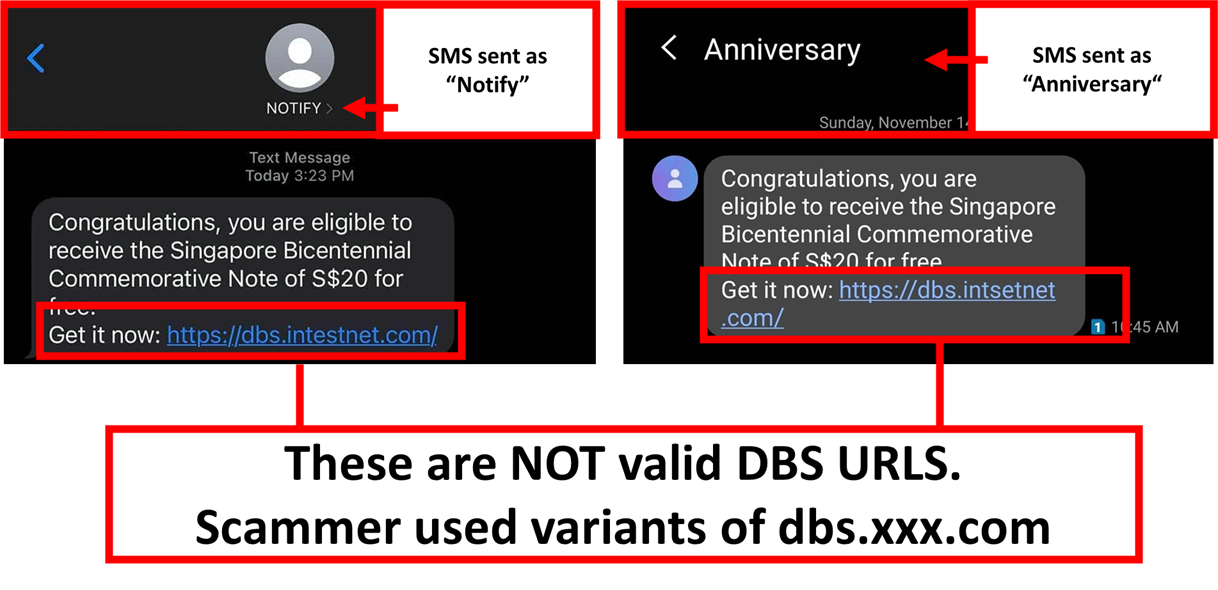

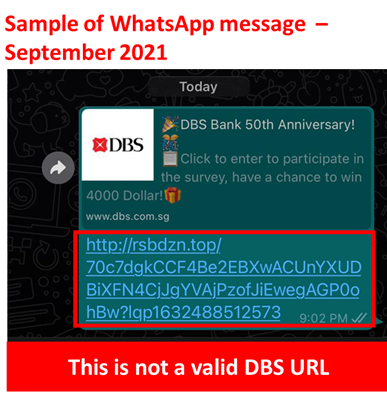

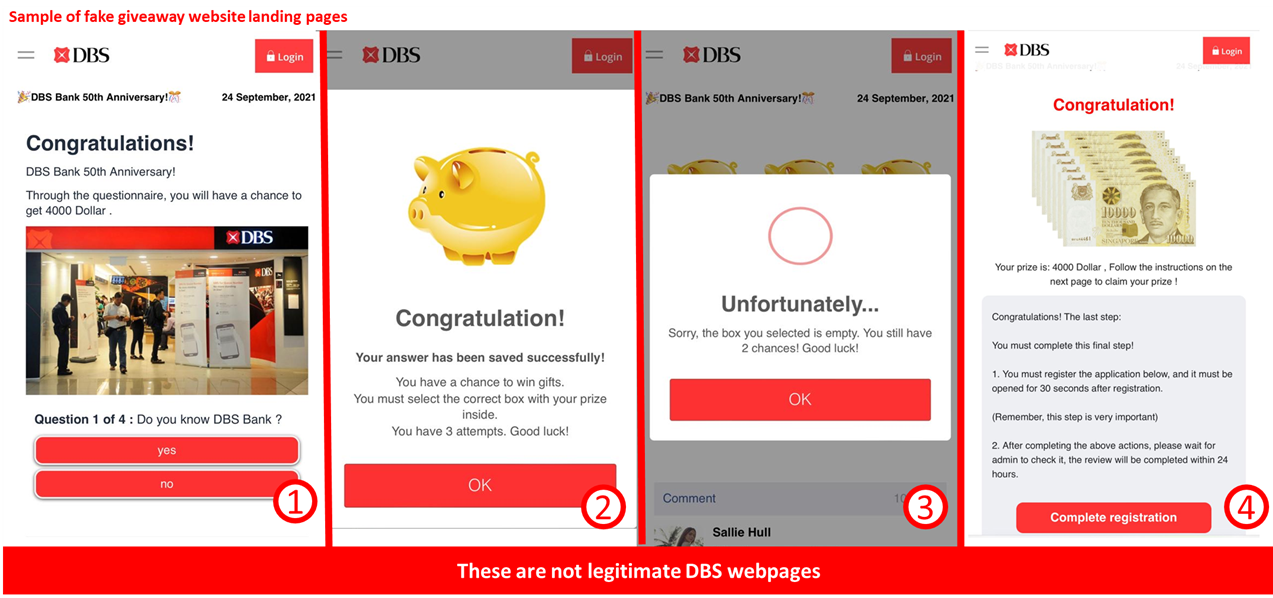

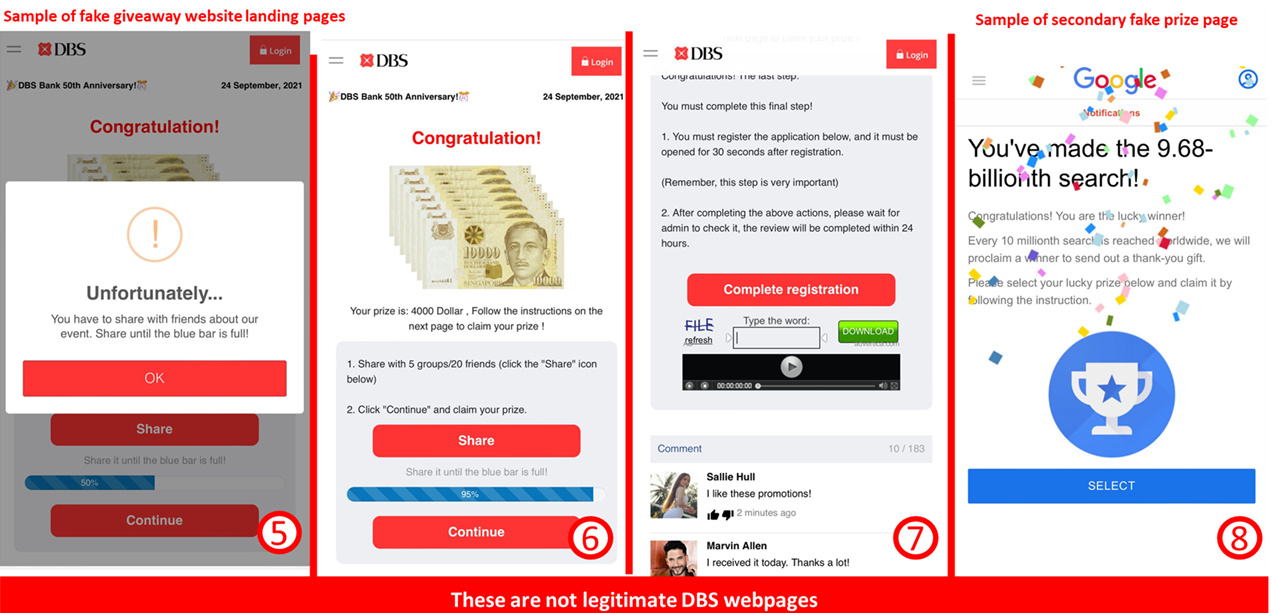

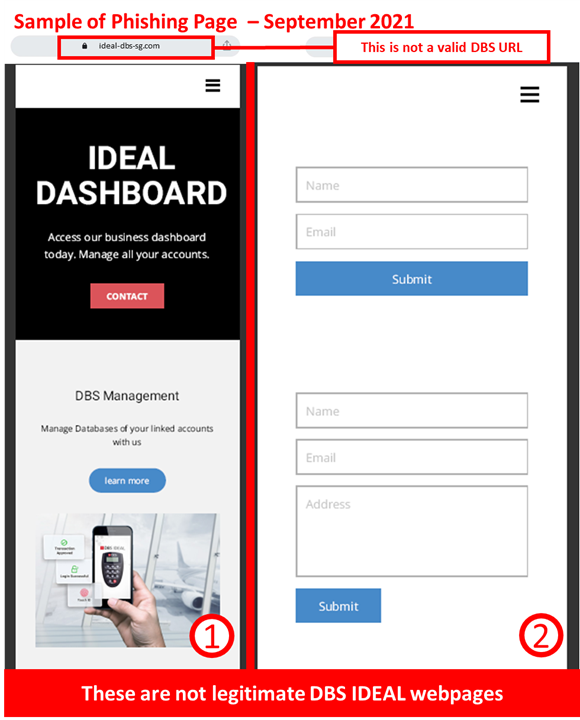

SMS Phishing Alert

Date: 06 January 2023

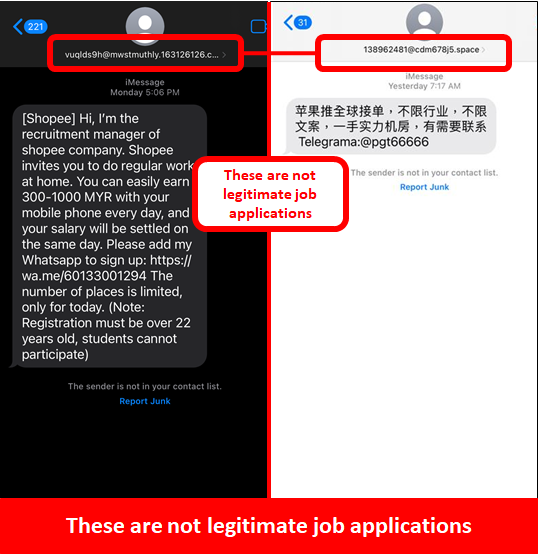

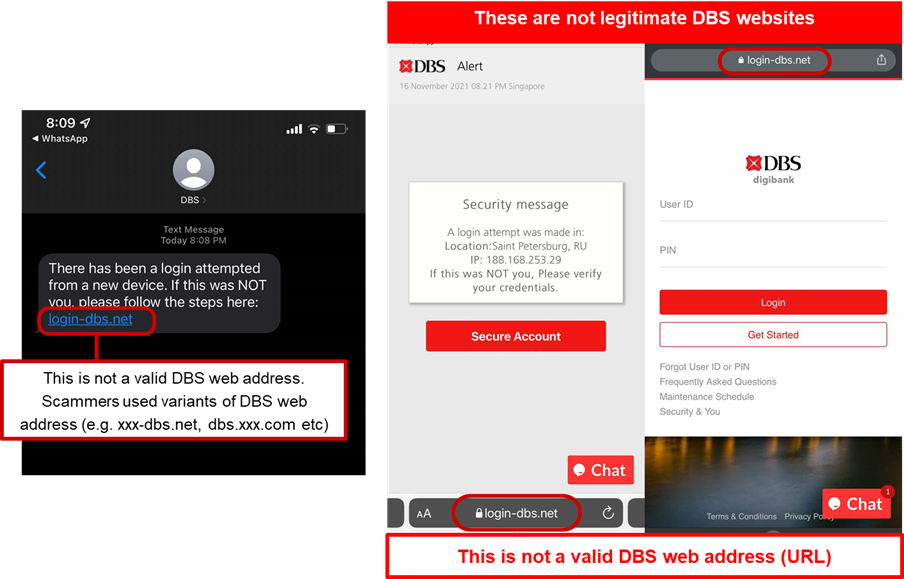

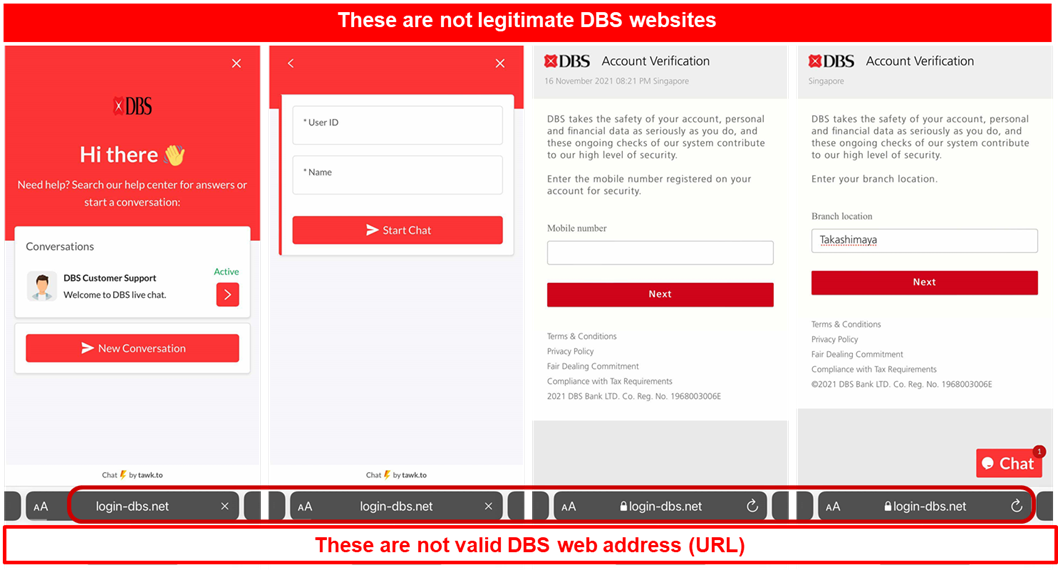

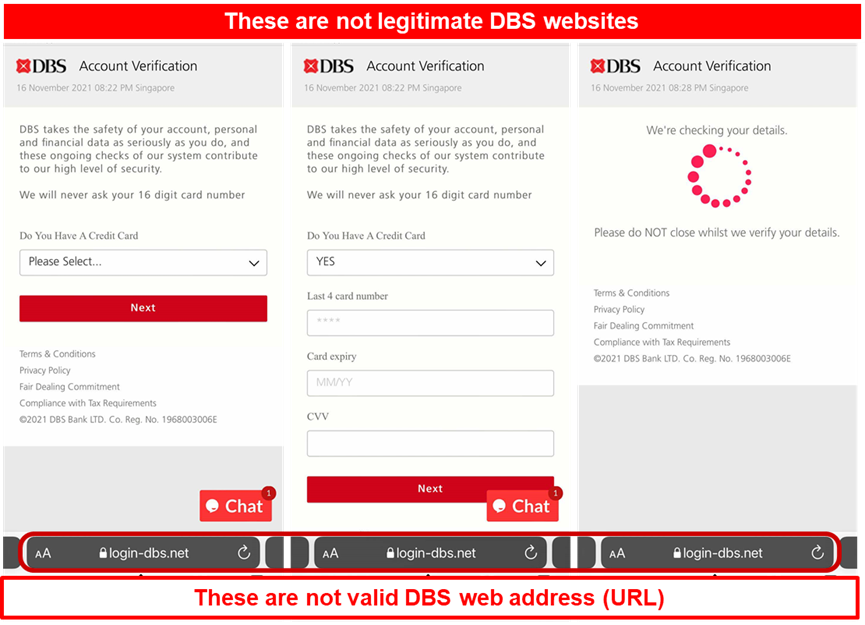

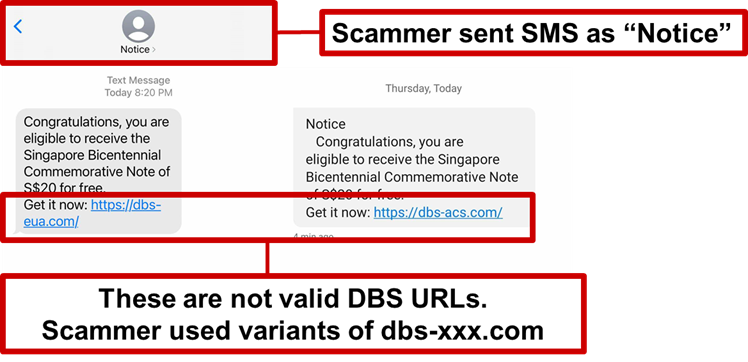

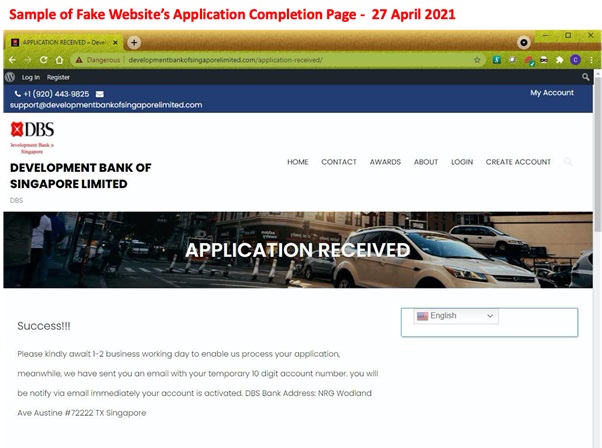

Description: Beware of scammers impersonating DBS bank staff through SMS and WhatsApp messages. These SMS and WhatsApp messages may claim there are unauthorised login attempts or transactions and provide a link to DBS Bank or PayLah! phishing website. These phishing websites will ask for your mobile number, DBS digibank login credentials and SMS OTP.

These scammers may also send you WhatsApp messages claiming to be bank officers. These scammers would impersonate bank security department officers and provide forged bank statements displaying unauthorised transactions made in your e-wallets.

Using your DBS digibank login credentials and SMS OTPs, scammers may be able to access your account, steal your funds, or activate your DBS Digital Token on their device. If these scammers activate the stolen DBS Digital Token on their device, they will gain full control of your DBS digibank account and conduct fund transfers without your permissions.

Always verify the authenticity of the websites and never provide your details such as your login credentials or PINs on these sites. These scammers will make use of your information to access and make unauthorized transactions on your cards or Bank account.

If you have provided your Username and PIN code to any non-DBS websites or mobile applications, please change your PIN code immediately.

You may do so by following the instructions here.

Learn more about this scam at this Singapore Police Force advisory.Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

PayLah! Phishing Alert

Date: 18 December 2023

Description: Beware of scammers using PayLah!-themed SMS messages and phishing websites to steal your DBS login credentials and OTPs. These SMS messages may claim that a payment has been made and provide a link to a PayLah! phishing website. These phishing websites will ask for your mobile number, DBS digibank login credentials and SMS OTP.

Using your DBS digibank login credentials and SMS OTPs, scammers may be able to access your account, steal your funds, or activate your DBS Digital Token on their device. If these scammers activate the stolen DBS Digital Token on their device, they will gain full control of your DBS digibank account and conduct fund transfers without your permissions.

Always verify the authenticity of the websites and never provide your details such as your login credentials or PINs on these sites. These scammers will make use of your information to access and make unauthorized transactions on your cards or Bank account.

If you have provided your Username and PIN code to any non-DBS websites or mobile applications, please change your PIN code immediately.

You may do so by following the instructions here.

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

- Check your mobile banking and wallet balances regularly through DBS' official digibank app.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Search Engine Advertisement Phishing Alert

Date: 14 December 2023

Description: Beware of phishing advertisements on search engines. Scammers are posting fraudulent advertisements on search engines, which appear as the first few search results when users search for financial services, such as loans. These fraudulent advertisements provide a fake website and contact number for victims to contact.

Always verify the authenticity of the websites and never provide your details such as your login credentials or PINs on these sites. These scammers will make use of your information to access and make unauthorized transactions on your cards or Bank account.

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Online Marketplace Phishing Alert

Date: 09 November 2023

Description: Beware of scammers targeting users on online marketplaces, such as Carousell. Online marketplace scammers pretend to be interested in your item before requesting for your contact details e.g. email or WhatsApp to complete the payment. These scammers will send a link or QR code via email or WhatsApp to direct potential victims to a phishing site.

Always verify the authenticity of the websites and never provide your details such as your login credentials or PINs on these sites. These scammers will make use of your information to access and make unauthorized transactions on your cards or Bank account.

If you have provided your Username and PIN code to any non-DBS websites or mobile applications, please change your PIN code immediately.

You may do so by following the instructions here.

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

Social Media Advertisement Phishing and Android Mobile Malware Alert

Date: 13 October 2023

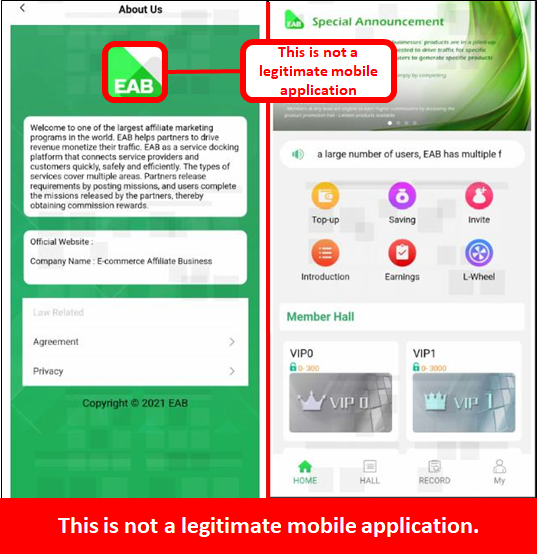

Description: Beware of Scammers using mobile malware to access and conduct fraudulent fund transfers from your bank account. Scammers may use attractive offers, discounts, and promotions to encourage you to download and install third-party applications via unofficial app stores, web links, email attachments, or WhatsApp file downloads.

The scammer or the app will ask for certain permissions, such as:

- Accessibility services.

- Change your SMS app to the newly installed app.

- View and send SMSes.

- Granting full control over your device.

Once these malicious apps are installed, the malicious apps grant the scammers remote access to your phone. With this remote access to your mobile device and your login credentials, the scammer will take over your phone and conduct unauthorized transactions such as changing to your transfer limits, adding payee and make fund transfer using your bank account.

To Protect Yourself:

- Remember that if a deal seems too good to be true, it often is.

- Be wary of deals that seem too good to be true, such as unbelievably low prices on iPhones, durians, or services like cleaning or pet grooming. Scammers often prey on your emotions with these enticing offers through ads, emails, SMS, or WhatsApp messages.

- Only download mobile apps from official app stores like Google Play Store and Apple App Store.

- Official app stores have security measures to minimize your risk of installing a malicious app. However, always check the reviews and ratings of apps to ensure their trustworthiness. Never sideload apps from third-party websites, emails, SMSes, or social media.

- Pay attention to the permissions an app asks for.

- Think twice if an app requests accessibility permissions, full control over your device, or access to sensitive information like SMS and emails. These requests are often red flags for malicious activities.

- Use mobile security software.

- o Install mobile anti-virus apps which can detect and block malware and malicious phishing links any malicious apps. Find more information on the list of recommended mobile security apps at https://www.csa.gov.sg/docs/default-source/our-programmes/cybersecurity-outreach/the-unseen-enemy/security-apps_infographic.pdf

- If you suspect that your phone is compromised by malware, do this immediately:

- Turn on airplane mode on your phone or turn off your phone.

- Call DBS immediately so we may help you.

Report scams to protect your family, friends, and our community.

- Help protect your friends and family by reporting scams and suspicious deals to the appropriate authorities, such as consumer protection agencies or local police.

- Use ScamShield, an app that helps you block scam calls and SMSes and use it to report scam calls, SMSes and messages from chat apps like WhatsApp, WeChat, and Viber. ScamShield filters incoming scam calls and messages based on a list maintained by the Singaporean Police Force. Install ScamShield from your official app store to enhance your protection.

- Find more information on ScamShield at https://www.scamshield.org.sg/.

Customers are advised to be mindful of such scams.

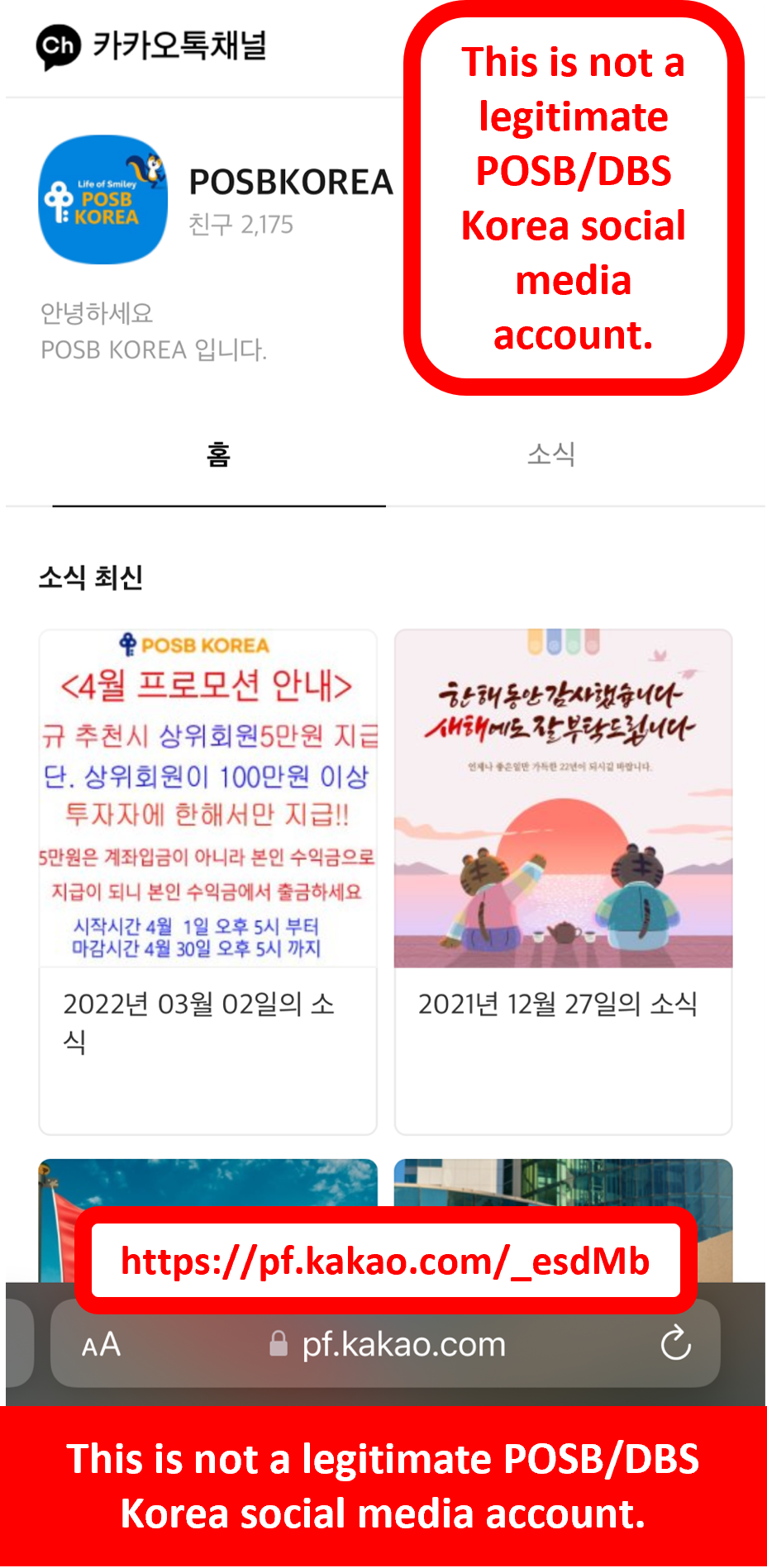

Customers are reminded to check that they're on DBS's official websites and social media accounts or use DBS's official mobile applications to conduct any DBS bank-related requests or call our official hotline. Go directly to https://www.dbs.com to ensure that you are on our website or use the hotline numbers listed below.

- DBS will not send you login links in our official SMSes.

- DBS will never ask you for your credit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Always verify the authenticity of the message with the official websites or sources.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

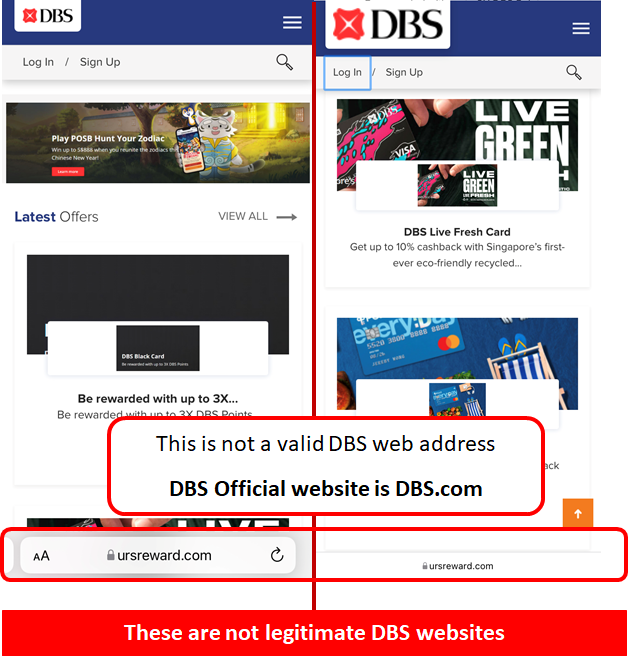

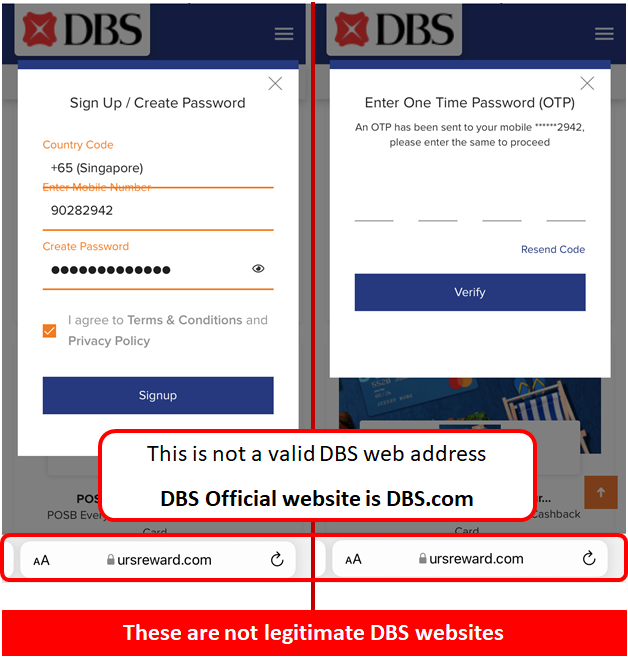

Phishing Alert

Social Media Ads Phishing Alert

Date: 25 September 2023

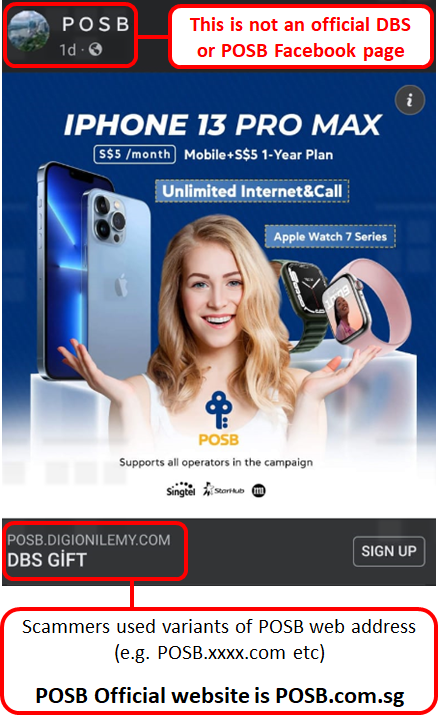

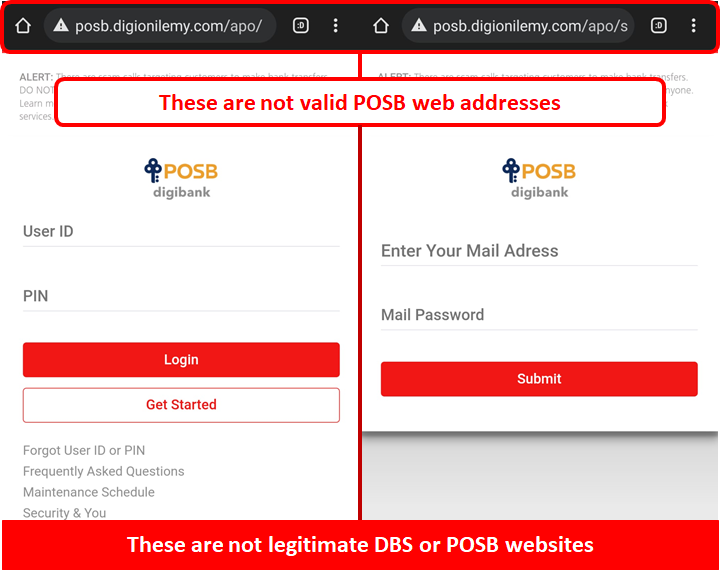

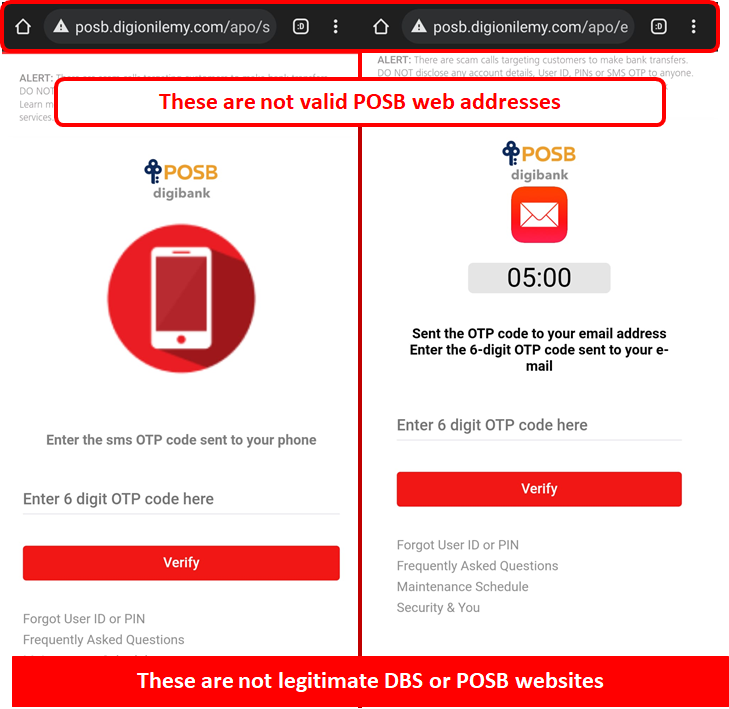

Description: Scammers are targeting you with bank-branded social media ads. These ads come from accounts pretending to be a bank's official profiles. These phishing ads offer enticing and exciting deals or giveaways on iPhones, Apple Watches or Telco contracts.

Clicking on these ads leads to phishing websites that ask for your bank username and PIN, digital token approvals or OTPs. Giving this phishing website your bank logins, digital token approvals or OTPs may result in scammers stealing your account or money.

If you have provided your DBS digibank username-PIN Code combination to any non-DBS websites or mobile applications, we strongly recommend changing your PIN Code immediately.

You may do so by following the instructions here.

Customers are advised to be mindful of such scams.

Customers are reminded to ensure they are on DBS’s official website or use DBS’s official mobile applications to conduct any DBS bank-related requests. Go directly to https://www.dbs.com to ensure that you are on our website.

Remember: Do not give out your Internet Banking credentials, OTP, Digital Token, or any DBS-related email or SMS verification approvals to other individuals, non-DBS websites, or mobile applications. Do not give your credit or debit card details out to unknown websites.

- Emails and SMSes from DBS will not include clickable links. Always go directly to our website to verify the authenticity of any banking-related requests or offers.

- DBS will never ask you for your credit or debit card details, CVV, SMS or email OTPs, or Digital Token approvals to verify or unlock your account.

- Do not call phone numbers, click on URL links, or scan QR codes in unsolicited emails, SMS, or other Messaging Application messages.

- Never disclose your card numbers or OTPs to unverified sources. Bank staff and government officials will never request your card details, OTPs, or Digital Token Approvals through SMS, voice calls, or unofficial websites.

Call us immediately at the hotlines below, message our chatbot, or visit our Quick Links for Self-Service page (if available in your country) if you suspect you’re a victim of fraud or notice any unexpected banking or card transactions.

Singapore: 1800-339-6963 or 6339-6963

Singapore Quick Links for Self-Service: https://www.dbs.com.sg/personal/bank-with-ease/contact-us

China: 400-820-8988

Hong Kong: 2290 8888

Hong Kong Quick Links for Self-Service: https://www.dbs.com.hk/personal/contact-us.page

India: 1-860-210-3456

Indonesia: 0804 1500 327

Taiwan: (02) 6612 9889 / 0800 808 889

Scamshield Feature - For Singaporean customers

ScamShield is an initiative by the Singapore Police Force and the National Crime Prevention Council. Singaporean customers may find more information on ScamShield at https://www.scamshield.org.sg/.

Block scam calls – ScamShield compares an incoming call against a list maintained by the Singapore Police Force to determine if the number has been used for illegal purposes and blocks it.

Filter scam SMSes – When you receive an SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm, and filter the messages to a junk SMS folder. Scam SMSes will be sent to NCPC and SPF for collation to keep app updated and help protect others from such scam calls and messages.

Report scam messages – You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, Viber, etc. You can forward the messages via ScamShield's in-app reporting function.

SMS Phishing Alert